What happens if I Overcontribute to TSP?

Contents

What Happens If You Are Overcontributed to Your TSP? If you accidentally contribute to your retirement account, the IRS will charge you a 6% fine for each year excess funds remain in your account.

What will happen if you pay more than TSP? If the payroll office submits contributions that exceed the elective deferral limit, TSP will reject all contributions and any associated matching contributions, and will send a report to the payroll office showing the additional contributions allowed for the year. On the same subject : Is Roth TSP worth it?.

Is maxing out TSP a good idea?

The Thrift Savings Plan (TSP) is a good tool for federal employees to save for retirement. Saving, and even maxing out your contribution to TSP is usually considered a good thing. True, maximizing your TSP can be very beneficial, but thought otherwise is the best thing for your financial future.

Should I increase my TSP? On the same subject : How do you become a millionaire on TSP?.

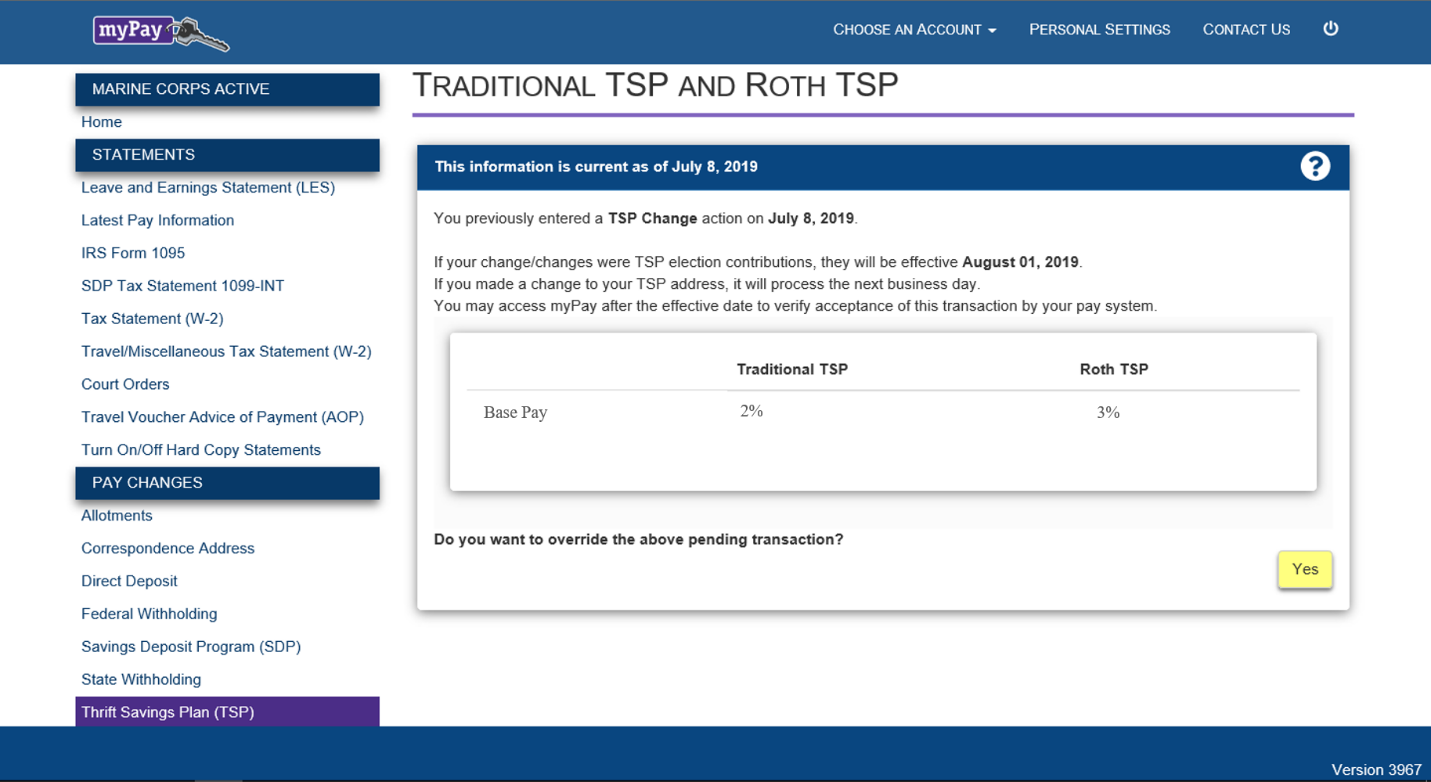

You may want to change your Thrift Savings Plan (TSP) contributions, especially if you are on a Blended Retirement System (BRS) and have not yet contributed at least 5% of your Basic Pay to your TSP. Contributions of 5% or more of your Basic Pay maximize government contributions that are eligible for BRS participants.

What happens when you max out TSP?

This is the limit that employees can deduct from their salary. That applies to traditional accounts with Roth TSP (which share the same limit, so you can’t contribute $ 20,500 each). This includes your base salary, special pay and bonuses. To maximize your TSP, you should contribute $ 1,625 per month from your salary.

What is the max catch-up for TSP?

The Internal Revenue Service (IRS) announced the Thrift Savings Plan (TSP) option deferral limit for 2022 will be increased to $ 20,500 per year. The catch-up limit has not changed from 2021 and remains at $ 6,500. This may interest you : Is the TSP a good retirement plan?. This restriction applies to the combined total of traditional and Roth contributions that are tax -deductible.

What is TSP catchup?

“Catch-up contributions” are additional tax-deferred employee contributions that can be made by employees age 50 or older to a Thrift Savings Plan (TSP) beyond the maximum amount that can be contributed by regular contributions.

How much is TSP catch-up for 2021?

The IRC § 414 (v) catch-up contribution limit for 2021 is $ 6,500. Important note: Beginning in 2021, participants do not have to make a separate contribution selection.

Does TSP automatically stop at limit?

For those over the age of 50 or older, after you exceed the elective deferral limit, your contribution will be a â € œspilloverâ € and automatically start counting until the catch limit. Those aged 50 and over can make an additional contribution or “spillover” of $ 6,500, totaling $ 27,000 per year ($ 20,500 $ 6,500).

How much can I put in TSP per year?

The maximum amount you can contribute to a TSP account for this year is $ 19,500. If you are 50 or older, your plan can allow you to donate an additional $ 6,500 as a “catch-up” contribution, bringing your total TSP 2021 contribution to $ 26,000. (This number is the same as the limit in 2020.)

What is the TSP limit for 2020? The IRS 2020 annual limit for regular TSP contributions will increase to $ 19,500. If you are covered by the Federal Employee Pension System (FERS, FERS-RAE, or FERS-FRAE), you can lose your eligible TSP Agency contribution by reaching the limit before the end of the calendar year.

What is the maximum percentage I can contribute to my TSP?

You can donate from 1 to 100 percent of any incentive salary, special salary, or bonus salary (even if you currently do not receive them) â € ”as long as you choose to donate from your base salary.

What is the max percentage TSP contribution for 2021?

The maximum contribution to the Thrift Savings Plan (TSP) in 2021 remains unchanged! The 2021 Internal Revenue Service (IRS) annual elective deferral limit, which applies to the total combined traditional and Roth contributions, remains $ 19,500.

What is the highest percentage you can put into TSP?

Suitable Employers. Federal agencies provide matching contributions to TSP accounts that can reach a maximum of 5 percent of an employee’s basic salary. Your employer matches your contribution dollar to the dollar in the first 3 percent and 50 cents per dollar for the next 2 percent.

How much can I put in my TSP for 2021?

The maximum contribution to the Thrift Savings Plan (TSP) in 2021 remains unchanged! The 2021 Internal Revenue Service (IRS) annual elective deferral limit, which applies to the total combined traditional and Roth contributions, remains $ 19,500.

Can I contribute more than 5% to my TSP?

The first 3% of the payment that you donate will match the dollar-for-dollar; the next 2% will match at 50 cents on the dollar. Contributions above 5% of your salary will not qualify. If you stop making regular employee contributions, your matching contributions will also stop.

How much can I contribute to my TSP each year?

TSPs are similar to 401 (k) plans, and they share the same annual contribution limit per person. This means that you cannot donate more than $ 19,500 ($ 26,000 with catch-up contributions) in both accounts in any calendar year.

Can I contribute more than 5% to my TSP?

The first 3% of the payment that you donate will match the dollar-for-dollar; the next 2% will match at 50 cents on the dollar. Contributions above 5% of your salary will not qualify. If you stop making regular employee contributions, your matching contributions will also stop.

What is the highest percentage you can put into TSP? Suitable Employers. Federal agencies provide matching contributions to TSP accounts that can reach a maximum of 5 percent of an employee’s basic salary. Your employer matches your contribution dollar to the dollar in the first 3 percent and 50 cents per dollar for the next 2 percent.

Can I add more money to my TSP?

No you can’t. All TSP contributions must come from salary deductions or from rollovers from qualified plans.

What is a good amount to contribute to TSP?

How Much Should You Invest in a TSP Account? We recommend investing 15% of your income for retirement. If you contribute 15% consistently, you set yourself up to have options when you retire.

Should you max out TSP contributions?

Amount of Contribution Limit I should note that the maximum amount you can contribute to the TSP in a year is $ 58,000 between employee contributions ($ 20,500) and government matches. However, certain government salary measures and employer matches (5%) this limit should not affect federal employees.

Should I invest more than 5% in TSP?

Employees must invest at least 5% in TSP; the percentage required to obtain the maximum matching funds available. Beyond that, Employees need to balance long -term investment needs with other needs.

What is a good percentage to contribute to TSP?

If you do not put at least 5% of your income into your TSP, to maximize the appropriate contribution from your institution, you are denied free money.

Is maxing out TSP a good idea?

The Thrift Savings Plan (TSP) is a good tool for federal employees to save for retirement. Saving, and even maxing out your contribution to TSP is usually considered a good thing. True, maximizing your TSP can be very beneficial, but thought otherwise is the best thing for your financial future.

What does Dave Ramsey recommend for TSP?

How Much Should You Invest in a TSP Account? We recommend investing 15% of your income for retirement. If you contribute 15% consistently, you set yourself up to have options when you retire.

What should the TSP do now?

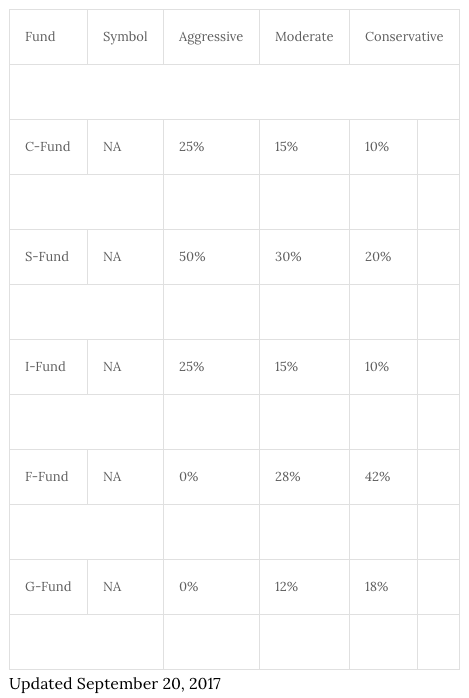

What is the best allocation for TSP?

Like other voices, he recommends a portfolio with 100% equities but recommends a breakdown of 60% C Fund, 20% S Fund, and 20% I Fund.

What TSP funds does Dave Ramsey recommend?

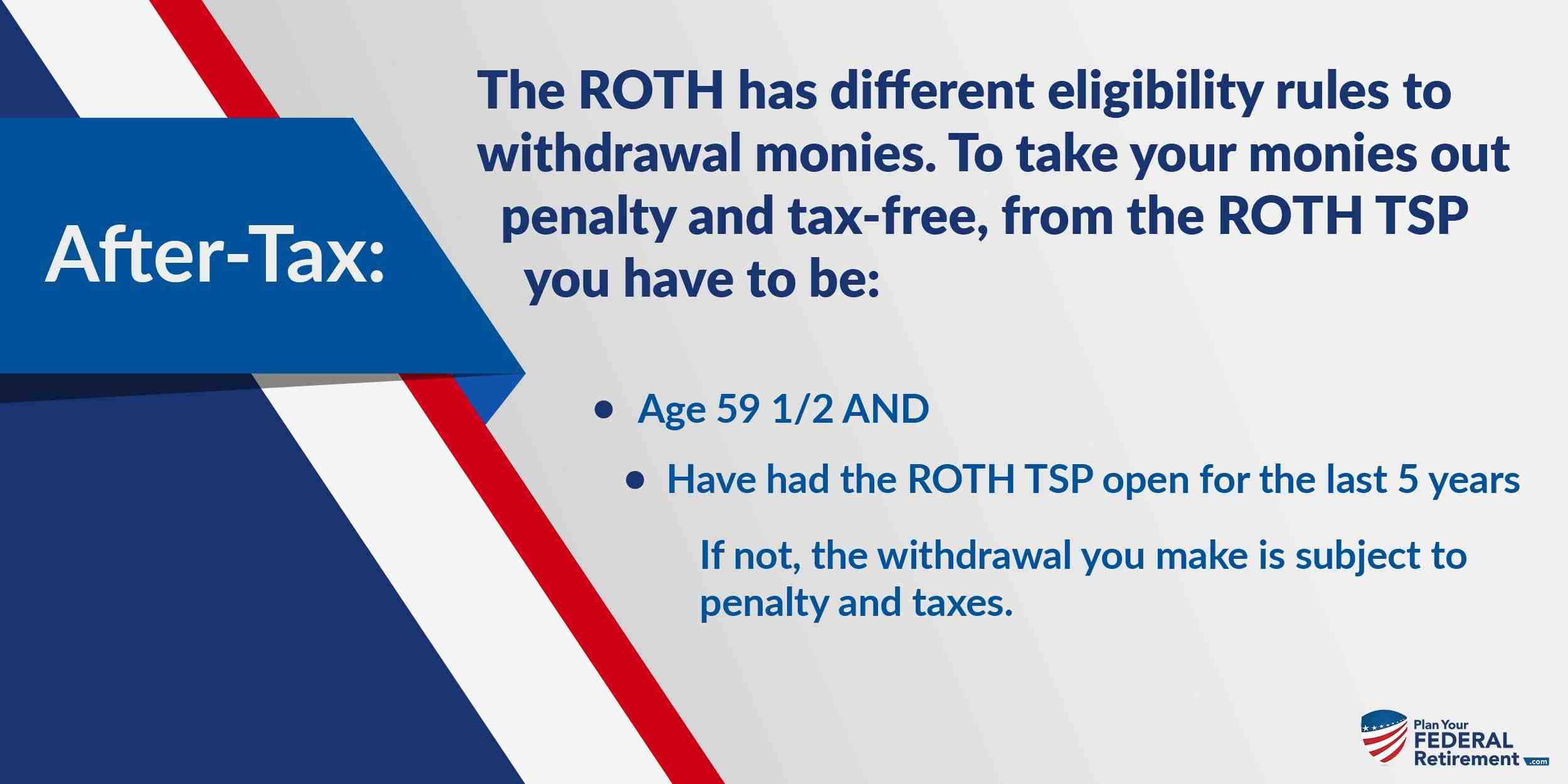

Dave Ramsey is very interested in Roth IRAs and Roth TSPs. That’s why, most of the time, Dave Ramsey tells people to only use Roth TSP instead of traditional TSP.

How do I maximize my TSP growth?

Increase your contribution each year Many people don’t start contributing to the maximum the first day on the job, so it’s important to increase your contribution when you start more. Each time you receive a COLA or step increase you should consider increasing your TSP contribution.

What TSP fund should I invest in 2021?

For more conservative investors, note that Fund G (often considered the safest TSP Fund) got 1.38% for the year. The L Income Fund, which also includes some stock investments, had better results than the G Fund. L Income in 2021 was 5.42%.

What TSP funds does Dave Ramsey recommend?

Dave Ramsey is very interested in Roth IRAs and Roth TSPs. That’s why, most of the time, Dave Ramsey tells people to only use Roth TSP instead of traditional TSP.

What TSP fund is the safest?

Fund G is invested in short -term U.S. Treasury securities that are issued specifically to TSP. Principal and interest payments are guaranteed by the U.S. government. Thus, there is no â € œcredit risk.â €

What is a good TSP balance at retirement?

I often say that there is not much money in a savings plan. If you want your TSP balance to be able to generate an annual income that is an inflation index of $ 10,000, most financial planners will recommend that you have a $ 250,000 balance when you retire.

What should my TSP distribution be?

How much should I contribute to my TSP? A general recommendation for how much to save for retirement is at least 15% of your income. Others believe that the minimum should be what maximizes your employer’s contribution; in the case of TSP funds, it would be 5% of your income.

How much should I have in my TSP at 50?

By age 40, you should have three times your annual salary. By age 50, six times your salary; by age 60, eight times; and by age 67, 10 times. 8 If you are 67 years old and receive $ 75,000 per year, you should save $ 750,000.

What is a good TSP balance at retirement?

I often say that there is not much money in a savings plan. If you want your TSP balance to be able to generate an annual income that is an inflation index of $ 10,000, most financial planners will recommend that you have a $ 250,000 balance when you retire.

What should be my TSP distribution? How much should I contribute to my TSP? A general recommendation for how much to save for retirement is at least 15% of your income. Others believe that the minimum should be what maximizes your employer’s contribution; in the case of TSP funds, it would be 5% of your income.

How much should I have in my TSP at 50?

By age 40, you should have three times your annual salary. By age 50, six times your salary; by age 60, eight times; and by age 67, 10 times. 8 If you are 67 years old and receive $ 75,000 per year, you should save $ 750,000.

What does the average 50 year old have saved for retirement?

But how many Americans have actually been saved? In the fourth quarter of 2020, Americans between the ages of 50 and 59 had an average 401 (k) balance of $ 203,600, according to data from the Fidelity retirement platform. Employees in this age group contribute an average of 10.4% of salary.

How much should I have saved for retirement by age 55?

Experts say to have at least seven times your salary saved at age 55. That means if you make $ 55,000 a year, you should have at least $ 385,000 saved for retirement.

Should I leave my money in TSP when I retire?

Depending on when you start retirement, you can easily leave money in TSP to let it continue to grow. If you don’t need to access it, think it’s better to leave it. Similar to other retirement accounts, you will need to start minimum withdrawals at age 72. This is called the Minimum Distribution Required (RMD).

Should I move my money out of TSP?

In short, although the recommendation is good, any financial professional who recommends you transfer money from a TSP to an IRA can benefit financially from that move.

What happens to TSP upon retirement?

If your vested account balance is $ 200 or more when you leave federal service, your TSP account stays right where it’s up to you to need it. You can save more of what you save thanks to our low cost. Plus, you can change your investment mix and transfer eligible money into your account.

What is the average TSP account balance?

Not surprisingly, more than half of the plan’s total participantsâ € ”3,663,973â €” have account balances of less than $ 50,000, but they’ve only been contributing for 5.77 years on average. And about a quarter of participants (1,529,078) fall in the $ 50,000- $ 249,000 range, but they have contributed an average of 15 years.

How much should I have in my TSP at retirement?

If you want your TSP balance to be able to generate an annual income that is an inflation index of $ 10,000, most financial planners will recommend that you have a $ 250,000 balance when you retire.

How many TSP participants are millionaires?

FedSmith states that based on the latest data provided by the Federal Pension Investment Agency (FRTIB), 1.7% of all Thrift Savings Plan investors – about 6.3 million – now become millionaires. They have participated in the TSP an average of 28.2 years.

Sources :