How much does the average retiree live on per year?

Contents

The average retirement family spends $ 6,819 per year ($ 568 per month) versus $ 9,761 ($ 813 per month) for the average US household. These numbers dropped by around 8. Read also : What is the average pension payout per month?.5% across all age groups in 2020, mainly due to people spending far less time driving and working.

How long does a retired couple have to live per year? Most experts say your retirement income should be around 80% of your final annual pre-retirement income. 1 This means that if you make $ 100,000 a year when you retire, you need at least $ 80,000 a year to have a comfortable lifestyle after you leave the workforce.

How much does the average retired person spend per year?

According to the Bureau of Labor Statistics, Americans aged 65 and over spend on average about $ 48,000 annually. To see also : Is there really a $16728 Social Security bonus?.

How much money does the average person have when retiring?

The survey, as a whole, found that Americans increased their personal savings by 10% from $ 65,900 in 2020 to $ 73,100 in 2021. In addition, average retirement savings increased by a reasonable 13%, from $ 87,500. for $ 98,800.

How much does the average person spend per month in retirement?

Average pension expenses by category. According to the Bureau of Labor Statistics, an American family led by a person aged 65 or over spent an average of $ 48,791 per year, or $ 4,065.95 per month, between 2016 and 2020.

What is the average retirees monthly income?

In 2021, the median monthly Social Security retirement income was $ 1,543. In 2022, the median monthly retirement income from Social Security is expected to be $ 1,657. Read also : What is considered a good pension?. Keep in mind, however, that your Social Security benefits may be lower.

What is a reasonable monthly income when you retire?

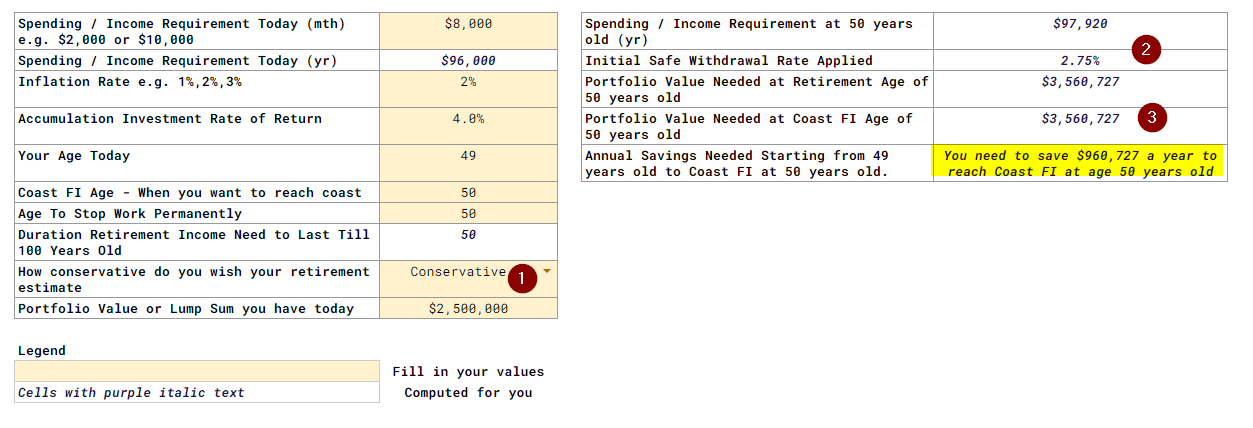

Based on the 80% principle, you can expect to need around $ 96,000 in annual income after retirement, which is $ 8,000 a month.

What does the average retiree live on per month?

Average pension expenses by category. According to the Bureau of Labor Statistics, an American family led by a person aged 65 or over spent an average of $ 48,791 per year, or $ 4,065.95 per month, between 2016 and 2020.

How can I make 10k a month passive?

How can I earn 10k a month from home? Below are six opportunities that are unique to how you can earn 10k a month online.

- Here’s how to make 10,000 a month.

- Property conservation firm.

- Virtual assistant.

- blogger.

- Social media manager.

- Sell on Amazon.

- Flip products from flea markets.

- Start a YouTube channel.

What is the average Social Security income?

The average social security benefit is $ 1,657 per month as of January 2022. The maximum possible social security benefit for those who retire at full retirement age is $ 3,345 in 2022.

What is the average social security allowance at the age of 67?

What is the average Social Security benefit at age 62?

According to the Social Security Administration’s payment statistics as of June 2020, the average Social Security benefit at age 62 is $ 1,130.16 per month or $ 13,561.92 per year.

What is the highest Social Security check at age 62?

The maximum amount an individual filing for Social Security retirement benefits in 2022 can receive per month is: $ 2,364 for someone filing at age 62. $ 3,345 for someone with full retirement age (66 and 2 months for people born in 1955, 66 and 4 months for those born in 1956).

What is the average Social Security benefit at age 62 in 2022?

The amount you are entitled to is modified by other factors, most notably the age at which you claim the benefits. For reference, Social Security’s estimated average retirement benefit in 2022 is $ 1,657 per month.

How much Social Security will I get if I make $60000 a year?

This adds up to $ 2,096.48 as a monthly benefit if you retire at full retirement age. In other words, Social Security will replace approximately 42% of your previous $ 60,000 salary. That’s a lot better than the figure of around 26% for those earning $ 120,000 a year.

How much Social Security will I get if I make $50 000 a year?

For example, the AARP calculator estimates that a person born on January 1, 1960, with an average annual income of $ 50,000 would get a monthly allowance of $ 1,338 if applying for Social Security at age 62, $ 1,911 at full retirement age. (in this case, 67) or $ 2,370 to 70.

How much Social Security will I get if I make $40 000 a year?

Those who earn $ 40,000 pay tax on all of their income in the social security system. It takes more than three times that amount to maximize Social Security payroll taxes. The current tax rate is 6.2%, so you can expect to see $ 2,480 straight from your paycheck into Social Security.

How much Social Security does the average person get?

The benefits of social security are much more modest than many people realize; Social Security’s average pension benefit in January 2022 was about $ 1,614 per month, or about $ 19,370 per year. (The average disabled worker and the elderly widow received slightly less.)

What is the average Social Security check at age 66?

At age 66: $ 3,240. At age 70: $ 4,194.

How much does the average person collect on Social Security?

Consider the Average Social Security Payment The average Social Security benefit is $ 1,657 per month as of January 2022. The maximum possible Social Security benefit for those who retire at full retirement age is $ 3,345 in 2022.

Is 6000 a month good for retirement?

The median retirement income for the elderly is approximately $ 24,000; however, the average income can be much higher. On average, seniors earn between $ 2,000 and $ 6,000 per month. Older retirees tend to earn less than younger retirees. It is recommended that you save enough to replace 70% of your monthly pre-retirement income.

Is 5000 euros a month good retirement income? There are some places where you can live an amazing life with a retirement income of $ 5,000 a month. Most of them have favorable taxes for retirees and lower living expenses. Savannah, Georgia has 16% lower living expenses and 17% cheaper healthcare.

What is a good monthly retirement income?

According to AARP, good retirement income is around 80% of your pre-tax income before you leave the workforce. This is because when you no longer work, you will not pay income tax or other work-related expenses.

What is a reasonable monthly income when you retire?

Based on the 80% principle, you can expect to need around $ 96,000 in annual income after retirement, which is $ 8,000 a month.

How much does the average person retire with?

And, thankfully, below we can find the average retirement savings by age, according to Federal Reserve SCF data 2019-2020: 18-24: $ 4,745.25. 25-29: $ 9,408.51. 30-34: $ 21,731.92.

How long will a million dollars last in retirement?

The site says that, on average, looking at data from the Bureau of Labor Statistics and average monthly Social Security benefits, having $ 1 million for retirement could last up to 29 years, 1 month, and 24 days on the card. That’s certainly a good amount of time if you retire at the age of 60.

Is 1 million dollars enough for a comfortable retirement? While it doesn’t envision the lavish lifestyle of the past few years, having $ 1 million in retirement is still a blessing. Many retirees rely on Social Security benefits for at least 50% of their income.

Can I retire at 60 with a million dollars?

Yes, you can retire at 60 with $ 1.5 million. At age 60, an annual annuity will provide a guaranteed level income of $ 78,750 per year starting immediately, for the rest of the insured’s life. The income will remain the same and will never decrease.

Can a 60 year old retire with 1million?

If you buy a $ 1 million annuity at age 60, you will receive $ 52,500 annually for the rest of your life. This income will be guaranteed and will never decrease. If you wait up to 61 years to purchase the annuity, your annual income will be $ 58,100 for life.

How much money should you retire with at 60?

By age 60, you should have seven times your annual retirement earnings saved, advises Ally Bank. Fidelity, once again, is more aggressive and recommends eight times the amount. This is also the time to make a push towards debt payment to retire with the minimum amount possible.

How long can a million dollars last?

Becoming a millionaire seems like a surefire way to live comfortably. However, if you no longer work, how long will a million dollars in retirement last? The answer is about 20 years old, according to Brent Lipschultz, a partner at accounting and consulting firm EisnerAmper in New York City.

Can a person live off 1 million dollars?

Historically, the stock market has an average annual rate of return of between 10 and 12%. So, if your $ 1 million is invested in mutual funds with good growth, that means you could potentially live on $ 100,000 to $ 120,000 annually without ever touching your million dollar goose.

Can you retire at 40 with a million dollars?

Early retirement means you can have 40, 50 or more years of retirement. Those $ 1 million will have to last a long time. On the other hand, most people will never accumulate close to a million dollars. Less than 10% of all US households are millionaires.

Sources :