What are the different types of financial plans?

Contents

Financial planning: Definitions, Goals, Types, Benefits and more. Read also : What is an example of financial plan?.

- INVESTMENT MANAGEMENT.

- FINANCIAL PLANNING.

- TAX DEVELOPMENT.

- PLANNING TO STAY.

- PLANNING A BUSINESS.

- PLANNING ITEMS.

- DENIAL AND FINANCIAL PLANNING.

- MONEY EDUCATION.

What are the 4 financial plans? The main features of the financial system include a retirement plan, a risk management plan, a long-term investment plan, a tax deduction plan, and a location plan.

What is an example of financial plan?

Planting (building equipment) Plan Your insurance. To see also : How do you write a financial plan?. An estate plan. Tax methods.

What is a simple financial plan?

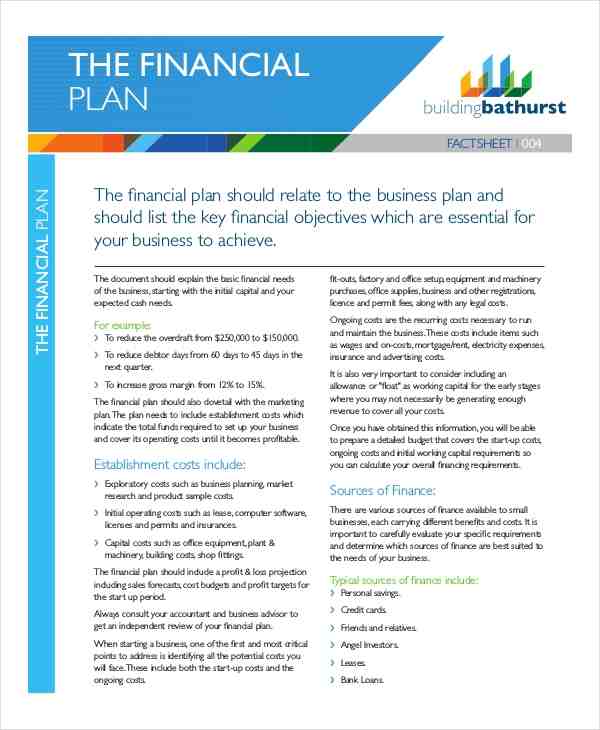

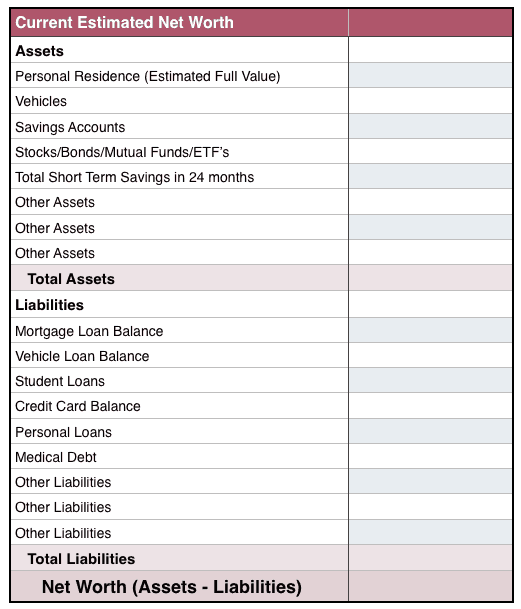

A financial plan is a complete indication of your current income, your financial goals and any means you have set to achieve those goals. A good financial plan should include information about your cash flow, savings, debt, finances, insurance and any other aspects of your financial life.

How many types of finance are there?

The financial field consists of three main components: personal finance, corporate finance, and public (public) finance. Read also : What are the 5 components of a financial plan?. Consumers and businesses use financial services to acquire financial assets and achieve financial goals.

What are the types of money? Payment is a way of financing business events, purchases, or investing. There are two types of financing: equity financing and loan financing.

What are the 3 types of finance?

The financial field consists of three main components: personal finance, corporate finance, and public (public) finance. On the same subject : What is a basic financial plan?.

What are the 3 area of finance?

Money can be broadly divided into three distinct categories: public finance, corporate finance, and personal finance.

What are the two main types of finance?

External sources of income fall into two main categories: equity financing, which is given in exchange for ownership and futures profits; and debt, which is the amount to be paid, usually at interest.

What is the purpose of a financial plan?

Financial planning is a step-by-step way to achieve personal goals. Financial planning serves as a guide as you travel through life’s journey. Basically, it helps you to be in control of your income, spending and finances so you can manage your finances and achieve your goals.

What is the purpose of the financial plan questions? What is the purpose of a financial plan? The financial plan provides the basis for which route they want to take with their money.

What are three purposes of a financial plan?

(i) Determining the amount of money required by the business to perform its operations. (ii) Determining the source of revenue, that is, the nature of the guarantees given. ADVERTISEMENTS: (iii) Establishment of appropriate operating rules and financial management.

What is Step 3 in creating a financial plan?

The third step in the financial process is to evaluate and evaluate your financial situation. Your facilitator should evaluate the information you provide so that he or she can evaluate your situation and determine what you need to do to meet your goals.

What is the purpose of financial plan?

Financial planning serves as a guide as you travel through life’s journey. Basically, it helps you to be in control of your income, spending and finances so you can manage your finances and achieve your goals.

What is the most important part of financial plan?

The most important first step in financial planning is Budgeting. Setting a budget is easy; so hard to stick to! Therefore, having the discipline to take the time and care to record and reconcile your applications in some way is essential.

What is the most important thing in finance?

Cash Flow Management One of the most important (and obvious) secrets of your money is your cash flow. This is where the money goes in, and where the money goes. Putting your money under control is important before you do anything with your money.

Is the one of the most important constituents of financial plan?

Cash flow analysis One of the most important aspects of financial planning is understanding your financial performance and the relationship between your current debt and debt. If you spend more than you did, you will probably not achieve your goals.

What is the fifth foundation?

5th Foundation. clothe yourselves with riches. a partnership of development in which one person shares knowledge, skills, and perspectives to promote one’s personal growth and expertise. mentorship. form of union or national grant that does not need to be paid.

What is the essence of the five principles? The Five Principles are the first steps to establish and maintain financial stability.

What is the five foundations?

Five principles: Five steps to financial success: (1) A $ 500 emergency fund; (2) Get out of debt; (3) Pay motor vehicle bills; (4) Pay College Fees; (5) Build wealth and give. 16. Sinking Fund: Saving money with the passage of major purchases.

What is the fifth foundation quizlet?

5th Foundation. clothe yourselves with riches. a partnership of development in which one person shares knowledge, skills, and perspectives to promote one’s personal growth and expertise.

What is the 5th foundation in personal finance?

The Fifth Foundation: Build wealth and give. “Being able to manage money is just a matter of skill,” said Eaglin. â € œThe Ramsey course is helping our students understand the realities of financial success: spend less on what you make, be generous and pay for things.

What is the purpose of the five foundation?

The Five Foundation is an organization working to end the practice of female genital mutilation (FGM). It was started by Nimco Ali and Brendan Wynne.

What is the most important part of financial plan?

The most important first step in financial planning is Budgeting. Setting a budget is easy; so hard to stick to! Therefore, having the discipline to take the time and care to record and reconcile your applications in some way is essential.

What is more important in finance? Cash Flow Management One of the most important (and obvious) secrets of your money is your cash flow. This is where the money goes in, and where the money goes. Putting your money under control is important before you do anything with your money.

What is the most important step in financial planning?

Assessing Your Financial Progress. Regular communication and follow-up steps are important in financial management. In fact, developing a plan is only a first step. You will always meet with your planner to see if you are on track to achieve your financial goals.

What is the most important financial rule?

The first rule of your money is to never carry a credit card amount. Credit card debt has skyrocketed and paying taxes is an easy way to compromise your network. If you carry a credit card for a long time, you are not ready to put your money in the markets.

Which is the first step in the financial planning process?

The first step in financial planning is to look at your current financial situation.

Is the one of the most important constituents of financial plan?

Cash flow analysis One of the most important aspects of financial planning is understanding your financial performance and the relationship between your current debt and debt. If you spend more than you did, you will probably not achieve your goals.

What is the importance of a financial plan?

Financial planning serves as a guide as you travel through life’s journey. Basically, it helps you to be in control of your income, spending and finances so you can manage your finances and achieve your goals.

What are three purposes of a financial plan?

(i) Determining the amount of money required by the business to perform its operations. (ii) Determining the source of revenue, that is, the nature of the guarantees given. ADVERTISEMENTS: (iii) Establishment of appropriate operating rules and financial management.

What do you mean by financial planning explain its two importance?

Financial planning is concerned with developing a financial plan for the organization’s operations in the future. The importance of financial planning is as follows: (a) It helps the company prepare for the future. (b) It helps in preventing business shocks and surprises.