How much will my FERS pension be?

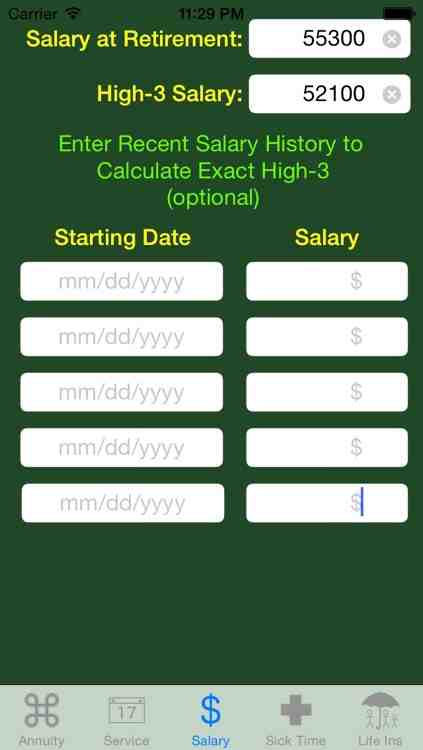

Generally, your FERS benefit is 1% of your ‘top-3’ salary over the years and months of your job. If you were 62 years apart and had about 20 years of employment, your annuity is 1.1% of your average “high-3” salary plus years and months of your employment.

How do I calculate my FERS pension? FERS (Instant or Initially) FERS annuities are based on a top-3 average income. Generally, the benefit is calculated as 1 percent of the average 3-year-old salary multiplied by the years of credit service. For those who retire at the age of 62 or later with at least 20 years of employment, 1.1 percent apply at 1 percent.

What is the average pension payout per month?

The average Social Security per month in 2021 is $ 1,543 after adjusting the living cost to 1.3 percent. How to Increase This Fund: Delay receipt of these benefits until full retirement age, or age 67.

What is the average pension payout?

Average Retirement Income in 2021. According to the U.S. Census Bureau data, the average retirement income for retirees aged 65 and over is $ 47,357. The average retirement benefit is $ 73,228.

What age do teachers retire in France?

With the exception of 62 years (legal age) the French retirement age is 62 for those born on January 1, 1955 or later.

What is the average FERS pension?

The average monthly salary for retired employees from CSRS in 2018 is $ 4907. Retired employees under FERS received an average monthly salary of $ 183. If he retires at the age of 30, his first FERS pension gives him 30 percent of his average salary.

What is a good retirement pension?

For those who retire with a retirement plan, the average annual pension is US $ 9,262 independent pension, $ 22,172 for federal government, and $ 24,592 for a train pension.

What is a typical pension payout?

Average income up to $ 60,000. The defined benefit plan uses a pension factor of 1.5 percent. Increase $ 60,000 1.5 times over and add 30 years of service. The annual pension amount comes to $ 27,000. This will be paid monthly.

Is FERS pension for life?

Your organization deducts the cost of Basic Benefit and Social Security from your salary as a reduction in salary. Your organization also pays a portion of it. Then, after you retire, you receive a monthly stipend for the rest of your life. The TSP component for FERS is the account that your agency prepares for you.

Are federal pensions for life?

Then, after you retire, you receive a monthly stipend for the rest of your life. Congress introduced the Federal Employees Retirement System (FERS) in 1986, and came into operation on January 1, 1987. Since then, new Federal government employees with retirement benefits are shut down by the FERS.

How long does FERS pension last?

After retirement you are entitled to a monthly annuity for life. If you leave the union before reaching full retirement age and have at least five years of FERS service you may choose to retire on a formal basis.

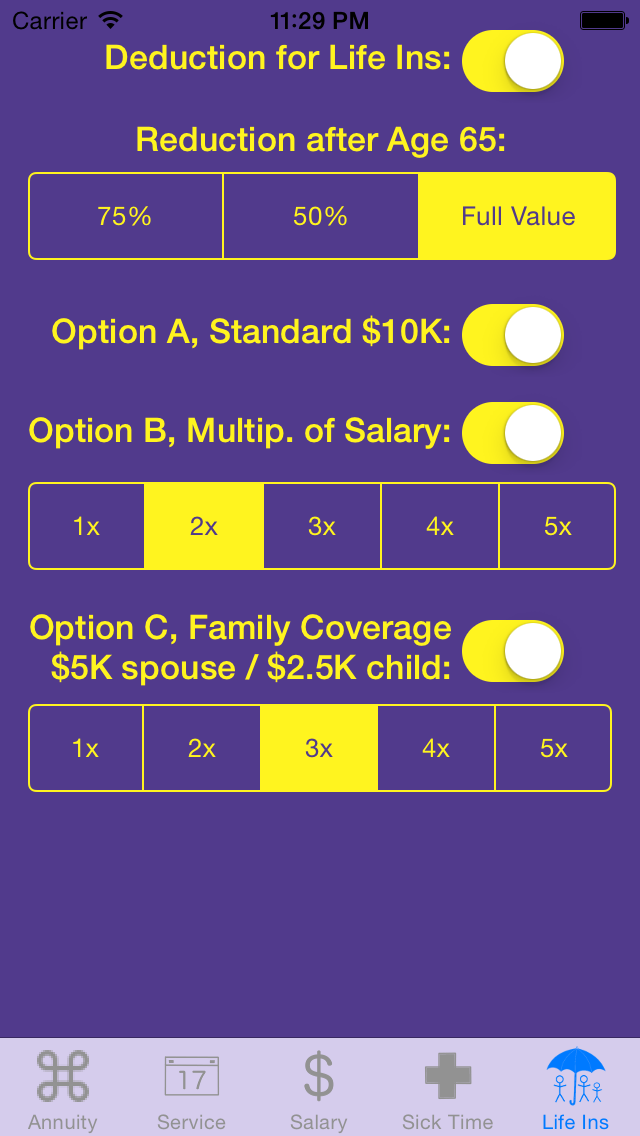

Do retired federal employees have life insurance?

Yes, you can secure your first life insurance policy if you meet all of the following: You are enrolled in life insurance under the Federal Employees’ Group Life Insurance (FEGLI) when you retire.

What is the average FERS pension?

| Type of pension | Median Benefit, 2019 |

|---|---|

| Federal Government Pension | $ 27,687 |

| State or local pension | $ 22,662 |

| Railway pension | $ 17,231 |

What is the average monthly pension? The average Social Security per month in 2021 is $ 1,543 after adjusting the living cost to 1.3 percent. How to Increase This Fund: Delay receipt of these benefits until full retirement age, or age 67.

What is a typical pension payout?

Average income up to $ 60,000. The defined benefit plan uses a pension factor of 1.5 percent. Increase $ 60,000 1.5 times over and add 30 years of service. The annual pension amount comes to $ 27,000. This will be paid monthly.

What is a good pension percentage of salary?

How Much Should I Retire? It is a good idea to keep a portion of your monthly income. If you can afford it, 15% of your annual salary, is recommended.

Is it better to take monthly pension or lump sum?

In many cases, the lump-sum option is clearly the way to go. The main difference between a budget and a monthly payment is that with a budget, you can have control over how your money is invested and what happens to it when you leave. If so, the lump-sum option is your best bet.

What is a good retirement pension?

For those who retire with a retirement plan, the average annual pension is US $ 9,262 independent pension, $ 22,172 for federal government, and $ 24,592 for a train pension.

How much does the average person retire with?

The survey, for the most part, found that Americans increased their savings by 10 percent from $ 699 to $ 209 by $ 209 in 2021. In addition, the average pension fund increased by 13 percent, from at eighty five hundred and five hundred to ninety eight hundred and eighty eight hundred dollars.

What is the average retirement monthly income?

In 2021, the average retirement income from Social Security was $ 1,543. In 2022, the average retirement income from Social Security is expected to be one hundred and sixty-seven dollars. Keep in mind, though, that your Social Security benefits may be small.

How do I check my FERS balance?

How can I get the rest of my pension account? If you are a current employee, you should contact your human resources office. If you are separated from the affiliate service or are currently retired, you should contact OPM’s Retirement Office at 1-888-767-6738 or retire@opm.gov.

Sources :