What are the three steps involved in financial planning?

3 Steps to Preparing Money for Long-Term Goals

- 3 Steps to Preparing Money for Long-Term Goals.

- Step # 1: Set a Realistic Goal.

- Step # 2: Looking for Inflation.

- Step # 3: Select an Investment Option to Achieve Your Goals.

- Bonus Level: Protection and Insurance.

- Review and Adjust Your System.

What are the three steps to managing money? These three steps are accumulating wealth, storing wealth, and sharing wealth.

What are the stages of financial?

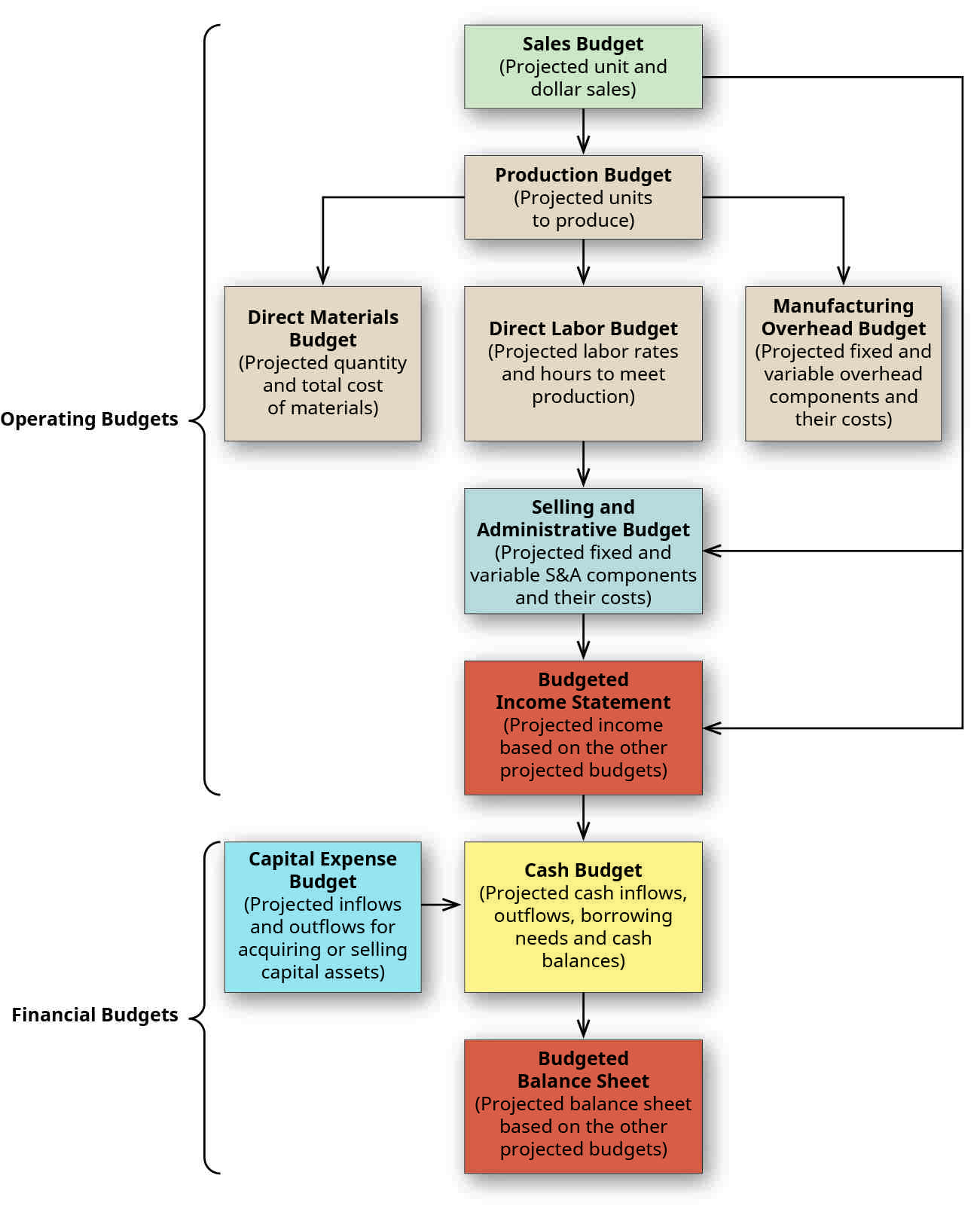

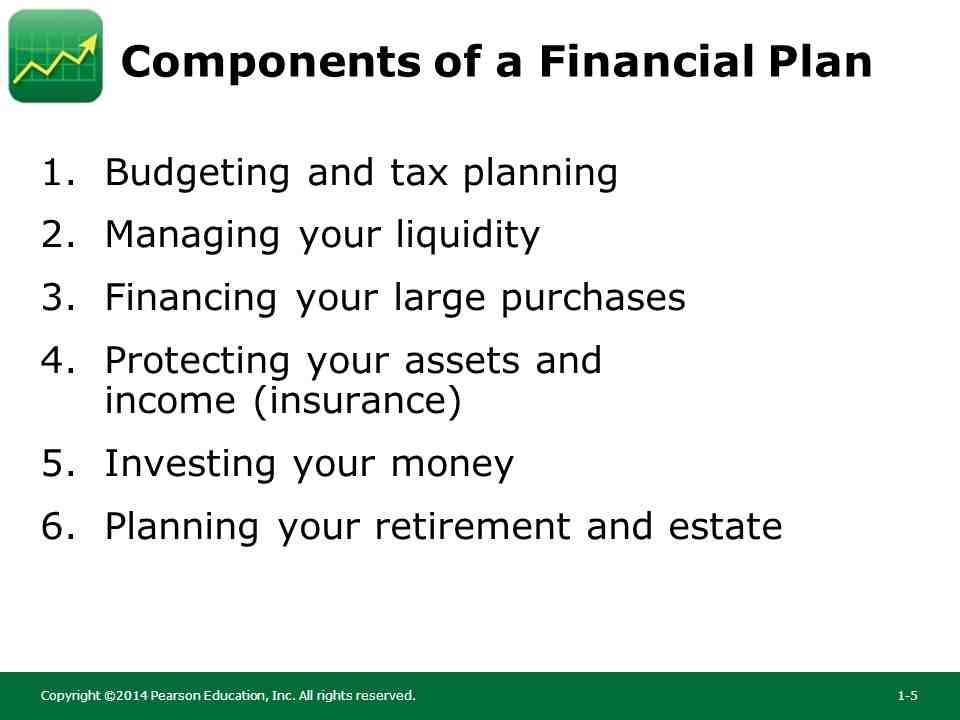

Part of the budget process includes budgeting for savings, investing in goals, securing, saving income through general life insurance, debt management and asset exchange.

What are the three common stages of financial goals?

Three Types of Monetary Policy. In the context of investment strategies, the Financial Conduct Regulatory Commission (FINRA) defines three types of financial goals as long-term (over 10 years), medium-term (3 to 10 years) and short-term time (less than 3). age).

What is the fifth foundation?

Foundation 5. property construction and delivery. a collaborative effort through which one person shares knowledge, expertise, and vision to enhance the development of one person and another expert. leadership. any form of federal or state financial assistance that does not require payment.

What is the fifth root quiz? Foundation 5. property construction and delivery. a collaborative effort through which one person shares knowledge, expertise, and vision to enhance the development of one person and another expert.

What is the five foundations?

Source Five: Five Steps to Financial Success: (1) $ 500 Emergency Fund; (2) Get out of debt; (3) Payment for a car; (4) Payment for College; (5) Building property and giving away. 16. Dive Account: Save money on time for big purchases.

What is the importance of the five foundations?

The Five Principles are the first steps to establishing and maintaining financial stability.

Why is it important to do the five foundations in order Ramsey?

Why is it important to have the Five Roots in order? First of all you need to save for every emergency, be free, pay your car bills, pay your college fees, so that when you graduate you will not get much debt holding you back. You can save for subscriptions on your home.

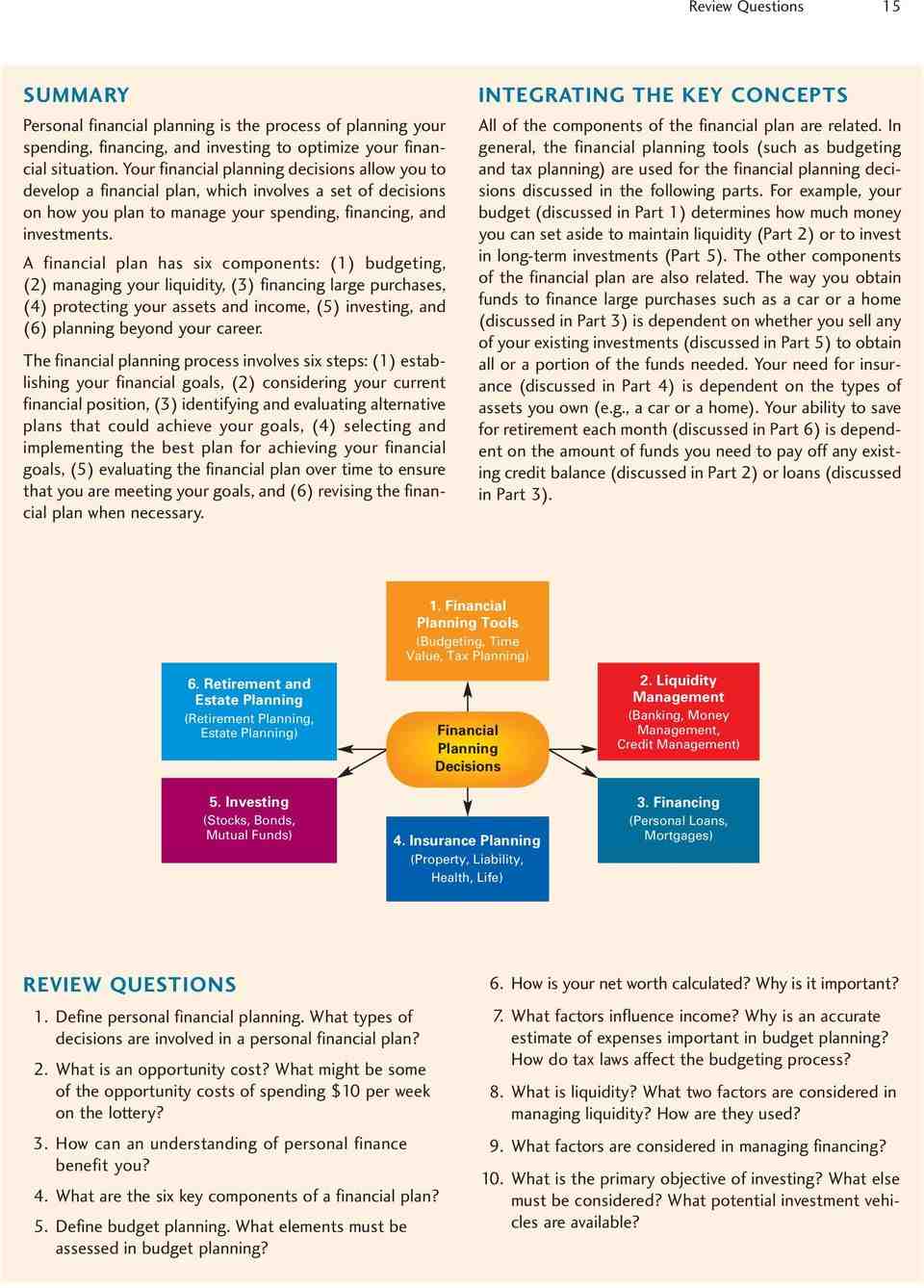

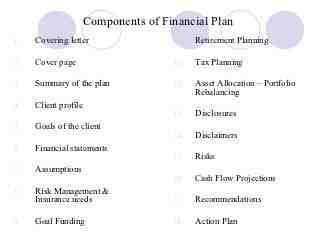

How many components are there in financial plan?

(Your legal guidance on land planning, inheritance, will, etc.) While the financial strategies of each investor may vary, there are 9 factors that are essential to making a complete financial plan, according to Neeraj Chauhan, Money Authorization.

What are benefits in personal finance?

The benefits of self-financing include the ability to budget appropriately for costs, the maximum amount of savings for retirement, and the choice of smart investments that will help a person achieve his or her financial goals.

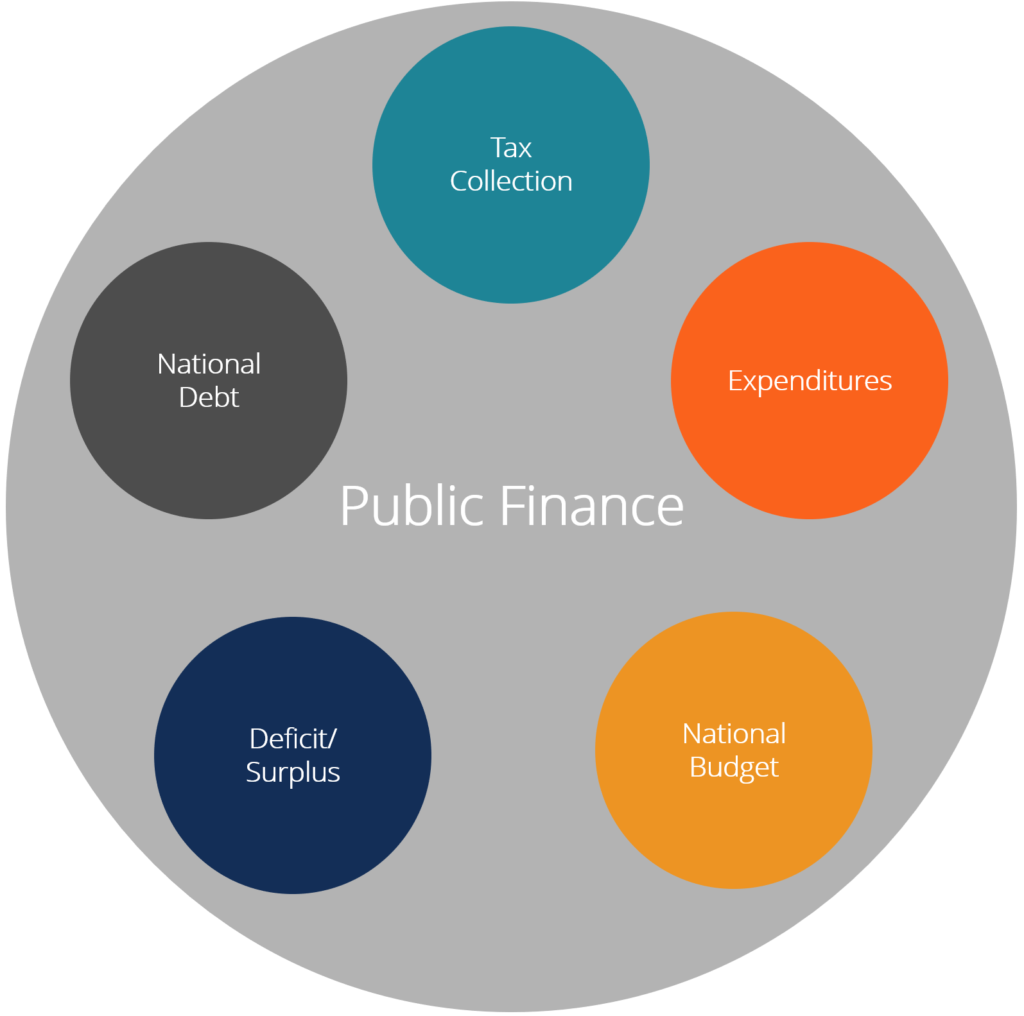

What are the 5 most important aspects of personal finance? Although there are many things about personal income, they are easily accessible to one of five categories: income, expenditure, savings, investment and protection. These five areas are important for planning your personal finance plan.

What are benefits of financial management?

The benefits of money management allow entrepreneurs to pay their bills, understand their profits, develop better relationships with brokers, clients, and clients, pay competitive prices and more.

What is the main importance of financial management?

Managing money provides ways to achieve goals and objectives within the organization. The main task of a financial manager is to measure the quality of an organization through positive share, acquisition and management. Provides guidance in financial planning. It helps to make money from different sources.

What are financial benefits?

monetary benefit refers to any monetary or material benefit including but not limited to any monetary, stock, security, service, license, authorization, contract, authorization, loan, travel, entertainment, discounts and no other public, real or personal, or something of value.

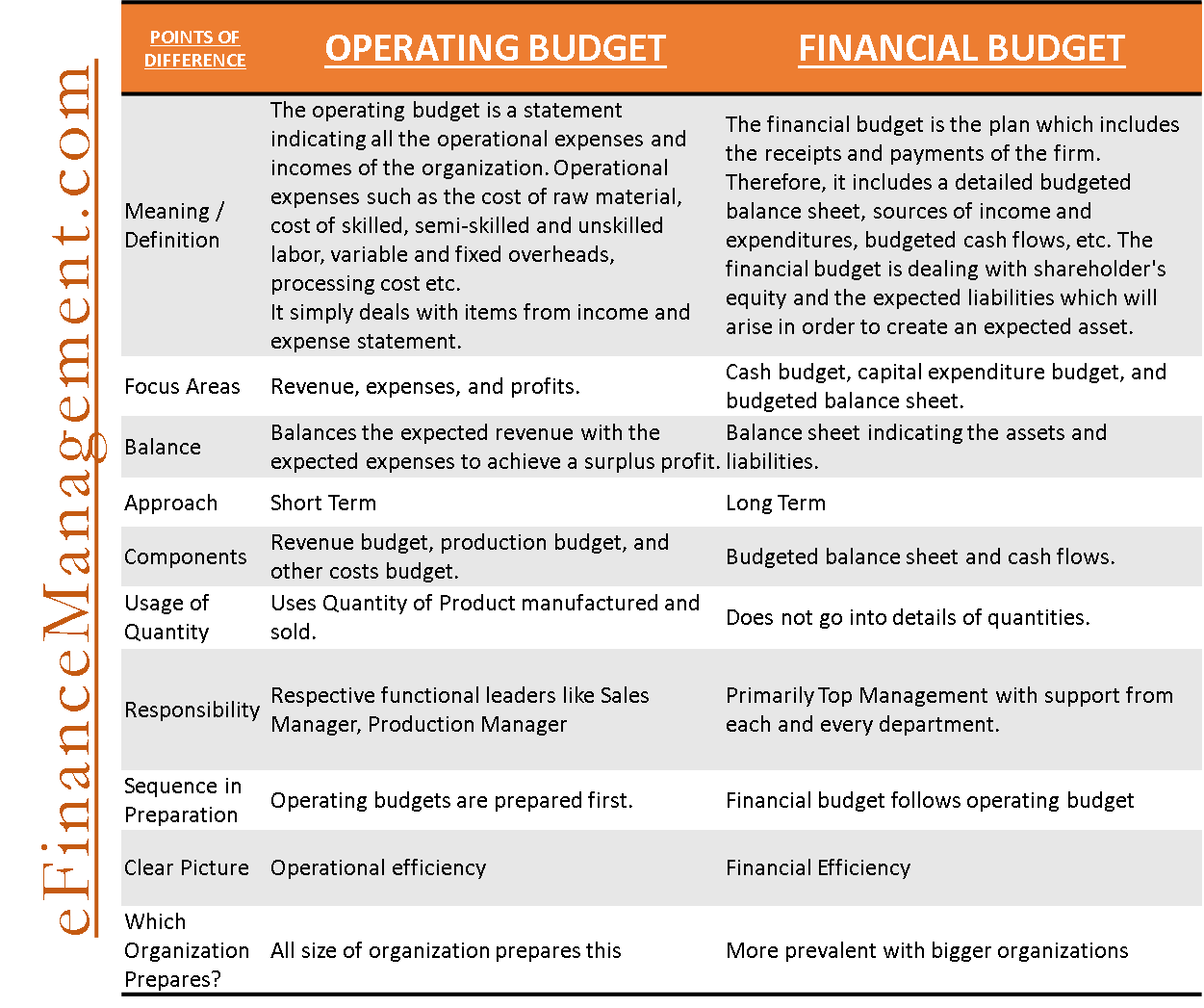

What are the 4 processes of financial management?

Managing money is an important part of any organization. It is the process of planning, planning, managing and managing financial resources with the aim of achieving the goals and objectives of the organization.

What are the 4 4 goals of money management? The main goals of financial management include profit and wealth growth, cash management, cost effectiveness, risk management, life management, and more.

Sources :