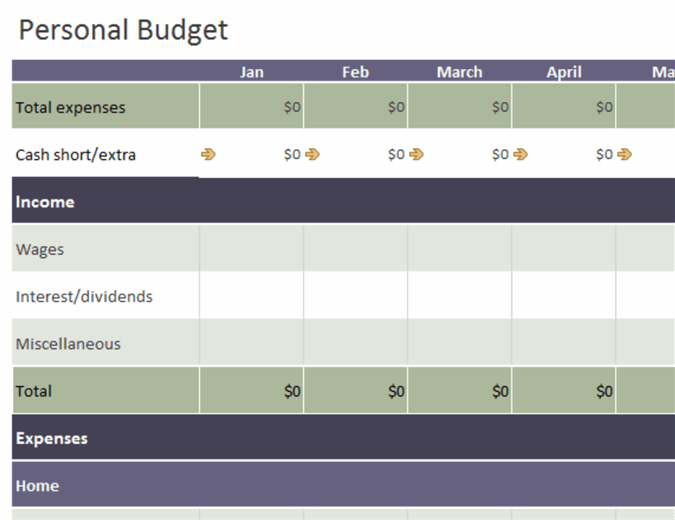

Budgeting is the most important initial element in financial planning. Setting a budget is relatively easy; it’s harder to stick to! However, it is up to you to take the time and care to record and resolve your expenses in some way.

What are the 5 components of a financial plan?

Be Prepared: 5 Key Components of a Strong Financial Plan

- Define your financial plan goals. …

- Make rough cash flow projections. …

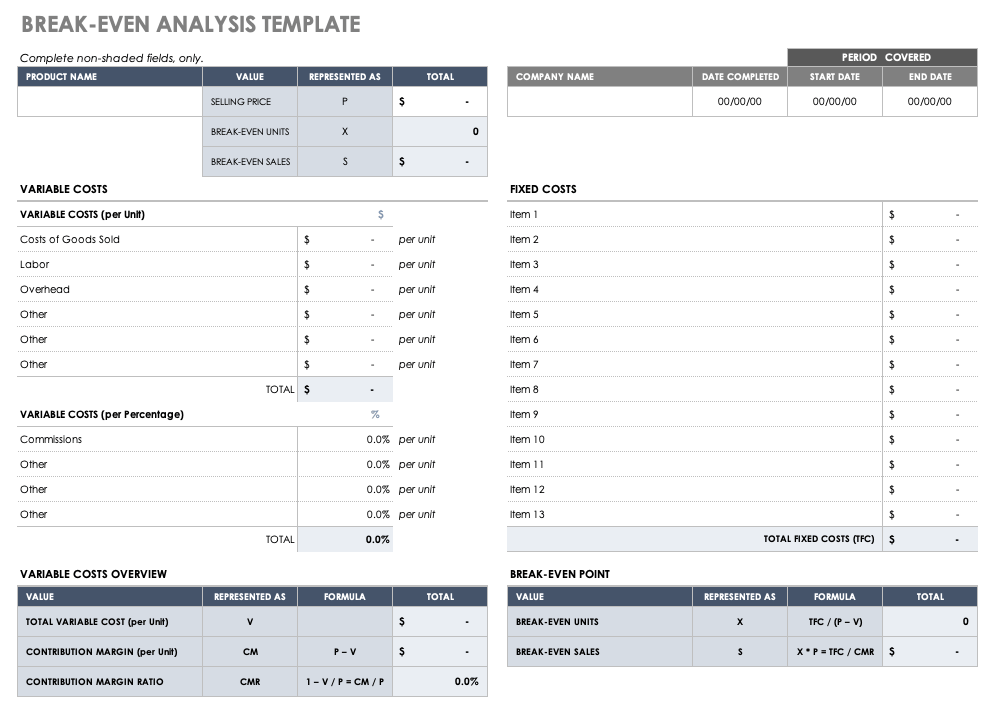

- Evaluate your risks. …

- Define an investment strategy based on the above factors. …

- Review and refine your plan regularly.

What are the six components of a financial plan? The key elements are cash flow management, investment management, tax planning, insurance assessment, retirement planning and estate planning.

What are the 5 main components of personal finance?

While personal finance has many aspects, it can easily fall into one of five categories: income, expenditure, savings, investment and protection. These five areas are crucial to shaping your personal financial planning.

What are the 5 key components of financial planning?

There are five essential components of a financial plan such as Insurance planning, Retirement Planning, Investment Planning, Tax Planning and Estate Planning.

What are the components of personal finance?

The components of personal finance include check and savings accounts, credit cards and consumer loans, stock market investments, retirement plans, social welfare benefits, insurance policies, and income tax management.

What is the first step of the financial planning process?

What is the First Step in Financial Planning? analyze current situation. For wealth management and financial planning, the first step that motivates financial advisors is to analyze your current financial situation.

What is a budget planning?

Budget planning is the process of building a budget and then using it to control the operations of a business. Budget planning aims to mitigate the risk that an organization’s financial results will be worse than expected.

What is the role of the budget in planning and control? Budgets are needed to highlight the financial implications of the plans, to define the resources required to achieve these plans and to provide a means of measuring, viewing and controlling the results obtained, compared to the plans.

What is the link between budgeting and planning?

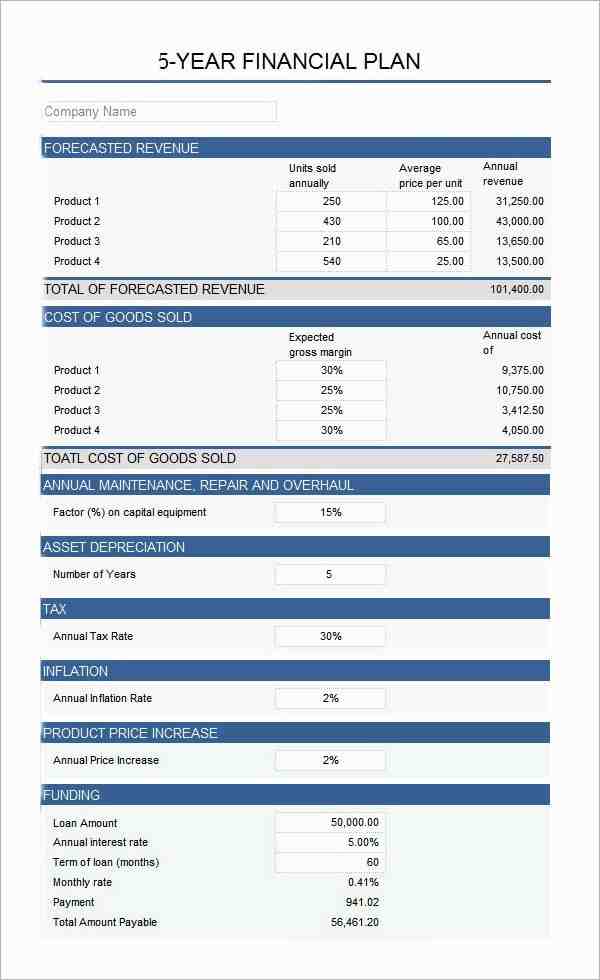

Planning provides a framework for business financial objectives – typically for the next three to five years. Budgeting details how the plan will be implemented from month to month and covers items such as income, expenses, potential cash flow and debt reduction.

What is the relationship of budgeting to the management planning and control?

“Planning identifies desirable outputs and the budget identifies the inputs required to achieve that output. Management therefore uses the planning process to establish a program, to make basic policies and to set goals and objectives for the whole organization.

How does budgeting help planning?

Because budgeting allows you to create a spending plan for your money, it ensures that you always have enough money for what you need and what is important to you. Following a budget or spending plan will keep you out of debt or help you find your way out of debt if you are currently in debt.

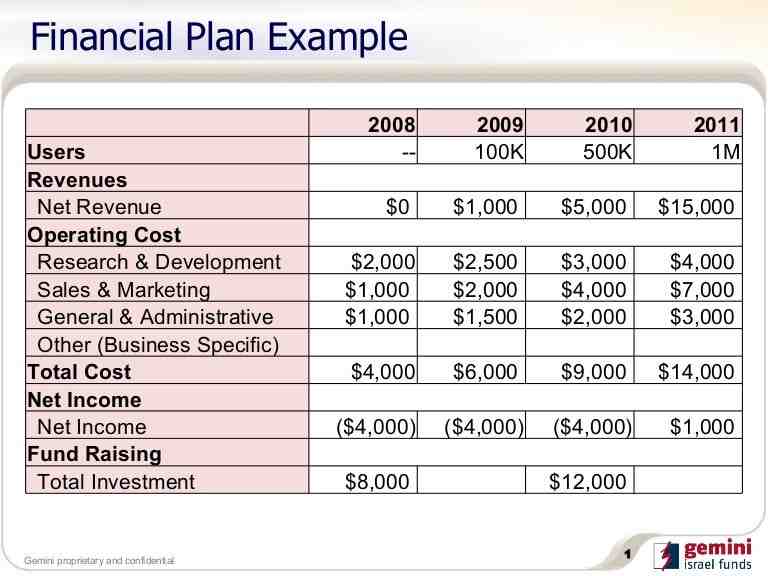

How do you structure a financial plan?

A financial plan has three main components: a cash flow forecast, an income statement and a balance sheet. Your financial plan answers essential questions to set and track progress toward setting goals. By using financial management software, you will gain the tools to make effective strategic decisions.

What are the three components of a financial statement?

The balance sheet, income statement and cash flow statement provide unique data with information that is all interconnected. The three statements together provide a comprehensive overview of the company’s operating activities.

What are the 3 components of the original financial statements? The income statement, balance sheet, and cash flow statement are financial statements. These three statements are informative tools that traders can use to analyze a company’s financial strength and to provide a quick picture of a company’s financial health and core value.

What are the main components of financial statements?

These are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) shareholder equity statements. Balance sheets show what a company owns and what is owed to it at a set point in time.

What are the five component of financial statement?

5 Key Features of the Financial Statements: Assets, Liabilities, Equity, Income, Expenses.

What are 4 components of financial statements?

There are four main financial statements. These are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) shareholder equity statements.

Sources :