Pension § 32 is a policy or contract purchased from an insurance company with funds from a registered pension scheme. The policy provides an annuity at some point in the future – a deferred annuity contract.

How long can you live outside of Canada without losing citizenship?

Contents

Your provincial or territorial health plan only covers parts, if any, of medical expenses outside of Canada and will not pay in advance. Furthermore, it will be invalid if you live elsewhere beyond a certain period of time – usually six to eight months, depending on the province or territory.

What happens if I stay away from Canada for more than 6 months? If you stay longer than 6 months under the eTA program and your stay has not been extended by Citizenship and Immigration Canada (emergency only), you will lose your travel authorization and will not be able to use eTA for future travel.

How long can a citizen of Canada stay out of Canada?

Canadians are allowed to visit the United States for up to six months (182 days) per calendar year. Citizens of other countries have only 90 days. You can collect these days with one long trip, or a collection of several short ones.

Can you lose your Canadian citizenship if you live in another country?

Under Canadian law, you can be both a Canadian citizen and a citizen of another country. However, some countries will not allow you to retain citizenship if you become a Canadian citizen.

How long can you be out of Canada without losing permanent residency?

Yes, you can lose your permanent resident status (PR). If you have not been to Canada for at least 730 days in the last five years, you may lose your PR status.

How long can you be out of Canada without losing permanent residency?

Yes, you can lose your permanent resident status (PR). If you have not been to Canada for at least 730 days in the last five years, you may lose your PR status.

Can I stay more than 6 months outside Canada?

A Canadian can stay for up to 182 days per calendar year (without paying US income tax). Visitors can stay for a maximum of six months in every 12 months (not a calendar year, but 12 months back from the date of entry).

How long Canadian PR stay outside Canada?

Canadian promotional cards are valid for a 5-year period and allow you to travel freely outside of Canada during that 5-year period.

Can I lose my citizenship if I live outside Canada?

The changes have created some confusion. Many people question the stability of their citizenship and the possibility that it may be revoked and whether living abroad may be the reason. A person born in Canada cannot lose his or her citizenship solely on the grounds that they do not live or have lived in Canada.

Can I lose my Canadian citizenship if I live in another country?

Many people question the stability of their citizenship and the possibility that it may be revoked and whether living abroad may be the reason. A person born in Canada cannot lose his or her citizenship solely on the grounds that they do not live or have lived in Canada.

How long can I stay out of Canada without losing my citizenship?

A Canadian can stay for up to 182 days per calendar year (without paying US income tax). Visitors can stay for a maximum of six months in every 12 months (not a calendar year, but 12 months back from the date of entry).

Does Florida tax your pension?

Florida, one of our 10 most tax-friendly states for seniors, has no state income tax. This means no state taxes on social security benefits, pensions, IRAs, 401 (k) s and other pension income. It also has no inheritance tax or property tax.

What taxes do you not pay in Florida? There is no personal income tax in Florida. Florida Sales Tax: Florida sales tax is 6%. Florida State Tax: Florida does not have a state income tax. Florida Corporate Income Tax: Companies that conduct business and earn income in Florida must file a tax return (unless they are exempt).

How much does Florida tax your pension?

Florida has no state income tax, which means that pension benefits from social security, retirement income and income from an IRA or a 401 (k) are all untaxed.

Does Florida tax retirement distributions?

Because Florida has no state income tax, this also means that retirement income is exempt from state taxation. All money you receive from individual pension accounts, private and public pensions, 401 (k) s and social security, is completely free of state taxation.

Why you should not retire in Florida?

Reasons not to retire in Florida include the chance of hurricanes, high expenses, animals, being far away from family and friends, many elderly people, many weird people, extreme weather, hot and sweaty weather, risk of sun damage to your skin, and sinkholes.

Which states do not tax pensions?

Nine of the states that do not tax income from retirement plans simply because dividends from retirement plans are counted as income, and these nine states have no state income tax at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

How can I avoid paying tax on my pension?

Employers for most pension schemes are required to withhold a mandatory 20% of the one-time payment when you leave the company. However, you can avoid this tax credit if you transfer these funds directly to an IRA transfer account or other similarly eligible plan.

Do all states tax your pension?

Eight states – Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming – do not tax income at all. A ninth state, New Hampshire, taxes only capital gains and dividend income. And five states – Alabama, Illinois, Hawaii, Mississippi and Pennsylvania – exclude retirement income from state taxes.

What are the 3 main types of pensions?

The three types of pension

- Defined contribution pension. Sometimes called a ‘cash buy’ pension or referred to as a pension pot, these schemes are very common today. …

- Defined benefit pension. This type of pension scheme has fallen in popularity. …

- State pension.

What are the main types of pension schemes? There are two main types of pension schemes: defined benefit and defined contribution plans. A defined benefit plan guarantees a fixed monthly payment for life (or a one-off payment upon retirement). A defined contribution plan creates an investment account that grows through the employee’s working year.

How many types of pension do we have?

There are 2 main types of pension schemes: defined benefit (DB) and defined contribution (DC).

How do I know what type of pension I have?

If you know that you have a pension, but are unsure of what kind of pension scheme it is, the best thing you can do is contact your pension provider. They will be able to give you all the details about your scheme, including what type it is, what fees you pay and how your pension performs.

How many different types of pensions are there?

The three types of pension Money is paid in by you or your employer over time and invested by the pension provider. The size of your pension pot at retirement depends on how much was paid in and how well your investments have done. It is up to you how to withdraw your money from a defined contribution pension.

What are examples of pensions?

As an example, a pension scheme may pay 1% for each year of the person’s service times the average salary for the last five years of employment. 2 So an employee with 35 years of service in that company and an average final year salary of $ 50,000 will receive $ 17,500 a year.

Is a 401k a pension?

What is the difference between a pension plan and a 401 (k) plan? A pension plan is financed by the employer, while a 401 (k) is financed by the employee. (Some employers will match some of your 401 (k) contributions.) A 401 (k) allows you to control your fund contributions, a retirement plan does not.

What are the three types of pension plans?

Benefit-based pension schemes can be further divided into three types: single employer, multi-employer agent and cost-sharing multiplier.

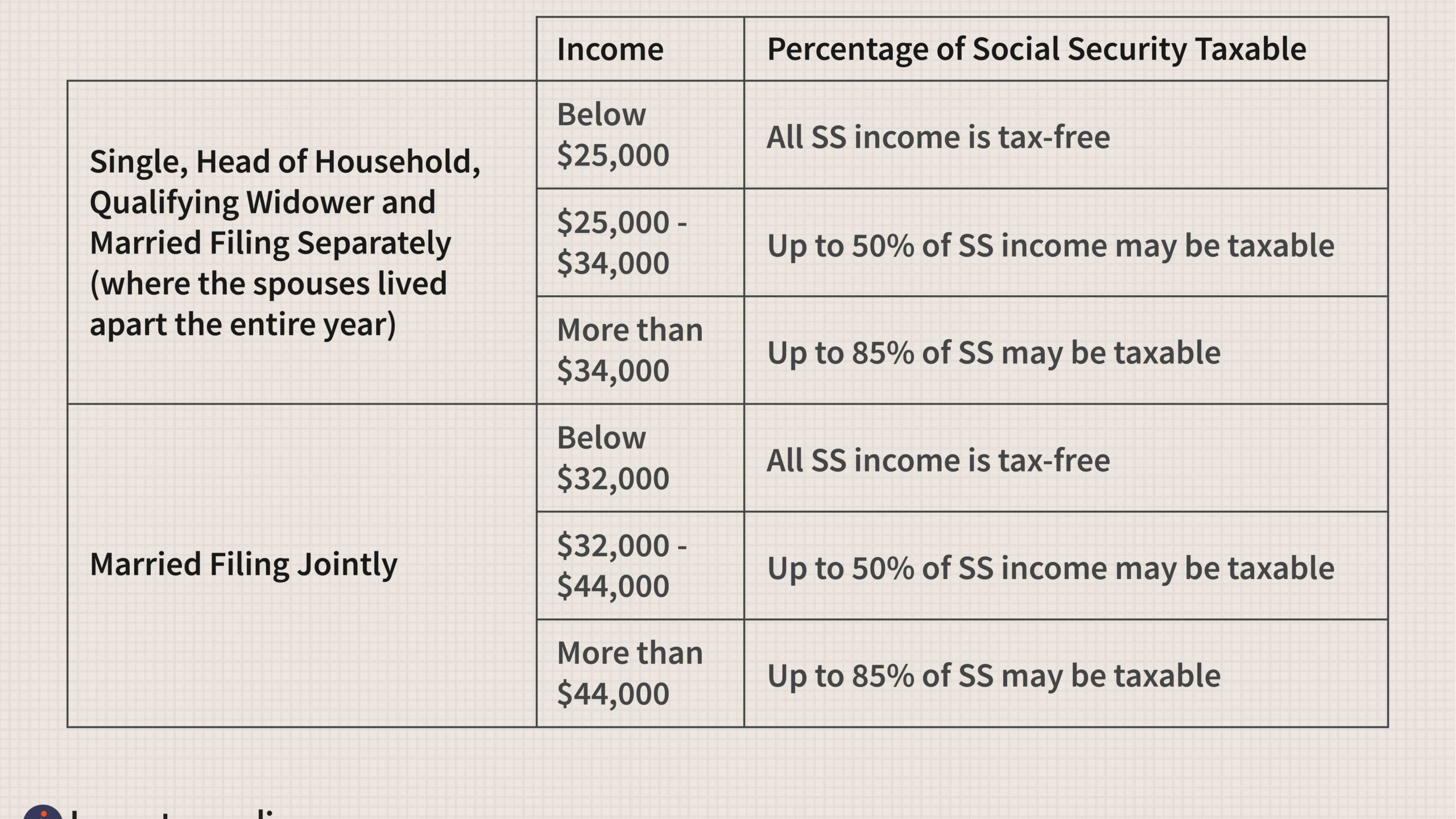

Does dual citizenship affect Social Security benefits?

They eliminate double social security taxation when an employee from one country works in another country and is required to pay social security tax to both countries on the same income.

Do you lose social security if you change your citizenship? Your social security number remains in place; you’re just not taxed as a US citizen anymore.

Can I collect Social Security with dual citizenship?

If you are a US citizen and qualify for Social Security, Family, Survivors’ or Disability Benefit, you can receive your payments while living in most other countries.

What are disadvantages of dual citizenship?

The disadvantages of being a dual citizen include the potential for dual taxation, the long and costly process of obtaining dual citizenship, and the fact that you are bound by the laws of two nations.

Can I collect my Social Security if I live in a foreign country?

If you are a U.S. citizen, you can receive Social Security payments outside of the United States as long as you qualify for them.

What are the disadvantages of having dual citizenship?

The disadvantages of being a dual citizen include the potential for dual taxation, the long and costly process of obtaining dual citizenship, and the fact that you are bound by the laws of two nations.

Where is dual citizenship not allowed?

| Afghanistan | El Salvador | Lithuania |

|---|---|---|

| Austria | Georgia | Montenegro |

| Azerbaijan | India | Netherlands * |

| Bahrain | Indonesia | Nepal |

| China | Japan | Poland |

What are the rules for dual citizenship?

Each country has its own nationality laws based on its own policy. Individuals can have dual citizenship by automatically enforcing different laws instead of by election. For example, a child born in a foreign country to a US citizen’s parents may be both a US citizen and a national of the country of birth.

Does dual citizenship affect SSI?

Hi, provided you retain your US citizenship, having citizenship of another country will not affect your Social Security benefits or your alternatives.

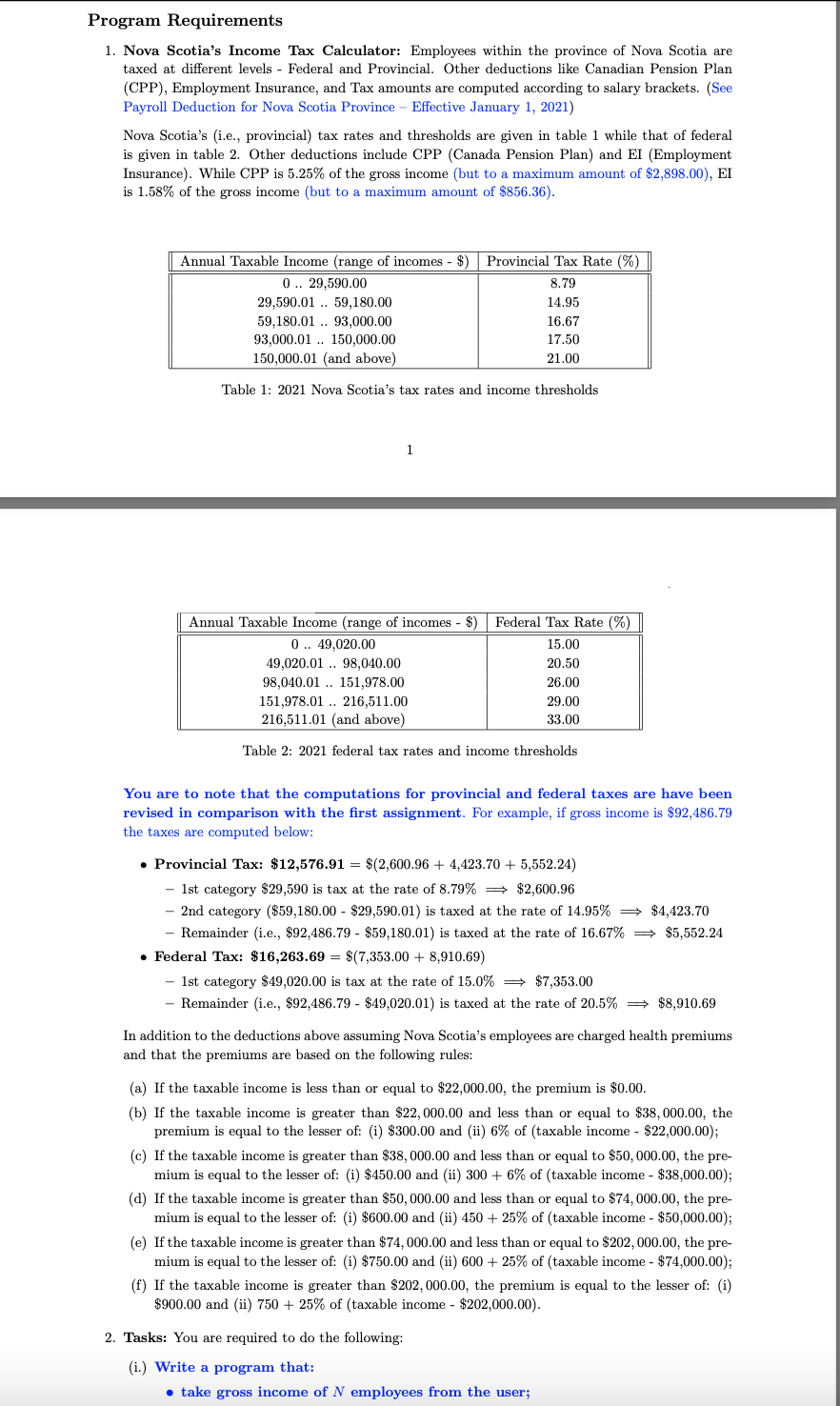

Do you pay tax on pension?

The short answer is that income from pensions is taxed like all other income. You have a personal deduction (£ 12,500 for the 2020/21 tax year) that you do not pay income tax, and then you pay 20 per cent income tax on anything from £ 12,501 to £ 50,000 before the higher tax rate starts.

Is old-age pension considered income? Pension payments, annuities and interest or dividends from your savings and investments are not income for social security purposes. You may have to pay income tax, but you do not pay social security contributions.

How much will my pension be taxed?

Both your income from these pension schemes and your earned income are taxed as ordinary income at rates from 10% to 37%. 5 And if you have an employer-financed pension scheme, that income is also taxable.

How much tax do I pay on my pension?

25% of your pension pot can be taken out tax-free. How you withdraw money from your pension will determine whether you pay tax on the other 75% now or later. Pay tax on 75% of the amount deducted. Choose how much you want to deduct from the tax-free portion.

Which states do not tax pensions?

Nine of the states that do not tax income from retirement plans simply because dividends from retirement plans are counted as income, and these nine states have no state income tax at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

What is the most tax friendly state for retirees?

1. Delaware. Congratulations, Delaware – you are the most tax-friendly state for seniors! With no sales tax, low property taxes and no death taxes, it’s easy to see why Delaware is a tax haven for retirees.

How can I avoid paying tax on my pension?

Employers for most pension schemes are required to withhold a mandatory 20% of the one-time payment when you leave the company. However, you can avoid this tax credit if you transfer these funds directly to an IRA transfer account or other similarly eligible plan.

How can I avoid paying tax on my pension?

Employers for most pension schemes are required to withhold a mandatory 20% of the one-time payment when you leave the company. However, you can avoid this tax credit if you transfer these funds directly to an IRA transfer account or other similarly eligible plan.

How much will my pension be taxed?

Withdrawals from pension accounts are fully taxed. Salary is taxed at normal rates and your marginal state tax rate is 5.90%. Public and private pension income is fully taxed.

Do I have to pay taxes on my pension?

Tax on pension income You must pay income tax on your pension and on withdrawals from any tax-exempt investments – such as traditional IRAs, 401 (k) s, 403 (b) s and similar pension schemes and tax-exempt annuities. € ”in the year you take the money. The taxes to be paid reduce the amount you have left to spend.

Sources :