What is the FERS death benefit?

Contents

Basic Death Benefit When a FERS employee dies, the surviving spouse is entitled to a one-time death benefit of 50% of the deceased’s current salary plus a one-time payment of $ 34,991. To see also : How much is the average federal pension?. (Note that this is the approved amount for 2021, but it adjusts for inflation annually.)

Who received a federal pension after death? The monthly annuity paid to the surviving spouse of an employee whose death occurred while he was employed by the federal government is 50 percent of the annuity calculated as if the employee had retired on the day of his death.

How much is the federal employee death benefit?

The spouse may be entitled to a basic death benefit equal to 50% of the employee’s final salary (average salary, if higher), plus $ 15,000 (increased for adjustments to the cost of living of the civil service retirement system starting on December 1, 87) . Read also : Is federal pension good?.

What is the FERS lump-sum death benefit?

When an FERS employee dies, the surviving spouse is entitled to a one-time death benefit of 50% of the deceased’s current salary plus a one-time payment of $ 34,991. (Note that this is the approved amount for 2021, but it adjusts for inflation annually.)

How much is the FERS monthly survivor benefit?

The maximum monthly annuity for a spouse who survives the FERS annuity is 50 percent of the annuity recipient before it is reduced by the price of the election to provide family benefits.

How much is the FERS monthly survivor benefit?

The maximum monthly annuity for a spouse who survives the FERS annuity is 50 percent of the annuity recipient before it is reduced by the price of the election to provide family benefits. On the same subject : Is 80 000 A good retirement income?.

Are survivors benefits paid monthly?

Fees are paid in the month following the month for which they are due. For example, in August you would receive a benefit for July. In general, the day of the month when you receive benefits depends on the date of birth of the person for whose records you receive benefits.

How much do you receive for survivor benefits?

Amount of compensation for survivors Widow or widower, full retirement age or older – 100% of the amount of compensation for the deceased worker. Widow or widower, 60 years â € ”full retirement age â €” 71½ up to 99% of the basic amount of the deceased worker. Widow or widower with a disability aged 50 to 59 â € ”71½%.

Do retirement benefits end at death?

According to the Internal Revenue Service (IRS), the Retired Employee Retirement Insurance Act of 1974 (ERISA) “protects the surviving spouses of deceased participants who earned the acquired pension before death.

How long do Social Security benefits continue after death?

Widows and widowers These benefits are paid for life unless the spouse starts collecting a pension that is higher than the family benefit. Beneficiaries entitled to two types of social security payments receive more than two amounts.

Who is entitled to retirement benefits after death?

Widow or widower aged 60 or over (50 or older if disabled). Surviving divorced spouse, under certain circumstances. Widow or widower of any age caring for a child who has died under the age of 16 or has a disability and receives child benefits.

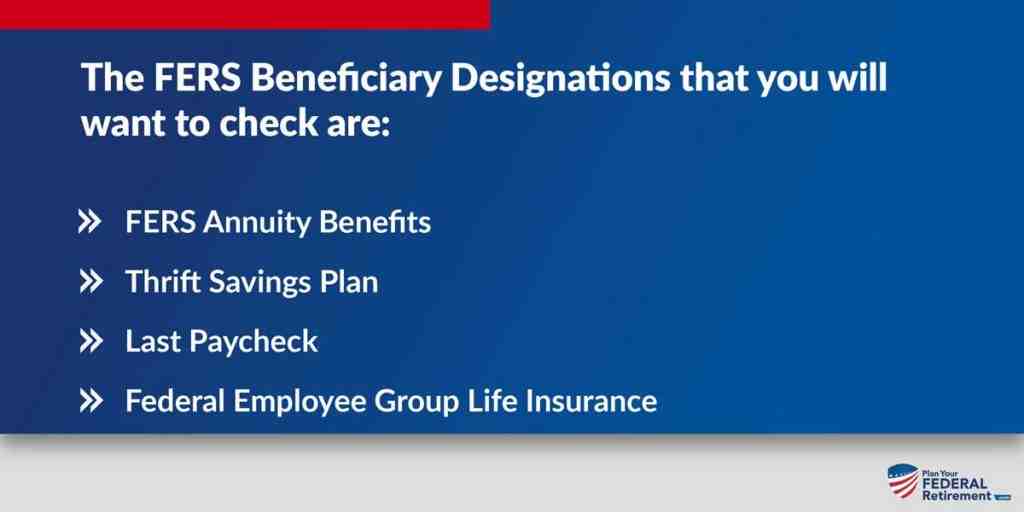

Does the federal government offer life insurance?

On August 29, 1954, the federal government established the Federal Employee Group Life Insurance Program (FEGLI). It is the largest group life insurance program in the world, covering over 4 million federal employees and retirees, as well as many members of their families. . Most employees are eligible for FEGLI coverage.

Do federal officials have life insurance? Unless they waive coverage, most federal employees have basic life insurance under a federal employee group life insurance program. Basic life insurance is equal to the actual annual basic salary rate (rounded to the next $ 1,000) plus $ 2,000 or $ 10,000, whichever is higher.

Does the government sell life insurance?

The policies are issued in various permanent plans and as renewable insurance. The maximum face value of a USGLI policy is $ 10,000. All USGLI policies were declared paid as of January 1, 1983, which means that no further premium payments were due. Annual dividends continue to be paid on these policies.

Does the government insure insurance companies?

Therefore, state insurance provides pensions through the federal corporation for the insurance of pension benefits, and each state maintains insurance solvency funds that pay out insurance claims, within limits, to policyholders of failed insurance companies. Sometimes state insurance is implicit.

Does the government provide life insurance?

Health Care and Insurance Life Insurance On August 29, 1954, the Federal Government established the Federal Employee Group Life Insurance Program (FEGLI). It is the largest group life insurance program in the world, covering over 4 million federal employees and retirees, as well as many members of their families.

Is federal life insurance free?

The state pays one-third of the cost of your basic life insurance. You pay 100% of the price of the Optional Insurance. FEGLI is a group term insurance. No cash or paid value.

Is FEGLI basic free?

The federal government pays the remaining 1/3 of the basic insurance price. (Basic is free for U.S. Postal Service employees). * When can I enroll? Newly hired and newly hired workers are automatically enrolled in the basic insurance on the first day in the status of salary and duties.

Does the federal government give life insurance?

In 1954, the federal government established the Federal Employee Group Life Insurance Program (FEGLI) to provide group life insurance. FEGLI can help you meet your life insurance needs.

Do federal employees get benefits for life?

Federal Employee Group Life Insurance (FEGLI) The Federal Employee Group Life Insurance (FEGLI) program covers over 4 million federal employees, retirees and family members.

Do term federal employees get benefits?

Temporary employees are entitled to participate in most benefit programs available to permanent federal employees, for example, FEHB, FEGLI, the Federal Retirement System (FERS) and the Savings Plan (TSP). ”(3) Competitive Appointment .

Does the federal government give life insurance?

In 1954, the federal government established the Federal Employee Group Life Insurance Program (FEGLI) to provide group life insurance. FEGLI can help you meet your life insurance needs.

What happens to your life insurance when you retire?

Retirement life insurance works the same way as most term or permanent policies: if you die, the death benefit aims to help you replace your income and help your customers pay your last expenses.

How does FEGLI pay out?

This basic coverage is the only part of FEGLI for which the government helps pay. For most employees, the state pays a ⅓ premium, and the employee takes over another ⅔. But if you are a postal clerk, the USPS pays 100% of your basic insurance premiums.

How much is my FEGLI policy worth? This is your basic insurance amount. FEGLI costs 15 ¢ for $ 1,000 of your BIA. So if, for example, you have a salary of $ 84,500, then you have coverage for $ 87,000. If you are paid every two weeks, then your coverage costs $ 13.05 every two weeks.

How is FEGLI paid out?

New federal employees are automatically guaranteed basic life insurance on the day they qualify for FEGLI. Premiums will be automatically deducted from employee salaries unless they give up. If the employee does not want to participate in FEGLI, he should inform his employer in writing.

How long does it take FEGLI to pay out?

How much does it take for FEGLI to pay? The insurance company must pay the Federal Employee Group Life Insurance (FEGLI) death insurance benefits within 30 days from the date the beneficiary submitted the notice of application and submitted all necessary supporting documentation.

What happens to my FEGLI after I retire?

If you do not meet the conditions (or do not want to) continue with your FEGLI coverage until retirement, you must either give up the coverage or turn it into an individual policy. This policy will remain in effect for 31 days after retirement at no cost to you.

What happens to my FEGLI after I retire?

If you do not meet the conditions (or do not want to) continue with your FEGLI coverage until retirement, you must either give up the coverage or turn it into an individual policy. This policy will remain in effect for 31 days after retirement at no cost to you.

Can I cash out my FEGLI life insurance?

No. FEGLI life insurance is a term life insurance. It does not create cash value. You cannot borrow against him or cash in on him.

Can a term appointment be made permanent?

Can this limited appointment become permanent? Based on workload needs, federal and state funding, and individual performance, limited-term appointments may become permanent in the future.

Can a job be made permanent? Transfer to permanent employment If an employee is appointed to a job through a public competition, turn him / her into a regular career service with permanent status.

Does term appointment count towards career tenure?

The KP does not adopt this proposal because appointments to non-career mandates or appointments are conditional on careers and therefore do not count towards career experience.

What does Would you accept a term appointment mean?

(1) Definition. Temporary appointment is a non-statutory appointment to a position in a competitive service, made for a fixed period of more than 1 year and not more than 4 years.

Is a term appointment career conditional?

Conditional appointment in a career, competitive service A term used to describe the status of an employee of the federal government. It includes permanent employees in the competitive service who have not completed three years of significantly continuous work experience in order to become full-time employees.

Is a term appointment career conditional?

Conditional appointment in a career, competitive service A term used to describe the status of an employee of the federal government. It includes permanent employees in the competitive service who have not completed three years of significantly continuous work experience in order to become full-time employees.

What does term appointment mean?

A fixed-term mandate means a fixed-term employment contract as agreed between the control body and the employee.

What does it mean to be a term employee?

Fixed-term employee means a fixed-term employee. The duration of an employment relationship can be based on a certain period of time or the completion of a certain job or until the occurrence of a certain event.

Sources :