What were the 4 components of financial planning?

Key components of a successful financial plan

- Tailor your financial plan to your personal values. …

- Participate in proactive retirement income planning. …

- Plan ahead for tax liabilities. …

- Incorporate property planning.

What four 4 common concerns would guide the development of their financial plan? What 4 common concerns should guide the development of their financial plan? The four principles of “flexibility, liquidity”, protection and minimization of taxes should guide the development of any financial plan.

What are the four 4 objectives of financial planning?

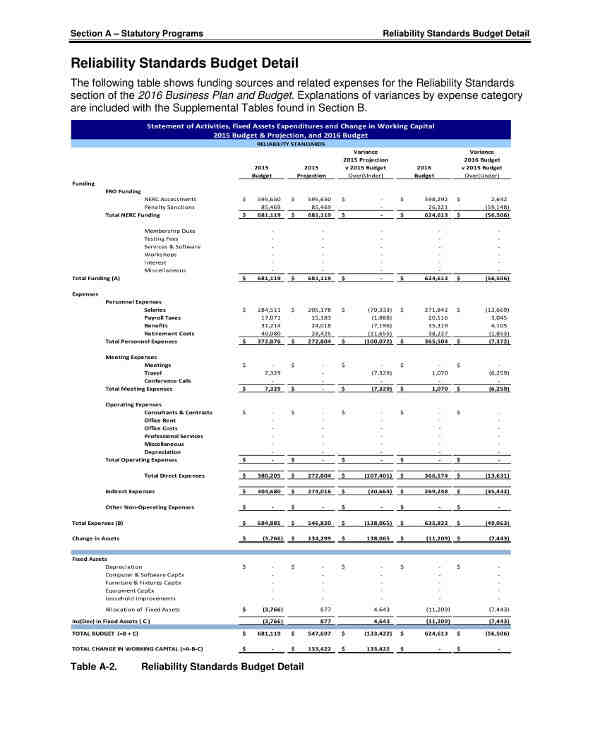

(i) Determining the amount of financing that a company will need to carry out its operations smoothly. (ii) Determination of sources of funds, ie. the pattern of securities to be issued. ADVERTISEMENTS: (iii) Establish appropriate policies for the proper use and management of funds.

What are the four elements of financial planning?

Most financial management plans will divide them into four elements that are commonly recognized in financial management. These four elements are planning, control, organization and management and decision making.

What are the 4 processes of financial management?

Financial management is a vital activity in any organization. It is the process of planning, organizing, controlling and monitoring financial resources in order to achieve organizational goals and objectives.

What were the four elements of the financial plan?

The main elements of a financial plan include a pension strategy, a risk management plan, a long-term investment plan, a tax reduction strategy and a property plan.

What are the four phases of personal financial life cycle?

There are four phases in a person’s financial life cycle. There is accumulation of wealth, growth or management of wealth, preservation and protection of wealth and transfer of wealth. Each phase of the cycle overlaps and must be managed using a comprehensive approach.

What is financial life cycle planning? The approach used to identify financial objectives for each phase and to provide strategies and plans to meet those objectives, while at the same time taking into account the different objectives for later stages, is called life cycle planning.

What is a personal financial life cycle?

The personal economic life cycle describes the financial resources we need to meet our needs and desires at the various stages of our lives.

Why is it important to plan a personal financial life cycle?

Financial planning is a step-by-step approach to achieving one’s life goals. A financial plan acts as a guide as you go through life’s journey. In essence, it helps you to have control over your income, expenses and investments so that you can manage your money and achieve your goals.

What is the personal life cycle?

Definition: A personal life cycle attempts to summarize the key phases that all individuals go through during their lifetime, matched with their changing financial needs. Birth / early age: Children and young teenagers are more likely to be supported by their parents / guardians.

What is the most important part of financial plan?

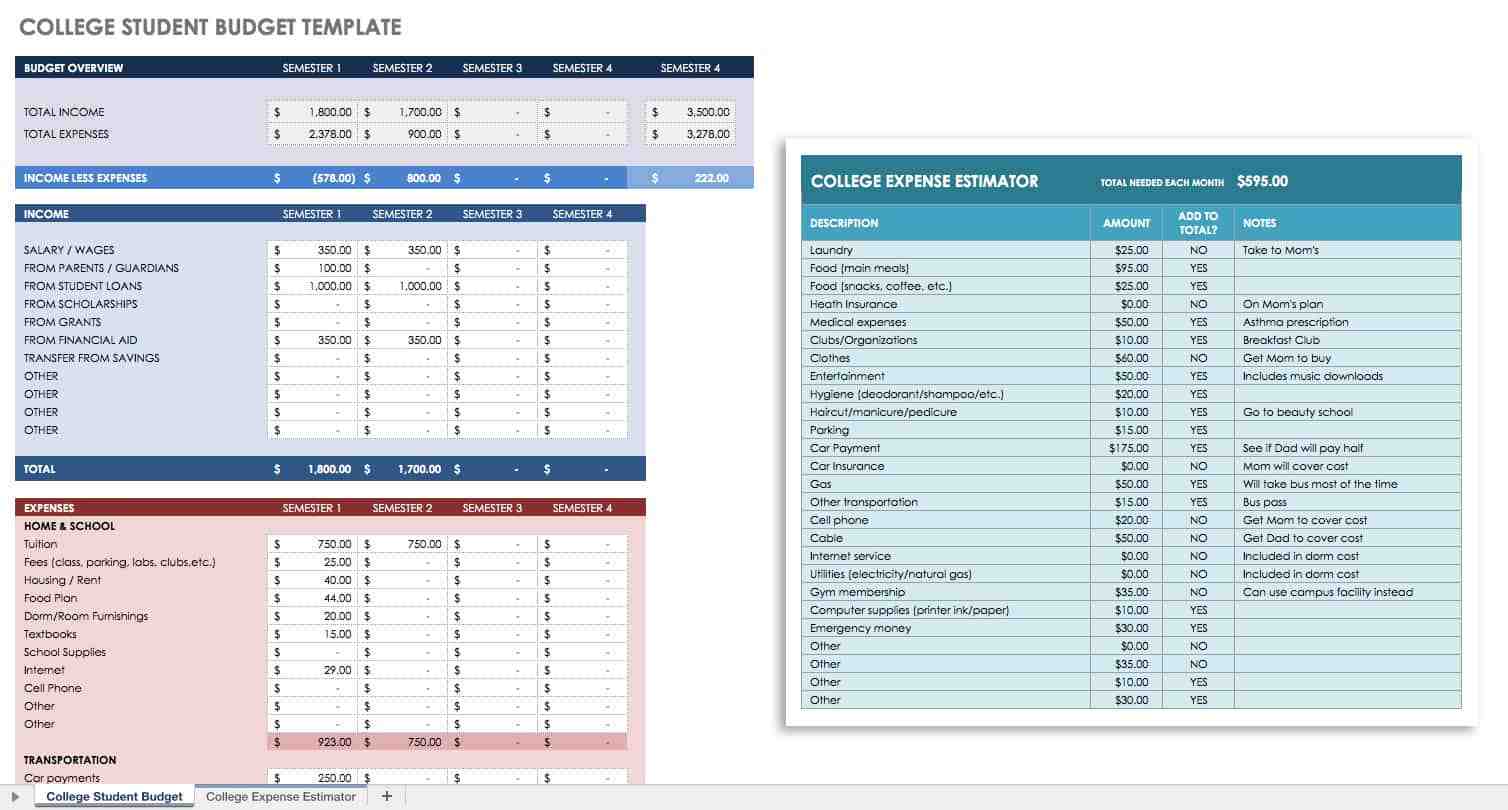

The most important introductory element in financial planning is budgeting. Setting a budget is relatively easy; it’s harder to stick to it! But having the discipline to take the time and care to record and reconcile your expenses somehow is what counts.

Is it one of the key components of the financial plan? Cash Flow Analysis One of the most critical aspects of financial planning is understanding your cash flow and the relationship between your current assets and debt. If you spend more than you earn, it will be impossible to achieve the goals you have set for yourself.

What is the importance of a financial plan?

A financial plan acts as a guide as you go through life’s journey. In essence, it helps you to have control over your income, expenses and investments so that you can manage your money and achieve your goals.

What are three purposes of a financial plan?

(i) Determining the amount of financing that a company will need to carry out its operations smoothly. (ii) Determination of sources of funds, ie. the pattern of securities to be issued. ADVERTISEMENTS: (iii) Establish appropriate policies for the proper use and management of funds.

What do you mean by financial planning explain its two importance?

Financial planning is basically about drawing up a financial plan for an organization’s future operations. The importance of financial planning is as follows: (a) It helps the company to prepare for the future. (b) It helps to avoid business shocks and surprises.

What is the most important step in financial planning?

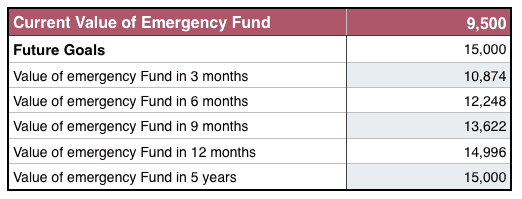

Monitoring your financial progress. Regular communication and follow-up are important steps in the financial planning process. In fact, creating the plan is really just the first step. You are in constant contact with your planner to find out if you are on track to reach your financial goals.

What is the most important financial rule?

The first rule of personal finance is to never have a credit card balance. Credit card loan rates are extremely high and paying these interest rates is an easy way to compound your net worth negatively. If you carry credit card debt for an extended period of time, you are not ready to invest your money in the markets.

How important is financial planning?

Financial planning is a step-by-step approach to achieving one’s life goals. A financial plan acts as a guide as you go through life’s journey. In essence, it helps you to have control over your income, expenses and investments so that you can manage your money and achieve your goals.

What is the most important thing in finance?

Cash Flow Management One of the most important (and obvious) aspects of personal finance is cash flow management. It’s all about how much money comes in and where the money goes. It is important to keep track of your cash flow before you can do anything else with your money.

What are the important aspects of finance?

They save, invest, financial protection, tax planning, retirement planning, but in no particular order. Here are the 5 aspects of a complete financial picture: Savings: You need to keep money aside as savings to cover any sudden financial need.

What are the 5 most important aspects of personal finance?

Although there are several aspects of personal finance, they easily fit into one of five categories: income, consumption, savings, investment and protection. These five areas are crucial to shaping your personal financial planning.

What is the most important step in financial planning?

Monitoring your financial progress. Regular communication and follow-up are important steps in the financial planning process. In fact, creating the plan is really just the first step. You are in constant contact with your planner to find out if you are on track to reach your financial goals.

What is the most important economic rule? The first rule of personal finance is to never have a credit card balance. Credit card loan rates are extremely high and paying these interest rates is an easy way to compound your net worth negatively. If you carry credit card debt for an extended period of time, you are not ready to invest your money in the markets.

Which is the first step in the financial planning process?

The first step in financial planning is to determine your current financial status.

How important is financial planning?

Financial planning is a step-by-step approach to achieving one’s life goals. A financial plan acts as a guide as you go through life’s journey. In essence, it helps you to have control over your income, expenses and investments so that you can manage your money and achieve your goals.

How important is financial planning for your future?

Income Growth: Financial planning helps you monitor your source of income properly and grow further. It lets your money work for you. It allows you to multiply your money that you can spend at the time you need it, whether it is short-term, medium-term or long-term.

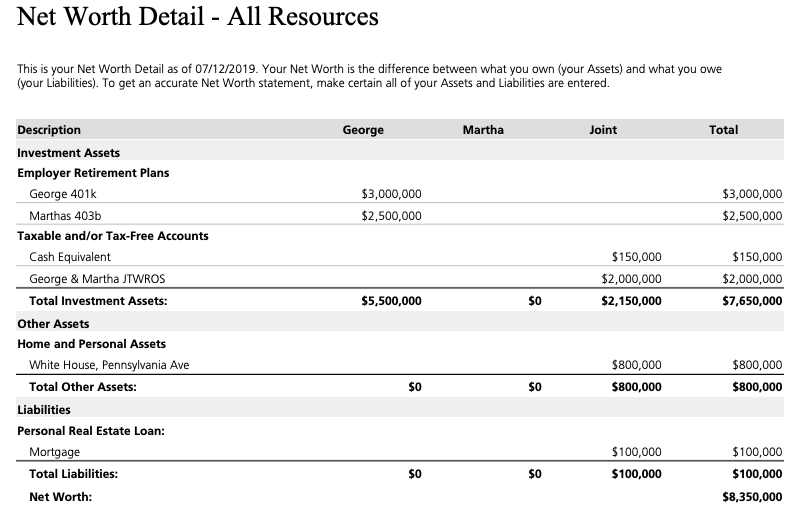

What does a personal financial plan look like?

A financial plan is a comprehensive picture of your current finances, your financial goals and any strategies you have set to achieve those goals. Good financial planning should include details about your cash flow, savings, debt, investments, insurance and other elements of your financial life.

What describes a personal financial plan? What exactly does personal financial planning mean? It is a comprehensive plan that stretches many years into the future. It’s not just for those with a lot of money. A financial plan secures you against life’s surprises. It includes details about your income, savings, investments, expenses, debt and insurance.

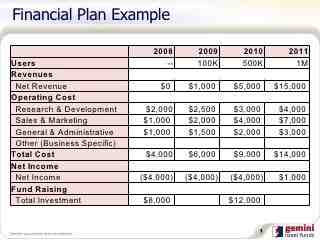

What is an example of financial plan?

An investment plan (to build assets) Personal insurance. A property plan. Income tax strategies.

What are the 4 financial plans?

The main elements of a financial plan include a pension strategy, a risk management plan, a long-term investment plan, a tax reduction strategy and a property plan.

Sources :