How much does the average 60 year old have saved for retirement?

Americans in their 30s: $ 45,000. Americans in their 40s: $ 63,000. Americans in their 50s: $ 117,000. Americans in their 60s: $ 172,000.

How much does the average 60-year-old have in 401 thousand? Average balance of 401 thousand aged 55 to 64 years – 586 486 USD; The median is $ 270,698. By your late 50s or early 60s you should have a better idea of what retirement might look like for you and what it really means for you to be ‘retired’. Do you want to keep working as long as you can?

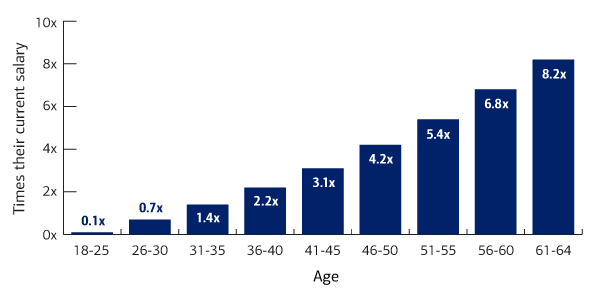

How much should you have saved at age 60 for retirement?

The general rule for retirement savings up to age 60 is that the target has saved seven to eight times your current salary. This means that someone earning $ 75,000 a year would ideally have between $ 525,000 and $ 600,000 in retirement savings at that age. If you’re not there yet, you’re not alone.

How much should 401k be at 60?

According to the results, the average 60-year-old should have between $ 800,000 – $ 5,000,000 saved in his 401,000, depending on the company’s relevance and investment performance. Just one or two percentage points in the performance difference can really add a lot in a 30-year savings period.

How much money should you have to retire at 60?

Retirement experts have offered different rules about how much you need to save: somewhere close to a million dollars, 80% to 90% of your annual pre-retirement income, 12 times your pre-retirement salary.

What does the average 58 year old have saved for retirement?

A 2019 Consumer Finance Survey conducted by the Federal Reserve found that the average American approaching retirement (ages 55-59) saved $ 223,493.56 with similar numbers for ages 60-64 to $ 221,451.67 . But some individuals have saved much more, while others have no retirement savings at all.

At what age should a 59-year-old retire? Retirement experts have offered different rules about how much you need to save: somewhere close to a million dollars, 80% to 90% of your annual pre-retirement income, 12 times your pre-retirement salary.

What is the average 401K balance for a 60 year old?

| DOB | AVERAGE STATE 401K | MEDIAN 401 K BALANCE |

|---|---|---|

| 45-54. | $ 161,079 | $ 56,722 |

| 55-64. | $ 232,379 | $ 84,714 |

| 65 | $ 255,151 | $ 82,297 |

How much does the average 65 year old have in retirement savings?

According to the Federal Reserve, the average amount of retirement savings for people aged 65 to 74 is just north of $ 426,000. While this is an interesting fact, your special retirement savings may be different from someone else’s.

How much should I have in my 401k at age 60?

According to the results, the average 60-year-old should have between $ 800,000 – $ 5,000,000 saved in his 401,000, depending on the company’s relevance and investment performance. Just one or two percentage points in the performance difference can really add a lot in a 30-year savings period.

Can I live off the interest of 2 million dollars?

And, can you live off a $ 2 million return? The answer is yes, if you are smart.

Can you comfortably retire with $ 2 million? The important question is to ask. Yes, for some, $ 2 million should be more than enough for retirement. For others, $ 2 million may not even scratch the surface. The answer depends on your personal situation and there are many challenges you will face.

How many millions does it take to live off interest?

Many investors are targeting $ 1,000,000 as the magic number for retirement. Here’s how the numbers break down. By earning 2% on your savings account, you could receive $ 20,000 in interest each year. Conservative stocks that pay 4% generate $ 40,000, while higher-risk stocks with an average of 10% generate $ 100,000 in interest.

How much interest does 1 million dollars earn per year?

As mentioned above, the average rate on savings accounts as of February 3, 2021 is 0.05% APY. A $ 1 million deposit with this APY would generate $ 500 in interest after one year ($ 1,000,000 X 0.0005 = $ 500). If left on a monthly basis for 10 years, it would generate $ 5,011.27.

How much money do you need to invest to live off the interest?

Be sure to calculate how much money you can safely withdraw without affecting the amount of interest you will earn. Plan to reinvest a portion of your income each year to keep up with the rising cost of living. To make a living from interest, you will probably need to save 25-30 times your current annual expenses.

How much income can 2 million generate?

Following the 4 percent rule for retirement, $ 2 million could provide about $ 80,000 a year, which is above average. The Bureau of Labor Statistics reports that the average 65-year-old spends about $ 3,800 a month on retirement – or $ 45,756 a year. Of course, these are all ‘back-of-the-napkin’ calculations.

How much monthly income can 1 million dollars generate?

A $ 1 million annuity would pay you approximately $ 4,790 each month for the rest of your life if you purchased an annuity at age 65 and started receiving payments immediately.

How much interest does 2 million dollars earn?

Live on a monthly interest rate of $ 2 million For example, the interest rate on $ 2 million is $ 501,845.11 over 7 years with a fixed annuity, which guarantees 3.25% per annum.

How much interest does 2 million dollars earn per year?

For example, interest on two million dollars is $ 501,845.11 over 7 years with a fixed annuity, which guarantees 3.25% per annum. Find all current fixed annuity rates here.

How much interest does 1 million dollars make a year?

The average savings account rate has been below 1% for a long time. This means that $ 1 million in savings would typically earn much less than $ 10,000 a year in interest.

How many millions do you need to live off the interest?

However, for a more conservative estimate, divide 60,000 by 3%. This gives you a $ 2 million savings goal. If you use a more conservative 1% interest rate (most savings accounts these days don’t reach the 1% interest rate), you’ll need $ 6 million to earn $ 60,000 a year in interest.

How much does the average 65 year old have in retirement savings?

Those who have pension funds do not have enough money in them: according to our research, people aged 56 to 61 have an average of $ 163,577, and those aged 65 to 74 have even less savings. 11 If that money turned into a life annuity, it would be only a few hundred dollars a month.

How much super Should a 60 year old have?

| 25 years | $ 24,000 |

|---|---|

| 55 years | $ 345,000 |

| 60 years old | $ 430,000 |

| 65 years | $ 523,000 |

Sources :