SSA limits the value of the resources you own to no more than $ 2000. The resource limit for a couple is only slightly higher at $ 3000. Resources are all assets that can be converted into cash, including bank accounts. However, some assets you own may not affect the eligibility for the program.

Should I take a lump sum pension or monthly payments?

In most cases, the lump sum option is clearly the way to go. The main difference between a lump sum and a monthly payment is that with a lump sum you get control over how your money is invested and what happens to it when you are away. If so, the lump sum option is the best option.

Is it better to pay monthly or lump sum? One-time payments give you more control over your money, and give you the flexibility to spend it or invest it when and how it suits you. Studies show that pensioners with a monthly pension income are more likely to maintain the level of consumption than those who take one-off distributions.

How do I decide between lump sum and pension?

If you choose to take the pension income, you can not withdraw more or less money in a given year. If you take the lump sum, you can. If you choose to take the lump sum, you can skip a withdrawal or withdraw more for a holiday or an emergency. You have more control over a lump sum.

Should you consider a lump sum pension withdrawal?

Consider both current age and life expectancy when deciding to retire. In general, the older you are, the less time the money you invest needs to grow, so the less upside it is to take a lump sum. The younger you are, the more time the money you invest has to grow.

How much will my Social Security be reduced if I have a pension?

We reduce your social security benefits by two thirds of your public pension. In other words, if you receive a monthly occupational pension of $ 600, two-thirds of it, or $ 400, must be deducted from your social security benefits.

Should you consider a lump sum pension withdrawal?

Consider both current age and life expectancy when deciding to retire. In general, the older you are, the less time the money you invest needs to grow, so the less upside it is to take a lump sum. The younger you are, the more time the money you invest has to grow.

Does a lump sum pension affect Social Security?

Pension payments, annuities and interest or dividends from your savings and investments are not income for social security purposes. You may have to pay income tax, but you do not pay social security contributions.

Is it better for you to take your pension payout as a lump sum or a lifetime monthly payment?

The main difference between a lump sum and a monthly payment is that with a lump sum you get control over how your money is invested and what happens to it when you are away. If so, the lump sum option is the best option.

Is it better to take a lump sum or monthly payments from an annuity?

A lump sum gives you more control over your assets But when you put it all together, the decision to accept a lump sum is more about controlling and preserving your future sources of income than it is the annuity payment you are promised from retirement.

What advantages are associated with taking an annuity retirement plan payments rather than a lump sum payment?

The biggest benefits annuities offer is that they allow you to take away a larger amount of cash and defer paying taxes. Unlike other tax-exempt pension accounts such as 401 (k) s and IRAs, there is no annual contribution limit for an annuity.

What is best way to take money from annuity?

The most unequivocal way to withdraw money from an annuity without penalty is to wait until the surrender deadline expires. If your contract includes a free withdrawal provision, take only what is allowed each year, usually 10 percent.

What is the average monthly retirement income in Canada?

The average monthly amount paid for a new defined benefit pension (at age 65) in January 2022 is $ 779.32.

What is a good pension amount in Canada? 70% income rule before retirement A rule of thumb is that you need approximately 70% of the income before retirement to spend each year on retirement. The rule of thumb is that if you earned $ 100,000 before retiring, you would need around $ 70,000 per year after retirement.

What is a good monthly pension amount?

Some advisers recommend that you save 10 times your average working salary before retiring. So if your average salary is £ 30,000, you should aim for a pension pot of around £ 300,000. Another top tip is that you should save 12.5 percent of your monthly salary.

How much does the average 65 year old have in retirement savings?

Those who have pension funds do not have enough money in them: According to our research, 56- to 61-year-olds have an average of $ 163,577, and those aged 65 to 74 have even less in savings. 11 If the money were converted into a lifelong annuity, it would amount to only a few hundred dollars a month.

What is a good monthly pension in the UK?

So if your average salary is £ 30,000, you should aim for a pension pot of around £ 300,000. Another top tip is that you should save 12.5 percent of your monthly salary. So if your annual salary is £ 30,000, you will save £ 312.50 a month – which over 40 years at 4% growth can build a pension pot of over £ 300,000.

How much does the average retiree get a month?

According to the Social Security Administration, the maximum social security benefit you can receive each month in 2021 is $ 3,148 for those who have full retirement age. The average social security income per month in 2021 is $ 1,543 after being adjusted for the cost of living of 1.3 percent.

How much money does the average retiree have?

The survey, on the whole, found that Americans have increased their personal savings by 10% from $ 65,900 in 2020 to $ 73,100 in 2021. In addition, the average retirement savings have increased by a reasonable 13%, from $ 87,500 to $ 98,800. .

What is a good retirement income per month?

Based on the 80% principle, you can expect to need around $ 96,000 in annual income after you retire, which is $ 8,000 per month.

What is the average Canadian retirement income 2020?

The average income of Canadian retirees. The median income after tax is $ 61,200. This income comes from a number of sources, such as those mentioned.

How much money does the average Canadian retire With?

| Age | Pension savings | Financial assets |

|---|---|---|

| Under 35 | $ 90,500 | $ 42,900 |

| 35-44 | $ 220 500 | $ 51,600 |

| 45-54 | $ 437 400 | $ 127,000 |

| 55-64 | $ 645 500 | $ 163 600 |

What does the average retiree have in savings?

The survey, on the whole, found that Americans have increased their personal savings by 10% from $ 65,900 in 2020 to $ 73,100 in 2021. In addition, the average retirement savings have increased by a reasonable 13%, from $ 87,500 to $ 98,800. .

What does a GS 15 make in retirement?

The average of these three unlimited salaries is $ 179,749, a total that will inform this hypothetical employee’s annuity upon retirement. Instead, he earned the same GS-15, step 10 salary of $ 164,200 in 2018, $ 166,500 in 2019 and $ 170,800 in 2020.

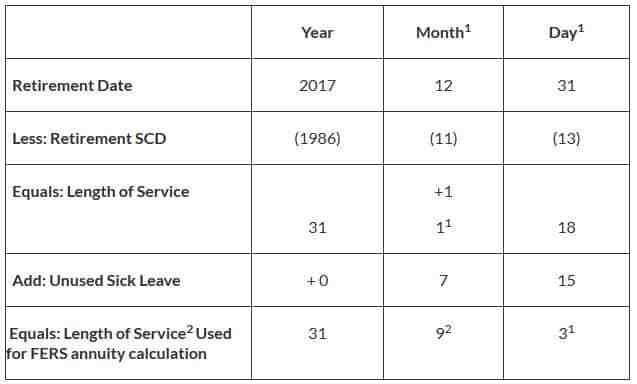

How is GS pension salary calculated? The benefit is usually calculated as 1 percent of the high-3 average salary multiplied by years of good service. For those who retire at the age of 62 or later with at least 20 years of service, a factor of 1.1 per cent is used instead of 1 per cent.

How does retirement work for GS employees?

Your agency withholds the costs of the basic benefit and social security from your salary as a payroll deduction. Your agency also pays its share. So, after you retire, you receive annuity payments every month for the rest of your life. The TSP section of FERS is an account that your agency automatically sets up for you.

How long do you have to work as a GS to retire?

Most people need 40 credits (10 years of work) to qualify for pension benefits from social security. As a federal employee, you pay the full social security contribution that corresponds to 6.2% of your salary.

What do federal employees get when they retire?

FERS is a pension scheme that provides benefits from three different sources: a basic benefit plan, social security and a savings plan (TSP). Two of the three parts of FERS (Social Security and TSP) can go with you to your next job if you leave the federal government before retirement.

Is a GS-15 a high grade?

GS-15 is the 15th grade in the pay scale General Schedule (GS), the pay scale used to determine the pay of most civil servants. The GS-15 salary grade is generally reserved for top-level positions such as supervisors, high-level technical specialists and top-level professionals with advanced degrees.

Is GS-15 high?

About grade GS-15 GS-15 is the highest ranking in the general salary overview. Once you reach GS-15, the only way to continue to increase your salary is through incremental increases and annual general salary increases that all federal employees receive.

Is GS-15 a good salary?

The GS-15 salary is limited to level V in the Executive Schedule. The starting salary for a GS-15 employee is $ 112,890.00 per year at step 1, with a maximum possible base salary of $ 146,757.00 per year at step 10. The hourly base salary for a step 1 GS-15 employee is $ 54.09 per time1.

What is the average retirement for a federal employee?

As of the financial year 2019, the average retirement age was 61.8 years, which is a small increase of 0.78 per cent from the financial year 2015, when the average age at retirement was 61.3 years.

Do federal employees get a good retirement?

This is one of the many reasons why the Federal Employees Retirement System is considered one of the best retirement packages out there. And on top of the sweet pension plan come the additional benefits of being able to collect social security and payments from the frugal savings plan.

What is the average pension payout per month?

The average social security income per month in 2021 is $ 1,543 after being adjusted for the cost of living of 1.3 percent. To maximize this income: Postpone these benefits until full retirement age, or 67 years.

What is the average pension payout per month?

The average social security income per month in 2021 is $ 1,543 after being adjusted for the cost of living of 1.3 percent. To maximize this income: Postpone these benefits until full retirement age, or 67 years.

What is a comfortable monthly retirement income? Based on the 80% principle, you can expect to need around $ 96,000 in annual income after you retire, which is $ 8,000 per month.

What is a typical pension payout?

The average amount is $ 60,000. The defined benefit plan uses a pension factor of 1.5 percent. Multiply $ 60,000 by 1.5 percent and then multiply by 30 years of service. The annual pension amount comes to $ 27,000. This is paid in monthly installments.

How is a pension payout calculated?

However, most people will use the average of your three highest years of compensation as a start for your payout calculations. Once this number is ready, it is multiplied by the percentage factor for your plan. You then multiply the following number by the number of years you were employed by the company.

What is the average pension payout?

Average retirement income in 2021. According to data from the U.S. The Census Bureau is the average average retirement income for seniors 65 and older $ 47,357. The average retirement income is $ 73,228.

How much retirement savings does the average 65 year old have?

Those who have pension funds do not have enough money in them: According to our research, 56- to 61-year-olds have an average of $ 163,577, and those aged 65 to 74 have even less in savings. 11 If the money were converted into a lifelong annuity, it would amount to only a few hundred dollars a month.

What is the average net worth of a 65 year old retiree?

In 2019, the median net worth for Americans under the age of 35 was $ 14,000, while the median net worth for Americans ages 65 to 74 was $ 266,070. In other words, retired Americans had a median wealth that was 19 times greater than those in the age group under 35. The median US net worth increases after 35 years.

How much money should a 65 year old have saved for retirement?

Since higher incomes will receive a smaller part of the income in pensions from social security, they generally need more assets in relation to the income. We estimated that most people who want to retire around the age of 65 should aim for assets totaling between seven and 13 times their gross income before retirement.

What is the average Social Security check?

Social Security offers a monthly performance check to many types of recipients. As of March 2022, the average check is $ 1,536.94, according to the Social Security Administration – but the amount can vary drastically depending on the type of recipient.

What is the average social security check at age 62? According to disbursement statistics from the Social Security Administration in June 2020, the average social security benefit at age 62 is $ 1,130.16 a month, or $ 13,561.92 a year.

What is the average Social Security check at age 67?

| Age | Average benefit |

|---|---|

| 65 | $ 1321 |

| 66 | $ 1489 |

| 67 | $ 1504 |

| 68 | $ 1522 |

How much more is Social Security at 65 or 67?

Social security benefits are reduced by 205/6% for a person who has a full retirement age of 65 and 2 months (retired at age 62 in 2000). Social security benefits will be reduced by 25% for a person who retires at the age of 62 if the full retirement age is 66 (born 1943-1954).

Is it better to take Social Security at 67?

The short answer is yes. Retirees who start accumulating social security at age 62 instead of at full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So postponing the requirement to 67 will result in a larger monthly check.

How much Social Security will I get if I make $50000 a year?

For example, the AARP calculator estimates that a person born on January 1, 1960, who has an average annual income of $ 50,000, will receive a monthly benefit of $ 1338 if they apply for Social Security at 62, $ 1911 at full retirement age (in this case, 67 ), or $ 2370 at 70.

How much Social Security will I get if I make $40000?

Those who earn $ 40,000 pay tax on all income in the social security system. It takes more than three times that amount to maximize your payroll tax. The current tax rate is 6.2%, so you can expect to see $ 2,480 go directly from your paycheck to Social Security.

How do you find out how much Social Security you will receive?

Benefit Calculators (En español) The best way to start planning for the future is to create a My Social Security account online. With my social security, you can verify your income, get your social security declaration and much more – all at home or in the office.

How much does the average person get in Social Security?

Consider the average social security payment The average social security benefit is $ 1657 per month in January 2022. The maximum possible social security benefit for someone who retires at full retirement age is $ 3345 in 2022.

How much Social Security will I get if I make $60000 a year?

That amounts to $ 2,096.48 as a monthly benefit if you retire at full retirement age. In other words, Social Security will replace about 42% of your previous $ 60,000 salary. This is much better than the figure of about 26% for those who earn $ 120,000 per year.

Sources :