What is a comfortable monthly retirement income?

Based on the 80% principle, you can expect to need about $ 96,000 in annual income after you retire, which is $ 8,000 per month.

What is the average good retirement income?

What does the average retiree live on per month?

Average Pension Expenditure on Section. According to the Bureau of Labor Statistics, an American family headed by a person 65 and older spent an average of $ 48,791 a year, or $ 4,065.95 a month, between 2016 and 2020.

How much does the average retiree retire with?

The survey, in general, found that the United States grew its personal savings by 10% from $ 65,900 in 2020 to $ 73,100 in 2021. In addition, the average retirement savings increased by a reasonable 13%, from $ 87,500 to $ 98,800 .

What is a good monthly retirement income?

According to AARP, a good retirement income is about 80 percent of your taxable income before you leave work. This is because when you are not working, you will not have to pay income tax or other work-related expenses.

How much does the average person retire with?

And, thankfully, below we can find the average retirement savings average, according to the 2019-2020 Federal Reserve SCF data: 18-24: $ 4,745.25. 25-29: $ 9,408.51. 30-34: $ 21,731.92.

What is a good monthly retirement income?

According to AARP, a good retirement income is about 80 percent of your taxable income before you leave work. This is because when you are not working, you will not have to pay income tax or other work-related expenses.

How long does the average person retire? And, thankfully, below we can find the average retirement savings average, according to the 2019-2020 Federal Reserve SCF data: 18-24: $ 4,745.25. 25-29: $ 9,408.51. 30-34: $ 21,731.92.

How much money does the average Canadian have in their bank account?

Statistics Canada states that in 2018, Canadian households had an average net worth of 85 $ 852. However, the top 20% of revenue saved ~ $ 41,393 per household.

What is the average Canadian bank account? In 2019, Canadian households saved an average of $ 2,482. Prior to that year, the net worth of Canadian households fluctuated significantly, reaching $ 3,709 in 2013, and a record low of $ 830 in 2005.

How much does the average person have in bank account?

The average U.S. reserve varies by family and population. As of 2019, according to the US Federal Reserve, the balance of the average household transaction (combined and securities) of the U.S. household was $ 5,300; The average (or average) balance in the transaction account was $ 41,600.

How much does the average 30 year old have in their account?

How much money did the average 30-year-old save? If you really saved $ 47,000 by age 30, congratulations! You are ahead of your peers. According to the 2019 Federal Reserve Consumer Survey, the median retirement account balance for people under 35 is $ 13,000.

What is a good amount to have in your bank account?

Aim to keep about one to two months of living expenses on your checking account, plus 30% savings, and another three to six months worth of savings accounts, where it can get more returns.

What does the average Canadian have in retirement savings?

23. Approximately 32% of Canadians between the ages of 45 and 64 said they had no pension savings. The average Canadian pension savings for 2018 was about $ 184,000. Some 19% of respondents had less than $ 50,000, and 30% had no retirement savings.

What is the average monthly retirement income in Canada?

The average monthly amount paid for new retirement benefits (age 65) in January 2022 is $ 779.32.

How much does the average person have in savings when they retire?

The survey, in general, found that the United States grew its personal savings by 10% from $ 65,900 in 2020 to $ 73,100 in 2021. In addition, the average retirement savings increased by a reasonable 13%, from $ 87,500 to $ 98,800 .

How much Social Security will I get if I make $120000 a year?

The goal is that if you have earned $ 120,000 in the last 35 years, due to the maximum taxable wage limit, the maximum Social Security benefit you can receive at full retirement age is $ 2,687.

How much Social Security will I get 62 if I make 100k a year? Based on our calculated $ 2,790 Social Security benefits, this means that a person earning an average of $ 100,000 in wages during his or her career can expect Social Security to pay $ 33,480 in annual income if they claim full retirement age.

What is the highest possible monthly Social Security payment?

The maximum number of people who apply for Social Security 2022 benefits can get a month:

- $ 2,364 per person 62.

- $ 3,345 per person filing full retirement age (66 and 2 months born 1955, 66 and 4 months born 1956).

Is there really a $16728 Social Security bonus?

$ 16,728 Social Security Allowance Most pensioners completely forget: If you are like the American people, you are a few years (or more) behind your retirement savings. But a few things known as “Social Security secrets” can help ensure you increase your retirement income.

How much Social Security will I get if I make $75000 a year?

If you earn $ 75,000 a year, you can expect to earn $ 2,358 a month – or about $ 28,300 a year – from Social Security.

How much will I get from Social Security if I make 120000 a year?

If you make $ 120,000, this is your calculated monthly benefits according to the Social Security formula in the first part, this will produce a monthly benefit of $ 2,920 for your full retirement age.

What is the highest monthly income you can get from Social Security?

The maximum number of Social Security 2022 benefits filing recipients can receive: $ 2,364 per month filing 62. $ 3,345 per filing at full retirement age (66 and 2 months for people born in 1955, 66 and 4 months for people born in 1956).

How much money do you need to retire with $100000 a year income?

Most experts say your retirement income should be 80% of your final pre-retirement income. 1 This means that if you make $ 100,000 a year in retirement, you need at least $ 80,000 a year to have a comfortable lifestyle after you leave work.

How much Social Security will I get if I make $125 000 a year?

In short, your gross margin is $ 2,982.97 per month. That is what you will get if you wait until full retirement age, when a person born in 1955 will be 66 years and two months old.

What is the highest monthly income you can get from Social Security?

The maximum number of Social Security 2022 benefits filing recipients can receive: $ 2,364 per month filing 62. $ 3,345 per filing at full retirement age (66 and 2 months for people born in 1955, 66 and 4 months for people born in 1956).

How do you calculate what your Social Security will be?

We: We base your Social Security benefits on your income for the rest of your life. Adjust or â & # x20AC; & # x2122; your actual income to calculate the average wage change since the year the income was received. Calculate your average monthly income of 35 earned.

Is 50k a good pension?

Using the retirement age of 66 (at this age you can apply for a state pension), this means that a man’s pension needs to last 18 normal years while a woman will need to grow up to 20 years. At the basic level, this means that £ 50k pension can give you: A man about £ 2,778 a year.

Is 50k pension enough for retirement? If you think you earn $ 50,000 and are now 61 years old, your Social Security emergency accountant says you can expect around $ 19,260 a year when you reach full retirement age. could be more than $ 27,756. Again, it depends on your work history.

What is considered a good monthly pension?

The good rule of thumb is to save enough to change about 80% of your retirement income before the month. For example, if you were earning about $ 5000 a month before you retired, you could aim for a full pension income after $ 4000.

How much does the average person have when they retire?

The survey, in general, found that the United States grew its personal savings by 10% from $ 65,900 in 2020 to $ 73,100 in 2021. In addition, the average retirement savings increased by a reasonable 13%, from $ 87,500 to $ 98,800 .

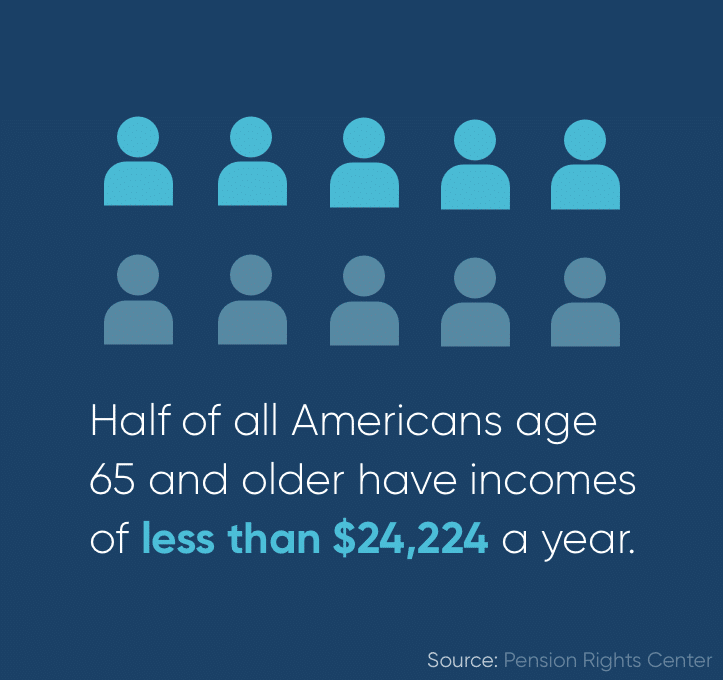

Is 6000 a month good for retirement?

When you have $ 6,000 a month, you have more money than the average pension “Americans aged 65 and over generally spend about $ 4,000 a month” and therefore more choices about where to live. Below, we’ve listed five amazing places you might consider spending your golden years.

Where can you retire with 50k a year?

Based on the results of the study, look first at the Midwest and South if you want to retire at a reasonable… .Where your pension costs less than $ 50,000 per year

- St.

- Atlanta, Ga …

- Mesa, Aris ….

- Raleigh, N.C ..

- Houston, Texas. …

- Las Vegas, Nev ..

- Colorado Springs, Colo ….

- Fresno, Calif ..

What state has the lowest cost of living for retirees?

South Dakota. Mount Rushmore County may not be the first place that comes to mind when you dream of a place to sit, but it is the first place in our overall assessment of all 50 states retirement. Affordability is the main factor pushing it to the top.

How much do I need to retire if I make 50k a year?

The advantage of this strategy is that it is easy to calculate. And you can use the results to estimate how much you need to save for retirement. For example, if your current income is $ 50,000 and you expect your retirement to last at least 30 years, you will need about $ 1.5 million for your nest ($ 50,000 x 30).

Sources :