Does Roth TSP affect Roth IRA?

Roth IRA Contributions Your contributions to a TSP will not affect your ability to contribute to a Roth IRA, but that does not mean you are eligible. To contribute to a Roth IRA, your modified adjusted gross income must not exceed the limits of your tax return status. If you do, you can’t contribute.

Does TSP count as an IRA? The savings plan (TSP) is not an individual retirement agreement (IRA), and vice versa. While both are similar because they are retirement savings plans with tax advantages, the rules can vary significantly and those who are unaware of the differences can pay a price at the time of taxation.

Does TSP count as Roth IRA for taxes?

TSP tax status Traditional TSP distributions count as taxable income when distributed. Roth TSPs work in a similar way to Roth IRAs, as your account money has already been included as part of your taxable income. Roth TSP qualified distributions do not count as taxable income when distributed.

Do I need to report Roth TSP on taxes?

If you have made excessive contributions to Roth, the additional amount is subject to tax. However, you do not need to report this on your tax return because the extra amount is already listed as taxable income in box 1 of your W-2.

Does Roth TSP count against Roth IRA?

Your contributions to a TSP will not affect your ability to contribute to a Roth IRA, but that does not mean you are eligible. To contribute to a Roth IRA, your modified adjusted gross income must not exceed the limits of your tax return status.

Does TSP count as IRA for tax purposes?

The TSP is not considered an IRA for any purpose. From the Internal Revenue Service website: â € œAn IRA owner must calculate the RMD separately for each IRA he owns, but may withdraw the full amount of one or more IRAs.

Does Roth TSP count as Roth IRA?

1 The first thing to keep in mind is the similarities between a Roth TSP and a Roth IRA. These are two versions of Roth Accounts, with the same benefits as all Roth Accounts. Pay a portion of your income in dollars after taxes.

What is the difference between Roth TSP and Roth IRA?

The main differences between a Roth TSP account and a Roth IRA involve restrictions on making Roth IRA contributions. Roth IRAs involve income limitations and contribution limits. The Roth TSP, on the other hand, has no income restrictions, any federal employee can contribute.

Can you contribute to both Roth TSP and Roth IRA?

Contribution limits do not overlap between TSPs and IRAs. As a result, every dollar you contribute to a TSP does not lower your IRA contribution limit. However, the boundaries are cumulative between Roth and traditional TSPs and Roth and traditional IRAs.

How much should I have in my TSP at 30?

This is the amount that Fidelity recommends that Americans save at every age: At age 30, you should save the equivalent of your salary. At age 40, you should save three times your salary. … At age 60, you should save eight times your salary.

What is the average TSP balance by age?

How much money should I have in my TSP?

How much should you invest in a TSP account? We recommend that you invest 15% of your retirement income. When you contribute 15% consistently, you prepare to have options when you retire.

How much should I have in my TSP by age 30?

At age 30: Save the equivalent of your current annual salary. If you earn $ 50,000, you should have $ 50,000 saved for retirement at that age.

Is TSP better than 401k?

Overall, the Thrift savings plan compares favorably to the 401 (k) plans, and if you work for the federal government and can participate, it most likely makes sense. It serves as a solid complement to the FERS pension, and the combination of TSP and FERS can provide a solid basis for retirement.

Is TSP a good retirement plan? In terms of defined contribution plans, the TSP is the largest in the world, with more than $ 558 billion in assets. More than 5 million people have a Thrift Savings Plan account, and even better, 89% of participants are satisfied or very satisfied with the Thrift Savings Plan.

Should I rollover 401k to TSP?

Ability to transfer old IRA 401k to TSP: You can transfer your old 401 (k) or IRA to TSP. This will allow you to consolidate investments into a single account for better management. This is highly recommended, as older 401 (k) plans often do not get as much TLC so consolidation can maximize your performance.

Should I roll over my 401k into TSP?

Option 2: Transfer your funds to your new employer plan If you leave the non-federal sector to work with the government, it is often worth transferring the money from your old employer plan to the TSP. Advantages of this move include: Simplification to have fewer accounts to keep track of.

Should I keep my money in TSP after retirement?

Leave it to the TSP and let it grow Depending on when you start retiring, you can simply leave the money in the TSP to keep it growing. If you still don’t need access, you might want to leave. As with other retirement accounts, you will need to start minimum retirement at age 72.

Should I roll into TSP?

5 – Transfer traditional IRA assets after taxes to the traditional TSP or transfer Roth IRA assets to Roth TSP. Traditional after-tax IRA assets should never be incorporated into the traditional TSP. Only traditional IRA assets should be transferred before taxes to the traditional TSP.

Should I leave my money in TSP?

Leave it to the TSP and let it grow Depending on when you start retiring, you can simply leave the money in the TSP to keep it growing. If you still don’t need access, you might want to leave. As with other retirement accounts, you will need to start minimum retirement at age 72.

Can the government take your TSP?

When they leave the federal government, to retire or for another job, more than half of federals withdraw some or all of their money from the Savings Plan. Many think that external IRAs offer them more investment and withdrawal options, and active advice than they receive from the TSP, which they do.

What happens to TSP when you quit?

Whether you retire from federal service or resign, your withdrawal options remain the same. Federal income taxes are still payable with withdrawals from the traditional portion of your TSP. State income taxes vary depending on where you live.

How much should I have in my TSP when I retire?

How much should you invest in a TSP account? We recommend that you invest 15% of your retirement income. When you contribute 15% consistently, you prepare to have options when you retire.

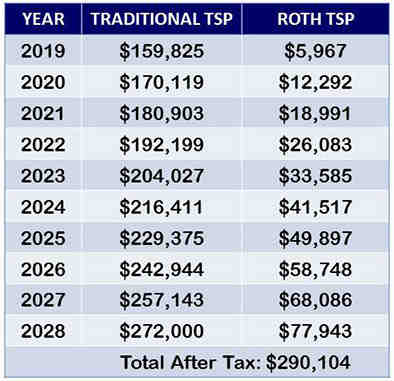

Should I do Roth TSP or traditional?

For most, the Roth TSP is the best option because you are currently at a lower tax level than you will be in the future. With a Roth, your earnings and withdrawals are tax-free so you can contribute money after taxes, that is, pay taxes in advance.

What is a good percentage for Roth TSP? Therefore, you should contribute a little over 28% of your income. Recovery contributions, for those over 50, are limited to $ 6,500 a year. Therefore, if you are eligible for recovery contributions, be sure to include it in your calculations.

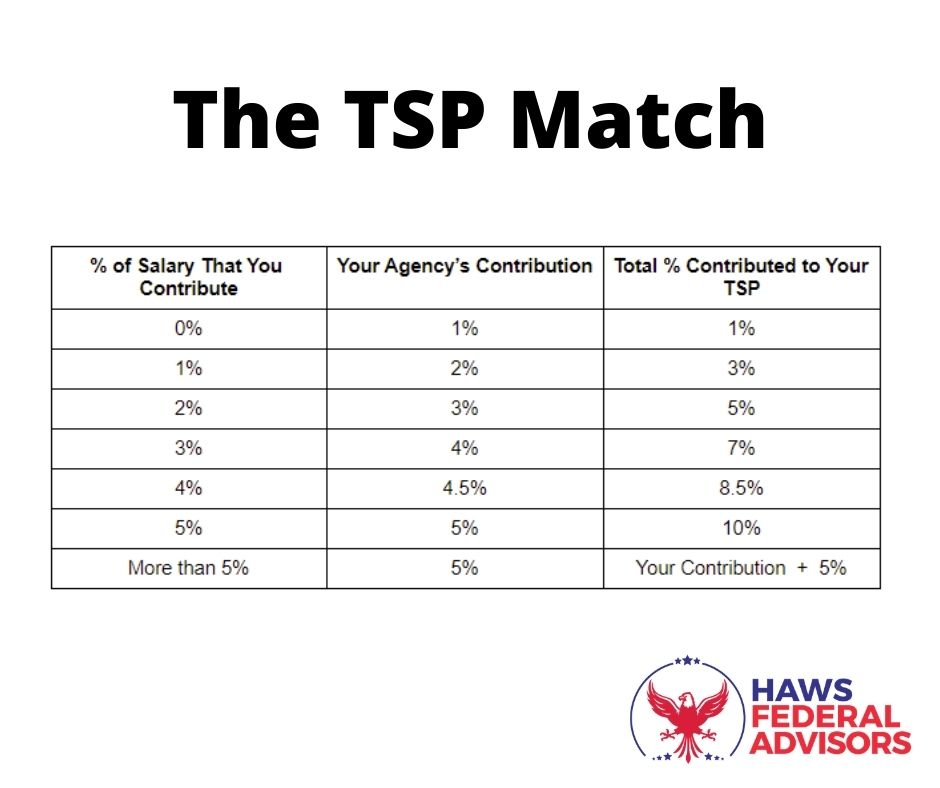

Does TSP match both Roth and traditional?

Your contribution allocation will apply equally to your traditional and Roth balances. … If you are covered by FERS, equivalent government contributions cannot go into your Roth TSP balance. Matching contributions are pre-tax and therefore must go to your traditional balance.

Can I have both traditional and Roth TSP?

You cannot convert any part of your existing traditional TSP balance into a Roth balance. You can make both traditional and Roth contributions if you wish. … Roth TSP is similar to a Roth 401 (k), not a Roth IRA. There are no income limits for Roth TSP contributions.

Does the TSP match Roth contributions?

â € œPlease note that it is impossible to invest in the Roth TSP alone because all matching contributions are made to the traditional TSP. For example, if you earn $ 100,000 a year and contribute a maximum of $ 18,500 to the Roth TSP, your $ 5 percent or $ 5,000 will be added to the traditional TSP.

Does TSP match traditional or Roth?

No matter how much income you choose to put into your Roth TSP account, either 0% or 100% of your contributions, the government item will always be deposited into your traditional TSP account.

Is it better to do Roth or traditional TSP?

For most, the Roth TSP is the best option because you are currently at a lower tax level than you will be in the future. With a Roth, your earnings and withdrawals are tax-free so you can contribute money after taxes, that is, pay taxes in advance. … At TSP Tradicional, the money you contribute is pre-tax.