Can you put a lump sum in TSP?

Lump sum payouts Lump sum payouts allow you to pay out up to your entire TSP account balance in one payment. This can be a direct payment, transfer to an IRA / Roth IRA, qualifying retirement plan (e.g. 401 (k)), or a combination.

Can I make a 100% contribution to TSP? Contributions of TSP uniformed services Military members may pay any percentage of the basic salary, as long as the annual amount of the tax-deferred investment does not exceed the maximum limit of contributions.

How much can you pay into TSP?

The maximum amount you can deposit into your TSP account this year is $ 19,500. If you are 50 or older, your plan may allow you to contribute an additional $ 6,500 as your equalization contribution, bringing your total TSP 2020 contribution to $ 26,000. (These amounts are higher than the maximum allowed in 2019)

Can I contribute 100% of my salary to TSP?

You can pay anywhere from 1 percent to 100 percent of your incentive, special wage or bonus (even if you are not currently in receipt of one) – as long as you choose to contribute from your basic salary. You cannot make contributions from sources such as Housing and Living Benefits.

What is the max TSP contribution for 2020?

IRC § 402 (g) The voluntary deferral limit for 2020 is $ 19,500. This limit applies to traditional (deferred tax) and Roth contributions made by the employee during the calendar year.

How much can I contribute to my TSP in 2021?

| Year | Annual limit of contributions | Yearly addition limit |

|---|---|---|

| 2022 | $ 20,500 | $ 61,000 |

| 2021 | 19 500 zlotys | $ 58,000 |

| 2020 | 19 500 zlotys | $ 57,000 |

| 2019 | $ 19,000 | $ 56,000 |

Can I make a lump sum payment to my TSP?

Your contributions to the Thrift Savings Plan must be made by a deduction from your wages; you cannot pay the lump sum.

Can I contribute directly to TSP?

Transfer money directly to TSP A transfer or “direct rollover” is when a qualifying plan sends all or part of your money to TSP. Use Form TSP-60, Transfer Request To TSP, for deferred tax amounts. To transfer Roth money, please use Form TSP-60-R, Request for Roth to TSP Transfer.

How do I put more money into my TSP?

- Go to myPay and log in.

- Under the heading “CHANGES TO PAYMENTS”, select the link “Savings Plan (TSP)”.

- Select the yellow pencil icon to change your TSP refill.

- In the pop-up that appears, make the changes you want to make. …

- Select the “Continue” button to go to the “Review” step.

Can I contribute military pension to TSP?

You can no longer contribute to the TSP after leaving the military. … After leaving the military, you can no longer make deposits into your military TSP account. However, you may be able to make contributions to a different Savings Plan account if you are hired by a government agency that offers this.

Can pensioners still contribute to the TSP? You can still enjoy deferred tax earnings and low administrative costs. Once you are separated, you will no longer be able to pay contributions. However, you can transfer money to your TSP account with an IRA (though not with a Roth IRA) and eligible employer plans.

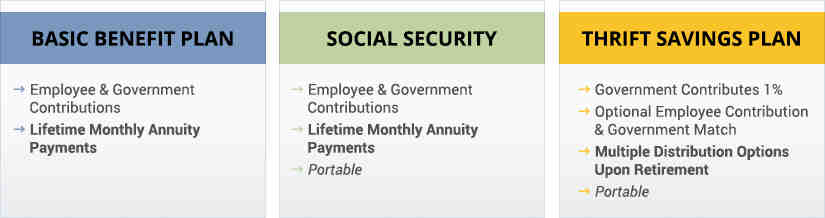

Does military contribute to TSP?

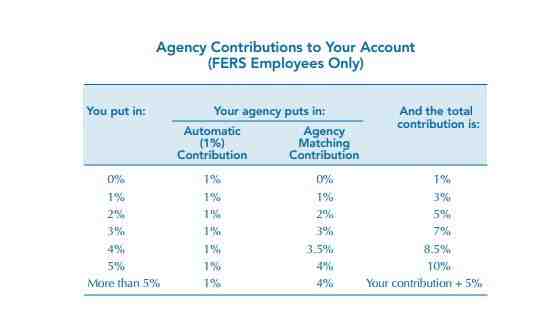

If you joined the military on or after January 1, 2018, or opted for BRS, the government will automatically transfer 1% of your basic salary to TSP, even if you don’t deposit any money yourself. If you make a payment to the TSP, the government adjusts your premium up to a maximum of 5% of your basic salary.

How much does Army contribute to TSP?

Also, if you choose to deposit a portion of your own salary into your TSP account, your service will cover a portion of that amount. This is called a service matching input. For every dollar you deposit, up to 3% of your base salary, your service will also earn you $ 1.

What is TSP for military?

TSP is a retirement savings and investment plan for civilian employees of the United States government and members of uniformed services. TSP is similar to the 401K plan offered by many public and private corporations.

Can you contribute lump sum to TSP?

Your contributions to the Thrift Savings Plan must be made by a deduction from your wages; you cannot pay the lump sum. … If you are unable to maximize your TSP contributions, increase your contributions to the full amount and add Aunt Bertha’s money to your budget to fill the gap caused by increased TSP contributions.

Can I contribute 100% of my salary to TSP?

You can pay anywhere from 1 percent to 100 percent of your incentive, special wage or bonus (even if you are not currently in receipt of one) – as long as you choose to contribute from your basic salary. You cannot make contributions from sources such as Housing and Living Benefits.

Can I add outside money to my TSP?

A. No, you can’t. All TSP contributions must be from wage deductions or rollovers from qualifying plans. Eligible plan is previous employer’s 401 (k), either traditional or Roth, or pre-tax money in traditional IRA.

Can I directly contribute to my TSP?

Transfer money directly to TSP A transfer or “direct rollover” is when a qualifying plan sends all or part of your money to TSP. Use Form TSP-60, Transfer Request To TSP, for deferred tax amounts. To transfer Roth money, please use Form TSP-60-R, Request for Roth to TSP Transfer.

What is the max I can put in TSP?

The maximum amount you can deposit into your TSP account this year is $ 19,500. If you are 50 or older, your plan may allow you to contribute an additional $ 6,500 as a catch-up contribution, which will increase your TSP contribution in 2021 to $ 26,000. (These amounts are the same as the limits in 2020)

What is the highest percentage you can spend on TSP? Employer match. Federal agencies provide adequate contributions to TSP accounts that can reach a maximum of 5 percent of an employee’s base salary. Your employer matches your premium to the dollar for the dollar for the first 3 percent and 50 cents on the dollar for the next 2 percent.

How much can I contribute to my TSP in 2021?

| Year | Annual limit of contributions | Yearly addition limit |

|---|---|---|

| 2022 | $ 20,500 | $ 61,000 |

| 2021 | 19 500 zlotys | $ 58,000 |

| 2020 | 19 500 zlotys | $ 57,000 |

| 2019 | $ 19,000 | $ 56,000 |

Can I contribute more than 5% to my TSP?

Contributions above 5% of salary will not be compensated. If you stop paying your regular employee contributions, your contributions will no longer be matched.

How much can I contribute to my Roth TSP in 2021?

IRC § 402 (g) The voluntary deferral limit for 2021 is $ 19,500. This limit applies to traditional (deferred tax) and Roth contributions made by the employee during the calendar year.

How much can I contribute to TSP per pay period?

If you are not old enough to make the relevant contributions, you can still make a contribution of $ 19,500 to the TSP in 2021. You do this by contributing $ 750 for the billing period.

What happens if you put too much money in TSP?

If you choose to receive excess deferrals as reimbursement from the TSP, you will receive IRS Form 1099-R, Pensions, Retirement or Profit Sharing Payments, IRAs, Insurance Contracts, etc. which will indicate the amount of the excess that has been returned to you.

How much should I have in my TSP by 40?

Goals for retirement savings At 40, you should have three times your annual salary. At 50, six times your salary; at the age of 60 eight times; and up to 67 years of age 10 times. 8 If you turn 67 and earn $ 75,000 a year, you should save $ 750,000.

How much should I have in my TSP at 60?

At 60: save eight times your annual salary. At 67: Save 10 times your annual salary.

How much will my TSP grow after retirement?

When the Federal Workers’ Pension Scheme was established, experts concluded that the TSP would be crucial because, along with social security and a modified civil pension, the TSP could provide anywhere from 30% to 50% of a retiree’s total income.

Can you contribute to 401k and TSP?

You can have both 401 (k) and TSPs, and you can deposit into each of them during the year. You can make contributions to both plans if you’ve worked for the government and a private employer. While you can own and contribute to both plans, the IRS limits the amount of money you can invest in them each year.

Does TSP count towards the IRA limit? Contribution limits do not overlap between the TSP and the IRA. As a result, every dollar you donate to the TSP doesn’t reduce the contribution limit for an IRA. However, limits are cumulative between Roth and Traditional TSP and Roth and Traditional IRA.

How much should I have in my TSP by 40?

Goals for retirement savings At 40, you should have three times your annual salary. At 50, six times your salary; at the age of 60 eight times; and up to 67 years of age 10 times. 8 If you turn 67 and earn $ 75,000 a year, you should save $ 750,000.

How much should I put into my TSP?

How much should I invest in a TSP account? We recommend that you invest 15% of your income into retirement. When you consistently contribute 15%, you are positioning yourself to have options upon retirement.

How much should I have in my TSP at 45?

According to a recent report by Fidelity, a financial services firm, experts recommend that you have four times your annual salary in a bank at 45 if you plan to retire at 67 and live a similar lifestyle.

How much should a 40 year old have in savings?

At 40: three times the savings of the annual salary. If you earn $ 50,000, you should plan to save $ 150,000 for retirement up to 40.

Can I have a TSP and Solo 401k?

Yes. You can set up a Solo 401k for a side company even if you participate in a 401k, 403b, 457 or Thrift Savings Plan through your primary employer.

Does TSP count 401k?

While the TSP isn’t technically a 401k, it is a defined contribution plan, as is the 401k (and 403b in this case). A defined contribution means that your employer – in this case the federal government – will pay a certain amount to your retirement pension under certain conditions.

Are TSP and 401k limits separate?

IRA Accounts – Separate Deposit Limits IRA accounts are separate accounts and their limits are independent of TSP and 401 (k) limits. Regardless of whether you are making 401 (k) or TSP contributions, you can always deposit up to $ 6,000 into your IRA from your earnings (or your spouse’s earnings).

Can I have both a 401k and a solo 401k?

When answering the question of whether you can have Solo 401k and regular 401k, it is important to note that individuals may be part of more than one 401k at a time, for example your 401k Sponsored Job, and also be part of Solo 401k if it generates income from self-employment.