According to this study by the Transamerica Center for Retirement Studies, the average retirement savings by age in the U.S. is: Americans in their 20s: $ 16,000. Americans in their 30s: $ 45,000. Americans in their 40s: $ 63,000.

What is the average TSP balance at retirement?

Contents

| Age | Average contribution rate | Average condition |

|---|---|---|

| 60-69. | 11% | $ 182,100 |

| 70-79. | 12% | $ 171,400 |

| All the years | 9% | $ 95,600 |

Should I keep my money in TSP after retirement? Leave it in the TSP and let it grow. Depending on when you start retiring, you can simply leave the money in the TSP and let it continue to grow. If you don’t need to access it yet, it might be wise to let it go. Similar to other retirement accounts, you will need to start with minimum payments at age 72.

Should I pay off mortgage with TSP?

Which should not be done. In general, it is not a good idea to withdraw from the TSP or IRA to repay the mortgage. If you withdraw money before you turn 59, you may incur taxes and penalties for early payment.

How do I avoid paying taxes on my TSP withdrawal? Read also : How much should I have in my TSP at 35?.

If you want to avoid paying tax on your TSP account for as long as possible, do not withdraw funds until asked to do so by the IRS. By law, you are required to receive the required minimum distributions (RMDs) from the year you turn 72.

Is a TSP loan a bad idea?

The most obvious reason why it is a bad idea to extract money from your TSP is that you are losing the profit that money would have generated if it had remained diverse in the TSP. … TSP charges you a G fund rate at the time of your loan, which remains fixed. You are returning this rate to yourself.

Is it better to payoff mortgage or keep money?

Early mortgage repayment helps you save money in the long run, but it’s not for everyone. Early mortgage repayment is a good way to free up your monthly cash inflow and pay less interest. But you will lose your mortgage interest tax deduction and you would probably earn more by investing instead.

What is the average amount in a TSP account?

To complete the table, 530,357 participants have account balances ranging from $ 250,000 to $ 499,000 (average 20. Read also : Can I make a lump sum contribution to TSP?.36 years contribution), and 212,110 participants range from $ 500,000 to $ 749,000 (average 23.12 years).

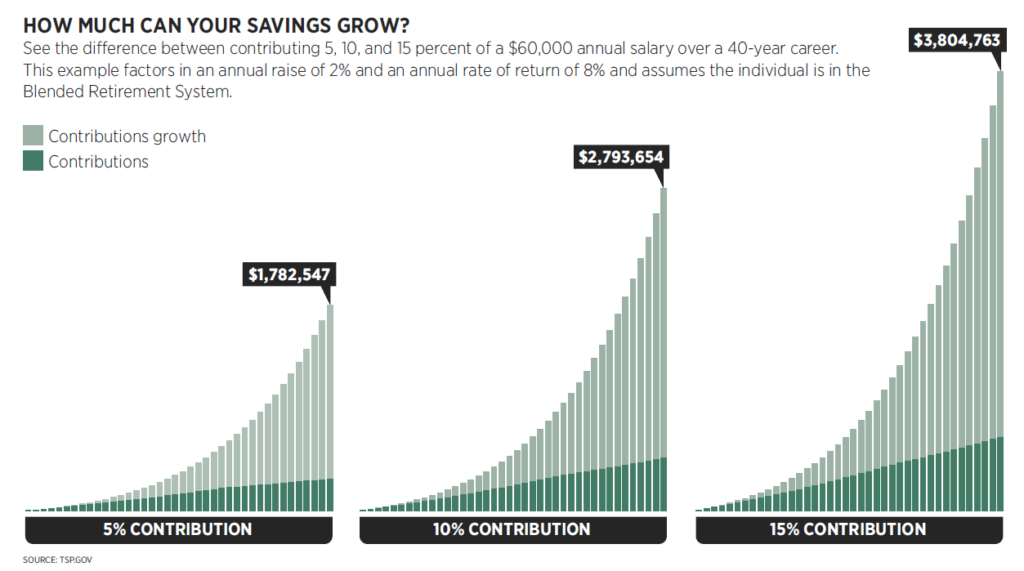

How much should I have in my TSP?

How much should you invest in a TSP account? We recommend that you invest 15% of your income in retirement. When you consistently contribute 15%, you set yourself up to have opportunities when you retire.

What is a good TSP balance at retirement?

2 – Maintaining the default level of TSP contributions Fidelity Investments recommends that individuals save at least 15 percent of their annual salary (divided between employer’s contribution and employer’s contribution) for retirement.

How much should I have in my TSP at 35?

So, to answer the question, we believe it is a reasonable goal to have one to one and a half times your income saved for retirement by age 35. This is an achievable goal for someone who starts saving at 25 years old. Read also : What is the max TSP contribution?. For example, a 35-year-old woman earning $ 60,000 would be on the right track if she saved about $ 60,000 to $ 90,000.

How much should the 35-year-old save? According to the oft-cited Fidelity Retirement chart, you should have double the annual income saved for 35.

How much should I have in my TSP at 60?

To retire by age 67, experts from pension plan provider Fidelity Investments say you should have saved eight times your income by the time you turn 60. If you’re close to 60 (or have already reached it), and not even close to that number, they’re not the only ones behind.

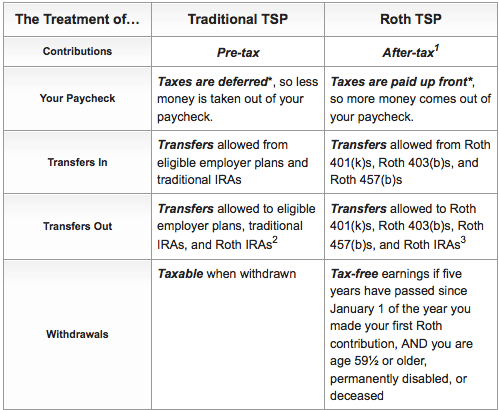

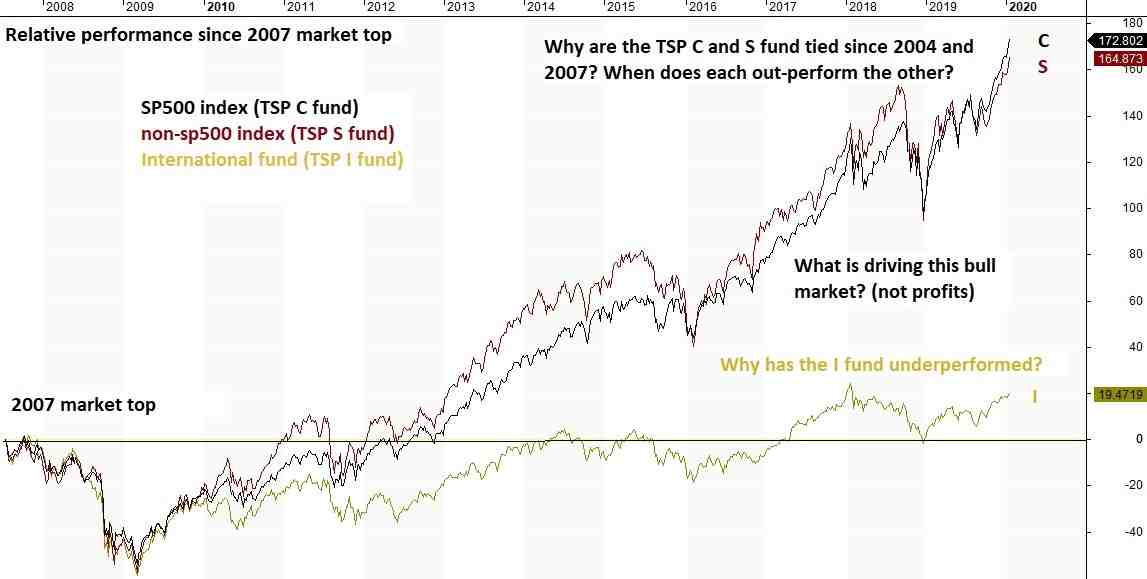

What is the safest fund for TSP?

TSP participants can choose to invest their money in five main funds: The G Fund. This fund invests in government securities and is the safest option. You will not lose money by investing in this fund, but your rate of return is the lowest.

How safe is the G fund in TSP? Summary: TSP G Fund (Government Securities Investment Fund) is a US bond fund of low volatility, almost risk-free. The TSP G fund allows investors to earn at interest rates similar to those for long-term U.S. treasury bonds, but without any risk of losing principal.

How safe is the F fund in TSP?

The F fund provides a higher return than the G fund, but with a little more risk. However, the risk is still lower than other individual funds in the TSP. The five-year average return of the F fund is 3.14%, while the 5-year average return of the G fund is 1.99%.

Which is better G fund or F fund?

The two bond funds available in the TSP are the G fund and the F fund. The G fund invests exclusively in short-term US government securities. … F fund invests in government, corporate and mortgage bonds and changes value as interest rates rise and fall. The F fund was usually the best.

What does TSP F fund invest in?

Fund F is invested in a bond index fund monitored by Bloomberg Barclays U.S. Aggregate Bond Index. This is a broad index representing the U.S. government sector, the mortgage, corporate, and overseas government sectors in the U.S. bond market.