Should I keep my money in TSP?

Leave it to the TSP and let it grow Depending on when you start retiring, you can simply leave the money in the TSP to keep it growing. If you still don’t need access, you might want to leave. Similar to other retirement accounts, you will need to start minimum retirement at age 72.

How much does the average person have in their TSP when they retire?

Should I move my TSP money to the G Fund 2020?

“For TSP fund investors, we currently recommend switching investments from C, S and I equity funds to G bond funds,” he says. More than 3 million federal employees invest in TSP (Thrift Savings Plan) funds.

Can the TSP G fund lost money?

With the TSP G Fund, you can earn medium and long-term interest rates without the risk of losing your money, no matter how long you keep your investment.

What is the best TSP fund to be in right now?

For more conservative investors, keep in mind that the G Fund (often considered the safest TSP Fund) returned 1.38% during the year. The L Income Fund, which also includes some equity investments, performed much better than the G Fund. L Income’s return in 2021 was 5.42%.

Can you lose money in a TSP?

If the stock market goes up, you can make money. If you fall, you may lose money. The risk is still higher than fund F, but the rate of return is also higher. The S Fund.

Can the government take your TSP money?

When they leave the federal government, to retire or for another job, more than half of federals withdraw some or all of their money from the Savings Plan. Many think that external IRAs offer them more investment and withdrawal options, and active advice than they receive from the TSP, which they do.

Is TSP reliable?

In terms of defined contribution plans, the TSP is the largest in the world, with more than $ 558 billion in assets. More than 5 million people have a Thrift Savings Plan account, and even better, 89% of participants are satisfied or very satisfied with the Thrift Savings Plan.

How much does the average person have in TSP?

As of December 31, it has dropped to 21,432. The average balance of the savings plan for federal employee retirement system participants (3.3 million people) was $ 138,933 in January. This compares to an average TSP account balance of $ 146,642 for the 314,193 participants in the civil service retirement system.

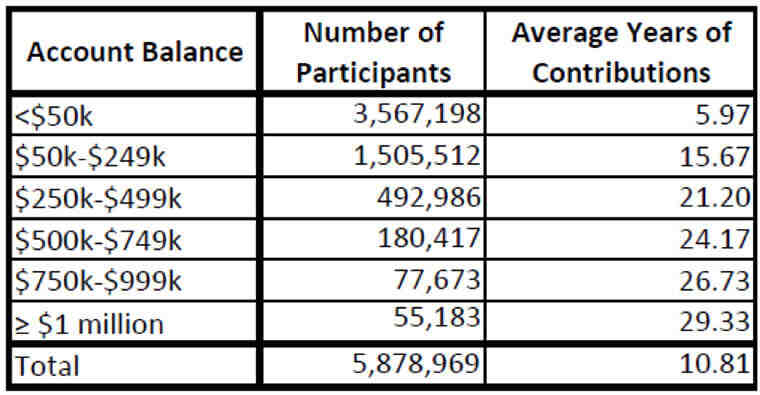

How many millionaires are there in the TSP?

In the last quarter of 2021, the number of millionaires investing in the Thrift Savings Plan (TSP) increased significantly by almost 50%. As of Dec. 31, there were 112,880 millionaire TSPs, up from 75,420 a year ago, according to the Federal Retirement Thrift Investment Board.

How much should I have in my TSP by age?

How much should I have in my TSP up to 40? Retirement Savings Goals At age 40, you should have three times your annual salary. At age 50, six times your salary; at age 60, eight times; and at age 67, 10 times. 8ï »If you reach the age of 67 and earn $ 75,000 a year, you should save $ 750,000.

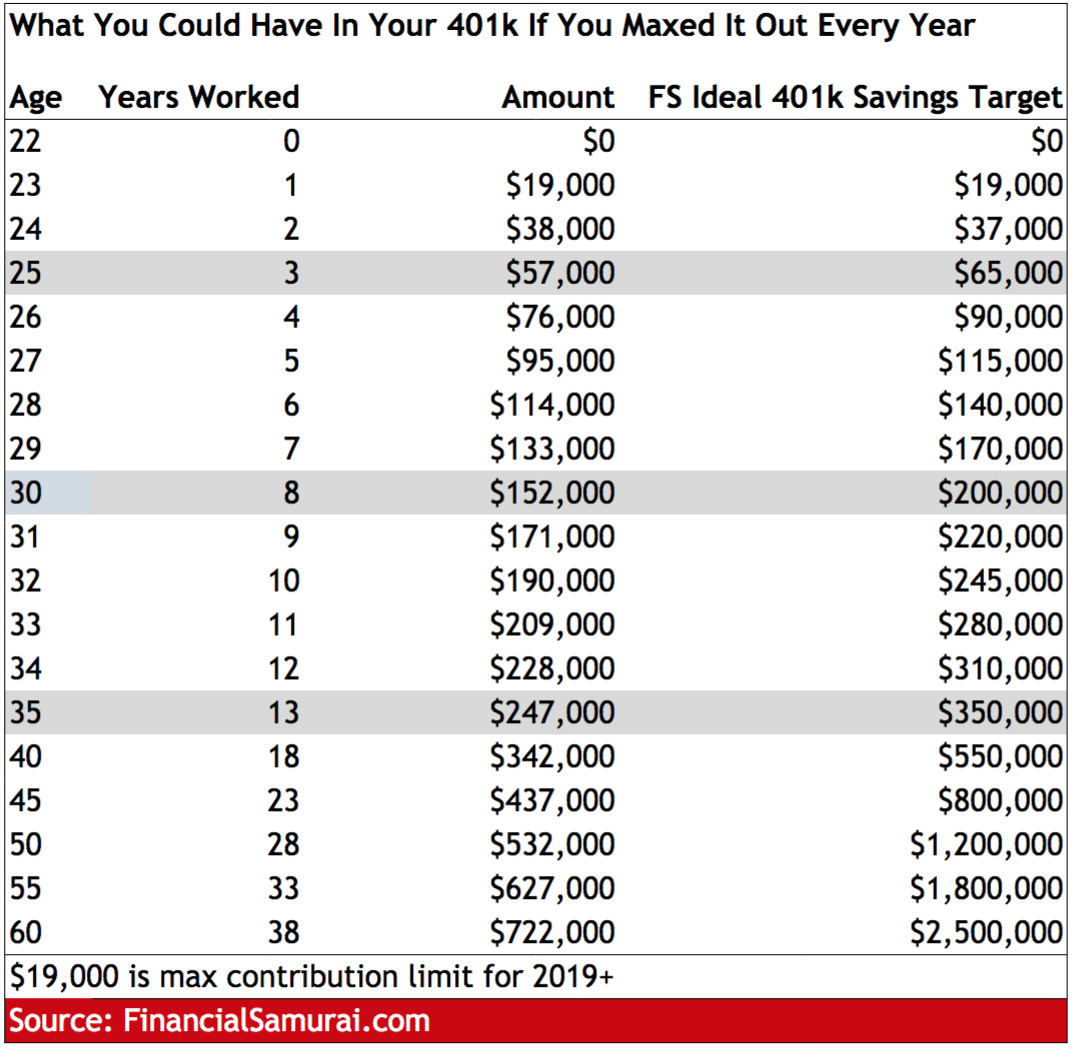

How much should I have in my 401k?

Retirement Savings Goals At age 40, you should have three times your annual salary. At age 50, six times your salary; at age 60, eight times; and at age 67, 10 times. 8 If you reach the age of 67 and earn $ 75,000 a year, you should save $ 750,000.

How much should I have on my 401K for 30? Retirement plan provider Fidelity recommends that your salary equivalent be saved when you reach the age of 30. This means that if your annual salary is $ 50,000, you should try to have $ 50,000 in retirement savings before the age of 30. While it may be a daunting figure, start saving as much as you can.

What percentage should I have my 401K at?

Most financial planning studies suggest that the ideal contribution rate to save for retirement is between 15% and 20% of gross income. These contributions could be made on a 401 (k) plan, a 401 (k) match received from an employer, IRA, Roth IRA, and / or taxable accounts.

What percentage should I contribute to my 401k at age 30?

If you started investing at age 20, you’ll need to invest $ 316.25 a month, or 7.6% of your salary. If you started investing at age 30, you’ll need to invest $ 884.76 a month, or 21.2% of your salary. If you started investing at age 40, you’ll need to invest $ 2,633.76 a month, or 63.2% of your salary.

Is 25% too much for 401k?

Twenty percent is a big goal, but some retirement experts suggest saving as much as 25% or even 30.

How much should a 40 year old have in 401K?

Fidelity says that at age 40, try to have a triple of your saved salary three times over. This means that if you earn $ 75,000, your retirement account balance should be around $ 225,000 when you turn 40. If your employer offers a traditional 401 (k) and a Roth, you may want to split your savings between the two.

How much does the average 40 year old have saved for retirement?

Saving for Retirement At 40 Although the recommended amount of savings from the retirement plan is up to four times your annual salary, this is not a reality for many Americans. The average income for forty-year-olds is just over $ 50,000, but the average retirement savings for this age group is $ 63,000.

How much should a 35 year old have in 401K?

Therefore, to answer the question, we believe that saving your retirement income at the age of 35 and a half is a reasonable goal. It is an achievable goal for someone who is starting to save at 25 years old. For example, a 35-year-old person earning $ 60,000 would be on the right track if he saved between $ 60,000 and $ 90,000.

How much should a 35-year-old have saved?

When you turn 35, you should save at least four times your annual expenses. Alternatively, you should have at least four times your annual expenses as equity. In other words, if you spend $ 60,000 a year living at age 35, you should have at least $ 240,000 in savings or a net worth of at least $ 240,000.

How much should I have in 401K at each age?

At age 40, you should have three times your annual salary. At age 50, six times your salary; at age 60, eight times; and at age 67, 10 times. 8 If you reach the age of 67 and earn $ 75,000 a year, you should save $ 750,000.

What is Max TSP contribution 2020?

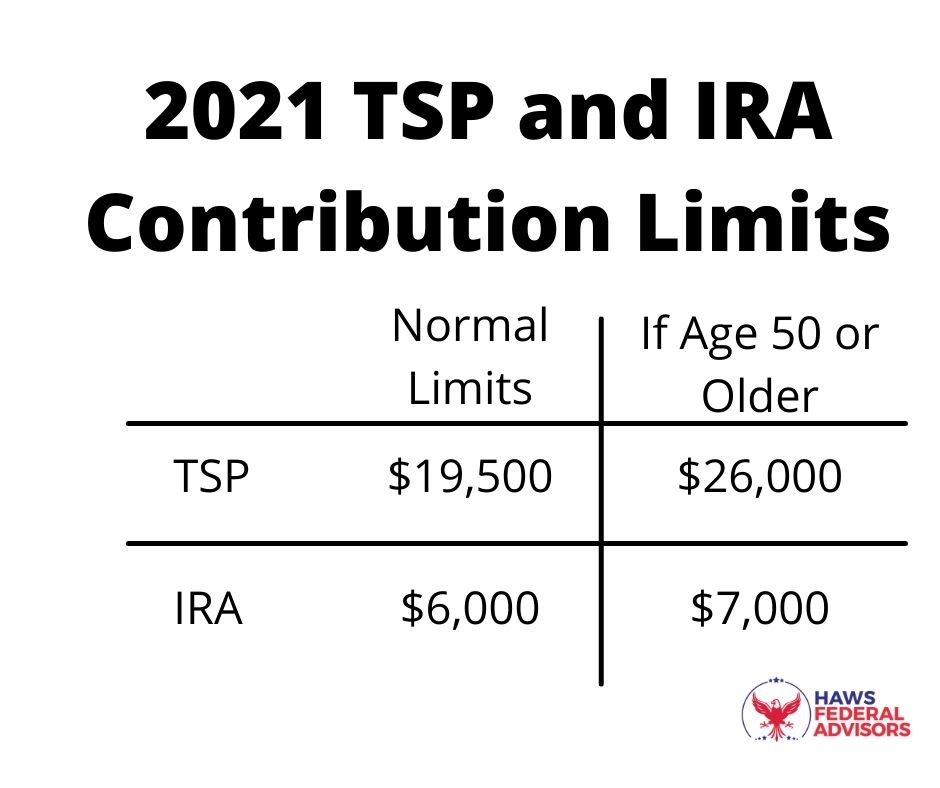

The 2020 IRS annual limit for regular TSP contributions will increase to $ 19,500. If you are covered by the Federal Employee Retirement System (FERS, FERS-RAE, or FERS-FRAE), you could lose valuable Agency TSP contributions by reaching the limit before the end of the calendar year.

What is the maximum TSP recovery contribution for 2020? The IRC § 414 (v) Recovery Contribution Limit for 2020 is $ 6,500.

What happens when you max out TSP?

What happens if you exceed the TSP limit? Earnings distributed in excess of deferral are considered taxable income in the year in which they are distributed. Any income from excess Roth TSP contributions is also taxable income. Employees will receive a special IRS 1099-R form indicating the amount of revenue.

What is the highest percentage you can contribute to TSP?

You can contribute 1 to 100 percent of any incentive, special salary, or bonus (even if you don’t currently receive them), as long as you decide to contribute your basic salary.

What is the maximum contribution to TSP for 2020?

The IRC § 402 (g) elective deferral limit for 2020 is $ 19,500. This limit applies to traditional (tax-deferred) and Roth contributions made by a service member during the calendar year.

How much can I put in my TSP for 2021?

Maximum contributions to the Thrift Savings Plan (TSP) in 2021 remain unchanged! The 2021 annual Internal Revenue Service (IRS) annual elective deferral limit, which applies to the combined total of traditional and Roth contributions, remains $ 19,500.

What is the max TSP contribution for 2021?

Maximum contributions to the Thrift Savings Plan (TSP) in 2021 remain unchanged! The 2021 annual Internal Revenue Service (IRS) annual elective deferral limit, which applies to the combined total of traditional and Roth contributions, remains $ 19,500.

What happens if you go over Max TSP contribution?

If a payroll office submits a contribution that exceeds the elective deferral limit, the TSP will reject the entire contribution and all associated associated contributions, and send a report to the payroll office showing the additional contributions allowed for the ‘year.

How do I max out my TSP 2022?

Employees who want to maximize their 2022 contribution using less than 26 pay periods can only divide the number of remaining pay periods in the fiscal year by $ 20,500 (for example, $ 20,500 / 24 = $ 854.17). Note that you will need to round to the next full dollar, which would be $ 789.

Is there anything better than 401k?

Good alternatives to a 401 (k) are traditional IRAs and Roth and Health Savings Accounts (HSAs). A non-retirement investment account may offer more earnings, but your risk may also be higher.

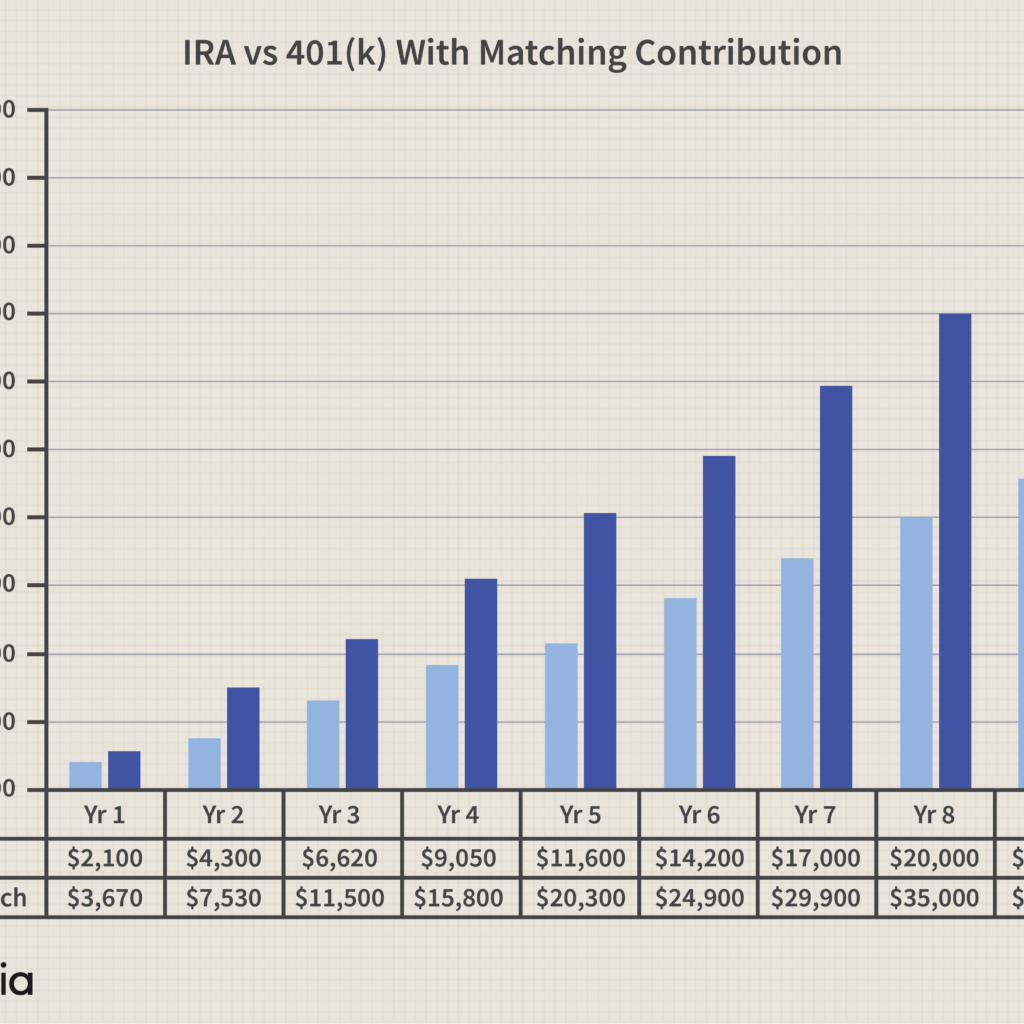

Do IRAs work better than 401k? 401 (k) is simply objectively better. The company-sponsored plan allows you to add much more to your retirement savings than an IRA: $ 20,500 compared to $ 6,000 in 2022. Plus, if you’re over 50, you’ll get a maximum payback. higher with $ 401 (k) $ 6,500 compared to $ 1,000 in the IRA.

Why is a Roth IRA better than a 401k?

Tax-free growth. Unlike a 401 (k), you contribute a Roth IRA with money after taxes. Translation? Because you invest in your Roth IRA with money that has already been taxed, the money in your account grows tax-free, and you won’t pay a single penny when you withdraw your money into retirement.

What is the downside of a Roth IRA?

Key Contributions A key downside: Roth IRA contributions are made with after-tax money, which means there is no tax deduction in the year of the contribution. Another drawback is that withdrawals from account receipts should not be made until at least five years have elapsed since the first contribution.

Is it better to have a Roth or 401k?

Contributions to a Roth 401 (k) may affect your budget more today because an after-tax contribution takes a bigger bite out of your salary than a pre-tax contribution to a traditional 401 (k). The Roth account may be more valuable in retirement.

Are 401ks worth it anymore?

A 2019 study found that 75% of 401 (k) savers will not have enough to maintain their lifestyle when they retire. Not to mention, the inherent extra profitability that participants enjoyed for many years has almost disappeared due to changes in tax laws and high rates.

Can I contribute to both TSP and a 401k?

You can have both a 401 (k) and a TSP and you can contribute to each one during the year. You can contribute to both plans if you have worked for the government and a private employer. While you can maintain and contribute to both plans, the IRS limits the amount of money you can invest in them each year.

Can I contribute to both TSP and IRA? Can I contribute to both my TSP account and an IRA? Yes. Your participation in the TSP does not affect your eligibility to contribute to an IRA.

Does TSP count as a 401k?

While the TSP is not technically a 401k, it is a defined contribution plan just like a 401k (and a 403b for that matter). Defined contribution means that your employer (in this case, the federal government) will provide a defined amount for retirement, subject to certain rules.

What is a TSP vs 401k?

Both work similarly in many ways, including tax benefits, contribution limits, and minimum retirement requirements. However, TSPs are only available to federal government employees, while 401 (k) plans are only available to employees of private sector companies.

Is TSP a Roth or 401k?

The Roth TSP provides another compelling reason for service members to start or increase what they are saving for retirement. The TSP is the federal government’s version of a 401 (k) plan. It allows participants to invest money for retirement through payroll deductions.

What is the max percentage you can contribute to TSP?

You can contribute 1 to 100 percent of any incentive, special salary, or bonus (even if you don’t currently receive them), as long as you decide to contribute your basic salary.

What is the max percentage TSP contribution for 2021?

Maximum contributions to the Thrift Savings Plan (TSP) in 2021 remain unchanged! The 2021 annual Internal Revenue Service (IRS) annual elective deferral limit, which applies to the combined total of traditional and Roth contributions, remains $ 19,500.

Can I contribute more than 5% to my TSP?

Employees can contribute up to $ 19,500 to their TSP plan for 2021, the same amount as in 2020. Employees 50 and older can receive an additional $ 6,500 recovery contribution in 2021, the same amount as in 2020.

Sources :