Is TSP like a 401k or IRA?

TSP is a tax-deferred “employer” pension scheme for federal employees comparable to a 401k plan in the private sector. An IRA is a tax-deferred “individual” pension plan. Big difference! The TSP must comply with the administrative rules of Section 401k of the Internal Revenue Code.

How many years do you have to work in the United States to retire? The number of credits you need to retire depends on when you were born. If you were born in 1929 or later, you will need 40 points (usually it is 10 years of work).

How much will my Social Security be reduced if I have a pension?

We reduce your social benefits by two thirds of your public pension. In other words, if you receive a $ 600 monthly civil servant pension, two-thirds of it, or $ 400, must be deducted from your Social Security benefits.

Can you collect Social Security and a pension at the same time?

Yes. There is nothing stopping you from getting both retirement and social benefits. But there are some types of pensions that can reduce social security payments.

At what income does Social Security get reduced?

If you start collecting benefits before you reach full retirement age, you can earn a maximum of $ 18,960 in 2021 ($ 19,560 for 2022) and still get your full benefits. When you earn more, Social Security deducts $ 1 from your benefits for every $ 2 earned.

Is there really a $16728 Social Security bonus?

The $ 16,728 social security bonus completely overlooks most retirees: If you’re like most Americans, you’re a few years (or more) behind with your retirement savings. But a handful of little-known “social security secrets” could help secure a boost in your retirement income.

How do I get a 16 728 Social Security bonus?

How to get a social security bonus

- Option 1: Increase your earnings. Social benefits are based on your earnings. …

- Option 2: Wait until age 70 to claim social benefits. …

- Option 3: Be strategic with spouse benefits. …

- Option 4: Make the most of COLA raises.

Is Social Security giving extra money this month?

It is easy to see how the benefit increase can evaporate. The average recipient will receive an additional $ 93 a month, the Social Security Administration said, meaning the typical monthly check will rise to $ 1,658 in January from $ 1,565 previously.

Is Social Security giving extra money this month?

It is easy to see how the benefit increase can evaporate. The average recipient will receive an additional $ 93 a month, the Social Security Administration said, meaning the typical monthly check will rise to $ 1,658 in January from $ 1,565 previously.

How do you pay URSSAF?

How can I pay my contributions?

- the simplest is via automatic bank debit for companies that have a bank account in France. …

- via international bank transfer to be made at the beginning of the month following receipt of the breakdown of your contributions, by order of Urssaf Alsace.

What is French Dpae?

â € œDPAEâ € is a statement that provides an opportunity to: Request registration of employer with the social security, the unemployment insurance fund and the occupational health service at first employment, proceed to the enrollment of the employee in the social security, ask the hiring medical examination of the employee .

Should I roll over my TSP?

You do not have to roll over 100% of the investment you have in TSP. You may decide to transfer some assets for a specific reason, leaving the rest to the TSP. Whatever you decide upon, get advice from a knowledgeable advisor who has no financial interest in your decision.

Can TSP be rolled over? A “rollover” is when you receive eligible money directly from your traditional IRA or plan, and then deposit it later into your TSP account. You can not transfer Roth money to the TSP and you must complete your rollover within 60 days from the date you receive your money.

Should I keep my TSP after separation?

Yes, you can leave your entire account balance in TSP when you leave federal service if the balance is $ 200 or more. You can continue to enjoy tax-deferred earnings and low administrative expenses. When you leave, you will no longer be able to make employee contributions.

How do I get my TSP money after separation?

There are three basic methods to withdraw money from your TSP account as a separate or beneficiary participant: installment payments, individual withdrawals, and annuity purchases.

How long does it take TSP to be notified of separation?

The first requirement is that the thrift plan must be notified of your federal separation of your employment agency. It will typically take up to 30 days after the separation date before your employment agency informs the plan administrators.

Should you move your TSP?

In short, even if the recommendation is sound, any financial professional who recommends moving money from the TSP to an IRA can benefit financially from this move. 6. Compare investment opportunities and other services.

Can I move my TSP?

You can move into your traditional TSP account both transfers and rollovers of tax-deferred money from traditional IRAs, SIMPLE IRAs and eligible employer plans.

Should I move my TSP after retirement?

Leave it in the TSP and let it grow. Depending on when you start retiring, you can simply leave the money in the TSP and let it continue to grow. If you do not need to access it yet, it may be wise to leave it at that. Like other pension accounts, you must start minimum payments at age 72.

Should I move my TSP after retirement?

Leave it in the TSP and let it grow. Depending on when you start retiring, you can simply leave the money in the TSP and let it continue to grow. If you do not need to access it yet, it may be wise to leave it at that. Like other pension accounts, you must start minimum payments at age 72.

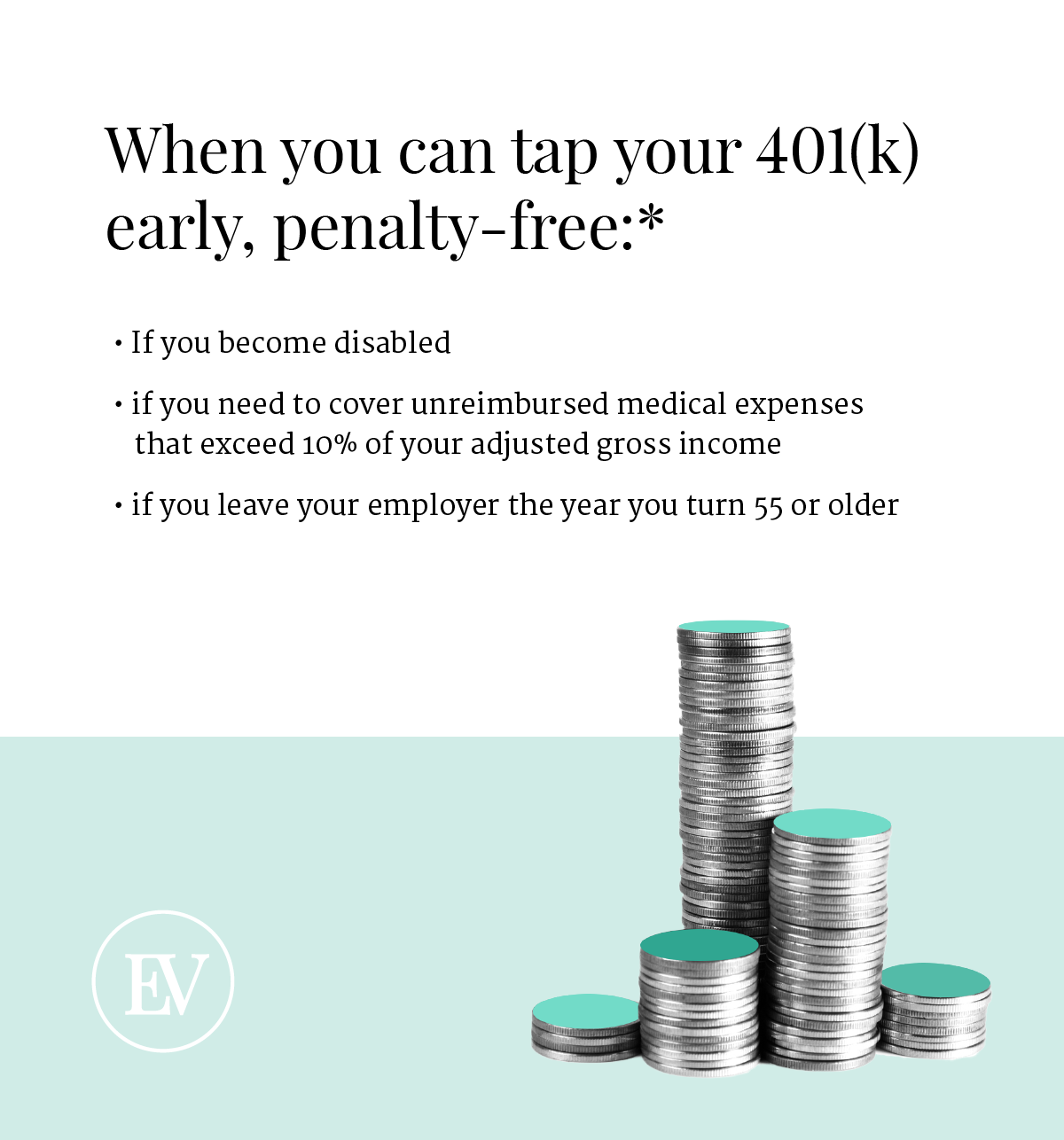

How do I avoid paying taxes on my TSP withdrawal?

If you want to avoid paying tax on the money in your TSP account for as long as possible, do not take any payouts until the IRS requires you to do so. By law, you are required to take the required minimum distributions (RMDs) from the year you turn 72 years old.

What is the average TSP balance at retirement?

| Age | Average contribution rate | Average balance |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| All ages | 9% | 95,600 USD |

Should I move my TSP money to the G fund 2020?

“For TSP Fund investors, we are currently recommending moving investments from the C, S and I equity funds to the G bond fund,” he says. More than 3 million federal employees invest in TSP (Thrift Savings Plan) Funds.

Should I put my money in G-fund?

What is the best TSP fund to be in right now?

For more conservative investors, note that the G-fund (often considered the safest TSP fund) had a return of 1.38% for the year. The L-income fund, which also includes some equity investments, had a much better return than the G-fund. The L-income return in 2021 was 5.42%.

Should I move my TSP money to the G fund 2020?

“For TSP Fund investors, we are currently recommending moving investments from the C, S and I equity funds to the G bond fund,” he says. More than 3 million federal employees invest in TSP (Thrift Savings Plan) Funds.

What TSP funds does Dave Ramsey recommend?

Dave Ramsey is very fond of both the Roth IRAs and the Roth TSP. This is why, by far most of the time, Dave Ramsey tells people that they should just use Roth TSP instead of the traditional TSP.

What should I do with TSP right now?

What should I put my TSP at?

How much should you invest in a TSP account? We recommend that you invest 15% of your retirement income. When you contribute 15% consistently, you set yourself up to have options when you retire.

How do I maximize my TSP growth?

Increase your contributions each year Most people do not start contributing to their maximum day on the job, so it is important to increase your contributions as you start earning more. Each time you receive a COLA or a step increase, you should consider increasing your TSP contributions.

Can the TSP G fund lost money?

With the TSP G Fund, you can earn medium to long interest rates without the risk of losing your money, no matter how long you keep the investment.

Is TSP losing money?

The small and medium-sized businesses in Thrift Savings Plan’s S Fund experienced the worst performance with a decrease of 10.57%. So far this year, the S-fund is at 18.83% in the red. And the common stock of the C-fund fell 8.72% last month, bringing its loss in 2022 to 12.91%.

Is the G fund guaranteed?

The payment of G Fund’s principal and interest is guaranteed by the US Government. This means that the US government will always make the necessary payments.

Can I retire at 60 with 500k?

So the answer to your question, “can I retire at 60 with 500k?”, Is “yes, you can”. How many years will 500k last in retirement? Following the 4% rule can help you figure out how long your savings can last.

At what age can you retire with 500k? Key takeaways. It may be possible to retire at the age of 45, but it will depend on a number of different factors. If you have $ 500,000 in savings, according to the 4% rule, you will have access to about $ 20,000 a year for 30 years.

How much do most 60 year olds have saved for retirement?

Americans in their 30s: $ 45,000. Americans in their 40s: $ 63,000. Americans in their 50s: $ 117,000. Americans in the 60s: $ 172,000.

What is the average 401 K for a 60 year old?

Age 60-69 Average 401 (k) balance: $ 195,500. Median 401 (k) balance: $ 62,000.

How much should I have saved for retirement by age 60?

A general rule for retirement savings within 60 years is that one strives to have about seven to eight times your current salary saved up. This means that a person earning $ 75,000 a year would ideally have between $ 525,000 to $ 600,000 in retirement savings at that age.

Can I retire on 500k plus Social Security?

Can I retire for $ 500,000 plus social security? Yes you can! The average monthly social security income check-in in 2021 is $ 1,543 per month. person. In the tables below, we will use an annuity with a lifetime income rider combined with SSI to give you a better idea of the income you can receive from a $ 500,000 savings.

Can I retire at 64 with $600000?

It is possible to retire with $ 600,000 in savings with careful planning, but it is important to consider how long your money will last. Whether you can retire with $ 600,000 may depend on a number of factors, including: Your desired retirement age.

What is a good monthly retirement income?

According to AARP, a good retirement income is about 80 percent of your pre-tax income before you leave the workforce. This is because when you no longer work, you do not pay income tax or other job-related expenses.

How much money do you need to comfortably retire at 60?

Most experts say that your retirement income should be around 80% of your final annual pre-retirement income. 1 This means that if you earn $ 100,000 a year upon retirement, you need at least $ 80,000 a year to have a comfortable lifestyle after leaving the workforce.

How much money should you retire with at 60?

At age 60, you should have seven times your annual earnings saved for retirement, Ally Bank recommends. Fidelity is again more aggressive and recommends eight times as much. This is also the time to make a push towards paying off debt to retire because of the minimum amount possible.

Is a million dollars enough to retire at 60?

Yes, you can retire as a 60-year-old with $ 1.5 million. At age 60, an annuity will provide a guaranteed income of $ 78,750 annually, starting immediately, for the remainder of the life of the insured. Income remains the same and never falls.

At what age does a Roth IRA not make sense?

Unlike the traditional IRA, where contributions are not allowed after age 70½, you are never too old to open a Roth IRA. As long as you’re still pulling income and breathing, the IRS is fine with you opening and financing a Roth.

At what age should I stop contributing to my Roth IRA? For 2020 and beyond, there is no age limit for making regular contributions to traditional or Roth IRAs. For 2019, if you are 70 ½ or older, you cannot make a regular contribution to a traditional IRA.

At what income level does a Roth IRA not make sense?

Roth IRA single-file contributions are prohibited if your income is $ 140,000 or more in 2021. The income-phasing-out range for singles is $ 125,000 to $ 140,000. Single taxpayers can not contribute to a Roth in 2022 if they earn $ 144,000 or more.

How are Roth IRAs taxed?

Roth IRAs allow you to pay tax on money that goes into your account, and then all future payouts are tax-free. Roth IRA contributions are not taxed because the contributions you make to them are usually made with after-tax money and you can not deduct them.

What positions should you hold in a Roth IRA?

In general, consider holding in a Roth any investment that brings:

- High growth potential (individual stocks that can rise dramatically in value)

- Generous dividends (REITs or other income-generating investments)

- High level of turnover (actively managed investment funds)

What is the downside of a Roth IRA?

Key Takeaways One major drawback: Roth IRA contributions are made with money after tax, which means there is no tax deduction in the contribution year. Another disadvantage is that withdrawal of account earnings must only take place when at least five years have elapsed after the first contribution.

What are disadvantages of Roth IRA?

One important drawback: Roth IRA contributions are provided with money after tax, which means there is no tax deduction in the contribution year. Another disadvantage is that withdrawal of account earnings must only take place when at least five years have elapsed after the first contribution.

Why wouldn’t you want a Roth IRA?

A Roth can take more income out of your hands in the short term because you are forced to contribute in dollars after tax. With a traditional IRA or 401 (k), on the other hand, the income required to contribute the same maximum amount to the account would be lower because the account draws on income before tax.

Sources :