Is Thrift Savings Plan an IRA or 401k?

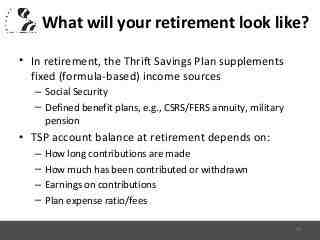

The TSP is a fiscal “employer” pension plan for federal employees comparable to a 401k plan in the private sector. An IRA is a taxable “individual” retirement plan.

What kind of plan is Thrift Savings Plan? The Thrift Savings Plan (TSP) is a fiscal pension savings and investment plan that offers federal officials the same kind of savings and tax benefits that many private companies offer their employees under 401 (k) plans.

Is a Thrift Savings Plan an IRA?

The Thrift Savings Plan (TSP) is not an individual retirement plan (IRA) – and vice versa. Even though they are both similar in that they are tax-benefit pension savings plans, the rules can vary significantly, and those who are unaware of the differences may pay a price during the tax period.

Do TSP contributions count as IRA?

Your participation in the TSP does not affect your eligibility to contribute to an IRA. However, the Internal Revenue Code (IRC) sets limits on the amount of dollars you can contribute to eligible employer plans such as the TSP and on individual retirement accounts such as traditional IRAs and Roth IRAs.

Is the TSP a 401k or IRA?

The TSP is a fiscal “employer” pension plan for federal employees comparable to a 401k plan in the private sector. An IRA is a taxable “individual” retirement plan. Big difference! The TSP must follow the administrative rules of Section 401k of the Internal Revenue Code.

Is TSP a Roth or traditional IRA?

A Roth TSP is similar to a Roth IRA, which means that the Roth TSP offers many benefits of Roth accounts. 8 The money contributed by the employee to the TSP account is in post-tax dollars, which means income tax will still be deducted from your salary before the contribution is deposited into the TSP account.

Is the TSP considered a 401k?

Not exactly, although they are similarly structured and have the same contribution limits. A TSP is what the federal government offers instead of a 401 (k), which is the kind of plan offered by private employers. So, you can not have both a TSP and a 401 (k).

Is TSP considered a retirement plan?

It is not only a qualified plan, but it is also part of the federal pension system that travels with federal employees who move into the private sector (or another level of government) before retiring.

Is TSP a 401k or IRA?

The TSP is a fiscal “employer” pension plan for federal employees comparable to a 401k plan in the private sector. An IRA is a taxable “individual” retirement plan. Big difference! The TSP must follow the administrative rules of Section 401k of the Internal Revenue Code.

Is the TSP considered a 401k for tax purposes?

Retirement Services My Annuity and Benefits The Thrift Savings Plan (TSP) is a fiscal retirement savings and investment plan that offers federal officials the same kind of savings and tax benefits that many private companies offer their employees under 401 (k) plans.

Do TSP contributions count as IRA?

Your participation in the TSP does not affect your eligibility to contribute to an IRA. However, the Internal Revenue Code (IRC) sets limits on the amount of dollars you can contribute to eligible employer plans such as the TSP and on individual retirement accounts such as traditional IRAs and Roth IRAs.

Is IRA different from TSP?

One major difference between these two accounts is that as a federal employee, your agency offers appropriate contributions when you invest in the TSP. Basically, your agency will contribute money to your TSP account based on how much you contribute. There is no match if you invest in an IRA.

Do TSP contributions count as IRA taxes?

Does TSP as a Roth IRA apply for taxes? Traditional distributions of TSP count as taxable income when distributed. Roth TSPs work similarly to Roth IRAs in that the money in the account is already included as part of the taxable income.

Is TSP an IRA or Roth IRA?

The huge federal-military 401 (k) plan, the Thrift Savings Plan, presents a Roth option, for its 4.5 million plus investors. The TSP, like other 401 (k) plans, is a way to save taxes. The money invested in the TSP will be tax deductible until you start withdrawing it.

Can I roll my 401k into my TSP?

Things to know: We accept both transfers and rollovers of tax money from traditional IRAs, SIMPLE IRAs, and eligible employer plans such as a 401 (k) or 403 (b) and the traditional balance of your account.

Is TSP better than 401k? While they may not have as many funds to choose from, TSP participants have a huge advantage over most 401 (k) investors: less fees. The total cost ratio, which covers both investment and administration costs, is 0.055% for individual TSP funds.

What is a good TSP balance at retirement?

I often say that there is not too much money in the savings plan. If you want your TSP balance to be able to generate an inflation-indexed annual income of $ 10,000, most financial planners suggest that you have a balance of $ 250,000 until you retire.

What is the average TSP account balance?

Not surprisingly, more than half of the total participants in the plan – 3,663,973 – have account balances of less than $ 50,000, but they have contributed on average for only 5.77 years. And about a quarter of the participants (1,529,078) fall into the $ 50,000- $ 249,000 range, but they have contributed an average of 15 years.

How much should I have in my TSP at 50?

How much should I have in my TSP at age 50? Up to 30, you should have saved half of your annual salary. Up to 40 years you should have double your salary, and up to 50 you should deduct about four times your salary from retirement savings.

Should I leave my money in TSP when I retire?

Depending on when you start retirement, you can simply leave the money in the TSP, let it continue to grow. If you do not need access yet, it is wise to leave it. Similar to other retirement accounts, you must start a minimum deduction at age 72. This is called a Required Minimum Distribution (RMD).

Can I roll my IRA into my TSP?

To transfer or transfer a traditional IRA to your TSP account, you will need to fill out Form TSP-60 at the IRA Depot, requesting a transfer to the TSP. The form is available on the TSP website or you can call the ThriftLine.

Can I transfer my IRA to a savings account?

One of the benefits of an Individual Retirement Account (IRA) is its individuality. Your IRA belongs to you, including all of its assets. You can withdraw these assets whenever you want and do whatever you want with them, even depositing them into a savings account.

Is TSP better than IRA?

The TSP is better when your taxes are high today and you expect them to be much lower in retirement. It is better to use your deduction against the higher tax rate. The Roth IRA is better the farther you are from retirement.

Can I transfer Roth IRA to Roth TSP?

TSP participants cannot transfer a Roth IRA to a Roth Tsp. However, you can transfer the Roth TSP to a Roth IRA. Learn why.

Can you roll over into TSP?

First and foremost, you can roll money into your TSP while you are still an employee or after being separated from federal work. The income component of a traditional IRA where you could not deduct your IRA contributions from your federal income tax (called “Traditional Non-Deductible IRA”).

What is the 4 rule in retirement?

A frequently used rule of thumb for retirement expenses is known as the 4% rule. It’s relatively simple: you set aside all your investments, and withdraw 4% of that total during your first year of retirement. In the following years, you adjust the dollar amount you deduct to calculate inflation.

What is a 4% calculator? You can take $ 4,000 per year income for every $ 100,000 you have (that is 4% of $ 100,000). If you saved $ 500,000 for retirement, that’s $ 20,000 of the annual income from your investments. If you have $ 1 million, that’s $ 40,000 a year.

How long will my money last using the 4 rule?

The 4% rule is based on research by William Bengen, published in 1994, which found that if you invested at least 50% of your money in stocks and the rest in bonds, you would most likely have a to retire. Inflation adjusted 4% of your nest egg every year for 30 years (and possibly longer, depending on …

Does the 4% rule still work for retirees?

Experts say the 4% rule, a popular retirement income strategy, is balanced. The 4% rule, a popular strategy for measuring retirement from a retirement portfolio, is not working so well in the coming decades due to lower projected stock and bond yields, according to a Morningstar paper published on Thursday.

Is the 4% rule too low?

The 4% rule can be a problem, especially for people who are considering a pension in the near future. In the past, there was concern that a 4% retreat would be too conservative, and in many market scenarios, retirees would end up taking far too little as retirement income.

How much do I need to retire based on 4% rule?

The 4% rule states that you should be able to comfortably live off 4% of your money and investments in your first year of retirement, then slightly increase or decrease that amount for each year thereafter to calculate inflation.

How much can I withdraw from retirement account each year?

The sustainable retirement rate is the estimated percentage of savings that you will be able to repay each year during retirement without running out of money. As an estimate, counting no more than 4% to 5% of your savings in the first year of retirement, then that amount adjusts to inflation each year.

How much money can you take out of your 401k?

With a 401 (k) loan, you borrow money from your retirement savings account. Depending on what your employer’s plan allows, you can withdraw as much as 50% of your savings, up to a maximum of $ 50,000, within a 12-month period.

How often can I withdraw retirement?

The 4% withdrawal rule The 4% rule states that you can withdraw 4% of your savings in the first year, and calculate next year’s deductions based on the inflation rate. This rule is based on the idea that you should withdraw 4% annually, and keep the financial security in retirement for 30 years.

How much can I withdraw from my retirement account each month?

The traditional withdrawal approach uses something called the 4% rule. This rule states that you can repay about 4% of your principal each year, so you can repay about $ 400 for every $ 10,000 you invest. But you would not necessarily spend it all; some of that $ 400 would have to go to taxes.

Does the 4% rule work for early retirement?

The 4% rule is a rule of thumb that suggests that pensioners should pay the amount equal to 4 percent of their savings in the year in which they retire and then adjust each year for 30 years for inflation. The 4% rule is a simple rule of thumb as opposed to a hard and fast rule for retirement income.

Does the 4% rule work forever?

It says you can conveniently withdraw 4% of your savings in your first year of retirement and adjust that amount for inflation for each subsequent year without risk for at least 30 years without spending money.

How much money do you need to retire at 55?

To find out how much money you need to save to move with 55, Doe suggests using a common rule of thumb: Take your current paycheck and multiply it by 10. Remember this is just a jumping off point – there are many other factors that You need to consider.

What is a good amount of money to retire early?

The first is the rule of 25: you should have saved 25 times your planned annual expenses before retiring. This means that if you plan to spend $ 30,000 during your first year in retirement, you should invest $ 750,000 when you leave your desk.

Should I leave my money in TSP?

Leave it in the TSP and let it grow. If you do not need access yet, it is wise to leave it. Similar to other retirement accounts, you must start minimum retirement at age 72.

How do I become a millionaire with TSP?

It’s an “elite club.” With over 75,000 members, the TSP millionaires gained their title by contributing to the TSP for 25-30 years, investing at least moderately aggressively with their funds. New members are welcome, but once you get to the financial “top” you have to work just as hard to stay there.

How can I get the most money from my TSP?

What percentage of TSP participants are millionaires?

FedSmith estimates that based on the latest data from the Federal Retirement Thrift Investment Board (FRTIB), 1.7% of all Thrift Savings Plan investors – about 6.3 million – are now millionaires. They participated in the TSP for an average of 28.2 years.

How many federal employees are TSP millionaires?

“There are about 4.5 million federal employees and about 2% of them, 112,880, are Thrift Savings Plan millionaires. These are the employees who have contributed to the TSP their entire federal career and invested aggressively. They all have financial storms and Crisis persisted.

How many TSP millionaires are there in 2021?

As of December 2021, there were 112,880 TSP millionaires, so the decline in Q1 2022 represents an 11% decline over Q4 2021.

Can you become a millionaire from TSP?

Here is a quick summary of how many TSP millionaires there are in the program. Of course, most TSP investors do not become millionaires, but combined with a pension, social security and TSP, a retired federal employee can very well live with less than $ 1 million in his retirement account.

Can you be a millionaire from TSP?

31, there were 112,880 TSP millionaires, up from 75,420 a year ago, according to the Federal Retirement Thrift Investment Board. What sets these TSP millionaires apart? Nothing.

How long does it take to be a TSP Millionaire?

It’s an “elite club.” With over 75,000 members, the TSP millionaires gained their title by contributing 25-30 years to the TSP, investing at least moderately aggressively with their funds. New members are welcome, but when you get to the financial â € œtopâ €, you have to work just as hard to stay there.

How much does the average person have in TSP?

U.S. households had a median balance of $ 5,300 and an average balance of $ 41,700 on their transaction bank accounts in 2019, according to data collected by the Federal Reserve.

What is a good return on TSP?

TSP’s performance in 2021 was excellent, and federal staff should be pleased to see results for December and for all of 2021.

How many federal employees are TSP millionaires?

“There are about 4.5 million federal employees and about 2% of them, 112,880, are Thrift Savings Plan millionaires. These are the employees who have contributed to the TSP their entire federal career and invested aggressively. They all have financial storms and Crisis persisted.

How many government employees are millionaires?

The Federal News Network reported on August 12 that there were 98,879 TSP millionaires – federal workers with at least $ 1 million in their DC accounts – as of June 30, 2021. That is up from just 45,219 in June 2020 and 84,808 from 31 March, 2021.

How much does the average federal employee have in TSP?

There are 3.6 million Federal Employees Retirement System participants, with an average balance sheet at the end of 2020 of $ 164,000.

How many TSP accounts have a million dollars?

The number of people investing in the Thrift Savings Plan (TSP) and who have now raised at least one million dollars now stands at 98,523. Nearly 100,000 federal employees, federal retirees or beneficiaries now have at least one million dollars in their accounts.

Sources :