Does TSP still grow after retirement?

Contents

Depending on when you first retire, you can just leave the money in the TSP and let it continue to grow. If you still do not need access to it, it may be wise to let it do so. As with other retirement accounts, you will need to start with a minimum withdrawal of 72 years.

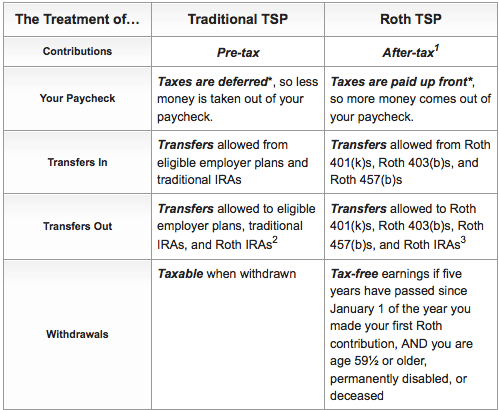

What happened to TSP after retirement? You can continue to enjoy the benefits of tax deduction and administrative expenses. Once you are separated, you will not be able to contribute to the staff. However, you can transfer funds to your TSP account from IRAs (although not from Roth IRAs) and eligible employee plans.

Is TSP a good retirement plan?

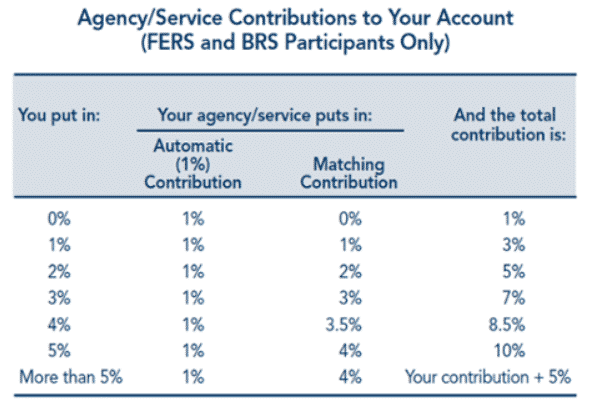

Many people consider it the best 401k plan. While. Average your contribution, investing through good times and bad times. … When it comes to 401k employee support plans, most experts say TSP, with 5% play and lower management fees, is the best deal around.

Can you lose money in TSP?

TSP participants can choose to deposit their money into five major accounts: G. Fund … You will not lose the investment amount in this account, but your return value is the lowest.

What is the average TSP balance at retirement?

| Age | Maximum Contribution Value | Average Measurement |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| Every Age | 9% | $ 95,600 |

Is TSP better than 401k?

In general, the Generational Plan compares favorably to 401 (k) plans, and if you work for the federal government and can participate, it may be logical to do so. It serves as a strong partner for FERS pension, and the combination of TSP and FERS could provide a solid foundation for retirement.

What is the average TSP balance at retirement?

| Age | Maximum Contribution Value | Average Measurement |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| Every Age | 9% | $ 95,600 |

How much should I have in my TSP by age 50?

Retirement Economy Policies At age 50, six times your salary; at age 60, eight times; and by age 67, 10. times 8ï »¿If you are 67 years old and earn $ 75,000 per year, $ 750,000 should be saved.

How much should I have in my TSP at 60?

Age 60: Be saved eight times your annual salary. Age 67: Saved 10 times your annual salary.

How many TSP is a millionaire?

The good news: There are 98,879 million people in the federal TSP! Bad news: Many people know it! The number of federal employees / postal workers who have become major financiers of the Strategic Plan has increased in recent years.

When can you withdraw money from TSP without penalty?

Since TSP is a retirement plan, there is no penalty for withdrawing your money while retiring. If you stop working for the federal government, you can start to retire when you turn 55. If you continue to work for the federal government, you need to wait until you turn 59-1 / 2.

At what age can I withdraw my TSP without conviction? Basically, if you leave the service before the year you turn 55 then you have to wait up to da 59 and ½ to avoid a 10% penalty (unless you qualify for someone else). Note: Your traditional TSP withdrawal will still be subject to tax even if you avoid the 10% penalty.

Can you withdraw from TSP at age 55?

Don’t worry, you can withdraw from TSP knowing that the 10% penalty will be ignored. Even if you delay the pension payment up to date, since you left the service in the year you turned 55, you are allowed to take part or all of the TSP, free of charge.

What age can you take money out of TSP?

The Internal Revenue Number (IRC) requires you to receive a portion of your TSP account from the beginning of the calendar year when you turn 72 * and you are disconnected from the service. This part is called the Minimum Distribution (RMD).

When can I withdraw from TSP without penalty?

With TSP, you are exempt from the initial withdrawal penalty if you leave the federal service within a year of reaching age 55 or later. For IRAs, the initial withdrawal penalty will apply to everything you take until you reach the age of 59 ½.

How much can I withdraw from TSP when I retire?

There is no limit to the amount of withdrawals you can take after you retire, although processing times limit you to more than one every 30 calendar days.

Can I withdraw money from my TSP without penalty?

You have the option of increasing or decreasing this retention. The taxable part of your withdrawal is subject to federal income tax at your current rate. Also, you may have to pay state income tax. An additional 10% IRS withdrawal penalty may apply if you are under 59½.

What is the best way to withdraw money from TSP?

A full withdrawal is the best way to use the money you have worked hard to accumulate.

What happens if I withdraw from my TSP?

The taxable part of your withdrawal is subject to federal income tax at your current rate. Also, you may have to pay state income tax. An additional 10% IRS withdrawal penalty may apply if you are under 59½.

How can I withdraw my TSP without penalty?

There are, however, ways to avoid early retirement if you retire before the age of 50 or 55. If you follow a life-long retirement plan for a longer one, 5 years or up you are. 59 59 shekaru, you will be set free from punishment.

What is average amount of TSP retirement?

| Age | Maximum Contribution Value | Average Measurement |

|---|---|---|

| 20-29 | 7% | $ 10,500 |

| 30-39 | 8% | $ 38,400 |

| 40-49 | 8% | $ 93,400 |

| 50-59 | 10% | $ 160,000 |

How much will I get in my TSP by age 50? Retirement Economy Policies At age 50, six times your salary; at age 60, eight times; and by age 67, 10. times 8ï »¿If you are 67 years old and earn $ 75,000 per year, $ 750,000 should be saved.

How much should I have in my TSP at 60?

Age 60: Be saved eight times your annual salary. Age 67: Saved 10 times your annual salary.

How much should I have saved for retirement by age 60?

By the age of 60, you should have seven times as much savings in your annual budget for retirement, Ally Bank recommends. Safety, again, is worse and recommends eight times as much. This is also the time to push towards paying a loan to retire because of the minimum amount possible.

How much savings should I have at 60?

To enjoy a life of retirement, a 60-year-old should save at least 15X his annual income. … In other words, if you spend $ 50,000 a year, you should earn at least $ 1,250,000 in savings or water worth 60 years to make a comfortable retirement.

How many TSP is a millionaire?

The good news: There are 98,879 million people in the federal TSP! Bad news: Many people know it! The number of federal employees / postal workers who have become major financiers of the Strategic Plan has increased in recent years.

What is the average amount in a TSP account?

The average balance of the Uniformed Service Member TSP account is close to $ 30,000 by the end of 2019, while the average share of new participants’ Retirement System (BRS) has reached nearly $ 7,000 in just two years since BRS she started working.

Can TSP make you a millionaire?

Of course, most TSP investors are not millions but, with cash, Social Security, and TSP, a retired federal employee can live very well with less than $ 1 million in retirement accounts.

How much should I have in my TSP at 35?

So, to answer the question, we believe getting one to one and a half saved income to retire through 35 years is a logical goal. It is a dream come true for those who start saving at the age of 25. For example, a 35-year-old earning $ 60,000 will be on the road if she saves around $ 60,000 to $ 90,000.

How much should you be worth at 35? At age 35, your income should be equal to almost 4X your annual income. Alternatively, your value in 35 years should be at least 2X your annual income. Given that the average household income is about $ 68,000 in 2021, the average household above should earn around $ 136,000 or more.

How much should a 35-year-old have in 401k?

Average 401k at Ages 35-44 â € “$ 229,375; Average $ 111,416. If you haven’t already started boosting your 401k by this year, then really start thinking about what changes you can make to bring your contribution to $ 19,500 per year. You do not want to miss out on many years of fun.

How much does the average 35-year-old have saved?

Average Economy Ages: 35 to 44 The 2019 Federal Consumer Expenditure Survey found that Americans between the ages of 35 and 44 have an average net worth of $ 27,900.

How much should you have in 401k by 36?

Considering the average age in the United States is about 36 years, the average 36-year-old should earn 401k worth of about $ 120,000. Unfortunately, $ 120,000 is still worth it. Below is the average savings of 401k per annum as of 4Q2020 according to Fidelity.

How much should I have in my 401k by age?

This is the number of experts at Fidelity recommend that you plan to retire at any age: By 30, you should earn the same amount as your salary. To 40, you should save three times your salary. With 50, you should save six times your salary.

How much should I save for retirement if I start at 35?

In order to retire peacefully, Fidelity Investments recommends that, when you are 30 years old, you should try to get one time your current salary in savings and double your salary at 35 years. come close to 67, you should get 10 times your last paycheck, the company said.

Can I start saving for retirement at 35?

It is never too late to start saving money for your retirement. … Even starting from the age of 35 means you can have more than 30 years to save, and you can still benefit greatly from the benefits of investing in tax-exempt cars.