How much money do I need in my TSP to retire?

Contents

Answer: More! I often state that there is no such thing as too much money in a Thrifty Savings Plan. Read also : Can a FERS employee retire early?. If you want your TSP balance to generate an inflation-indexed annual income of $10,000, most financial planners will suggest that you have a $250,000 balance by the time you retire.

How much should I have in my TSP at 45? At 45, experts recommend that you have the equivalent of four times your annual salary in the bank if you plan to retire at 67 and maintain the same lifestyle, according to a recent report by financial services firm Fidelity.

How much should I have in my TSP by age 50?

Retirement Savings Goal At age 50, six times your salary; at the age of 60, eight times; and at the age of 67, 10 times. 8 If you reach the age of 67 and earn $75,000 per year, you should have $750,000 in savings.

How much does the average person have in TSP? To see also : Can I retire after 5 years of federal service?.

There are 287,000 participants in the Civil Service Retirement System, with an average account balance at the end of 2020 of $175,000.

How much should I have in my TSP at 40?

At 40, Fidelity recommends setting aside three times your salary. If you earn $50,000 per year, you should aim to have $150,000 in retirement savings by the time you turn 40. If your annual salary is $100,000 per year, you should aim to save $300,000.

How much should I have in my TSP at 60?

At 60: Save eight times your annual salary. On the same subject : Can I retire at 55 under FERS?. At 67: Save 10 times your annual salary.

How much savings should I have at 60?

To have a comfortable retirement lifestyle, a 60 year old must save at least 15X his annual expenses. The main goal is to save 25X your annual expenses by the time you are ready to retire.

What is the average TSP balance by age?

| Age | Average Contribution Rate | Average balance |

|---|---|---|

| 20-29 | 7% | $10,500 |

| 30-39 | 8% | $38,400 |

| 40-49 | 8% | $93,400 |

| 50-59 | 10% | $160,000 |

Can you collect both a pension and Social Security?

Yes. There’s nothing to prevent you from getting retirement and Social Security benefits. … If your pension comes from what Social Security calls an “insured” job, where you pay Social Security payroll taxes, it has no effect on your benefits.

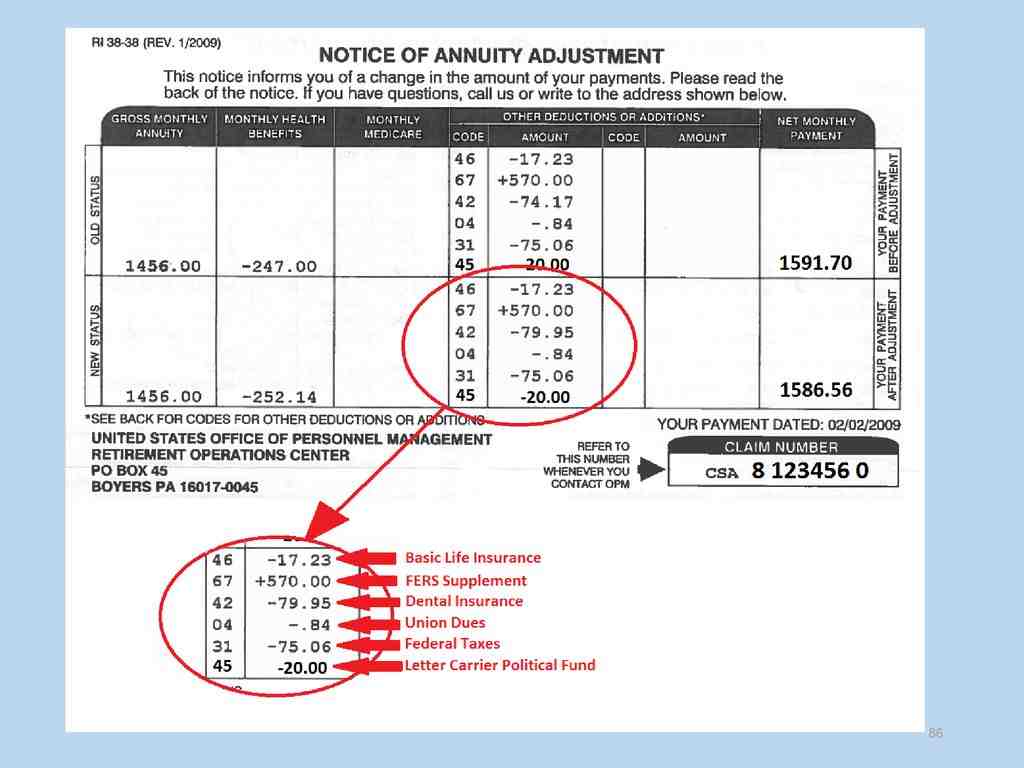

Does Pension count towards Social Security? Only income earned, your wages, or net income from self-employment is covered by Social Security. … Retirement payments, annuities, and interest or dividends on your savings and investments are not income for Social Security purposes.

How much will my Social Security be reduced if I have a pension?

We will reduce your Social Security benefits by two-thirds of your government pension. In other words, if you earn a monthly civil service pension of $600, two-thirds, or $400, must be deducted from your Social Security benefits.

Will my Social Security be reduced if I have a pension?

Will retirement reduce my Social Security benefits? In most cases, no. If the pension comes from an employer deducting FICA taxes from your paycheck, as nearly all do, it will not affect your Social Security retirement benefits.

Is a pension considered earned income?

For the year you file, earned income includes all income from employment, but only if it is included in gross income. … Income earned does not include amounts such as pensions and annuities, welfare benefits, unemployment compensation, workers compensation benefits, or social security benefits.

Can I live on pension and Social Security?

Bottom line: Yes, you can live on Social Security, if staying alive is the goal. But those living mostly or entirely on Social Security will face downward mobility in retirement—a reality that 40% of older workers now face.

Can you collect Social Security and a pension at the same time?

Can I take Social Security and pension? Yes. There’s nothing to prevent you from getting retirement and Social Security benefits. … If your pension comes from what Social Security calls an “insured” job, where you pay Social Security payroll taxes, it has no effect on your benefits.

Do you lose Social Security if you have a pension?

Will retirement reduce my Social Security benefits? In most cases, no. If the pension comes from an employer deducting FICA taxes from your paycheck, as nearly all do, it will not affect your Social Security retirement benefits.

Can you collect a pension and Social Security when you retire?

Yes. There’s nothing to prevent you from getting retirement and Social Security benefits. However, there are several types of pensions that can reduce Jamsostek payments. … In this case, your Social Security payments may be deducted under a rule called the Windfall Elimination Provision (WEP).

Can you collect Social Security and a pension at the same time?

Can I take Social Security and pension? Yes. There’s nothing to prevent you from getting retirement and Social Security benefits. … If your pension comes from what Social Security calls an “insured” job, where you pay Social Security payroll taxes, it has no effect on your benefits.

Do you lose Social Security if you have a pension?

Will retirement reduce my Social Security benefits? In most cases, no. If the pension comes from an employer deducting FICA taxes from your paycheck, as nearly all do, it will not affect your Social Security retirement benefits.

Is it better to retire at the beginning or end of the month?

Absolutely not. The last day of each month works really well, because you will be paid until the end of the month and your pension will start accruing the next day. Should I always choose the last day of the month even if it’s not a work day? In general, it doesn’t make too much of a difference.

What day of the month is the best to retire? For CSRS or CSRS Offset employees, the best day of the month to retire is the last three days of the calendar month or the first three days of the following month. For FERS/”Trans” FERS employees, the best day of the month to retire is the last three days of each month.

What is the best time to retire?

Age 65 has long been considered the typical retirement age, in part because of the rules surrounding Social Security benefits. In 1940, when the Social Security program began, workers were able to receive non-deductible pension benefits starting at age 65.

Is it better to retire early or later?

The advantages of early retirement include health benefits, opportunities to travel, or starting a new career or business venture. Cons of early retirement include pressure on savings, due to increased costs and smaller Social Security benefits, and the effects of depression on mental health.

What is the best age to retire?

The normal retirement age is usually 65 or 66 for most people; this is when you can start withdrawing your full Social Security retirement benefits. However, it makes sense to retire earlier or later, depending on your financial situation, needs and goals.

What is the best month to retire for tax purposes?

So as you can see, there is a lot of Income Tax to save by choosing March as the best month to retire. As a bonus, there are also other good reasons to retire at the end of the tax year. You’re about to enter spring so the weather will be warmer and the nights longer with more to do!

Is it best to retire at the end of a tax year?

By retiring at the beginning of the year, you will receive your leave payment in one year at a potentially lower income, thus minimizing the tax on those payments. … If you retire very close to the last day of the year (December 31), you will not receive annual leave payments until the following year.

What is the best month to start Social Security?

Following the recommendations on the Social Security website, you apply online three months before you want your benefits to begin, i.e. on or before May 10. Again, no matter what your actual “date” of birth is, your benefits can start in August.

Is it better to take Social Security at 62 or 67?

If you claim Social Security at age 62, rather than waiting until full retirement age (FRA), you can expect a reduction in monthly benefits of up to 30%. For each year you delay claiming Social Security through your FRA until age 70, you get an 8% increase in your benefits.

Does it matter what month you start Social Security?

Jamsostek does not make half-month payments. Individuals are first eligible to receive benefits during the month following their 62nd birthday month. … If you want to receive the first payment in the first month you qualify, you must register three months before your birthday.

How much should I have in my TSP when I retire?

How Much Should You Invest in a TSP Account? We recommend investing 15% of your income for retirement. When you contribute 15% consistently, you set yourself up to have options when you retire.

Should I leave my money in TSP after I retire? Leave it in TSP and let it grow Depending on when you start retiring, you can simply leave money in TSP and let it continue to grow. If you don’t need to access it yet, it might be wise to leave it. Similar to other retirement accounts, you must start withdrawals at the minimum age of 72.

How much should I have in my TSP at age 60?

At 60: Save eight times your annual salary. At 67: Save 10 times your annual salary.

What is the average TSP balance by age?

| Age | Average Contribution Rate | Average balance |

|---|---|---|

| 20-29 | 7% | $10,500 |

| 30-39 | 8% | $38,400 |

| 40-49 | 8% | $93,400 |

| 50-59 | 10% | $160,000 |

How much savings should I have at 60?

To have a comfortable retirement lifestyle, a 60 year old must save at least 15X his annual expenses. The main goal is to save 25X your annual expenses by the time you are ready to retire.

How much will my TSP be taxed when I retire?

Because we make payments directly to you and not to your retirement plan or other IRA, we are required to withhold 20% of your payments for federal income taxes. This means that in order to roll over your entire payment, you will have to use other funds to make up for the 20% withheld.

Can I cash out my TSP when I retire?

There is no limit to the number of withdrawals you can take after you retire, although the processing time limits you to no more than one every 30 calendar days.

What happens to my TSP when I retire?

Depending on when you start retiring, you can leave the money in the TSP and let it continue to grow. If you don’t need to access it yet, it might be wise to leave it. Similar to other retirement accounts, you must start withdrawals at the minimum age of 72. This is called the Minimum Required Distribution (RMD).

What is the average amount in TSP balance at retirement?

| Age | Average Contribution Rate | Average balance |

|---|---|---|

| 60-69 | 11% | $182,100 |

| 70-79 | 12% | $171,400 |

| All ages | 9% | $95,600 |

How much should I have in my TSP by age 50?

Retirement Savings Goal At age 50, six times your salary; at the age of 60, eight times; and at the age of 67, 10 times. 8 If you reach the age of 67 and earn $75,000 per year, you should have $750,000 in savings.

What is the average account balance in TSP?

The average TSP account balance for Uniformed Service Members reached nearly $30,000 at the end of 2019, while balances for new ‘Blended Retirement System’ (BRS) participants reached nearly $7,000 in just two years since BRS started operations.

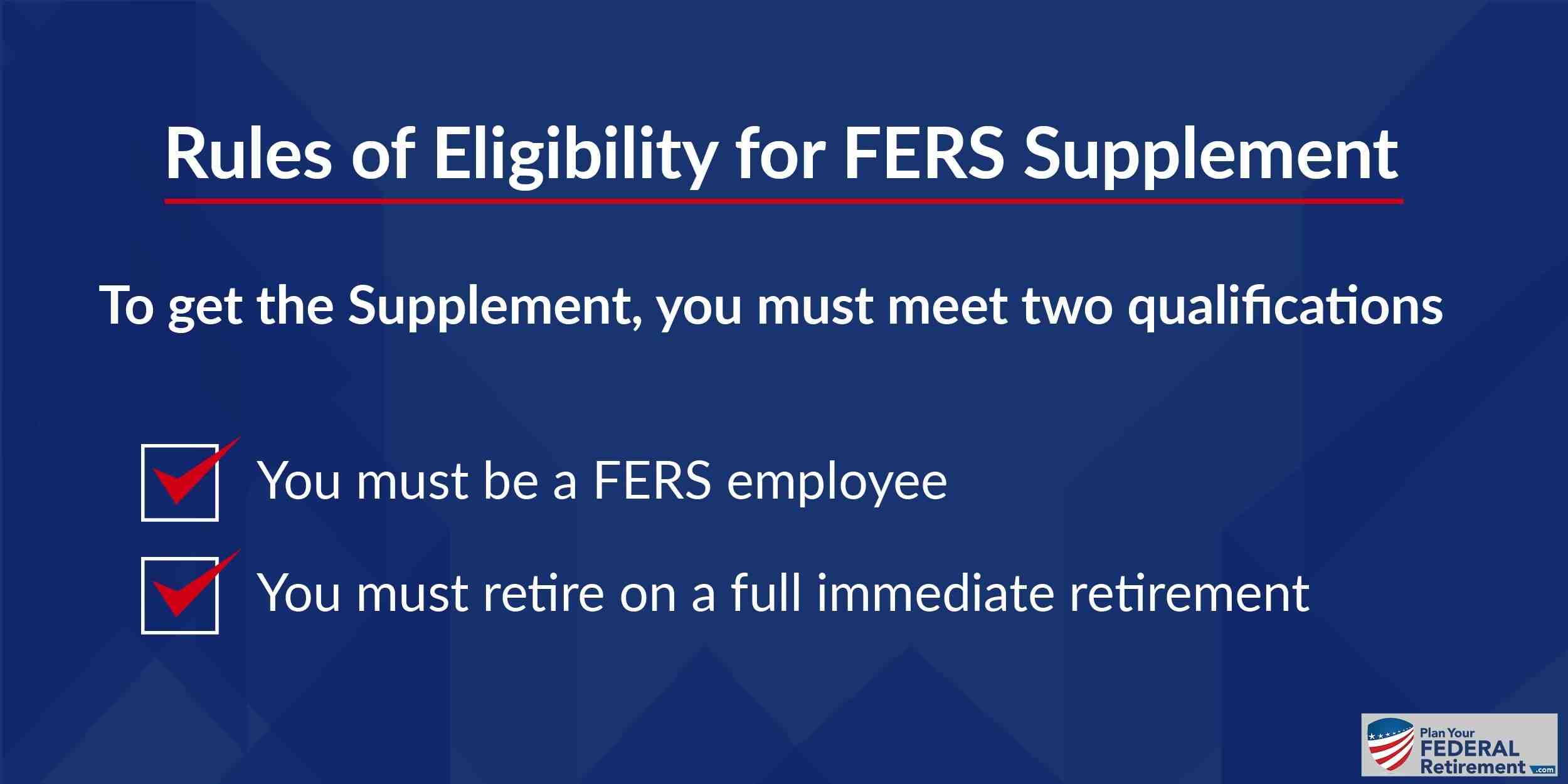

Is FERS pension for life?

FERS is a retirement plan that provides benefits from three different sources: Basic Benefit Plan, Social Security and Thrift Savings Plan (TSP). … Then, after you retire, you receive an annuity payment every month for the rest of your life.

What is the average FERS pension? The defined benefits of FERS are smaller–an average of about $1,600 per month and a median of about $1,300, for annual figures of $19,200 and $15,600–because the program also includes Social Security as a basic element.

How long does FERS pension last?

After retirement, you are entitled to a monthly annuity for life. If you leave federal service before you reach full retirement age and have at least 5 years of FERS service, you can choose to take out a deferred pension.

How long is FERS service?

You must work for at least 5 years with the Federal Government before you become eligible for the FERS Federal Pension, and for each year you work, you will qualify for at least 1% of your History High-3 Average Salary.

Does a federal pension run out?

While it’s nearly impossible for federal or postal retirees to run out of money, it is possible to run very low – even with annuities indexed as a whole, or partially inflation. …and retired FBI don’t run out of money. They can, even with COLA, and especially diet-COLA, run out of money.

Can you lose your FERS retirement?

The short answer is no. Unfortunately, the misconception that you could lose your federal pension if fired persists even among federal employees. Many employees mistakenly believe that they will lose their federal pension benefits if the agency fires them.

Can a federal pension be taken away?

It is very difficult for federal employees to lose their pensions once they qualify for retirement. Even if a former federal employee who meets the requirements for retirement is convicted of a crime, the pension is still guaranteed–in most cases.

How can you lose your federal retirement?

The main way to lose your pension is to be convicted of crimes against the national security of the United States (you will find a list of these types of crimes under Section 5 of USC 8312).

Is FERS pension fully funded?

FERS annuities are fully funded by the amount of employee and employer contributions and interest earned on Treasury bonds held by the Civil Service Pension and Disability Fund (CSRDF).

How is FERS retirement paid out?

System Benefits (FERS) Generally, your FERS benefit is 1% of your “high-3” average salary multiplied by the year and month you worked. If you are at least 62 years old at the time of separation and have at least 20 years of service, your annuity is 1.1% of your “high-3” median salary multiplied by the year and month you worked.

Are federal pensions secure?

About 80 percent of the 29,000 private-sector defined benefit programs are insured by the federal Pension Benefit Guaranty Corp. was underfunded by $740 billion. … “Retirement assetsâ€â€â€“assets that are legally yours after a certain period of time—are generally safe thanks to federal law.