Why govt jobs are decreasing?

The decline in the number of vacations in the public sector is a result of increased privatization, digitalisation and automation, academics observe. “The liberalization policy of 1991 has recently moved to another level.

What is the future of government work in India? According to the 2020 budget, by 2020-2021 there will be 3.5 million union officials, just a 0.7% increase (or 24,000 jobs) over the current year.

Why is govt job better?

Government jobs are better than private ones because of the benefits they offer. The major benefits to getting a government job are â € “job security, work-life balance, bonuses, fixed working hours, medical benefits, good pay, a decent amount of off-days, retirement life benefits, and much more.

Is government job really good?

Above all, it is with “job security”, even if the salary is low compared to a job in the private sector. Well, the reality is different. … Myth 1: The pay and benefits of public employment are always higher than those of private jobs. At the entry level, state government jobs pay the best wages, not the lowest.

Why do you want govt job?

are highly respected jobs. Even government positions put you in a position of power and thereby there are people who work under you and give you the respect you deserve. The private sector also places great value on people who have worked in the public sector.

Why government jobs are reducing?

“Although it seems as if there is widespread shortage of government posts, most of these shortcomings are at the entry level,” said a DOPT official. “The government needs to keep in mind the career progression of the people it recruits, and keep room for promotions. Therefore, there is a downward trend.”

Why govt jobs are decreasing?

The decline in the number of vacations in the public sector is a result of increased privatization, digitalisation and automation, academics observe. â € œThe liberalization policy of 1991 has recently moved to another level.

Are govt jobs decreasing?

NPS data show that the central government employed on average almost 11,000 people every month in 2017-18, falling to 9,900 in 2019-20 and 7,285 in 2020-21. At the state government level, the average monthly additions were 32,421 in FY21 compared to 45,208 in FY19.

Are government jobs decreasing?

The Union Public Service Commission (UPSC) has noticed a decline in the number of jobs for candidates over the years. … The decline in the number of vacations in the public sector is a result of increased privatization, digitalisation and automation, academics observe.

Why there is craze for government jobs?

Why is there so much madness for government officials? … They are under the false impression that a government job is ‘not required’, ‘has no goals’ and ‘offers many benefits’. Above all, it is with “job security”, even if the salary is low compared to a job in the private sector.

Are govt jobs decreasing?

NPS data show that the central government employed on average almost 11,000 people every month in 2017-18, falling to 9,900 in 2019-20 and 7,285 in 2020-21. At the state government level, the average monthly additions were 32,421 in FY21 compared to 45,208 in FY19.

What is a good retirement income?

Most experts say that your retirement income should be around 80% of your last pre-retirement salary. That means if you make $ 100,000 a year in retirement, you need at least $ 80,000 a year to lead a comfortable lifestyle after you leave the workforce.

What is a realistic retirement income? Retirement experts have suggested some smug rules about how much you should save: somewhere around $ 1 million, 80% to 90% of your annual pre-retirement income, 12 times your pre-retirement salary. But what is right for you?

What is a comfortable retirement income?

Among those surveys, “comfortable” pensions had annual incomes ranging from $ 40,000 to $ 100,000 and a nest egg of $ 99,000 to $ 320,000. “Affluent” pensions have reported at least $ 100,000 in annual income and assets of $ 320,000 or more.

What is a good monthly retirement income?

Median retirement income for seniors is approximately $ 24,000; however, average income can be much higher. On average, seniors earn between $ 2,000 and $ 6,000 per month. Older retirees tend to earn less than younger retirees. It is recommended that you save enough to cover 70% of your pre-retirement monthly income.

How much do you need to retire comfortably?

What is a comfortable retirement income for couples? According to research (2021), couples in the UK need a minimum retirement income of £ 15,700 to live a moderate lifestyle for £ 29,100 or £ 47,500 to live comfortably. These statistics are a national average outside of London, and your circumstances may be different.

What is a wealthy retirement income?

EBRI defines affluent retirees as those with high levels of financial wealth, over $ 320,000, and high annual incomes of $ 100,000 or more. … Comfortable retirees were more likely to have average financial wealth levels between $ 99,000 and $ 320,000 and annual retirement incomes of less than $ 100,000 per year.

What is considered a good monthly retirement income?

On average, seniors earn between $ 2,000 and $ 6,000 per month. Older retirees tend to earn less than younger retirees. It is recommended that you save enough to cover 70% of your pre-retirement monthly income. This works out to about 10-12 times the amount you make in a year.

How much do you need for a wealthy retirement?

Most experts say that your retirement income should be around 80% of your last pre-retirement salary. 3ï »¿That means if you earn $ 100,000 a year in retirement, you need at least $ 80,000 a year to live a comfortable lifestyle after you leave the workforce.

What is a good retirement salary?

The US Census Bureau reports the average retirement income for Americans over age 65 as both median and average. In the latest data from 2019, the figures were as follows: Median pension income: $ 47,357. Average Retirement Income: $ 73,288.

Can I retire on $5000 a month?

Typically, you can generate at least $ 5,000 a month in retirement income, guaranteed for the rest of your life. This does not include social security benefits.

What is a good retirement income per month?

According to 2016 data from the Bureau of Labor Statistics, the average 65-plus household spends $ 48,885 per year, which works out to about $ 4,000 per month.

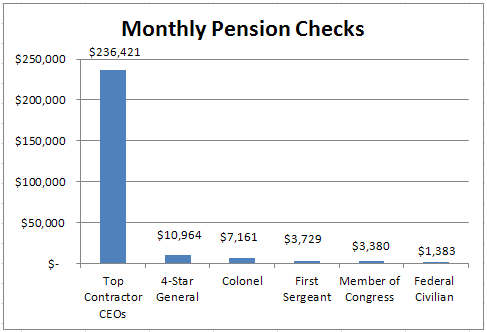

How much is the average government pension?

| Table 10. Median benefits for persons aged 65 and over with income from private pensions and pensions, public pensions and veterans’s benefits | |

|---|---|

| Type of pension benefit | Median Benefit, 2019 |

| Federal Government Pension | $ 27,687 |

| State or local government pension | $ 22,662 |

| Railway pension | $ 17,231 |

What is the average monthly pension payment? The average monthly Social Security benefit paid to retired workers in 2021 is $ 1,548.29, or $ 18,579.48 a year. The average monthly Social Security benefit paid to Widows & Widowers is $ 1,457.54, or $ 17,490.48 per year.

How much is the UK state pension 2020?

The total rate of the new state pension will be £ 179.60 per week (in 2020/21) but what you get could be more or less depending on your National Insurance (NI) record.

How much is the UK Old Age Pension 2020?

The full new state pension is £ 179.60 per week. The actual amount you receive depends on your National Insurance Record. The only reasons that the amount can be higher are if: You have over a certain amount of additional state pension.

How many years do you have to work to get a full State Pension?

Under these rules, you usually need at least 10 qualifying years on your National Insurance record to get a state pension. You will need 35 qualifying years to receive the full new state pension.

How much is the UK state pension 2021?

In 2021-22, the full level of the new state pension is currently £ 179.60 per week (£ 9,339.20 per year). Due to the changes in the state pension, it is no longer possible to build up an additional state pension – nor to “contract out” to receive a higher private pension.

What is the full UK State Pension 2021?

The full new state pension is £ 179.60 per week. The actual amount you receive depends on your National Insurance Record.

How much is the State Pension for a married couple UK 2021?

The total rate for the new state pension for the fiscal year 2021/2022 is £ 179.60. If both you and your partner have completed the full 35 qualifying years, you will receive double this amount as a married couple. This comes to £ 359.20 between you.

What is the average pension in the United States?

Retirement – Less than one-third (31%) of Americans today return with a defined benefit retirement plan. For those retiring with a retirement plan, the median annual retirement benefit is $ 9,262 for a private pension, $ 22,172 for a federal government pension, and $ 24,592 for a railroad pension.

What is a good retirement income?

Most experts say that your retirement income should be around 80% of your last pre-retirement salary. 3ï »¿That means if you earn $ 100,000 a year in retirement, you need at least $ 80,000 a year to live a comfortable lifestyle after you leave the workforce.

How much does the average person have in their pension?

After a lifetime of savings, the average UK retirement pot is set at £ 61,897. [3] With current pension rates, this would buy you an average pension income of just around £ 3,000 extra per year out of 67, which adds to the maximum state pension, making just over £ 12,000 a year, just enough for a basic pension lifestyle.

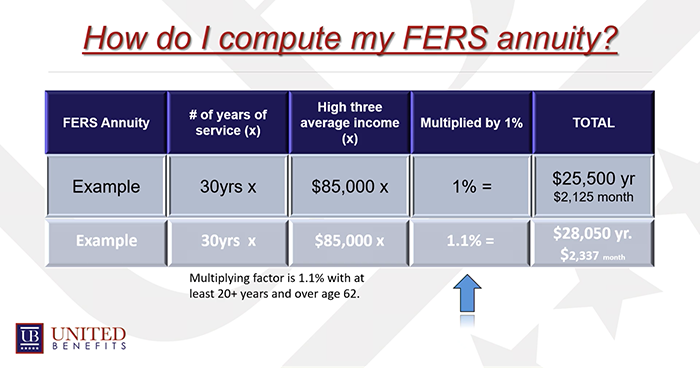

How much will my federal pension be?

FERS PENSION = 1.1% x high pay-3 x year worked. This corresponds to 1% – 1.1% of your highest annual salary for each year of federal service. You can maximize your benefits with more than 30% of your covered pre-retirement income.

How long do you have to work for the federal government to get a pension? You must work with the federal government for at least 5 years before you are eligible for a FERS Federal pension, and for every year you work, you are eligible for at least 1% of your high-3 average salary history. Automatic sales, those of.

How many years do you need to retire under FERS?

Under FERS, an employee who meets one of the following age and service requirements is entitled to a direct pension benefit: age 62 with five years of service, 60 with 20, minimum retirement age (MRA) with 30 or MRA with 10 (but with reduced benefits) ).

What happens to FERS if you leave before 5 years?

If you leave your government job before you are eligible to receive the pension: You can request that your pension contributions be repaid in a flat-rate payment, or. if you have at least five years of creditable service, you can wait until you are of retirement age to apply for monthly retirement benefit payments.

Can I retire after 5 years of federal service?

To be eligible (eligible to receive your Pension Benefit from the Basic Benefit Plan when you leave the Federal Service before you retire), you must have at least 5 years of credible civil service.

Is FERS pension for life?

FERS is a retirement plan that offers benefits from three different sources: a Basic Benefit Plan, Social Security and the Thrift Savings Plan (TSP). … Then, after you retire, you will receive monthly pension payments for the rest of your life.

What is the average FERS pension?

The FERS defined benefits are smaller – an average of about $ 1,600 monthly and a median of about $ 1,300, for annual figures of $ 19,200 and $ 15,600 – because this program also includes Social Security as a basic element.

How long does FERS pension last?

After retirement, you are entitled to a monthly annuity for life. If you leave the federal service before you reach full retirement age and have a minimum of 5 years of FERS service, you may choose to take out a deferred pension.

What is the average pension of a federal employee?

The FERS defined benefits are smaller – an average of about $ 1,600 monthly and a median of about $ 1,300, for annual figures of $ 19,200 and $ 15,600 – because this program also includes Social Security as a basic element.

How much will I get when I retire from the federal government?

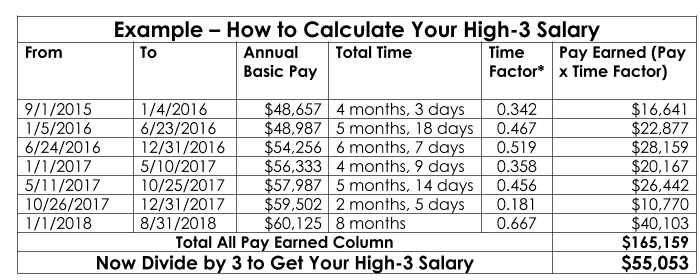

Overall, your FERS benefit is 1% of your “high-3” average salary multiplied by your years and months of service. If you have been at least 62 years of separation and have been in service for at least 20 years, your pension is 1.1% of your “high-3” average salary multiplied by your years and months of service.

How much pension do government employees get?

The amount of the pension is 50% of the payments or average payments, which is also profitable. Minimum pension is currently Rs. 9000 per Mount. Maximum limit on pension is 50% of the highest salary in the Government of India (currently Rs.

How is government pension calculated?

Your regular salary, together with any local salary, is included in the calculation for your average of three. FERS PENSION = 1.1% x high pay-3 x year worked. This corresponds to 1% – 1.1% of your highest annual salary for each year of federal service.

How do I calculate my pension amount? A typical multiplier is 2%. So, if you worked for 30 years, and your last average salary was $ 75,000, then your retirement would be 30 x 2% x $ 75,000 = $ 45,000 a year. That $ 45,000 will be your guaranteed lifetime income.

How is pension calculated from salary?

A pension is calculated by multiplying your service by your average salary and then dividing by 60.

What is the formula for pension calculation?

Effective September 1, 2014, the contribution is made as follows: 8.33% of 15,000 rupees = Rs 1250. Kasturirangan says: “The formula for calculating the EPS pension is as follows: Monthly pension amount = (Pension salary X Pension service) / 70. “

How is pension calculated based on salary?

The formula Average salary * Pensionable service / 70 where, Average salary means the average of the basic salary DA combined, in the last 12 months, and. The pension service means the number of years who worked in the organized sector after 15 November 1995.

Can you get military retirement and federal retirement?

Federal pension, military pension The general rule is that a retired military member who takes a federal job cannot receive both military pension and federal pension pay for the same period. You may not be paid twice for the same year of service.

How does military service affect the federal pension? As a general rule, military service in the U.S. Army is credible for Federal Retirement purposes if it has been completed active service under honest conditions, and done before separation from civilian service for retirement.

Can I draw my military retirement and Social Security?

You can receive both social security benefits and military pensions. In general, there is no reduction in Social Security benefits due to your military retirement benefits. You will receive your social security benefit based on your income and the age you choose to receive benefits.

Do veterans draw more Social Security?

Because Social Security benefits are calculated based on a person’s lifetime, these loans generally result in higher monthly payments to qualified veterans. … The amount of extra credit varies depending on how long the veteran has served and for what period of time.

Will your Social Security be reduced if you have a pension?

Does a pension reduce my social security benefits? In the vast majority of cases, no. If the pension is from an employer who has deducted the FICA taxes from your paychecks, as almost all of them do, it does not affect your Social Security pension benefits.

Can you combine federal and state retirement?

A: No, it will not be the same as working for the federal government. The two forms of employment are not interchangeable. You need to check with your state to find out if any of your military service would be credible and what are the requirements for retirement …

How many years does a federal employee need to retire?

Normally, an employee is eligible to withdraw from the Federal Service if the employee has at least 30 years of service and is at least age 55 under the Civil Service Retirement System or 56 in two months under the Federal Employees Retirement System; has at least 20 years of service and is at least 60 years of age; or at …

What happens to my retirement if I leave the federal government?

If you leave your government job before you are eligible to receive the pension: You can request that your pension contributions be repaid in a flat-rate payment, or. if you have at least five years of creditable service, you can wait until you are of retirement age to apply for monthly retirement benefit payments.

Can you receive FERS and military retirement?

The best part is that you will be able to apply your active-duty service time to both a guard / reserve pension and FERS pension. Unfortunately, federal law prohibits your military time from counting to an active retirement pension and a FERS retirement pension.

Does military time count towards FERS?

Year of Creditable Service: This is the number of years that count towards your retirement. However unique for the FERS Supplement Calculation – years of military service that you repaid for retirement will * not * count in this calculation. However, there are some unique exceptions.

Can a military retiree lose their retirement benefits?

Procedures by military departments may suspend retired pay under the authority of the head of retired pay activity if the pension does not require administrative action on time, or if the pension refuses further payments.