Civil servants under FERS are required to contribute a portion of their salary to receive future benefits from a defined benefit-benefit annuity. The amount of this contribution has changed several times recently, due to changes in Federal law.

What is the TSP limit for 2021?

The 2021 IRS annual average regular TSP donations will remain at $ 1550. If you are covered by the Federal Employees Retirement System (FERS, FERS-RAE, or FERS-FRAE), you will lose important contributions to the Agency Matching TSP, if you reach the limit within one year of the calendar year.

What is the Roth TSP target for 2021? Extensive contributions to the Thrift Savings Plan (TSP) in 2021 remain unchanged! The 2021 International Internal Revenue Service (IRS) annual election control limit, which applies to a combined full of old and Roth donations, remains $ 19,500.

Does TSP automatically stop at limit?

After this change is made, member contributions will only be suspended on the Elective Deferral Limit of $ 19,500, and will prevent any additional contributions taken from the paying member, preventing the need for a refund.

How do I max out my TSP 2021?

To provide the 2021 annual maximum for all familiar TSP and TSP Catch-up combinations of $ 26,000, you must deposit an additional $ 1,000 in payment on MyPay on December 6 â € “12, 2020, and your choice must be effective. December 20, 2020, the first payment period for 2021.

Does TSP have a limit?

The maximum amount you can contribute to this year’s TSP account is $ 19,500. If you are 50 years old or older, your plan may allow you to donate another $ 6,500 as a “catch-up” contribution, bringing your 2021 TSP contribution up to $ 266.

What are TSP contribution limits for 2021?

The maximum amount you can contribute to this year’s TSP account is $ 19,500. If you are 50 years old or older, your plan may allow you to donate another $ 6,500 as a “catch-up” contribution, bringing your 2021 TSP contribution up to $ 266. (These measures are similar to the limits in 2020.)

What is the maximum percentage I can contribute to my TSP?

Federal agencies make contributions corresponding to TSP accounts which can be up to 5 percent of the employee’s minimum wage. Your employer compares your dollar contribution to the first 3 dollars and 50 cents a dollar to the next 2 percent.

What is the max TSP contribution for 2020?

| Limit Name | IRC | 2020 Limit |

|---|---|---|

| Elective Deferral Limit | § 402 (g) | $ 19,500 |

| Catch-up Contribution Limit | § 414 (v) | $ 6,500 |

| Annual Addition Limit | § 415 (c) | $ 57,000 |

How much can you max out TSP?

| Year | Annual Offer Limited | Max Catch-Up Contribution Limit |

|---|---|---|

| 2020 | $ 19,500 | $ 6,500 |

| 2019 | $ 19,000 | $ 6,000 |

| 2018 | $ 18,500 | $ 6,000 |

| 2017 | $ 18,000 | $ 6,000 |

What are the TSP limits for 2020?

The 2020 IRS annual average monthly TSP donations will increase to $ 1550. If you are covered by the Federal Employees Retirement System (FERS, FERS-RAE, or FERS-FRAE), you may lose valuable contributions compared to the Agency TSP by the end of the calendar year.

How do I max my TSP 2021?

To provide the 2021 annual maximum for all familiar TSP and TSP Catch-up combinations of $ 26,000, you must deposit an additional $ 1,000 in payment on MyPay on December 6 â € “12, 2020, and your choice must be effective. December 20, 2020, the first payment period for 2021.

What is the best day to retire under FERS?

December 31,2021 is recommended as a good retirement date for an employee closed by FERS eligible for retirement for the following reasons: (1) a retired employee will receive his or her first FERS annuity check of February 1, 2022; and (2) a retired employee may receive an excessive amount of …

Is it better to retire at the end of the month or the beginning? No. The last day of any month works well, because you will be paid at the end of the month and your retirement will start to increase the next day. Should I always choose the last day of the month even if it is not a working day? For the most part, it does not make much difference.

What day of the month is best to retire?

Her pension does not start until February 1. This could leave Frannie in the pickle because she will not be getting a pension until next month. That is why the main rule of thumb in FERS is to retire on the last day of the monthâ € ”no matter what day of the week!

What is the best month to retire for tax purposes?

So as you can see there is plenty of Income Tax to be saved by choosing March as the best month to relax inside. As a bonus there is also another good reason to retire at the end of the tax year. You will be going in the spring so the weather should be warm and long nights with plenty of work to do!

What is the best month to start Social Security?

Following the recommendation on the Social Security website, you file online three months before you want your benefit to begin, that is, on or before May 10th. Also, no matter what the exact “date” of your birth, your assistance may start in August.

What is the best month to retire for tax purposes?

So as you can see there is plenty of Income Tax to be saved by choosing March as the best month to relax inside. As a bonus there is also another good reason to retire at the end of the tax year. You will be going in the spring so the weather should be warm and long nights with plenty of work to do!

Is it best to retire at the end of a tax year?

By retiring at the beginning of the year you will receive your vacation in the salary year which is likely to be less, thus reducing your income tax. … If you retire too late — close to the last day of the year (December 31) you will not receive your annual vacation until next year.

Is it better to retire at the end of the year or the beginning?

Silverberg recommends that retirees receive a three-to-five-year retirement savings plan. That way, they will not have to spend money on investments such as stocks during the downturn. … For such employees, the best time to retire may be at the beginning or end of the year.

What is the best time to retire from the federal government?

With CSRS, it is clear-cut: the end of the â € œ year of resignationâ € is the logical day to retire. This is where they can carry more than 240 hours of vacation from last year. For the CSSS, that date is January 3, 2022. The end of the holiday season is a reasonable time for the person who has resigned from FERS to resign.

When should a federal employee retire?

Generally, an employee is eligible to resign from a union or employee who is approximately 30 years of service and 55 years under the Civil Service Retirement System or 56 two months under the Federal Employees Retirement System; has about 20 years of service and is in his 60’s; or on …

What is the average pension of a federal employee?

Defined benefits for FERS small-average approximately $ 1,600 per month and averages $ 1,300, at annual rates of $ 19,200 and $ 15,600â € ”because the program also includes Social Security as a priority.

Can you retire from USPS after 20 years?

Employees who are dissolved for any reason, other than as stated in 583.11, are eligible for retirement and immediately reduced if they meet the age and occupation requirements: … Age 60 and 20 years of debt service include 5 years public service credit.

Is the post office giving you a quick exit? USPS began announcing that it would offer its first retirement commitment to qualified non-bargaining unit employees in early March. … Employees must have at least 50 years of service, or any age at least 25 years of service, in order to retire at any time.

How many years before you can retire from USPS?

Minimum Retirement Years (MRA) with 30 years of credit service including 5 years of government loan service.

Can you retire from USPS after 10 years?

If you are in your MRA with less than 10 years of service, you are eligible for retirement at 62, as described above. … If you are in your MRA at about 10 years of age but less than 20 years of service, if you wait until 62 years to use your retirement savings, the down payment will be waived.

How many years do you have to work at USPS to retire?

How Many Years Should You Work For The Post Office to Retire? To be eligible for retirement annuities, a union employee must have at least 5 years of credible government service and 20 years of service.

Does USPS have good retirement?

The Post Service is involved in the government’s retirement plan, which provides defined benefits (pension), as well as disability coverage. Eligibility is determined by your age and number of credit years.

What retirement does USPS have?

Today, most postal workers are eligible to participate in one of two categories of federal retirement benefits: The Civil Service Retirement System (CSRS), which provides benefits to many employees who were laid off before 1984. The Federal Employee Retirement System (FERS), which includes all employees . made after 1984.

How long do you have to work at USPS to retire?

How Many Years Should You Work For The Post Office to Retire? To be eligible for retirement annuities, a union employee must have at least 5 years of credible government service and 20 years of service.

Can postal workers retire after 20 years?

How Many Years Should You Work For The Post Office to Retire? To be eligible for retirement annuities, a union employee must have at least 5 years of credible government service and 20 years of service. They must also be of a certain age to receive the blessings, and this age depends on the year of birth.

What age can you retire from USPS?

Automatic USPS retirement starts at the age of 65, but there are plans to retire at the local level Civil Service Retirement System and Federal Employment Retirement System are disruptive.

Does USPS have a good retirement?

Post office staff can contribute to the Thrift Savings Plan (TSP), which is similar to the 401 (k) retirement savings plans offered by individual employees. Employees provide support to TSP on a tax-refundable basis and may receive automatic and comparable donations (up to 5 percent of pay) from Post Service.

Can you retire from USPS after 10 years?

If you are in your MRA with less than 10 years of service, you are eligible for retirement at 62, as described above. … If you are in your MRA at about 10 years of age but less than 20 years of service, if you wait until 62 years to use your retirement savings, the down payment will be waived.

Can I retire with 10 years of union service? Under the MRA 10 election, only 10 years of service is required to retire immediately if you are under 62 (but you must be on your MRA at the time of your separation from the union).

Can you retire early from USPS?

They can allow qualified employees to leave early years on a reduced annuity protected from inflation. But the annual cost of living adjustment does not start to reach 62 years for anyone under the age of 62 years.

How can I retire early from the post office?

To qualify for early retirement, employees must be at least 20 years of age and must be at least 50 years of age or older, or 25 years of service at any age. For employees in the Civil Service Retirement System, the annuity is reduced by 2 percent annually for employees under the age of 55.

Can you retire from USPS after 5 years?

If you leave with five years or more of employment, you are eligible for a fixed retirement benefit at the age of 62 years or later. If you go for about five years but less than 10 years of work, you should apply for retirement at the age of 62.

How long do you have to work for USPS to retire?

How Many Years Should You Work For The Post Office to Retire? To be eligible for retirement annuities, a union employee must have at least 5 years of credible government service and 20 years of service.

How do I retire from the USPS?

While the Office of Personnel Management (OPM) makes all decisions regarding retirement rights, existing employees are required to apply for retirement through the USPS Human Resources Shared Services (HRSSC). HRSSC can be obtained by calling 877-477-3273, option 5.

Do USPS workers get a pension?

The Post Service is involved in the government’s retirement plan, which provides defined benefits (pension), as well as disability coverage. Eligibility is determined by your age and number of credit years.

What is the average postal workers pension?

As an example of USPS retirement under the CSSS, a postal worker with an average 3-year average of $ 60 and 20 years of work earns $ 820,000 per month without deduction. That equates to $ 22,000 a year. An employee with the same salary and 40 years of work earns $ 3,837 per month, or about $ 46,000 per year.

How many years do you need to retire from the post office?

If you are about 5 years old and less than 10 years old, you should be eligible for retirement at age 62. Benefits are calculated as 1% multiplied by the average salary of your top three-year years and months of service. .

What is the retirement for USPS?

| Birth Year | MRA |

|---|---|

| 1952 | 55 Years and 10 Months |

| 1953–1964 | 56 Years |

| 1965 | 56 Years and 2 Months |

| 1966 | 56 Years and 4 Months |

How are FERS monthly payments calculated?

FERS Annuity Calculation

- Less than 20 years of service (approximately 62 years): Service years x High-3 x 1% = Annuity Payment.

- Twenty or more years of service (approximately 62 years): Working years x High-3 x 1.1% = Annuity Payment.

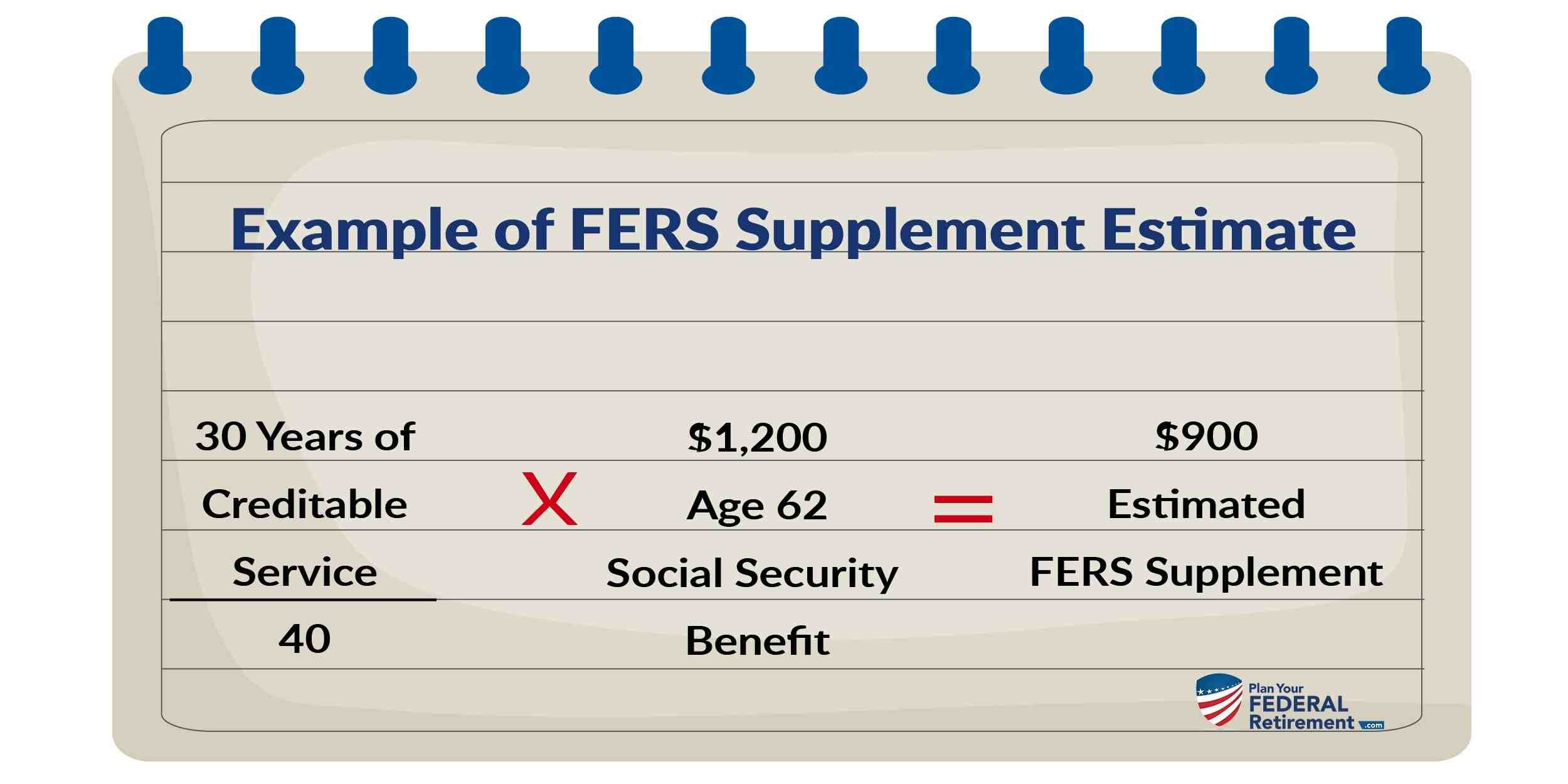

Is FERS annuity paid monthly? FERS Annuity Supplement This amount is paid to you every month up to the age of 62 years. It is similar to the Social Security you received when you were a civil servant.

How are FERS contributions calculated?

Generally, the FERS key benefit is your 1% top-3 average pay period for your credit years. FERS employees can currently contribute up to 11% of the initial payment to the Thrift Savings Plan. The Government’s automatic contribution adds 1% of the initial salary to each employee of the FERS TSP account.

What is the FERS employee contribution rate?

Employee contributions are calculated as union money. More than 95 percent of civil servants participate in FERS, and most of them give 0.8 percent of their salary to their future annuity.

What is the FERS retirement formula?

Your regular income, as well as local income, is included in your average third-party earnings. FERS pension = 1.1% x high salary-3 x years employed. This equates to 1% – 1.1% of your gross annual earnings for the union.

What is the average FERS pension?

Defined benefits for FERS small-average approximately $ 1,600 per month and averages $ 1,300, at annual rates of $ 19,200 and $ 15,600â € ”because the program also includes Social Security as a priority.

What is the average pension of a federal employee?

The average number of civil servants who retired in FY 2016 was 61.5 years and had spent 26.8 years in the state government. the average monthly salary for employees who resigned under CSSS in FY 2018 was $ 4,973. Employees who have resigned under the FERS have received an average monthly annuity of 1,834.

How much do you get paid at FERS?

FERS employees can currently contribute up to 11% of the initial payment to the Thrift Savings Plan. The Government’s automatic contribution adds 1% of the initial salary to each employee of the FERS TSP account. The government adds up to another 4% of the initial pay, depending on which employee chooses to contribute.

Are FERS payments monthly?

Your FERS Annuity, in short, the pension you receive from the Federal Employee Retirement System. After you retire, you will receive a monthly stipend from the government for the rest of your life.

How is FERS retirement paid out?

System (FERS) Benefit Generally, your FERS benefit is 1% of your â € œmour 3â € salary plus multiplied by the years and months of your work. If you were 62 years apart and had about 20 years of employment, your annuity is 1.1% of your average “high-3” salary multiplied by the years and months of your job.

Is FERS automatic?

The FERS retirement system came into operation in 1987, and almost all new Federal civilian workers hired after 1983 are simply covered by the new system.

How much do you get paid at FERS?

FERS employees can currently contribute up to 11% of the initial payment to the Thrift Savings Plan. The Government’s automatic contribution adds 1% of the initial salary to each employee of the FERS TSP account. The government adds up to another 4% of the initial pay, depending on which employee chooses to contribute.

Is FERS retirement paid monthly? FERS is a retirement plan that offers benefits from three different courses: Basic Benefit Plan, Social Security and Thrift Savings Plan (TSP). … Now, after you retire, you get a monthly income for the rest of your life.

How are FERS benefits paid?

When you retire, FERS will pay you a monthly salary based on your years of service under FERS, your income and retirement age. Thus, first aid is often referred to as monthly payments. With this help, you pay 0.8% of your total payroll.

Where does FERS money go?

FERS is a retirement plan that offers benefits from three different courses: Basic Benefit Plan, Social Security and Thrift Savings Plan (TSP). Two-thirds of the FERS (Social Security and TSP) can go with you to your next job if you leave the Federal Government before retiring.

Are FERS payments monthly?

Your FERS Annuity, in short, the pension you receive from the Federal Employee Retirement System. After you retire, you will receive a monthly stipend from the government for the rest of your life.

How much will I get from FERS?

System (FERS) Benefit Generally, your FERS benefit is 1% of your â € œmour 3â € salary plus multiplied by the years and months of your work. If you were 62 years apart and had about 20 years of employment, your annuity is 1.1% of your average “high-3” salary multiplied by the years and months of your job.

What happens to my FERS if I quit?

As FERS employees are covered by Social Security, when they apply for Social Security those years will be counted along with those received through outside work. In this case, there is nothing wrong with leaving the government.

How much can I expect from FERS retirement?

Generally, your FERS benefit is 1% of your average “higher-3” salary over the years and months of your work. If you were 62 years apart and had about 20 years of employment, your annuity is 1.1% of your average “high-3” salary multiplied by the years and months of your job.

What is the average FERS pension?

Defined benefits for FERS small-average approximately $ 1,600 per month and averages $ 1,300, at annual rates of $ 19,200 and $ 15,600â € ”because the program also includes Social Security as a priority.

What is the average pension of a federal employee?

The average number of civil servants who retired in FY 2016 was 61.5 years and had spent 26.8 years in the state government. the average monthly salary for employees who resigned under CSSS in FY 2018 was $ 4,973. Employees who have resigned under the FERS have received an average monthly annuity of 1,834.

How much is a federal pension worth?

In 2016, the average pension for over 65 executives working in the private sector was worth $ 9,262 a year. The state pension for the union, at this time, was $ 22,172, and for the state and local pension, it was $ 17,576, according to the Pension Rights Center.