Is the TSP better than a 401k?

How Much Should I Have in My TSP at 40? Retirement Savings Goals If you make $ 50,000 by age 30, you should have $ 50,000 in the bank for retirement. By the age of 40, you should have three times your annual salary.

What is the average balance of the TSP at the time of retirement?

Is thrift savings plan good?

Can you lose money in TSP? Participants in the TSP can choose to invest their money in five main funds: The G. Fund … You will not lose money by investing in this fund, but your rate of return is the lowest.

How much should I have in my TSP at 40?

How much should a 40-year-old save? By age 40: Save three times your annual salary. If you make $ 50,000, you should plan to save $ 150,000 for retirement by 40.

How much should I have in my TSP when I retire?

How Much Should I Have in My TSP at the Age of 60? To retire by age 67, retirement plan provider Fidelity Investments experts say you should have eight times your income saved by the time you turn 60. If you are approaching 60 (or have already reached it) and you are not close to that number, you are not the only one behind.

How do I avoid paying taxes on my TSP withdrawal?

How much tax do you pay on a TSP withdrawal? The TSP is required to withhold 20% of the federal income tax payment. This means that in order to transfer the entire payment, you need to use other funds to recover the 20% withheld. If you do not renew the full payment amount, the non-renewed portion will be taxed.

What is the average TSP balance?

How much should I have in my TSP at 50? At 30, you should save half of your annual salary. By age 40 you should have double your salary and by age 50 you should aim for about four times your salary in retirement savings.

Can you have a Thrift Savings Plan and a 401k?

Can you contribute to the second-hand and 401k savings plan? 401 (k) Maximum Contributions Also, if you have a TSP account that you are saving into, it allows you to contribute up to “$ 19,500” in annual elective deferrals. … However, it would be helpful to practice with caution when you want to contribute to both a TSP and 401k at the same time.

Can I have a TSP and Solo 401k? Yes. You are eligible to establish a 401k Solo for a side business even if you participate in a 401k, 403b, 457 or Thrift savings plan through your primary employer. … Your employer’s 401k, 403b, or TSP contributions count towards your Solo 401k salary deferral limit.

Does TSP count as 401 K?

Is the TSP better than 401k? Overall, the thrift savings plan compares favorably to 401 (k) plans, and if you work for the federal government and can participate, it most likely makes sense to do so. It serves as a solid complement to the FERS retirement and the combination of TSP and FERS can provide a solid foundation for retirement.

What is a 401k thrift plan?

Is a second-hand savings plan the same as a 401k? A second-hand savings plan is similar to a 401 (k) plan but is only open to federal employees and uniformed service personnel. Participants in a TSP can get an immediate tax break for their savings or invest in a Roth to be tax free after retirement.

Are thrift savings plans taxable?

Do you have to pay taxes on the savings plan? The TSP is required to withhold 20% of the federal income tax payment. This means that in order to transfer the entire payment, you need to use other funds to recover the 20% withheld. If you do not renew the full payment amount, the non-renewed portion will be taxed.

Are TSP and 401k limits separate?

Does TSP count towards the 401k limit? 401 (k) Maximum Contributions Also, if you have a TSP account that you are saving into, it allows you to contribute up to “$ 19,500” in annual elective deferrals. You also have the option to contribute an additional “$ 6,500” to increase your TSP investment limits if you are 50 or older.

Is TSP a 401k for tax purposes?

Is TSP considered a 401k? While the TSP isn’t technically a 401k, it’s a defined contribution plan just like a 401k (and a 403b for that matter). … The limits on TSP contributions are equivalent to those for 401 (k) plans. For 2021, that amount is $ 19,500 plus an additional $ 6,500 recovery grant for employees aged 50 and over.

Is TSP better than IRA?

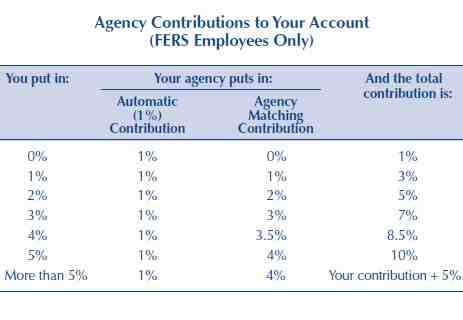

What is the difference between TSP and IRA? One major difference between these two accounts is that, as a federal employee, your agency makes matching contributions if you invest in the TSP. Basically, your agency will contribute money to your TSP account based on how much you are contributing. There is no match when investing in an IRA.

Can you lose money in TSP?

Is TSP savings safe? 2. You are 100% invested in the G Fund. Many federal employees like the Government Securities Investment Fund (G) because it feels safe. The fund is invested in short-term US Treasuries issued specifically for the TSP, therefore principal and interest payments are guaranteed by the federal government.

What’s wrong with the TSP? A toxic substance, TSP can be harmful if ingested and exposure to it (in granular or diluted form) can cause serious eye damage and skin irritation.

How do you become a millionaire on TSP?

How long does it take to be a TSP millionaire? An article by Lyn Alden on FEDweek notes that the average contribution years of a TSP millionaire exceed 29 years. Your investments will grow, but it will take some time for your investments to reach $ 1 million.

What TSP fund is best?

Which TSP Fund is Better C or S? As of December 31, 2020, Fund S has outperformed Fund C over the past 1, 3, 5, 15 and 20 year periods. Fund C has slightly outperformed over the past 10 years. Despite Fund S’s historical record of outperforming C, TSP participants invest three times more in Fund C than in Fund S.

Which is better C fund or S fund?

Is fund S a good investment? Why should I invest in the S Fund? While investing in the S Fund involves risk, it also offers the opportunity to earn gains from equity ownership of small and medium-sized US companies. It provides an excellent means of further diversifying your national equity holdings.

What age can you withdraw from TSP without penalty?

Can I withdraw money from my TSP without penalty? You have the option of increasing or waiving this deduction. The taxable portion of your withdrawal is subject to federal income tax at your ordinary rate. Additionally, you may have to pay state income tax. If you are under the age of 59 and a half, an additional 10% IRS early withdrawal penalty may apply.

What happens to your TSP if you quit?

What happens to the TSP if I resign? Yes, you can leave your entire account balance in the TSP when you leave the federal service if the balance is $ 200 or more. You can continue to enjoy tax deferred earnings and low administrative fees. Once you separate, you will no longer be able to make employee contributions.

How do I maximize my TSP growth?

How can I maximize my TSP contributions in 2021? To contribute to the 2021 annual maximum amount for both the Regular TSP and the TSP Catch-up for a combined total of $ 26,000, you must enter an election amount of $ 1,000 into myPay during December 6-12, 2020 and your election it should be effective on December 20, 2020, the first pay period for 2021.