What is the penalty for retiring at 62?

If your full retirement age is 67 and you are claiming Social Security at age 62, your monthly benefit will be reduced by 30 percent, permanently. Join 65 and you’ll lose 13.33 percent. If your total retirement benefit is $ 1,500 a month, that 20.33 percent penalty in 20 years adds up to almost $ 48,000.

How much do you lose if you retire at age 62? Employees can choose to retire at age 62, but doing so could result in a 30 percent reduction. Starting to receive benefits from the normal retirement age can bring greater benefits.

What is the average Social Security benefit at age 62?

According to Social Security Administration payment statistics for June 2020, the average Social Security benefit at age 62 is $ 1,130.16 per month, or $ 13,561.92 per year.

Is it better to take Social Security at 62 or 67?

If you claim Social Security at age 62, instead of waiting until you reach retirement age (FRA), you can expect a 30% reduction in your monthly benefits. For every year you defer your Social Security claim for up to 70 years, you will receive an 8% increase in your benefit.

What is the maximum monthly Social Security benefit at age 62?

The maximum Social Security benefit in 2021 depends on the age at which you start collecting payments, which is $ 2,324 at age 62. $ 3,148 at age 66 and 2 months. $ 3,895 at age 70.

What happens if I retire at 62?

If you claim Social Security at age 62, instead of waiting until you reach retirement age (FRA), you can expect a 30% reduction in your monthly benefits. For every year you defer your Social Security claim for up to 70 years, you will receive an 8% increase in your benefit.

What happens if you retire at 62 instead of 65?

If your total retirement age is 67 and you are claiming Social Security at age 62, your monthly benefit will be reduced by 30 percent, permanently. Join 65 and you’ll lose 13.33 percent. If your total retirement benefit is $ 1,500 a month, that 20.33 percent penalty in 20 years adds up to almost $ 48,000.

What is the maximum Social Security benefit at age 62?

In 2021, if you claim at age 62, the maximum amount you can get in benefits is $ 2,324, but if you have the maximum right and the full retirement age is 66, then waiting until you start your benefits entitles you to $ 3,113 a month. That’s a big increase for waiting five years or less to claim Social Security.

What are the disadvantages of retiring at 62?

The downsides of early retirement

- It can be bad for your health. …

- Your Social Security benefits will be lower. …

- Your retirement savings should last longer. …

- You will need to seek health insurance. …

- You may get bored and lose your job.

Is it better to take Social Security at 62 or wait?

Deciding when to take Social Security depends on your situation. You can start taking it at the age of 62 (or if you are alive or disabled from another Social Security claimant earlier), wait until you reach retirement age, or even until you are 70 years old.

Can I retire at 62 and still work part time?

You can get Social Security retirement or survival benefits and work at the same time. But, if you are younger than the full retirement age and earn more than a certain amount, your benefits will be reduced. The amount that reduces your benefits, however, is not really lost.

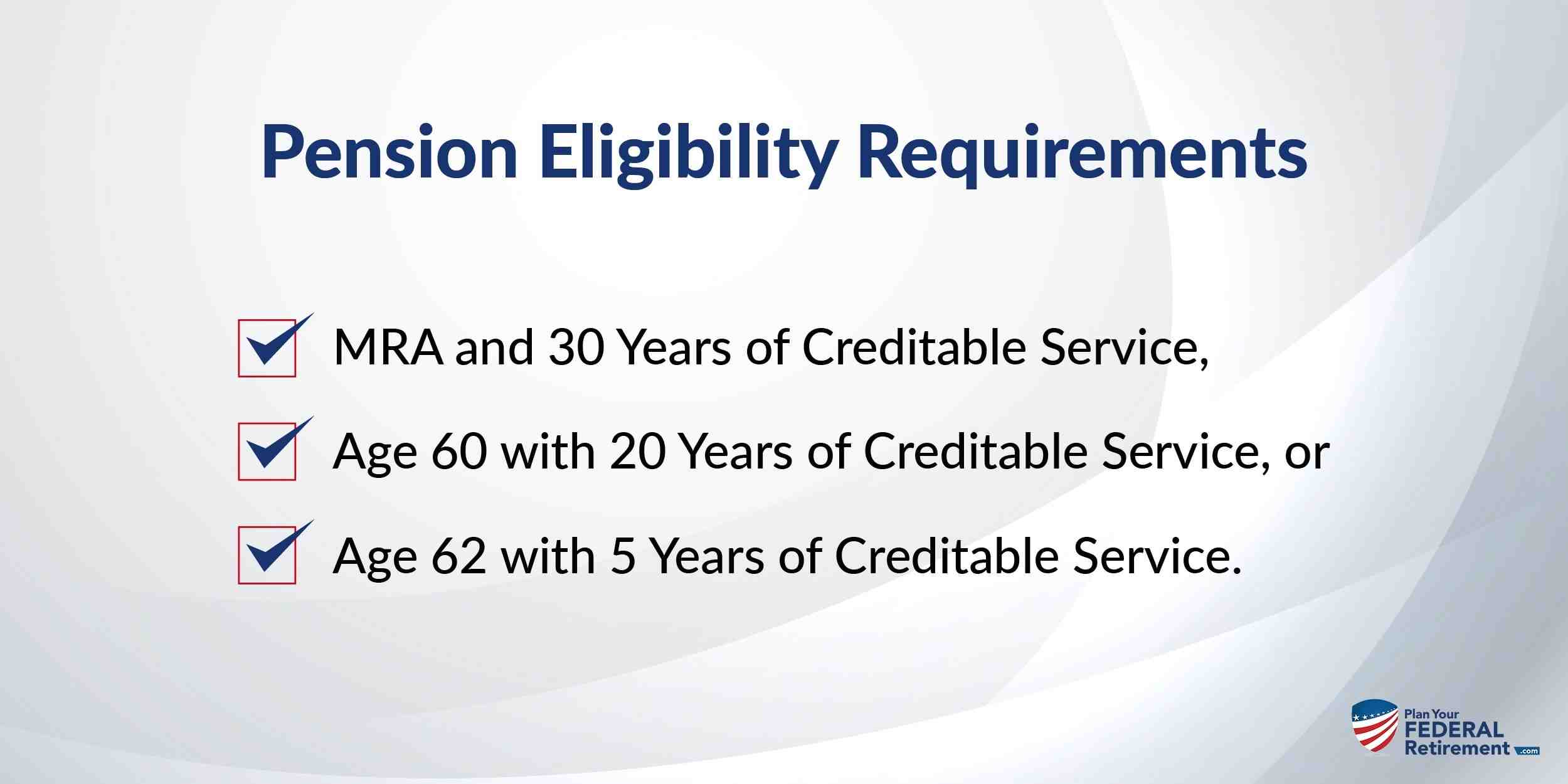

How many years of service is required for full pension?

State judicial officials who have completed 20 years of service are entitled to a full pension. However, in the case of State Judicial Officers retiring between 1/1/2006 and 01/09/2008, it shall be calculated in accordance with the provisions of the Regulations in force.

What is the minimum service year for receiving a pension? The minimum period for receiving a pension is 10 years. A Central Government official who retires under the Pensions Rule is entitled to receive a pension after completing at least 10 years of qualified service.

How many years do you have to work to get a full pension?

You will need to turn 35 to get a full state pension. You will receive a proportion of your new state pension if you are between the ages of 10 and 35. You have been on your National Insurance Register for 20 years since April 5, 2016. You divide £ 179.60 by 35 and multiply by 20.

How many years is full National Insurance contributions?

Registration of your National Insurance You must have completed a total of 30 years of National Insurance contributions or credits to obtain a full basic pension in the State. This means that for 30 years, one or more of the following applied to you: you were working and you were paying National Insurance.

How many years do you need to contribute to get a full State Pension?

You need at least ten years of contributions or credit to get a state pension, and 35 years to get the full amount on your record. In some cases, the amount you get may be higher.

How much pension do you get after 20 years?

The salary of retirees will be 2% of the number of years of service. If you retire from 20 years of service, you will receive 40% of your final salary. If you retire from 30 years of service, you will receive 60% of your final salary. You can get your full retirement when you are eligible or you can choose to get a temporary retirement benefit.

What is the average pension payout?

For those who retire with a pension plan, the annual pension benefit is $ 9,262 for a private pension, $ 22,172 for a federal government pension and $ 24,592 for a railroad pension.

Do you have to work 20 years to get a pension?

Half of the traditional plans managed by state governments require workers to work for at least 20 years before they can accumulate employer-funded pension benefits (Figure 2).

What jobs allow you to retire early?

Top 30 Jobs If You Want to Retire Early

- Insurance brokers, examiners and researchers.

- Secondary School Teachers. …

- Industrial Engineers. …

- Special Education Teachers. …

- Psychologists. …

- Insurance sales professions. …

- Teachers of Early Childhood Education and Early Childhood Education. …

- Mechanical engineers. …

Can I retire early from business? Companies can offer long-term retirement packages to long-term employees when they want to restructure their workforce. The package may include incentives such as health insurance and severance pay to encourage employees to accept the agreement.

Who is eligible for early retirement?

You are entitled to early retirement benefits calculated with the 25 and out formula: if you are under 55, at least 25 but 30 years of service. Do not qualify for Rule 80 (your age plus your years of service are 80 or more)

Can I take early retirement at 55?

So can you retire at age 55 and claim Social Security? The answer, unfortunately, is no. The youngest age to start receiving Social Security retirement benefits is 62 years old.

What are the qualifications for early retirement?

The common definition of early retirement is any age over the age of 65, then you are eligible for Medicare benefits. Currently, males retire at age 64, while females retire at age 62. Retirement before the usual 65 years can be exciting and can provide some insight.

Can you retire after 20 years of work?

Not only can you retire at age 50 with 20 years of service, but you can also retire at age 25 at any age. Unused sick leave cannot be used to be eligible for retirement for the duration of the service. It can only be added to the duration of your service when you have the right to retire.

How much retirement do you get after 20 years?

The salary of retirees will be 2% of the number of years of service. If you retire from 20 years of service, you will receive 40% of your final salary. If you retire from 30 years of service, you will receive 60% of your final salary. You can get your full retirement when you are eligible or you can choose to get a temporary retirement benefit.

Can I retire in 20 years?

The exact amount you can save in 15 or 20 years depends on several factors, but it is certainly possible to take a comfortable retirement. … Good health is also helpful, as it allows you to continue working hard enough to save money, and helps reduce health care costs in retirement.

What is the earliest you could retire?

It’s the first 62 years you can receive Social Security retirement benefits, but your checks will definitely be reduced by 25% and 30% compared to what you can get at full retirement age. Full retirement is now 66 years old, but is rising to 67 years for people born in 1960 and later.

What happens to my Social Security if I retire at 55?

The SSA does not permanently penalize retired workers. Once you reach retirement age you will receive all the benefits attached to the government. At that point, the SSA recalculates your benefit amount.

Can I retire at 55 and collect Social Security?

So can you retire at age 55 and claim Social Security? The answer, unfortunately, is no. The youngest age to start receiving Social Security retirement benefits is 62 years old. … When you turn 62, you can claim Social Security retirement benefits, but earnings from consulting work can affect the amount you receive.

When can you retire from the public service?

The first time a PSPP member can start a pension is 55 years old. Retirement before the ordinary retirement age means retirement before the age of 65 means that you will receive a reduced monthly pension if you do not have sufficient pension service to meet factor 85 (described below).

Can I retire at 55 and receive a pension? He is usually 65 years old, although many pension plans start receiving early retirement benefits before the age of 55. If you decide to start receiving benefits before you reach retirement age, the size of your monthly payment will be smaller than it would be. if you wait.

When can you retire from local government?

Your LGPS pension will be paid in full from your regular pension age, which is related to your State pension age (but at least 65 years old). However, you can choose to retire and take your pension from LGPS at any time between the ages of 55 and 75, provided you have completed a 2-year period of the scheme.

What happens to my local government pension if I leave?

If you leave work before retirement or leave the scheme and meet a 2-year term, you have two options: You can choose to keep the formed pension in the LGPS; your pension will be adjusted annually according to the cost of living. This is known as a deferred benefit.

How does local government retirement work?

These public pension plans typically provide pensions for members ’years of service and average salary for a specific year of work. … Many members also receive cost-of-living adjustments that help them maintain their purchasing power in retirement.

Can you retire after 20 years of service?

You have the right to retire at any age after completing a credible 20-year service. You can also receive a service retirement benefit at age 62, even if you don’t have a credible 20-year service.

How much pension do you get after 20 years?

You will receive 50% of your maximum 36-month average salary if you retire with 20 years of service or 100% if you retire after 40 years. These are usually the last three years of active service.

Can you retire from military after 20 years?

If you retire from 20 years of service, you will receive 40% of your final salary. If you retire from 30 years of service, you will receive 60% of your final salary. You can get your full retirement when you are eligible or you can choose to get a temporary retirement benefit.

What is the retirement age in the public service?

12. Compulsory retirement. (1) An official shall retire at the age of sixty years.

At what age do civil servants retire?

The retirement age for Central Government officials is 60, not 58 years. The retirement age for Central Government officials is 60 and not as mentioned.

What is retirement age in public service?

7 Rule 020810 of the second chapter of the Civil Service Rules (PSR) states that the compulsory retirement age for all levels of service shall be 60 years or 35 years in the service of a pensioner, whichever is earlier, and no civil servant shall be admitted. continue in service after reaching the age of 60 or 35 years of retirement …

How much does a GS 12 make in retirement?

How much does a GS-12 earn in retirement? GS-12, Step 10, the rest of the U.S. payroll, is $ 95,388 in 2018. Using that as a top 3, and with those under 30 and under 62, the pay is $ 28,616 (with a $ 25,754 survival benefit). . At age 62 or older, it would be $ 31,478 ($ 28,330).

How do I calculate my GS retirement pay? Overall, the benefit is calculated as 1 percent of the top 3 average salary, multiplied by the years of credible service. For those with at least 20 years of service who are at least 20 years of age or later retiring, a factor of 1.1 percent is used rather than 1 percent.

What is the retirement pay for a GS 13?

How much does a GS 13 earn in retirement? Payment for a GS-12, Step 10, for the rest of the U.S., is $ 95,388 in 2018. Using a maximum of 3, and with those under 30 and under 62, the income is $ 28,616 (with $ 25,754 survivor). benefit). At age 62 or older, it would be $ 31,478 ($ 28,330).

How long does it take to get from GS 13 to GS 14?

To be a GS-14 level job, you must have at least one year of GS-13 level experience. Depending on the position, candidates may substitute for education for any of the required experience.

Is GS 13 a good salary?

GS-13 is the most common grade in the General Schedule Payment System. The GS-13 is the highest grade of many federal government careers.

What is the average pension of a federal employee?

The average federal civilian employee who retired in 2016 was 61.5 years old and served 26.8 years in federal service. The average monthly salary payment for employees who retired under CSRS in 2018 was $ 4,973. Employees who retired from FERS received an average monthly income of $ 1,834.

How much is the average FERS retirement?

FERS-defined benefits are lower — averaging about $ 1,600 a month and a median of about $ 1,300 for $ 19,200 and $ 15,600 a year — because the program also includes Social Security as a core element.

Do federal employees have good retirement?

Contrary to the government’s well-known image as a lifelong employer, most people who join federal services do not have enough time to retire and earn an income. … A person who turns 25-30 years old could retire with his income and expect a good life.

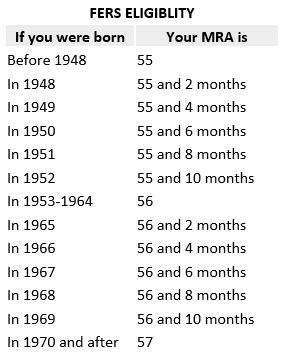

How long do you have to work as a GS to retire?

You must have worked with the Federal Government for at least 5 years before receiving a Federal FERS Pension, and for each year you work, you will be entitled to receive at least 1% of your High-3 Average Salary History.

Can I retire after 5 years of federal service?

| Adina | Years of service |

|---|---|

| 62 | 5 |

| MRA | 30 |

| MRA | 10 |

How long do you have to be in GS to retire?

To be eligible (if you leave federal service before retiring from the right to receive Basic Benefits plan retirement benefits), you must have at least 5 years of credible civil service.