At what age can you withdraw from TSP?

Basically, if you leave the service before the year you turn 55, then you have to wait until age 59 and ½ to avoid the 10% penalty (unless you qualify for another exception). Note: Your traditional TSP withdrawal will still be subject to taxes, even if you avoid the 10% penalty.

Can I withdraw my TSP at age 56? If you are 55 years of age or older when you leave the service, you can withdraw from your TSP without penalty.

What age can you take money out of TSP?

Age-based in-service withdrawals are withdrawals that you can make from your TSP account when you are 59½ or older.

Can you withdraw money from TSP before retirement?

If you are 591/2 or older, you can withdraw from your TSP account while you are still employed. This is called an “age-based retreat” or “591/2 retreat”. Patron Plan.

Can I withdraw from my TSP without penalty?

By not receiving any penalty for the forfeiture, it allows a person to keep all the money they withdraw, which does not happen under normal circumstances.â Even if the additional tax, or penalty, is waived, d ‘Income tax on the distributions still applies, depending on the type of account from which you deduct funds.

Can I withdraw from my TSP at age 55?

Do not worry, you can withdraw from the TSP knowing that this 10% penalty will be waived. Even if you cancel your pension until a later date because you are separated from the service in the year you have reached the age of 55, you can take part or all of the TSP without penalty.

Can I withdraw money from TSP before retirement?

If you are 591/2 or older, you can withdraw from your TSP account while you are still employed. This is called an “age-based retreat” or “591/2 retreat”. Patron Plan.

Can I withdraw from my TSP without penalty?

By not receiving any penalty for the forfeiture, it allows a person to keep all the money they withdraw, which does not happen under normal circumstances.â Even if the additional tax, or penalty, is waived, d ‘Income tax on the distributions still applies, depending on the type of account from which you deduct funds.

How early can you withdraw from TSP?

With the TSP, you are exempt from the early withdrawal penalty if you leave the Federal Service in the year in which you reach 55 years or later. For IRAs, the early withdrawal penalty applies to everything you take out until you reach the age of 59 ½.

When can I withdraw from my TSP without penalty?

Since the TSP is a retirement plan, there is no penalty for withdrawing your money during retirement. If you stop working for the federal government, you can start making pension reductions when you turn 55. If you continue to work for the federal government, you will have to wait until you are 59-1 / 2.

What is a good rate of return on TSP?

TSP returns for the last 12 months are excellent. A fund has risen more than 62%. The fund in second place returned 40.29%.

What is a good percentage for TSP? How much should you invest in a TSP account? We recommend investing 15% of your income to retire. If you contribute 15% consistently, you are set to have options when you retire.

What is a good tsp return?

Best TSP return year-to-date The S fund also comes out ahead of all other core TSP funds with a return of 12.34%. The C fund is second best with a return of 11.83%. The I Fund has returned 6.73% so far in 2021. All of these yields are high and certainly good news for any TSP investor.

How do you become a millionaire on TSP?

It’s an “elite club.” With over 75,000 members, the TSP millionaires gained their title by contributing 25-30 years to the TSP, investing at least moderately aggressively with their funds. New members are welcome, but when you get to the financial â € œtopâ €, you have to work just as hard to stay there.

What is the average rate of return for the TSP C fund?

The TSP C fund, which covers the S&P 500, has an average annual profit of 12.29 percent between 1988 and 2020; the TSP F-fund, a broad index representing the U.S. bond market, averaged 6.29 percent annually from 1988 to 2020; and the G-Fund, long-term US Treasury Notes, had an annual average of 4.70 …

What is the average TSP balance by age?

| Alter | Average contribution rate | Average equilibrium |

|---|---|---|

| 20-29 | 7% | $ 10,500 |

| 30-39 | 8% | $ 38,400 |

| 40-49 | 8% | $ 93,400 |

| 50-59 | 10% | $ 160,000 |

What is the average rate of return on TSP?

| TSP Investment Funds 8/31/1990 – 11/19/2021 | TSP G Fund | TSP F Fund |

|---|---|---|

| 5-year return | 1.98% | 3.69% |

| 10-year return | 1.94% | 3.22% |

| Annual return since 8/31/1990 | 4.3% | 5.9% |

| Annualized standard deviation [2] | 0.3% | 3.8% |

What is the average annual return for TSP?

The TSP C fund, which covers the S&P 500, has an average annual profit of 12.29 percent between 1988 and 2020; the TSP F-fund, a broad index representing the U.S. bond market, averaged 6.29 percent annually from 1988 to 2020; and the G-Fund, long-term US Treasury Notes, had an annual average of 4.70 …

Which TSP fund is the most aggressive?

The C, S, and I funds are the more aggressive of the funds in the TSP. The reason why they are called “aggressive” is because they have a much higher chance of sustaining the large growth over time. But for that they can also be much more volatile than the G and F funds.

What happens if you go over your TSP limit?

If a payroll bureau submits a contribution that exceeds the elective allowance limit, the TSP will reject the entire contribution and all associated matching contributions, and will send a report to the payroll office that will allow the additional contributions for the year.

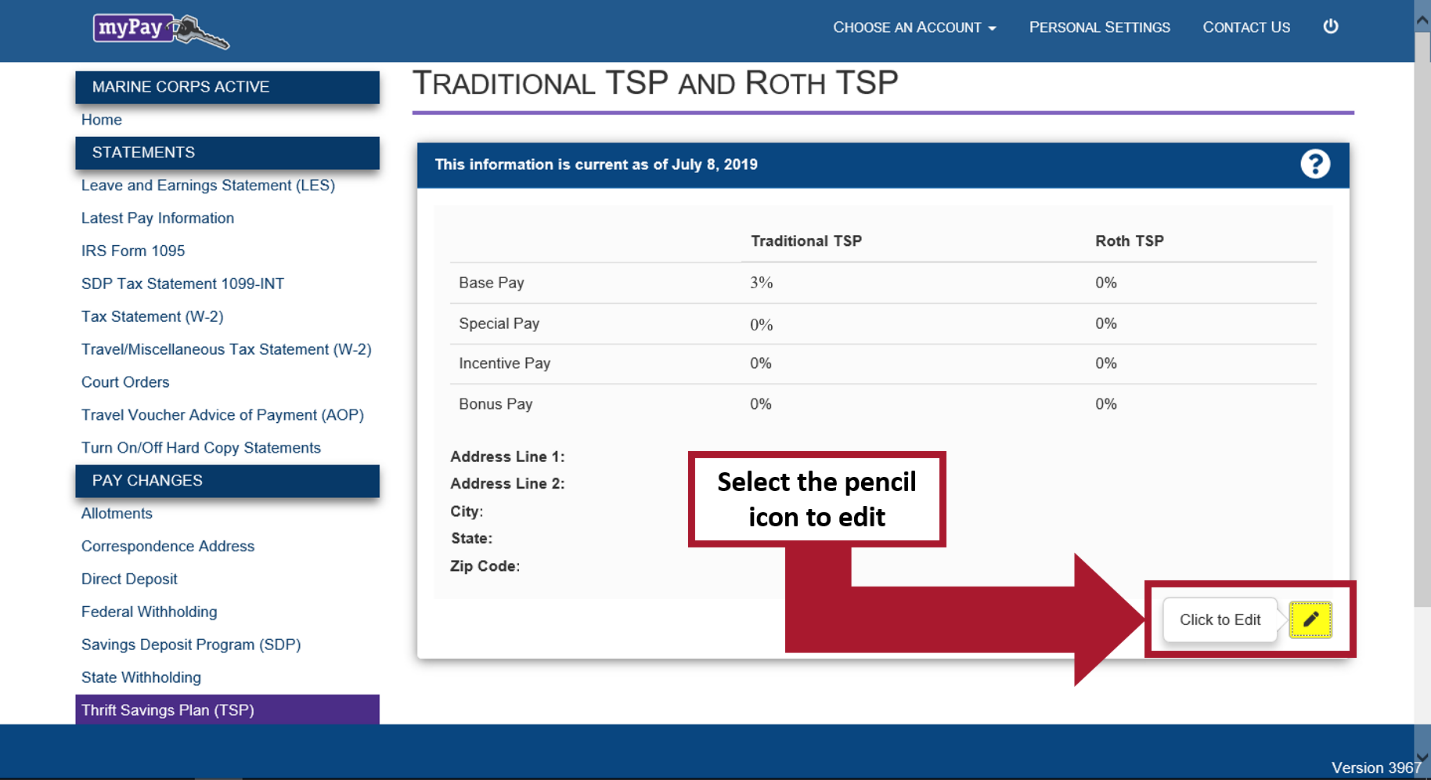

Can you maximize TSP? The maximum TSP contribution for 2021 is $ 19,500. If you want to set up your direct deposit to reach the maximum TSP contribution each year, you should set an elective delay of $ 750 per payment period. Note that if you are over 50, you are allowed to make “catch up” contributions.

How do I max out my TSP 2021?

The maximum amount you can contribute to a TSP account for this year is $ 19,500. If you are 50 or older, your plan may allow you to contribute an additional $ 6,500 as a catch-up contribution, bringing your total 2021 TSP contribution to $ 26,000. (These amounts are the same as the limits in 2020.)

Can I contribute 100% to TSP?

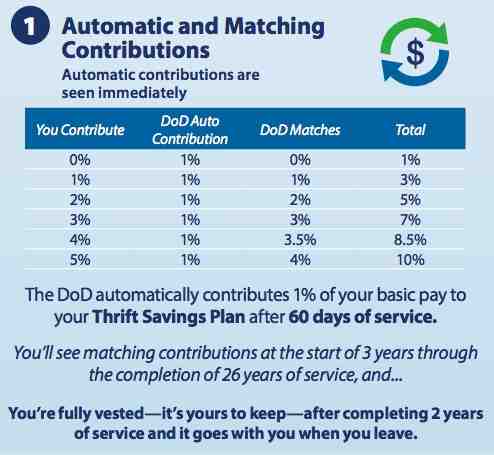

You can contribute from 1 to 100 percent of any incentive pay, special pay or bonus pay (even if you do not currently receive it) – as long as you have chosen to contribute from your base pay.

What is the pay period to max out TSP 2021?

If you are not old enough to make appropriate contributions, you can still contribute $ 19,500 to the TSP in 2021. You do this by contributing $ 750 per pay period. This will maximize you in the pay period 26, marking the government match in every single pay period.

How do I max out my TSP?

This applies to traditional and Roth TSP accounts (which share the same limit, so you can not contribute $ 20,500 for each). This includes your base salary, special salary and bonus. To maximize your TSP, you need to contribute $ 1,625 per month of your paychecks.

How does TSP spillover work?

This spillover method streamlines the catch-up contribution process for those 50 or older while eliminating the requirement to make an affirmative opinion poll every year. For those younger than 50: System changes are planned to be implemented in the 4th quarter of 2021.

What happens if you go over TSP limit?

If you reach the annual maximum too quickly, you may lose some agency / service matching contributions because you only receive agency / service matching contributions on the first 5% of your base salary that you contribute each pay period.

Is TSP catch-up worth it?

Making regular contributions can help you strengthen your pension funds as much – or more. … At an 8% annual return, you’d be looking at about $ 30,000 extra for retirement. (Additionally, a $ 1,000 contribution to a traditional IRA can reduce your income tax bill by $ 1,000 for that year.)

What is the TSP spillover method?

The spillover method streamlines the catch-up contribution process for eligible service members who are 50 years of age or older, eliminating the requirement for participants to make an affirmative opinion poll each year.

How much money does the average 70 year old have in savings?

How much does the average 70-year-old have? According to Federal Reserve data, the average amount of retirement savings for 65- to 74-year-olds is just north of $ 426,000. Even if it is an interesting date point, your specific retirement savings may be different from another.

How much is the average 70 year old worth? The latest report released in September 2020 (with data collected in 2019) shows that the median US household net worth is $ 121,700 – but it is more than double that for people aged 65 to 74 years. for Americans in their late 60s and early 70s is $ 266,400.

How much does the average senior have in savings?

| Median Retirement Account Balance by Age | |

|---|---|

| Age group | 401 (k) / IRA balance |

| 45-54 | $ 90,000 |

| 55-64 | $ 120,000 |

How much savings does the average 60 year old have?

Have you saved enough? How much does the average 60-year-old have to save for retirement? According to Federal Reserve data, for 55- to 64-year-olds, that number is little more than $ 408,000.

How much does the average 65 year old have in retirement savings?

According to Federal Reserve data, the average amount of retirement savings for 65- to 74-year-olds is just north of $ 426,000. Even if it is an interesting date point, your specific retirement savings may be different from another.

How much money do you need to retire comfortably at age 70?

A rule of thumb is that you need 70% of your pre-retirement annual salary to live comfortably.

How much money you need to retire at every age and live comfortably?

Most experts say that your retirement income should be about 80% of your last annual income before retirement. 1 That is, if you earn $ 100,000 a year in retirement, you need at least $ 80,000 a year to live a comfortable lifestyle after you leave the workforce.

How much does the average 75 year old have in retirement savings?

Both generations are well behind baby boomers (ages 57 to 75), who have an average of $ 102,400 in personal savings and $ 138,900 in their retirement accounts.

How much should a 70 year old have for retirement?

By age 70, you should have at least 20X your annual expenses and savings or as reflected in your overall net worth. The higher your spending coverage ratio around 70, the better. In other words, if you spend $ 75,000 a year, you should have about $ 1,500,000 in savings or net worth to live a comfortable retirement.