Should I put more than 5% in TSP?

Contents

Employees must invest at least 5% in the TSP; that is the percentage required to obtain the maximum available matching funds. Beyond that, Employees need to balance long-term investment needs with other needs.

Is maxing out TSP a good idea? The Thrift Savings Plan (TSP) is a great tool for federal employees to save for retirement. Savings, and even the maximum of your TSP contributions are usually considered a good thing. Read also : How much money do I need in my TSP to retire?. Yes, maximizing your TSP can be very beneficial, but it may not be the best thing for your financial future.

Should I contribute more than 5% to TSP?

That’s why it’s important to invest at least enough to get the game going. This may interest you : Does TSP offer Roth IRA?. Most TSP participants are on it: About 80% of those who contribute to a TSP account are earning at least 5% of their pay to get the full item.

Should I increase my TSP contribution?

Increase your contributions each year Most people do not start contributing the maximum on their first day at work, so it is important to increase your contributions as soon as you start doing more. Each time you receive COLA or an increase in pace you should consider increasing your TSP contributions.

What is a good percentage to contribute to TSP?

How Much Should You Invest in a TSP Account? We recommend investing 15% of your retirement income. When you contribute 15% consistently, set yourself up for options when you retire.

How much of my base pay should I put in TSP?

If you are a participant in the Mixed Withdrawal System (BRS) and want to maximize your item, your total base pay percentage must be a minimum of 5%. It doesn’t matter how much you contribute to either the Traditional TSP or the Roth TSP as long as your total Base Pay percentage is at least 5%. This may interest you : How do you become a millionaire on TSP?.

How much should I contribute to TSP per pay period?

To receive the maximum Agency or Service Matching Contributions, you must contribute 5% of your basic salary for each payment period.

What percentage of pay should go to TSP?

How Much Should You Invest in a TSP Account? We recommend investing 15% of your retirement income. When you contribute 15% consistently, set yourself up for options when you retire.

Should I increase my TSP contribution?

Increase your contributions each year Most people do not start contributing the maximum on their first day at work, so it is important to increase your contributions as soon as you start doing more. Each time you receive COLA or an increase in pace you should consider increasing your TSP contributions.

Should I increase my TSP?

You may want to change your Savings Plan (TSP) contributions, especially if you are in the Mixed Retirement System (BRS) and you are not yet contributing at least 5% of your Salary. Your basics to your TSP. A contribution of 5% or more of your Basic Wage maximizes the matching government contribution for BRS participants.

What is a good percentage for TSP?

How Much Should You Invest in a TSP Account? We recommend investing 15% of your retirement income. When you contribute 15% consistently, set yourself up for options when you retire.

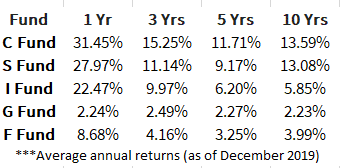

Should I move TSP money to G fund?

Fund G is often considered the “safest” TSP Fund as it never goes down. It also doesn’t rise much when the stock market is booming as it has been for the last few years. But, for now, when market yields are negative, Fund G is alone on the list with a positive return.

What is the return rate of the TSP G fund?

What fund should my TSP be in?

How much should I contribute to my TSP? A common suggestion for how much to save for retirement is at least 15% of your income. Others believe that the minimum should be to maximize your employer’s contribution; in the case of TSP funds, this will be 5% of your income.

Is the TSP C fund a good investment?

Fund C can be useful in a portfolio that also contains stock funds that follow other indices such as Fund S and Fund I. By investing in all segments of the stock market (as opposed to just one). , reduce your exposure to market risk. Fund C can also be useful in a bond portfolio.

What TSP funds does Dave Ramsey recommend?

Dave Ramsey is very popular with both Roth IRAs and Roth TSPs. That’s why, most of the time, Dave Ramsey tells people to only use TSP Roth instead of traditional TSP.

Does TSP G fund keep up with inflation?

While the G Fund does not guarantee inflation protection, it is very likely to provide it, and then some. TIPS guarantee your capital against inflation and pay a fixed interest rate on that principal every six months until maturity.

What happens to the G fund when interest rates rise?

In addition, when interest rates rise, the G Fund rate will rise sharply with them – again, without the capital loss experienced in Fund F under the same circumstances. From this perspective, as far as bond funds go, the G Fund is still a better deal than anything else out there.

How is the G fund in TSP doing?

The G Fund has achieved a compound annual return of 4.3% since August 1990. The year-to-date return is 0.90%, and its annual return is 1.75%.

Should I contribute to Roth or traditional TSP?

For many, the Roth TSP is the best choice because right now, you’re at a lower tax level than you are in the future. With Roth, your earnings and withdrawals are tax-free because you contribute cash after tax, i.e. you pay taxes in advance.

Should I contribute more Roth or traditional? Saving the maximum amount ultimately results in more after-tax retirement assets for the Roth account balance than a traditional pre-tax contribution.

What’s better Roth or traditional TSP?

With Roth TSP, your contributions go into TSP after withholding tax. This means that you pay taxes on your contributions at your current income tax rate. The advantage of Roth TSP is that you will not pay taxes later when you withdraw your contributions and any qualified earnings.

Should I change my TSP to Roth?

For those who already contribute a maximum of $ 17,000 a year to TSP, the switch to TSP Roth actually puts more money into TSP. You have to switch to TSP Roth unless: You will not work hard enough to qualify for a pension; or.

Is TSP better than Roth IRA?

Beyond that, TSP is better if your taxes are high today and you expect them to be much lower in retirement. It is best to use your deduction against the higher tax rate. The Roth IRA is better the farther you are from retirement.

Should I convert TSP to Roth?

Is TSP better than Roth IRA?

Beyond that, TSP is better if your taxes are high today and you expect them to be much lower in retirement. It is best to use your deduction against the higher tax rate. The Roth IRA is better the farther you are from retirement.

Why should I not do a Roth conversion?

If you are approaching retirement or need your IRA money to survive, it is unwise to convert to Roth. Because you’re paying taxes on your funds, converting to Roth costs money. It takes a number of years before the money you pay in advance is justified by the tax savings.

Can you contribute to both traditional and Roth TSP?

An employee can contribute to both the traditional TSP and the Roth TSP during 2021. Total contributions may not exceed $ 19,500 for employees under 50 during 2019 and $ 26,000 for employees over 49 during 2021.

Can you have both traditional and Roth TSP?

Can I contribute to Roth TSP and traditional TSP at the same time? Yes, you can use both in any combination as long as you do not contribute more than the annual limit between the two accounts. For 2021, the annual limit is $ 19,500 or $ 26,000 if you are 50 or older.

Can you contribute 19500 to both Roth and traditional?

Yes. You can contribute to both plans in the same year to the extent permissible. However, you can’t beat both your Roth accounts and traditional individual retirement accounts (IRAs) in the same year.

How much money do you need to retire with $100000 a year income?

How much money do you need for $ 100k a year? To create a $ 100,000 retirement income, you may need $ 1.9 million in savings.

How much money do you need to retire at $ 120,000 a year? Let’s say you consider yourself the typical retiree. Between you and your spouse, you currently have an annual income of $ 120,000. Based on the 80% principle, you can expect to need about $ 96,000 in annual income after retirement, which is $ 8,000 a month.

What is a good monthly retirement income?

According to AARP, a good retirement income is about 80 percent of your pre-tax income before you leave the workforce. This is because when you stop working, you will not be paying income tax or other work-related expenses.

What is the average monthly retirement income?

According to the Social Security Administration, the maximum Social Security benefit you can receive each month in 2021 is $ 3,148 for those of full retirement age. The average monthly Social Security income in 2021 is $ 1,543 after being adjusted to a 1.3 percent cost-of-living.

What is a good average retirement income?

Average Household Retirement Income 2022: Median Income – $ 46,360 (down from $ 56,632 in 2019) Average Income – $ 71,446 (down from $ 84,153 in 2019)

Can a couple retire on 100k per year?

Yes, you can retire at $ 100,000 a year. Therefore, living at $ 100,000 a year in retirement is possible if you build a realistic plan and are willing to work hard.

How much do I need to make to retire 100k a year?

Our data calculated that $ 1,739,130 would immediately generate $ 100,000 per year for life beginning at age 65. Our data estimates that $ 1,600,000 immediately generates $ 100,000 a year for life beginning at age 70.

Can a retired couple live on 100000 a year?

Income Based One of these rules suggests that you need to save enough money to live on 75% to 85% of your income before retirement. 1 If you and your spouse earn $ 100,000 together, for example, you should both plan to save enough money to have between $ 75,000 and $ 85,000 a year in retirement.

What is a good average retirement income?

Average Household Retirement Income 2022: Median Income – $ 46,360 (down from $ 56,632 in 2019) Average Income – $ 71,446 (down from $ 84,153 in 2019)

How much does the average person retire with?

The survey, in general, found that Americans increased their personal savings by 10% from $ 65,900 in 2020 to $ 73,100 in 2021. In addition, average retirement savings increased by a reasonable 13%, from $ 87,500 to $ 98,800.

What is a good retirement income per month?

Based on the 80% principle, you can expect to need about $ 96,000 in annual income after retirement, which is $ 8,000 a month.

How many TSP is a millionaire?

In the last quarter of 2021, the number of millionaires who invested in the Thrift Savings Plan (TSP) increased significantly by almost 50%. As of Dec. 31, there have been 112,880 millionaire TSPs, up from 75,420 years ago, according to the Federal Investment Board for Thrift Retirement.

Sources :