Is 60000 a year enough to retire on?

Contents

Suppose you spend $ 60,000 a year. Depending on the strategy, in retirement, you need about $ 48,000 per year to live. Now take this number and multiply it by 20 and 25 to find out how much you need in savings, all said. The answer you get is $ 960,000 to $ 1.2 million.

How many ordinary people retire with it? A federal study found that the average retirement savings ratio in the United States ” just looking at those with retirement accounts ” is only $ 65,000 in 2019 (the survey is conducted every three years). The average balance is $ 255,200. This may interest you : How do I avoid paying taxes on my TSP withdrawal?.

Can a couple live comfortably in $60 000 a year?

Earning $ 60k a year is good for couples, especially considering that the average domestic income in the United States in 2018 is $ 63,179. This may interest you : Do I report TSP on taxes?. As you will be less than that amount, your income is on track with most of what people are earning.

How much should a couple make a year to live comfortably?

The capital of California is northeast of San Francisco, Oakland and the rest of the expensive Bay Area. However, it seems that some prices have moved up there, because you need to earn over $ 90,000 a year to live in peace.

What is a good combined salary for a couple?

While ZipRecruiter sees annual earnings as low as $ 186,500 and less than $ 115,000, the average domestic couple currently earns between $ 125,500 (25th percent) and $ 156,000 (75 percent) with major owners earnings (90th percent) make $ 175 per year. .

How comfortable can you live on 60k a year?

$ 60,000 per year is a really good salary to live in peace. However, personal and financial circumstances are different.

What is the average income for a retired couple?

It means that high-income couples will earn an annual income from SSA of $ 33,036 in 2022. On the same subject : TSP vs 401K. The fact that this amount is so low for couples can be surprising, especially since the average The benefit for all retirees is $ 1,657 next year. .

What is a good retirement income?

With this in mind, you should expect to need about 80% of your income before retirement to pay for living expenses in retirement. That is, if you earn $ 100,000 now, you need about $ 80,000 per year (in dollars today) after you retire, according to this principle.

What is the median income of retired couples?

According to the US Census, the average income for a home for a couple who are 65 years of age or older is about $ 105,000 in 2019. The average income for these homes is about $ 75,000.

How much should a couple retire comfortably?

Most experts say the retirement income should be about 80 percent of your annual income before your final retirement. 1 This means that if you make $ 100,000 a year while retiring, you need at least $ 80,000 per year to have a comfortable lifestyle after leaving work.

How can I maximize my TSP?

Increase your contribution each year Whenever you receive a COLA or upgrade level you should consider upgrading your TSP contribution. A good goal is to increase your contribution by 1% per year until you increase it.

How can I make the most money in my TSP?

How do you become a millionaire on TSP?

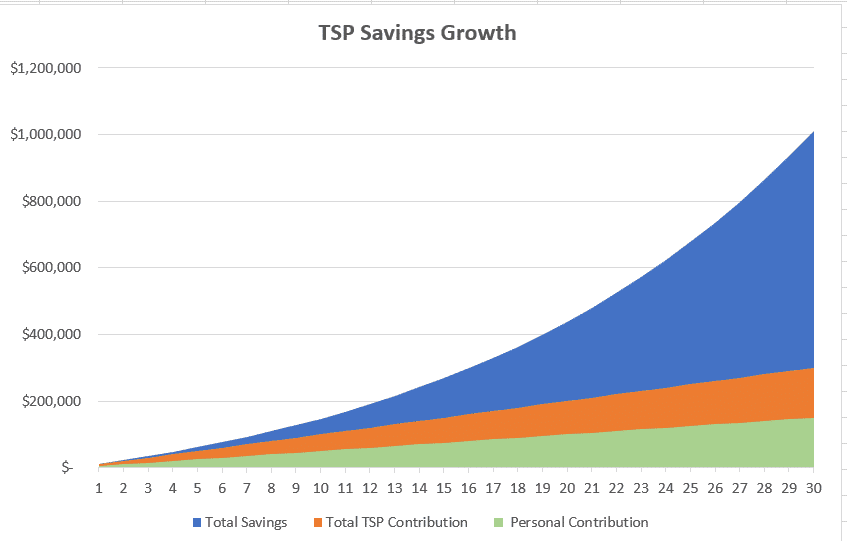

The liteElite Clubâ € has more than 75,000 members, TSP billionaires have won their championship by contributing to TSP for over 25-30 years, being at least a very strong investor. New members are welcome, but once you reach the â œ œ top â kudi kudi venue, you need to work hard to stay there.

What is the average TSP balance at retirement?

| Age | Average Contribution Value | Average Measurement |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| Every Age | 9% | $ 95,600 |

How many TSP is a millionaire?

The good news: There are 98,879 federal TSP members! Bad news: Many people know it! The number of federal employees / postal workers who have become major financiers of the Strategic Plan has increased in recent years.

How long does it take to be a TSP Millionaire?

An article by Lyn Alden in FEDweek notes that the average age of contributions to the TSP million is over 29. Your investment will grow, but it will take time before your investment reaches $ 1 million. Second, do not be upset when the market she did not do what you think she should do.

How do I maximize my TSP contributions in 2020?

If you would like to increase your contribution by 2020, enter your MyPay subscription between December 8 â € “December 14, 2019, and your submission should take effect on December 22, the first payment period of 2020. Be sure to enter the amount the money you want. want to prevent you from paying your bill every time you pay.

What is a good percentage to contribute to TSP?

How Much Should You Invest in a TSP Account? We recommend depositing 15% of your income for retirement. When you contribute 15% on a regular basis, you set yourself up to have options when you retire.

Should I maximize my TSP?

Savings Thrift (TSP) plans are a great tool for federal employees to save for retirement. Save, and even increase your contribution to TSP is considered a positive thing. Yes, deploying your TSP can be very rewarding, but it may not be the best solution for your financial future.

How do I increase my civilian TSP contribution?

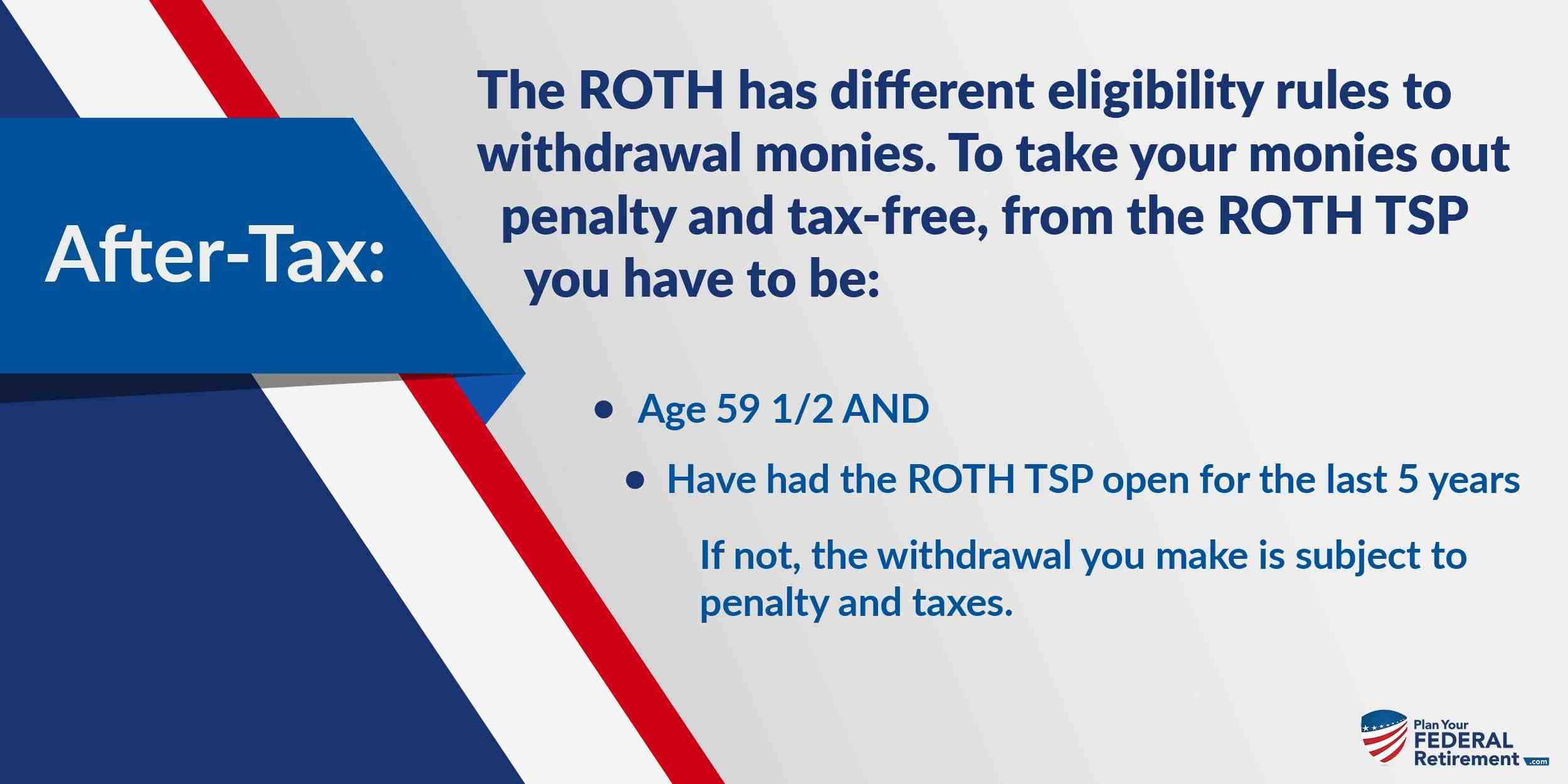

To change the employee contribution amount, use the agency’s electronic system or submit Form TSP-1, Select Form. you pull them out. in the Roth5 balance of your TSP account and are taxed when you contribute. You do not pay federal income tax on these contributions when you withdraw them.

Can TSP make you a millionaire?

“The club is outstanding.” With over 75,000 members, TSP billionaires have gained their legitimacy by contributing to TSP for over 25-30 years, being at least the highest grossing investment. New members are welcome, but once you get to the “top” of money, you need to work hard to stay there.

How much is TSP million? The good news: There are 98,879 federal TSP members! Bad news: Many people know it! The number of federal employees / postal workers who have become major financiers of the Strategic Plan has increased in recent years.

How do I become a millionaire with TSP?

What is the average amount in TSP balance at retirement?

| Age | Average Contribution Value | Average Measurement |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| Every Age | 9% | $ 95,600 |

How long does it take to be a TSP Millionaire?

An article by Lyn Alden in FEDweek notes that the average age of contributions to the TSP million is over 29. Your investment will grow, but it will take time before your investment reaches $ 1 million. Second, do not be upset when the market she did not do what you think she should do.

Can you get rich from TSP?

As most federal / postal workers and retirees know, the Thrift Support System is excellent. About 2% of the 75,000 people became TSP millioners during their federal service. They do not have a high salary, but they do have time and patience. And it worked.

How long does it take to be a TSP Millionaire?

An article by Lyn Alden in FEDweek notes that the average age of contributions to the TSP million is over 29. Your investment will grow, but it will take time before your investment reaches $ 1 million. Second, do not be upset when the market she did not do what you think she should do.

Can you become a millionaire from TSP?

Of course, most TSP investors are not millions but, with cash, Social Security, and TSP, a retired federal employee can live very well with less than $ 1 million in retirement accounts.

What is the TSP limit for 2021?

The average contribution to the Savings Savings System (TSP) in 2021 does not change! The Internal Revenue Service 2021 (IRS) annual tax rate, which covers the total contribution of traditional and Roth contributions, is $ 19,500.

What is the limit of Roth TSP for 2021? Summary of Roth TSP Rules and Traditional TSP Rules For the 2021 tax year, the average is $ 19,500, and $ 6,500 if you are 50 years of age or older. In 2022, it will increase by $ 1,000 to $ 20,500. This is for Roth TSP or traditional TSP, or even account integration if you have more than one.

What’s the max percentage for TSP?

The Match Workers’ Union is making a significant contribution to the TSP account which can reach an average of 5 percent of the employee’s salary. Your worker equals your dollar contribution over the first 3 percent and 50 cents per dollar for the next 2 percent.

What is the max TSP contribution for 2020?

The annual IRS annual limit for regular TSP contributions will increase to $ 19,500. If you are covered by the Federal Employees Retirement System (FERS, FERS-RAE, or FERS-FRAE), you may lose the appropriate TSP contribution by reaching the limit before the end of the calendar year.

Can I contribute 100% of my salary to TSP?

Optional rates for SIMPLE plans are 100% off or $ 13,500 in 2020, 2021 and 2022, $ 13,000 in 2019 and $ 12,500 in 2018. Catch contributions can be made if the employee reaches 50 years or more.

Is there a max contribution to TSP?

The IRC § 402 (g) maximum delay for the 2021 elections is $ 19,500. This limit applies to the traditional (tax-deductible) contributions made by Roth during the calendar year. … TSP is not allowed to accept staff contributions that exceed the annual election limit.

Can I max out my TSP and 401k?

The maximum contribution contribution for 2022 for TSP and 401k plans is $ 20,500 ($ 6,500 contribution contribution). You can donate up to $ 6,000 to Traditional and Roth IRAs ($ 1,000 donation to capture).

What happens when you max out TSP?

If the payroll office makes a contribution that exceeds the voting limit, TSP will reject all contributions and all relevant contributions, and will send a report to the payroll office indicating the additional contribution authorized for the year.

Does TSP count 401k?

The savings plan is similar to the 401 (k) plan but is only open to federal and service employees. Participants in TSP can get an immediate tax break for their savings or invest in Roth for tax exemption after retirement.

Does TSP count towards limit?

Alternatively, your contribution will automatically count towards the IRS capture limit if you fill out the delay or extension year and continue saving. If you qualify for an official game or service, the contribution that flows to the catch limit will qualify for the game at 5% of your salary.