What do I do with my TSP when I retire?

Many people in retirement choose to withdraw the entire amount and transfer the TSP to an IRA …. Basically, when you retire you have 4 options for your TSP:

- Start regular (likely monthly) installment payments. …

- Buy an annuity. …

- Leave it in the TSP and let it grow. …

- Make one withdraw / transfer the TSP to an IRA.

How does TSP work when you retire? You can get a fixed dollar amount from your TSP each month after retirement. The money is deducted from your TSP retirement account, and the withdrawal will continue for as long as your money lasts. … Advantages – You get a predictable monthly income for as long as your money lasts.

How do I avoid paying taxes on my TSP withdrawal?

If you want to avoid paying taxes on the money in your TSP account for as long as possible, don’t take any withdrawals until you are asked to do so by the IRS. You are required by law to take the required distributions (RMDs) that start the year you turn 72.

Are TSP withdrawals considered income?

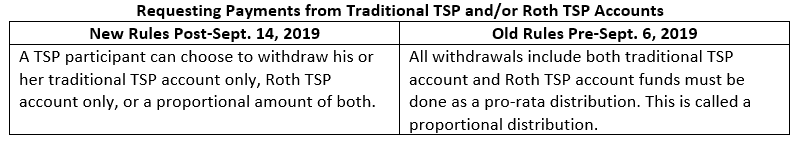

The general rules about federal income tax deduction from the Cushion Savings scheme are: A) All withdrawals from your traditional TSP balance are fully taxable as ordinary income; B) All qualifying deductions from your Roth TSP balance are exempt from federal income tax; and C) In any qualifications …

What is the best way to withdraw money from TSP?

Full withdrawal is the best way to use the funds you have worked so hard to build up.

How much tax do you pay on a TSP withdrawal?

The TSP is required to withhold 20% of your payment for federal income taxes. This means that in order to transfer your entire payment, you must use other funds to make up the 20% withheld. If you do not roll over the entire amount of your payment, the non-transferrable portion will be taxed.

How do I get my TSP money after retirement?

To request a withdrawal, log in to My Account and click on the ‘Withdrawal and Changes to Installment Payments’ link on the menu. From there, you will have access to an online tool to begin your withdrawal.

Can you withdraw your TSP when you leave the service?

Yes, you can leave your entire account balance in the TSP when you leave federal service if the balance is $ 200 or more. You can still enjoy tax deferred earnings and low administrative expenses.

How long does it take to get TSP money after retirement?

Generally, it takes between 7 and 10 business days to process your application once you have completed and submitted it properly. We pay back money every business day. You can check My Account at tsp.gov or call the ThriftLine to find out the status of your withdrawal request, including whether the payment has been made.

How do I withdraw my TSP after retirement?

Transferring or rolling your withdrawal The tax rules on transfer and transfer can be complicated. You should consult a tax adviser to make sure you understand the tax consequences of such a transaction.

How much should I have in my TSP at 40?

Retirement Saving Goals If you earn $ 50,000 by age 30, you should have $ 50,000 banked for retirement. By age 40, you should have three times your annual salary.

How much should I get in my TSP at 45? By age 45, experts recommend that if you plan to retire at age 67 and maintain a similar lifestyle, you have the equivalent of four times your annual salary at the bank, according to a recent report by financial services firm Fidelity.

What is the average TSP balance by age?

| Age | Average Contribution Rate | Average Balance |

|---|---|---|

| 20-29 | 7% | $ 10,500 |

| 30-39 | 8% | $ 38,400 |

| 40-49 | 8% | $ 93,400 |

| 50-59 | 10% | $ 160,000 |

How many TSP is a millionaire?

Good news: There are 98,879 federal TSP millionaires! Bad news: Too many people know it! The number of federal / postal workers who have become millionaires on the Fair Cushion Savings Scheme has skyrocketed in recent years.

How much should I have in my TSP at 60?

By age 60: Save eight times your annual salary. By age 67: Save 10 times your annual salary.

How much should I have in my TSP at 50?

At 30, you should save half your annual salary. By 40, you should have twice your salary, and by 50, you should aim for around four times your salary in retirement savings.

How much should a 40 year old have in savings?

By age 40: Save three times your annual salary. If you earn $ 50,000, you should plan to save $ 150,000 for a retirement of 40.

How much should a 25 year old have in his savings?

By age 25, you should have saved around 0.5X of your annual expenses. The more the better. That is, if you spend $ 50,000 a year, you should have around $ 25,000 in savings. 25 is an age where you should have landed a job in an industry you like.

How much does the average American have in savings 2021?

Overall, the survey found that average Americans’ personal savings have grown 10% year-on-year, from $ 65,900 in 2020 to $ 73,100 in 2021. Retirement savings have jumped 13% from $ 87,500 to $ 98,800.

What is a good savings amount by age?

By age 30: the equivalent of your annual salary saved; if you earn $ 55,000 a year, by your 30th birthday you should have $ 55,000 saved. By age 40: three times your income. By age 50: six times your income. By age 60: eight times your income.

How do I avoid paying taxes on my TSP withdrawal?

If you want to avoid paying taxes on the money in your TSP account for as long as possible, don’t take any withdrawals until you are asked to do so by the IRS. You are required by law to take the required distributions (RMDs) that start the year you turn 72.

Is TSP withdrawal considered income? The general rules about federal income tax deduction from the Cushion Savings scheme are: A) All withdrawals from your traditional TSP balance are fully taxable as ordinary income; B) All qualifying deductions from your Roth TSP balance are exempt from federal income tax; and C) In any qualifications …

What is the best way to withdraw money from TSP?

Full withdrawal is the best way to use the funds you have worked so hard to build up.

Is it bad to withdraw from TSP?

As the TSP is a retirement plan, there is no penalty for withdrawing your money during retirement. If you stop working for the federal government, you can start withdrawing money when you turn 55. … You will still have income tax on your withdrawal entire retirement.

How much will I lose if I withdraw my TSP?

The early withdrawal penalty is a 10% penalty. In addition to any taxes you owe on your withdrawal, you will owe an additional 10%. The ability to avoid the early withdrawal penalty if you separate in the year you turn 50 or 55 applies only if you leave your money in the TSP – transfers are subject to the penalty.

Do I have to report TSP withdrawal on taxes?

â € œDistribution, â € œ payment, â € and withdrawal all mean the same thing: money you receive from your TSP account. … You do not pay income tax on the portion of your money deducted from your Roth contributions.

Do I have to claim TSP on my taxes?

No, you should not include your separate TSP contributions on your tax return. … At the end of the year, when you receive your W-2 return showing your earnings, you will notice that your wages are subject to federal income tax (box 1) lower because of your contributions TSP scheme (box 12).

Do you pay federal taxes on TSP withdrawal?

The TSP is required to withhold 20% of your payment for federal income taxes. This means that in order to transfer your entire payment, you must use other funds to make up the 20% withheld. If you do not roll over the entire amount of your payment, the non-transferrable portion will be taxed.

Is withdrawal from TSP taxable?

Money held in the traditional balance of your TSP account is fully taxable as ordinary income when it is withdrawn. … There is a big difference, though, in how much is withheld from your TSP payments for federal income tax. The amount of taxes withheld on TSP withdrawal varies depending on how you withdraw the money.

Do I have to report TSP withdrawal on taxes? â € œDistribution, â € œ payment, â € and withdrawal all mean the same thing: money you receive from your TSP account. … You do not pay income tax on the portion of your money deducted from your Roth contributions.

How much will I be taxed if I withdraw my TSP?

We will withhold 10% on the taxable part of your federal income tax withdrawal. You have the option of increasing or removing this suspension. The taxable portion of your withdrawal is subject to federal income tax at your normal rate.

Can I withdraw money from my TSP without penalty?

With the TSP, you are exempt from the early withdrawal penalty if you separate from federal service in the year you reach age 55 or later. For IRAs, the early withdrawal penalty will apply to anything you take until you reach the age of 59 ½.

How much tax do you pay on a TSP withdrawal?

The TSP is required to withhold 20% of your payment for federal income taxes. This means that in order to transfer your entire payment, you must use other funds to make up the 20% withheld. If you do not roll over the entire amount of your payment, the non-transferrable portion will be taxed.

Can I withdraw money from my TSP without penalty?

With the TSP, you are exempt from the early withdrawal penalty if you separate from federal service in the year you reach age 55 or later. For IRAs, the early withdrawal penalty will apply to anything you take until you reach the age of 59 ½.

When can you withdraw money from TSP without penalty?

As the TSP is a retirement plan, there is no penalty for withdrawing your money during retirement. If you stop working for the federal government, you can start drawing retirement when you turn 55. If you continue to work for the federal government, you need to wait until you turn 59-1 / 2.

What happens if I withdraw from my TSP?

The taxable portion of your withdrawal is subject to federal income tax at your normal rate. You may also have to pay state income tax. An IRS 10% withdrawal penalty may apply if you are under 59 ½.

What is the best way to withdraw money from TSP?

Full withdrawal is the best way to use the funds you have worked so hard to build up.