Why is TSP the best?

Contents

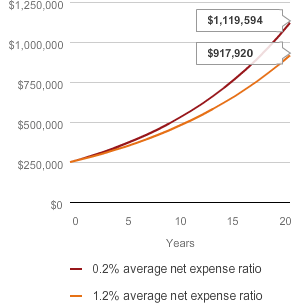

Taxes are delayed and affordable. Like IRAs, federal income tax on income in your TSP is delayed until they are deducted. Read also : Should I move my TSP to an IRA?. In addition, TSP costs are relatively low compared to programs offered to civilian employees and other mutual funds within or outside IRAs. All of this means that your extra money goes to work for you.

Is TSP better than Iran? TSP is better if your taxes are higher today and you expect them to be higher in retirement. It would be better to use your deduction on higher tax rates. A Roth IRA is best if you are retired.

Is TSP the best investment?

TSP is considered one of the best, most managed and lowest cost in the business. This may interest you : What happens to my TSP if I quit?. But many people believe that it is not flexible and does not offer as many investment options as most outside plans.

What is the average TSP balance at retirement?

| Age | Average Contribution Value | Average Measurement |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| Every Age | 9% | $ 95,600 |

Is the TSP a good investment?

According to the proposed contribution plan, TSP is the largest in the world, with assets of over $ 558 billion. 89% of participants are satisfied or satisfied with the Economic Plan.

Is TSP better than 401k?

In general, the Generational Plan compares favorably to 401 (k) plans, and if you work for the federal government and can participate, it may be logical to do so. It serves as a strong partner for FERS pension, and the combination of TSP and FERS could provide a solid foundation for retirement.

Is TSP better than a 401k?

In general, the Generational Plan compares favorably to 401 (k) plans, and if you work for the federal government and can participate, it may be logical to do so. It serves as a strong partner for FERS pension, and the combination of TSP and FERS could provide a solid foundation for retirement.

Is TSP a good retirement plan? This may interest you : Do I report TSP on taxes?.

According to the proposed contribution plan, TSP is the largest in the world, with assets of over $ 558 billion. 89% of participants are satisfied or satisfied with the Economic Plan.

How is a Thrift Savings Plan TSP different from a 401k plan?

The savings plan is similar to the 401 (k) plan but is only open to federal and service employees. Participants in TSP can get an immediate tax break for their savings or invest in Roth for tax exemption after retirement.

Is TSP the best?

According to the proposed contribution plan, TSP is the largest in the world, with assets of over $ 558 billion. 89% of participants are satisfied or satisfied with the Economic Plan.

What’s so bad about TSP? TSP is toxic and can cause eye and skin damage and is harmful if swallowed. TSP needs attention when you are working on it. Always use eye protection with waterproof gloves when handling or cleaning with TSP. Also wear full leather protection, including long sleeves and long pants.

Is TSP better than 401k?

In general, the Generational Plan compares favorably to 401 (k) plans, and if you work for the federal government and can participate, it may be logical to do so. It serves as a strong partner for FERS pension, and the combination of TSP and FERS could provide a solid foundation for retirement.

Is TSP the best investment?

TSP is considered one of the best, most managed and lowest cost in the business. But many people believe that it is not flexible and does not offer as many investment options as most outside plans.

What is the average TSP balance at retirement?

| Age | Average Contribution Value | Average Measurement |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| Every Age | 9% | $ 95,600 |

How long before you are vested in TSP?

When you qualify, your agency automatically deposits into your TSP account the equivalent of 1% of your total payment for each payment period, even if you do not contribute your money. After 3 years of Federal civil service (or 2 years in some cases), you are given these contributions and what they receive.

At what age can I withdraw my TSP without conviction? Even if you delay the pension payment up to date, since you left the service in the year you turned 55, you are allowed to take part or all of the TSP, free of charge.

Can I withdraw my TSP if I quit?

As a candidate, you have several options regarding your TSP account: If you are over 70½ years old and you do not plan to withdraw your account, you may leave it in the TSP and decide to withdraw later. You may also be able to withdraw part of your account in one installment.

Can you withdraw from TSP at any time?

Since TSP is a retirement plan, there is no penalty for withdrawing your money while retiring. If you stop working for the federal government, you can start to retire when you turn 55. If you continue to work for the federal government, you need to wait until you turn 59-1 / 2.

How do I get my money out of TSP?

To request a withdrawal, log in to my Account on the TSP website and click on the â € œDate and Change for Payments link in the menu. You will then be able to use the online tool with which to start your withdrawal.

How much will I lose if I withdraw my TSP?

The penalty for early removal is a 10% penalty. In addition to any taxes you owe on your withdrawal, you will incur an additional 10%. The ability to avoid early withdrawal penalties if you split in the year you turn 50 or 55 only works if you leave your money in the TSP – rollovers are under penalty.

What does it mean to be fully vested in TSP?

TSP uses the term vesting and civilian retirement plans as 401 (k). It Makes It Easier. When you are given, this means you can take all the contributions of the staff. with you after you separate or retire and you can transfer it to another retirement account if you choose.

What does it mean to be full vested?

â € hPresidentâ € in the retirement plan means ownership. This means that each employee will contribute, or own, a portion of their account in the program each year. An employee who is given 100 per cent of his / her savings account owns 100 per cent and the employer cannot lose, or return, for any reason.

What happens when you are fully vested?

When you are given a full retirement plan, you have 100% ownership in your account. This occurs at the end of the installation period. You have fulfilled all the requirements set by your employee. And since this money is yours, your landlord can not confiscate it no matter what happens.

What is the average amount in TSP balance at retirement?

To complete the grid, 530,357 participants had an account balance of $ 250,000- $ 499,000 (20.36 years contributing on average) and 212,110 participants were in the $ 500,000- $ 749,000 range (23.12 years on average).

Should I move my TSP money to the G Fund 2021?

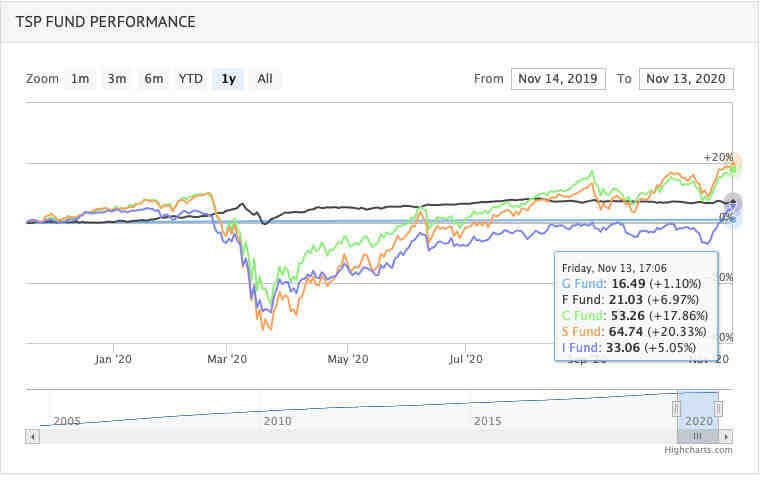

| November 29, 2021 | G Account |

|---|---|

| Almost | 16.7149 |

| Change | 0.0022 |

| YTD * | 1.12% |