THRIFT SAVINGS PLAN VS. 401(K) PLANS

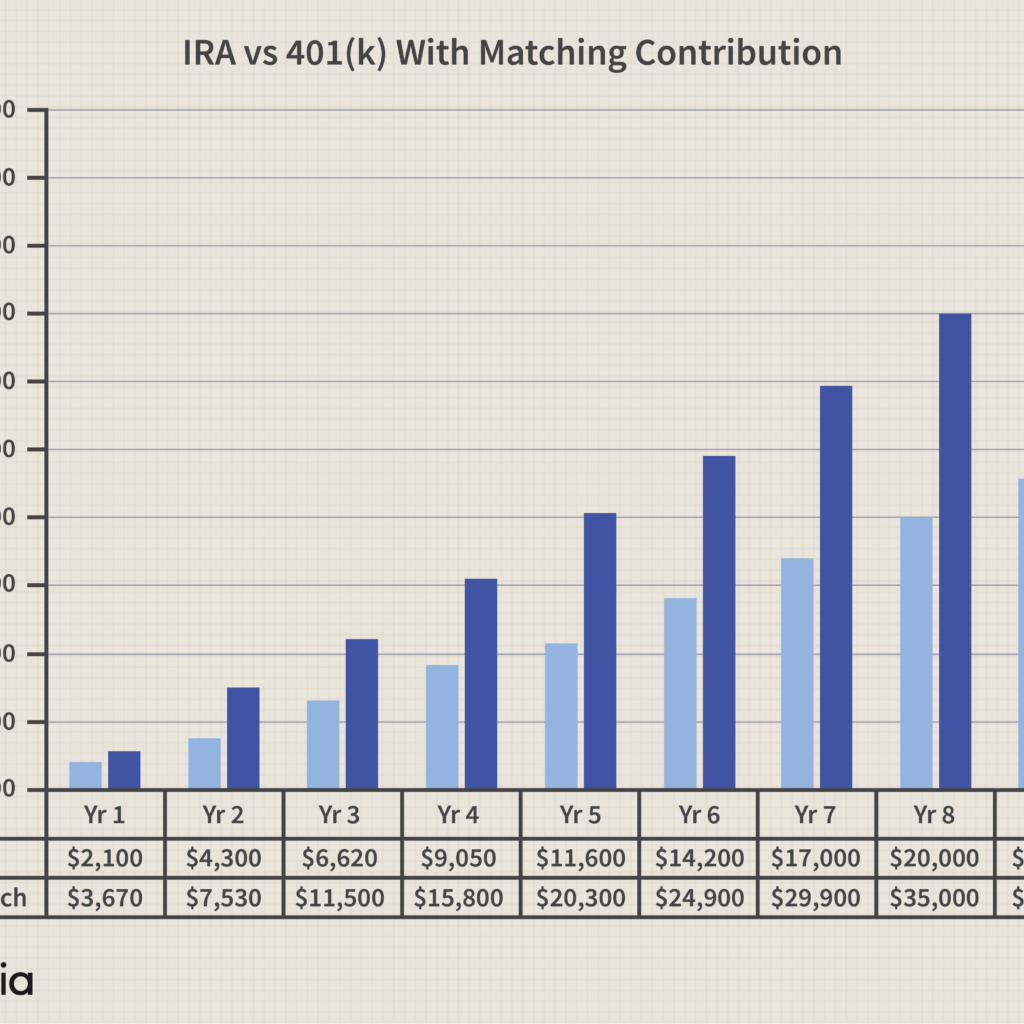

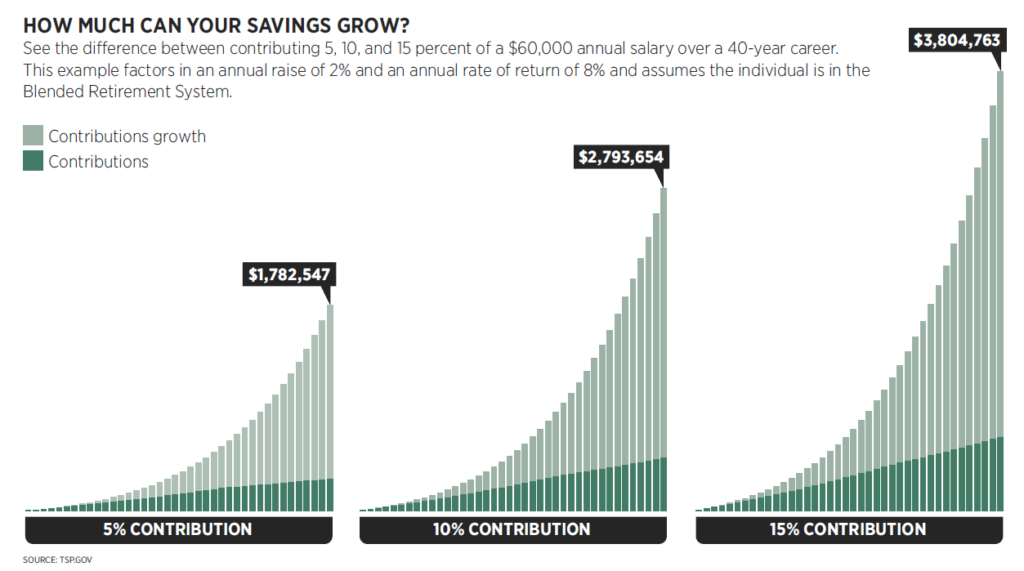

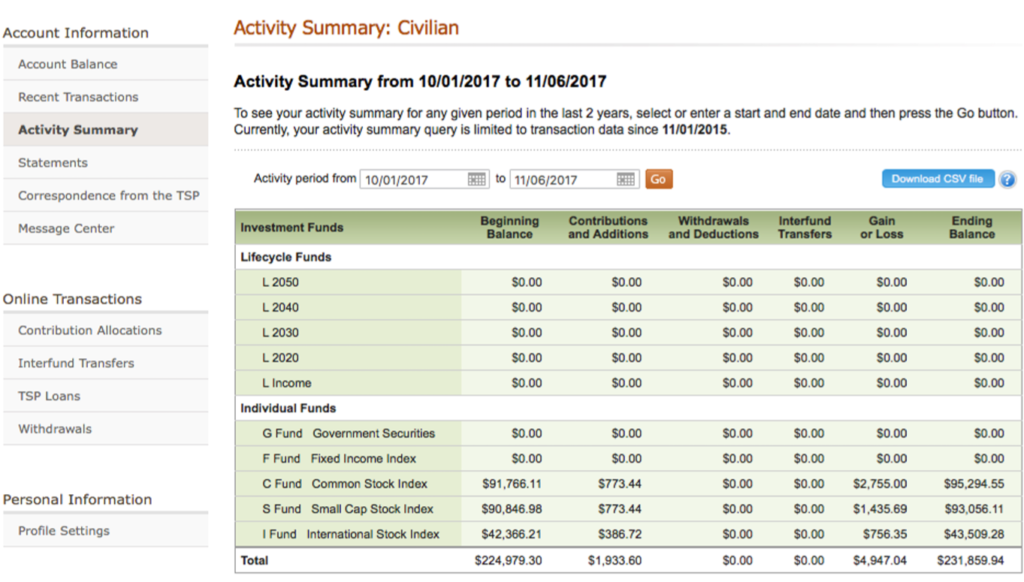

Is Thrift Savings Plan an IRA or 401k? The TSP is a fiscal “employer” pension plan for federal employees comparable to a 401k plan in the private sector. An IRA is a taxable “individual” retirement plan. What kind of plan is Thrift Savings Plan? The Thrift Savings Plan (TSP) is a fiscal pension savings and […]

THRIFT SAVINGS PLAN VS. 401(K) PLANS Read More »