How Much Should You Invest in a TSP Account? We recommend that you invest 15% of your retirement income. When you contribute 15% consistently, you prepare yourself for options when you retire.

What type of account is TSP?

Contents

An economic savings plan (TSP) is a defined contribution pension plan that has many of the benefits of private sector plans. To see also : Is TSP a 401k for tax purposes?.

Is TSP an IRA or a 401k? The TSP is a tax-deferred “employer” pension plan for federal employees comparable to a 401k plan in the private sector. An IRA is a tax deferred “individual” pension plan. Big difference! The TSP must follow the administrative rules of Section 401k of the Internal Revenue Code.

Is TSP considered an IRA?

The Thrift Savings Plan (TSP) is not an Individual Retirement Arrangement (IRA) – and vice versa. While both are similar in that they are tax-facilitated retirement savings plans, the rules can vary significantly and those who are unaware of the differences may pay a price at tax.

What is the difference between IRA and TSP? See the article : What age can you withdraw from TSP?.

One major difference between these two accounts is that, as a federal employee, your agency makes matching contributions if you invest in the TSP. Basically, your agency will contribute money to your TSP account based on how much you are contributing. There is no match when investing in an IRA.

Is TSP considered traditional IRA for tax purposes?

A. The TSP is not considered an IRA for any purpose. From the Internal Revenue Service website: “An IRA owner must calculate the RMD separately for each IRA he owns, but he can withdraw the total amount from one or more of the IRA.

Is TSP a Roth or traditional IRA?

The main differences between a Roth TSP account and a Roth IRA relate to the restrictions on making Roth IRA contributions. Roth IRAs have both income limits and contribution limits. The Roth TSP, on the other hand, has no income restrictions, any federal employee can contribute.

Is a TSP account an asset?

Retirement Funds: Retirement accounts like your 401 (k), IRA, or TSP are considered assets. See the article : Whats the difference between TSP and 401k?.

What is a TSP account considered?

The Thrift Savings Plan (TSP) is a tax-deferred retirement savings and investment plan that offers federal employees the same type of savings and tax benefits that many private companies offer their employees under 401 (k) plans.

Does TSP count as a qualified retirement plan?

CSRS, FERS and TSP annuities are considered qualified retirement plans.

Is TSP considered income?

Therefore, the earnings portion of the TSP payment will be taxed as income and, if the TSP participant is under the age of 59.5, an early termination penalty (10 percent) will apply. This is unless the payment is transferred to a Roth IRA or a Roth account managed by an eligible employer plan.

What is the difference between a Roth IRA and a traditional IRA?

With a Roth IRA, you contribute dollars after tax, your money grows tax free, and you can generally make withdrawals free of tax and penalties after age 59 and a half. With a traditional IRA, you contribute dollars before or after tax, your money grows on deferred tax, and withdrawals are taxed as current income after age 59 and a half.

What is the purpose of a traditional IRA? Traditional IRAs (Individual Retirement Accounts) allow people to contribute pre-tax dollars to a retirement account where investments grow on deferred tax until retirement during retirement. Upon retirement, withdrawals are taxed at the current income tax rate of the IRA owner.

What are the 3 types of IRA?

There are several types of IRAs:

- Traditional IRA. Contributions are generally tax deductible. …

- Roth IRA. Contributions are made with after-tax funds and are not tax deductible, but earnings and withdrawals are tax free.

- SET IRA. …

- SIMPLE IRA.

Which is better a Roth IRA or a traditional IRA?

In general, you are better off in a traditional one if you expect to be in a lower tax bracket when you retire. … If you expect to be in the same or higher tax bracket when you retire, you might want to consider contributing to a Roth IRA instead, which allows you to pay off your tax bill now rather than later.

How do I know if I have a traditional or Roth IRA?

If you are unsure what type of IRA you have, we recommend that you check the documents you received when you first opened your account. It will explicitly state what type of account it is.

What is the downside of a Roth IRA?

One key drawback: Roth IRA contributions are made with after-tax money, which means there are no tax deductions in the contribution year. Another drawback is that the withdrawals of the earnings from the account must not be made before at least five years have passed since the first contribution.

When would you not want a Roth IRA?

Roth IRA contributions from single filers are prohibited if your income is $ 140,000 or more in 2021. The income phasing out range for singles is $ 125,000 to $ 140,000. Individual tax registrants cannot contribute to a Roth in 2022 if they make $ 144,000 or more. Your contribution is reduced if you earn between $ 129,000 and $ 144,000.

Why bother with a Roth IRA?

Contributing to a Roth IRA is more tax efficient than simply investing in a taxable brokerage account. Roth IRA money is tax free and all contributions and earnings can be withdrawn tax free once you have kept your Roth IRA open for more than five years.

Is a Roth IRA good or bad?

Roth IRAs might seem ideal, but they come with drawbacks, including the lack of an immediate tax cut and a low cap. … In the world of retirement accounts, the Roth IRAs are the favorite child. What’s not to love about totally tax-free growth on your retirement savings?

Does TSP count as Roth IRA for taxes?

Traditional distributions of TSP count as taxable income when they are distributed. Roth TSPs work similarly to Roth IRAs in that the money in the account has already been included as part of the taxable income. Qualifying Roth TSP distributions do not count as taxable income when distributed.

Does Roth TSP count against Roth IRA? Your contributions to a TSP won’t affect your ability to contribute to a Roth IRA, but that doesn’t mean you’re eligible. To contribute to a Roth IRA, your modified modified gross income must not exceed the limits for your tax return status.

Is TSP considered a Roth IRA?

Roth TSP is NOT a Roth IRA!

What is the difference between TSP and Roth?

With Roth TSP contributions, you contribute after-tax income by paying taxes upfront. During retirement, you receive qualified Roth tax-free distributions. The traditional TSP allows you to pay contributions before taxes are deducted from your income and then pay the taxes on withdrawals.

Does the TSP count as an IRA?

The Thrift Savings Plan (TSP) is not an Individual Retirement Arrangement (IRA) – and vice versa. While both are similar in that they are tax-facilitated retirement savings plans, the rules can vary significantly and those who are unaware of the differences may pay a price at tax.

Is TSP a Roth IRA?

1 The first thing to keep in mind are the similarities between a Roth TSP and a Roth IRA. They are two versions of the Roth accounts, with the same benefits offered by all Roth accounts. You pay a portion of your earnings in dollars after tax.

Do I need to report Roth TSP on taxes?

If you have overpaid Roth contributions, the additional amount is taxable. However, it is not necessary to report this on your tax return because the additional amount is already listed as taxable income in box 1 of your W-2.

Do I need to report my TSP on my taxes?

No, you should not include your TSP contributions separately in your tax return. … At the end of the year, when you receive the W-2 form showing your earnings, you will notice that your wages subject to federal income tax (box 1) are lower due to your TSP contributions (box 12).

Do I need to declare Roth IRA on taxes?

Roth IRA contributions are NOT reported on your tax return. … But there is no place to report Roth IRA contributions. While it is not necessary to report Roth IRA contributions upon return, it is important to understand that the IRA custodian will report these contributions to the IRS on Form 5498.

Where do I report TSP on tax return?

- Carry out the taxable portion of the TSP distribution on line 16b of Form 1040. …

- Report the entire TSP distribution as a pension and a non-taxable annuity distribution on line 16a of Form 1040 if any of the distributions are not taxable.

Is TSP a Roth or traditional IRA?

The main differences between a Roth TSP account and a Roth IRA relate to the restrictions on making Roth IRA contributions. Roth IRAs have both income limits and contribution limits. The Roth TSP, on the other hand, has no income restrictions, any federal employee can contribute.

Does TSP offer a Roth IRA? The Roth TSP is available to all service members. Anyone who is currently serving can enroll and contribute to the Roth TSP. There are no income limits. In 2021, individual taxpayers with income greater than $ 140,000 cannot contribute to a Roth IRA ($ 208,000 for joint files).

What kind of IRA is TSP?

The TSP is classified as a ‘defined contribution’ pension plan. It is similar to a qualified 401 (k) retirement plan sponsored by a private company or a 403 (b) qualified retirement plan from a nonprofit organization.

Is TSP a 401 or IRA?

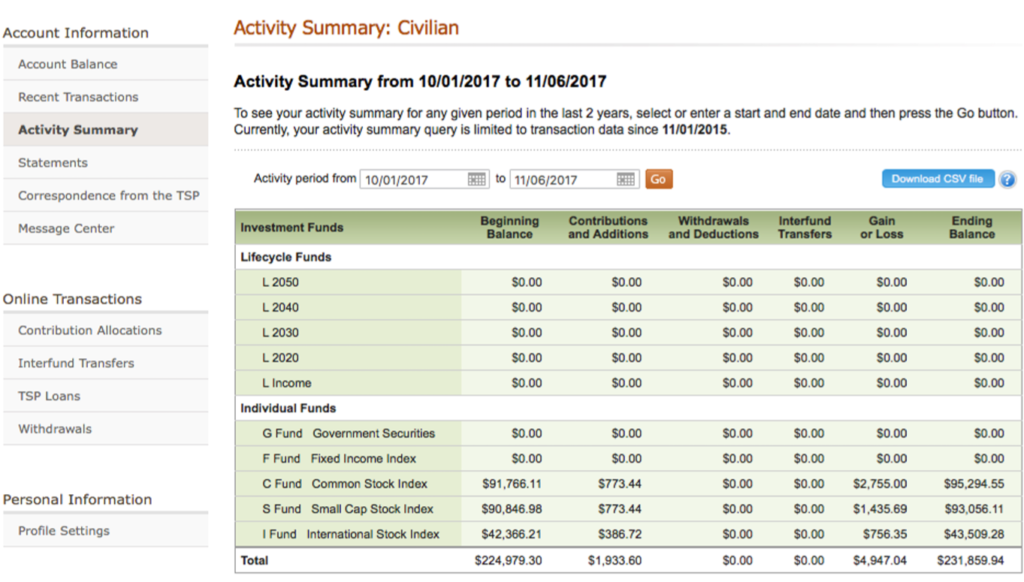

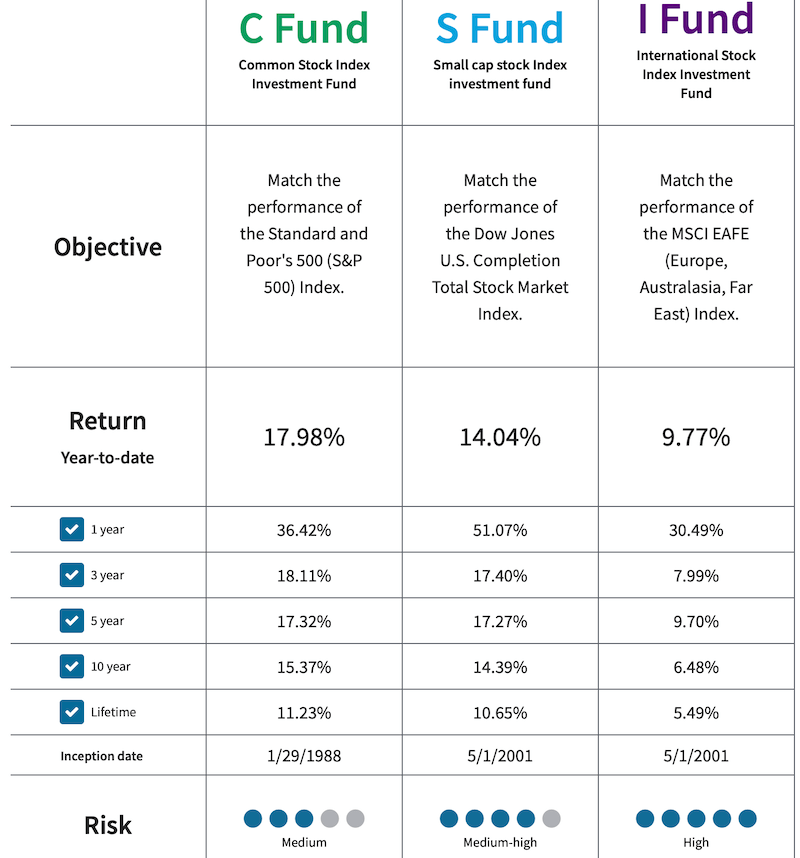

The TSP is a tax-deferred “employer” pension plan for federal employees comparable to a 401k plan in the private sector. An IRA is a tax deferred “individual” pension plan. … The TSP, just like any other 401k, must offer a variety of investments. It offers a G-fund, an F-fund, a C-fund, an S-fund and an I-fund.

Is TSP considered an IRA?

The Thrift Savings Plan (TSP) is not an Individual Retirement Arrangement (IRA) – and vice versa. While both are similar in that they are tax-facilitated retirement savings plans, the rules can vary significantly and those who are unaware of the differences may pay a price at tax.

Is TSP considered traditional IRA for tax purposes?

A. The TSP is not considered an IRA for any purpose. From the Internal Revenue Service website: “An IRA owner must calculate the RMD separately for each IRA he owns, but he can withdraw the total amount from one or more of the IRA.

Is TSP a traditional IRA?

The Thrift Savings Plan (TSP) is not an Individual Retirement Arrangement (IRA) – and vice versa. While both are similar in that they are tax-facilitated retirement savings plans, the rules can vary significantly and those who are unaware of the differences may pay a price at tax.

Is TSP considered traditional IRA for tax purposes?

A. The TSP is not considered an IRA for any purpose. From the Internal Revenue Service website: “An IRA owner must calculate the RMD separately for each IRA he owns, but he can withdraw the total amount from one or more of the IRA.

Do TSP contributions count as IRA?

Traditional IRA Eligibility Your eligibility to contribute to a traditional IRA is not affected by your contributions to a TSP. To contribute to a traditional IRA, you must be under 70 and a half years old at the end of the calendar year and must have earned an income equal to or greater than your contribution.