How much will my TSP grow after retirement?

Contents

With the launch of the Federal Employees Retirement System, experts said the TSP would be important because with Social Security and a state-of-the-art annuity, TSP could provide up to 30 percent to 50 percent of total retirement income.

How much should I get in my TSP at 50? By age 40, you should have tripled your annual income. At the age of fifty, six times in your salary; age 60, eight; and at age 67, 10 times. To see also : Is Roth TSP worth it?. 8 If you reach the age of 67 and earn $ 75,000 a year, you should have $ 750,000 saved.

How much does the average person have in TSP?

From December 31 it has dropped to 21,432. The average Thrift Savings Plan balance for participants Federal Employees Retirement System â € ”3.3 million people â €” was $ 138,933 in January. Compared to the average TSP account amounting to $ 146,63,313 Civil Service Retirement System participants.

How many millionaires are there in the TSP? Read also : Is TSP better than 401k?.

In the last quarter of 2021, the number of millions investing in the Thrift Savings Plan (TSP) has risen sharply by 50%. As of December 31, there were 112,880 TSP million, up from 75,420 last year, according to the Federal Retirement Thrift Investment Board.

What is the average TSP balance?

| Age | Average donation | Average level |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| All ages | 9% | $ 95,600 |

Does TSP still grow after retirement?

Depending on when you first retire, you can simply leave money in the TSP to keep growing. If you do not want to get it right now, it might be wise to leave it at that. See the article : Why is TSP so good?. As with other retirement accounts, you will need to begin a bit of retirement at age 72.

How much should I have in my TSP at 50?

How much should I get in my TSP at the age of 50? By the time you are 30, you should have saved half of your annual income. By 40, you should have doubled your salary, and by 50, you should have deducted at least four times your salary from your retirement savings.

How long can you keep TSP after retirement?

1. Leave Money in TSP. You can withdraw money from your Thrift Savings Plan account until April 1 of the year after you turn 70 ½. After that, you should start taking the distribution.

How much money should I have in my TSP when I retire?

Many experts say that your retirement income should be about 80% of your final annual income. 1 This means that if you earn $ 100,000 a year in retirement, you need up to $ 80,000 a year to live a comfortable life after retirement.

What is the average amount in TSP balance at retirement?

| Age | Average donation | Average level |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| All ages | 9% | $ 95,600 |

Should I leave my money in TSP when I retire?

Depending on when you first retire, you can simply leave money in the TSP to keep growing. If you do not want to get it right now, it might be wise to leave it at that. Like other retirement accounts, you will need to begin retirement at the age of 72. This is called the Minimum Distribution (RMD).

What does Dave Ramsey recommend for TSP?

How Much Should You Put in a TSP Account? We recommend investing 15% of your retirement income. If you contribute 15% regularly, you are ready to make your choice when you retire.

What is the best TSP rate for withdrawal? I usually say that there is not much money in the maintenance program. If you want your TSP to be able to generate an annual inflation-indexed amount of $ 10,000, most financial planners will prove that you have $ 250,000 left over when you retire.

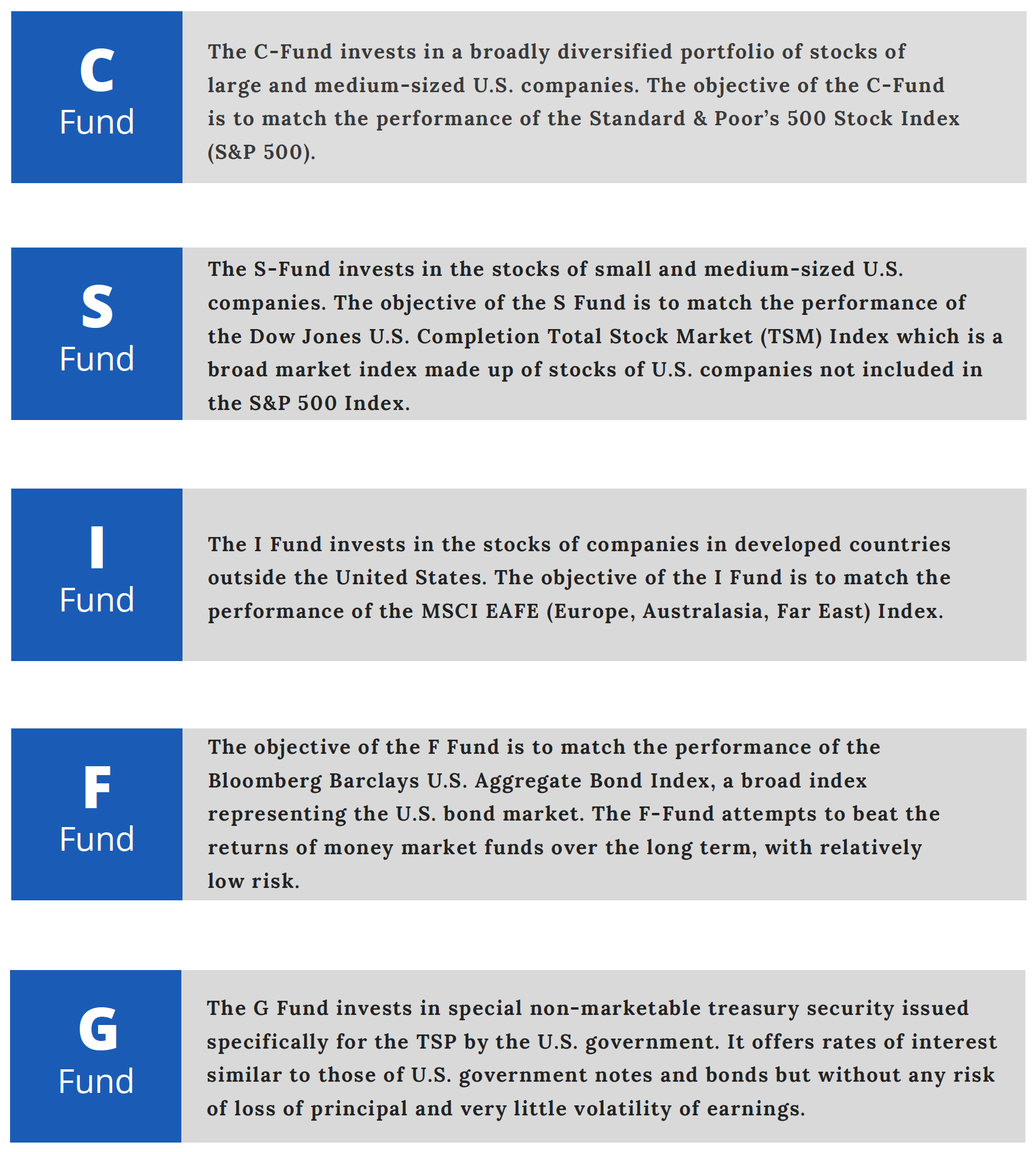

What is the best allocation for TSP?

Like other words, they promote a portfolio with 100% equities but promote a collapse of 60% C Fund, 20% S Fund, and 20% I Fund.

Should I move TSP money to G Fund?

| FUND | PRICE | Year-to-Date |

|---|---|---|

| L 2060 | $ 13.6051 | -8.58% |

| L 2065 | $ 13.6048 | -8.58% |

How do I maximize my TSP growth?

Increase your contributions every year Most people do not start giving much of their first day at work, so it is important to increase your contributions as you start to increase. Every time you receive a COLA or an extension step you should consider adding your TSP donations.

What should I do with TSP right now?

Should I cash out my TSP?

They are trying very hard to delete your TSP account to pay them. But that would probably be the worst thing you could do. Most experts agree that withdrawing money from your TSP (or any tax-free or tax-deductible) pension account before the age of 59½, which is a normal retirement age, is unwise.

What is the best TSP fund to be in right now?

Best Performance Among the L 2050 Investment Funds had a good return of 16.34% and L 2045 returns 15.4%. For most investors, note that the G Fund (commonly referred to as the secure TSP Fund) has a return of 1.38% for the year.

Should I move TSP money to G Fund?

| FUND | PRICE | Year-to-Date |

|---|---|---|

| L 2060 | $ 13.6051 | -8.58% |

| L 2065 | $ 13.6048 | -8.58% |

Can the TSP G fund lost money?

With the TSP G Fund you can get medium to long prizes without the risk of losing your money, no matter how long you save.

How is the TSP G fund doing?

The S Fund grew by 0.03% in February, bringing 2022 to -0.05%, while the G Fund increased 0.14%, bringing its performance this year to 0.28%. The adjusted financial bonds in the F Fund lost 1.08% in value in February, bringing its performance from January to -3.15%.

How can I make my TSP grow?

Increase your donations each year Every time you receive a COLA or step increase you should consider increasing your TSP donations. A good goal would be to increase your contributions by 1% per year until you increase them.

Will my TSP continue to grow after I retire? Depending on when you first retire, you can simply leave money in the TSP to keep growing. If you do not want to get it right now, it might be wise to leave it at that. As with other retirement accounts, you will need to begin a bit of retirement at age 72.

What is the average return on TSP?

The TSP C-Fund, which reaches S&P 500, has an average annual 12.29 percent gain between 1988 and 2020; The TSP F-Fund, a broad index representing the US bond market, has averaged 6.29 percent year-on-year from 1988 to 2020; and G-pocket, long-term US Treasury notes, had an average annual average of 4.70 …

What is a good TSP return rate?

TSP’s performance in 2021 was positive, and union workers should be happy to see the results of December and all of 2021. TSP’s performance was quite good last year.

What is the average amount that in a TSP at retirement?

| Age | Average donation | Average level |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| All ages | 9% | $ 95,600 |

How do I become a millionaire in TSP?

The “elite club.” With more than 75,000 members, TSP millionaires have received their name and made a contribution to TSP for 25-30 years, with moderate anger and investing their money. New members are welcome, but once you get to the â € œtopâ €, you have to work hard to stay there.

How much to invest in TSP to become a millionaire?

If you choose the planting-of-the-long course you can do, like 112,000 position-and-file union and postal workers did, you become a TSP million. With that $ 2-3 million that, along with your stable federal annuity and inflation-indexed Social Security guarantees you a better retirement. As much as it is better.

How do I make the most money in my TSP?

Increase your contributions every year Most people do not start giving much of their first day at work, so it is important to increase your contributions as you start to increase. Every time you receive a COLA or an extension step you should consider adding your TSP donations.

Is TSP a good retirement plan?

While they may not have much money to choose from, TSP participants have one major advantage over many 401 (k) vendors: low cost. The total price tag, which covers both investment and administration costs, is 0.055% for individual TSP costs.

What is the average TSP rate drop?

Should I keep my money in TSP after retirement?

Leave it at TSP and make it grow Depending on when you start retirement, you can simply leave the money in TSP to keep growing. If you do not want to get it right now, it might be wise to leave it at that. As with other retirement accounts, you will need to begin a bit of retirement at age 72.

What should I do with my TSP after retirement?

If your closed account balance is $ 200 or more when you leave a joint venture, your TSP account stays on until you need it. You can save some of your savings because of our low prices. Additionally, you can adjust your investment mix and transfer the appropriate amount into your account.

Should I place a hold on my TSP account?

Consider adding a â € œholdholdâ € to your account to prevent fraudulent loans and withdrawal requests. If you have a problem with identity theft, data breach, or someone else accessing your TSP account, you may consider asking to be excused to avoid new hacking and loan requests.

Is TSP enough for retirement?

The choice of TSP is a good, but not the least, thing to have for those under the Civil Service Retirement System (CSRS) program that has high benefits and full protection from rising prices. But for people under the FERS program, TSP has no idea.

How much money should you have in your TSP to retire?

If you want your TSP to be able to generate an annual inflation-indexed amount of $ 10,000, most financial planners will prove that you have $ 250,000 left over when you retire.

What do most people do with their TSP when they retire?

Most retirees are selected to take all the money and send the TSP to IRA. This is the best option for people because it gives you great control. Think about those first three options again: If you start picking regularly you end up in your planting options.

Is TSP better than IRA?

The IRA has a great opportunity on the TSP. Flexibility. As long as you’re in the middle of nowhere, you’re in for a rude awakening! you have a lot of fun, you have a lot of fun and you have a lot of fun and you have a lot of fun and you have a lot of fun and you have a lot of fun and you have a lot of fun and you have a lot of fun and you have a lot to do system, you can withdraw money from your IRA however you may want. With TSP however, there are a number of rules governing that and when you can take money out.

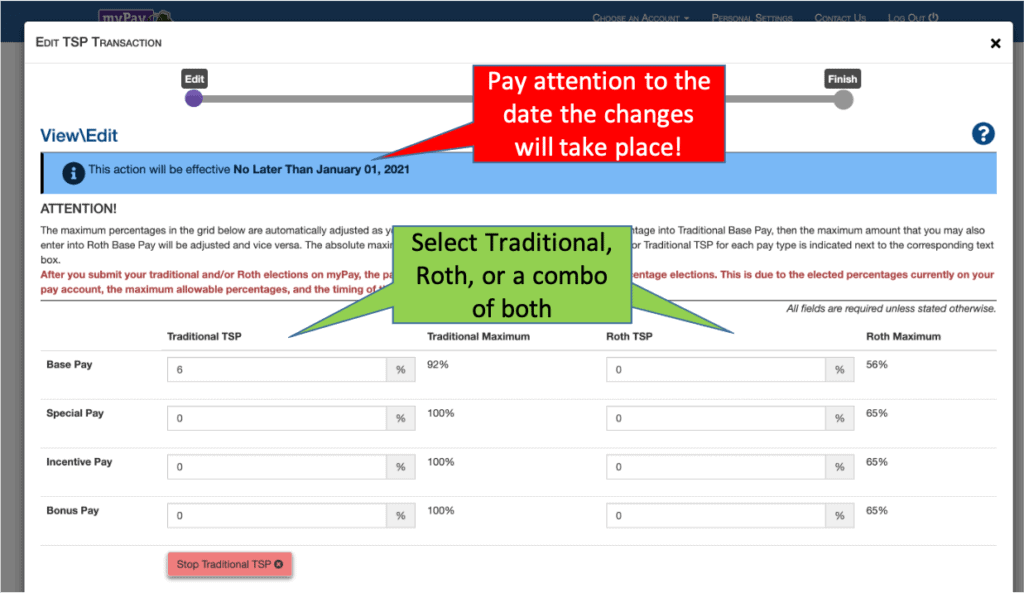

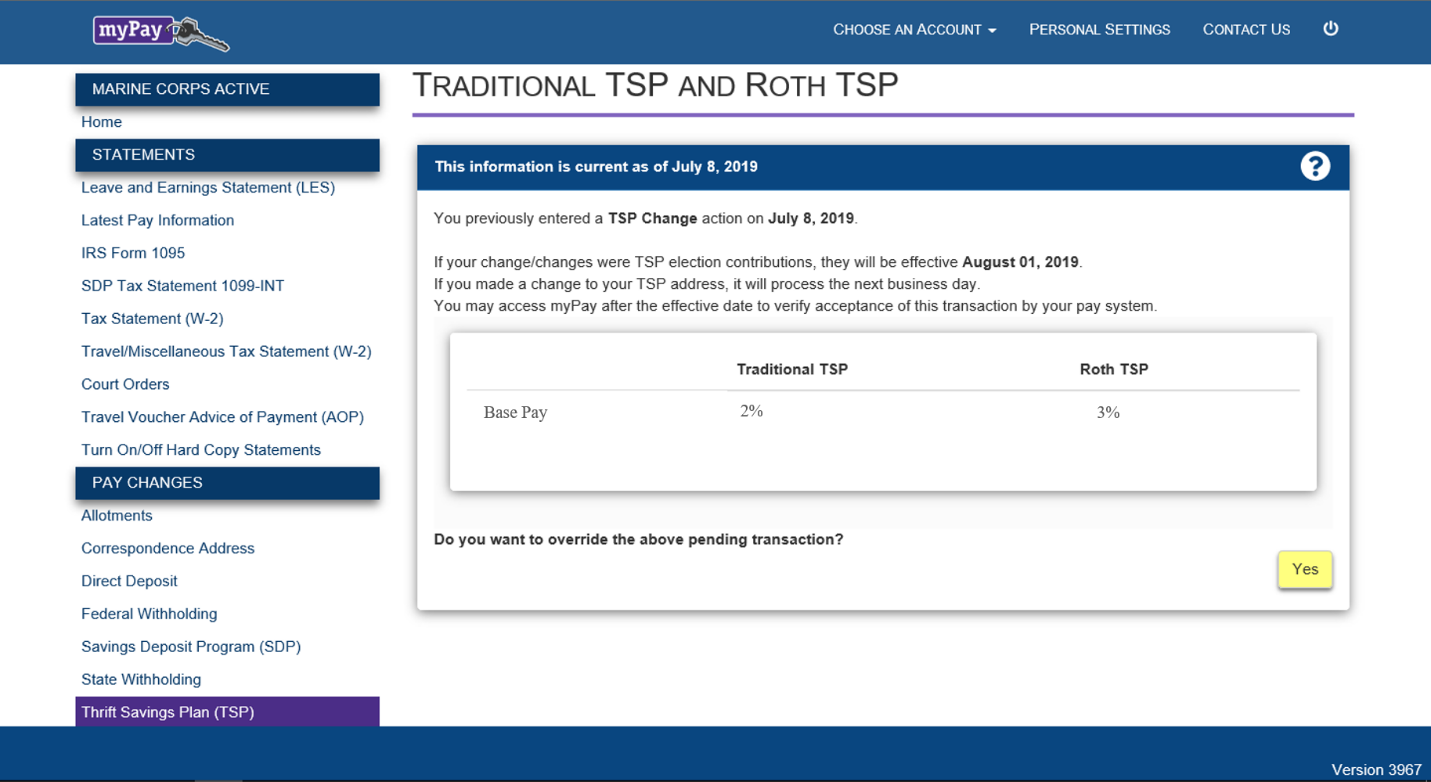

Should I have a TSP and an IRA?

Your entry into the TSP does not affect your eligibility to submit an IRA. However, the Internal Revenue Code (IRC) sets limits on the amount of money you can give to eligible employer programs such as TSP and retirement accounts as traditional IRAs and Roth IRAs.

What is the difference between an IRA and a TSP?

The TSP should be paid with a reduced fee, while the IRA can be paid from any source as long as you have enough money to cover the contribution. You can donate from your income to the IRA to your unemployed spouse; not so with TSP.

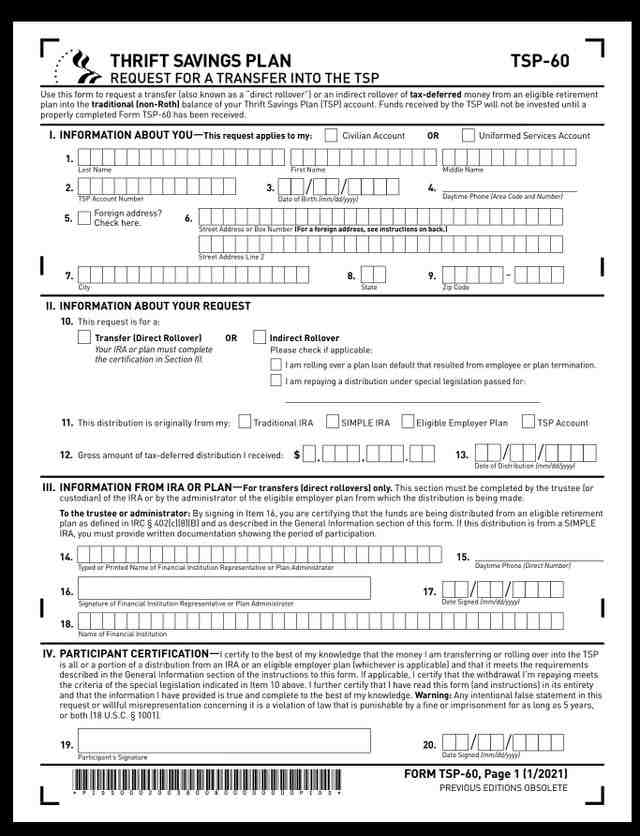

How do I transfer an IRA?

If you want to transfer your personal retirement account (IRA) balance from one donor to another, just call now the provider and ask for a “trustee-to-trustee”. This transfers money from one financial institution to another, and does not tax. .

How do I submit my IRA without penalty? You can avoid the initial withdrawal penalty by waiting until the age of 59 1/2 to start taking the distribution from your IRA. When you reach the age of 59 1/2, you can withdraw any money from your IRA without paying a 10% penalty. Accordingly, a regular salary tax will still be required upon each waiver of the IRA.

Can I move my IRA to another bank?

Transferring an IRA from your current provider to another institution can be done through a direct trustee-to-trustee transfer. Alternatively, you can choose an indirect rollover where your bank or broker sends you a check, which you must submit to the new IRA institution within 60 days.

How much does it cost to transfer IRA?

There is usually no travel fee paid when you turn your 401 (k) into a new account-benefit retirement account. Your new account balance may be higher than your current account account. Turning over 401 (k) to the IRA is often the way to go to reduce costs.

How long does it take to transfer an IRA from one bank to another?

Open an IRA account with your new bank, fill out a travel order form, and allow three to five business days to complete the transfer. If you are converting an IRA custom to Roth IRA, you will need to take a few steps to adjust your tax return.

Can I transfer an IRA myself?

Yes, you can rollover to the self-directed IRA. As for Old 401 (k), it will be the self-governing IRA. As for Roth 401 (k), it will be Roth IRA led. Yes, you can turn-over to the traditional IRA-led version.

Can I move my IRA from one broker to another?

Transferring a withdrawal account from one broker to another without paying tax is called a rollover. You can rotate one IRA to another broker or rotate other types of retirement accounts, including employer-supported 401 (k), 403 (b), SIMPLE IRAs and SEP IRAs in the Rollover IRAs.

Can I move my IRA without penalty?

The IRS allows tax-free rollovers from the IRA to transfer to another retirement plan or IRA within 60 days from the date of delivery without incurring prior penalty.

Can you transfer an IRA from one company to another?

Transferring an IRA You can transfer an IRA money from one financial company to another by taking the money and depositing it in cash or having it transferred directly. Both methods are sometimes called rollover.

Can I switch investments in an IRA?

Key Takeaways. You can transfer your personal retirement account (IRA) account from stocks and bonds to cash, and vice versa, without tax or penalties. The act of changing assets is called portfolio rebalancing. There may be costs and costs associated with the rebalancing portfolio, including transaction costs.

Can an individual manage their own IRA?

The self-governing IRA is a traditional or Roth IRA, which means it allows you to retire at a taxable rate and has similar IRA contributions. There is a difference between self-administration and some IRAs are the only types of assets you have in the account.

Sources :