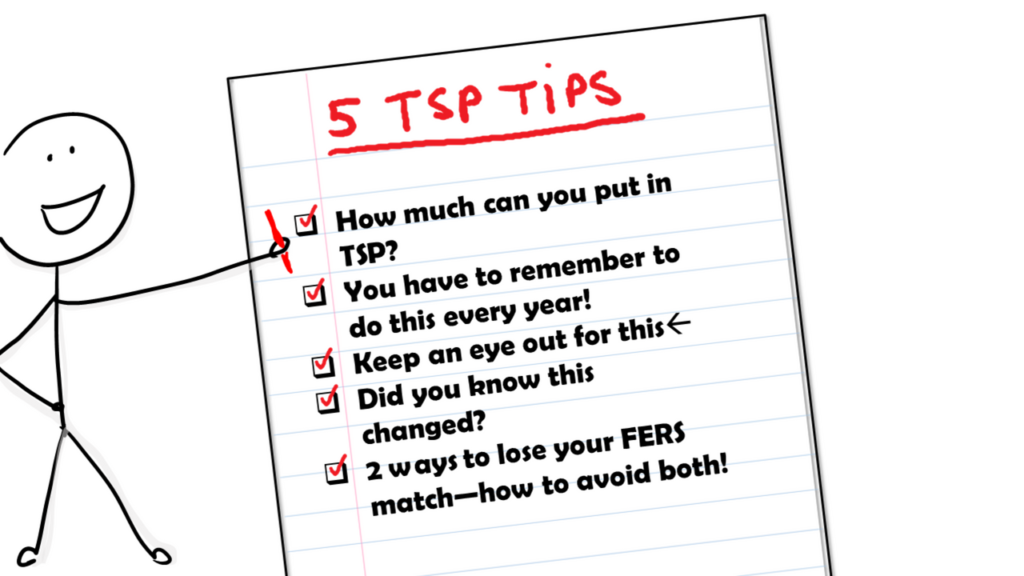

Why is TSP so good?

Is it better to contribute to 401k or Roth 401k? If you prefer to pay taxes now and get them out of the way, or you think your tax rate will be higher in retirement than it is now, choose a Roth 401 (k). … In return, each Roth 401 (k) contribution will reduce your […]

Why is TSP so good? Read More »