The salary figure used to calculate pension benefits is typically the average of the two to five consecutive years in which the employee receives the highest compensation. This average amount is multiplied by a percentage called a pension factor. Typical pension factors can be 1.5 percent or 3 percent.

Do federal employees have good retirement?

Contrary to the popular image of the government as an employer for life, most people who enter federal service do not stay long enough to retire and receive an annuity. … Someone who puts in 25-to-30 years could retire with their annuity and expect a good life.

Does the federal government have a good retirement plan? This is one of the many reasons why the Federal Employees Retirement System is seen as one of the best retirement packages out there. And on top of the sweet pension scheme come the added benefits of being able to charge social security and payments from thrifty savings.

How much does a federal employee need to retire?

Most people need 40 credits (10 years of work) to qualify for Social Security pension. As a federal employee, you pay full social security tax equal to 6.2% of your salary.

How much do I need to retire as a federal employee?

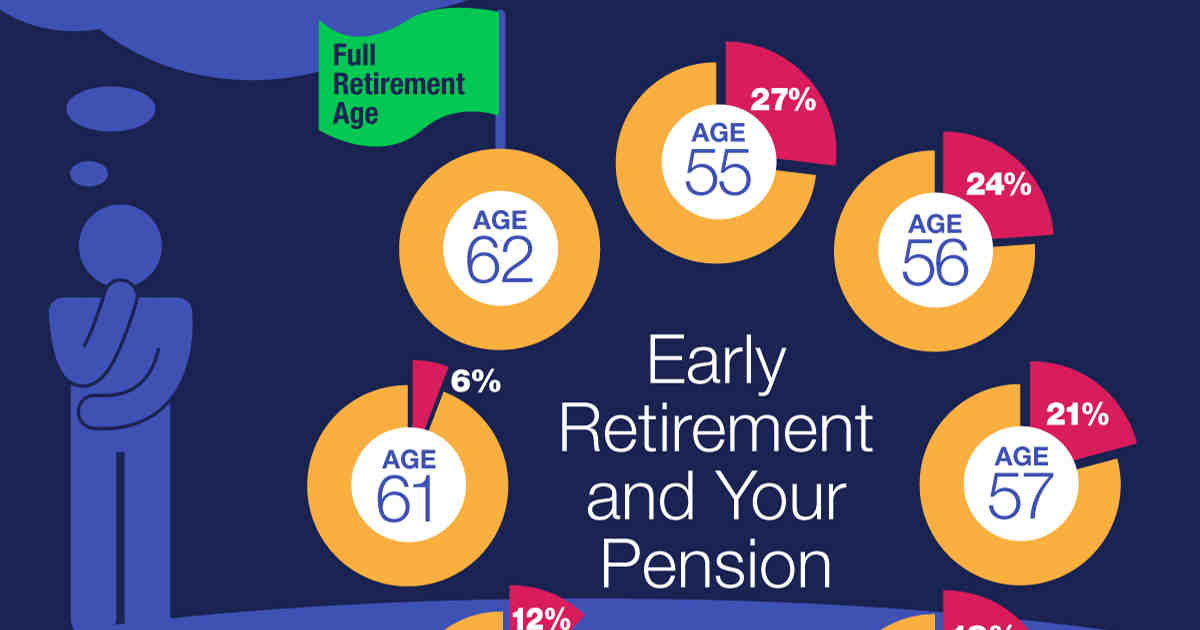

It is simply a general rule that does not apply to everyone. I have helped federal employees who needed more than 80% of their early retirement income, and some who were able to comfortably retire with 50% of their early retirement income. Fortunately, the “80% rule” is not a fixed rule for every federal employee.

How many years do you have to work in the federal government to get a pension?

You must work for at least 5 years with the federal government before you are eligible for a FERS federal pension, and for each year you work, you will be entitled to at least 1% of your High-3 average pay history. Automatic deductions that may vary from.

What is the average pension of a federal employee?

What is the average pension for a federal employee? Median pension benefit The average private pension benefit for persons aged 65 and over was $ 9,827 per year. The average pension benefit from the local or state government was $ 22,546 per year.

How much pension do government employees get?

The pension amount is 50% of the remuneration or the average remuneration, whichever is advantageous. The minimum pension is currently DKK 9,000 per month. The maximum pension limit is 50% of the highest salary in the Government of India (currently Rs.

How much is the average FERS retirement?

The FERS-defined benefits are smaller – an average of about $ 1,600 a month and a median of about $ 1,300, for annual figures of $ 19,200 and $ 15,600 – because this program also includes social security as a basic element.

At what age do most federal employees retire?

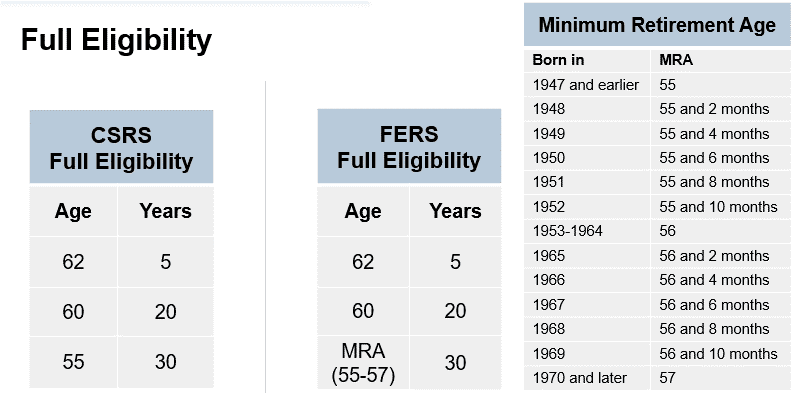

- For CSRS, normal retirement can take place as early as the age of 55 for an employee with 30 years of seniority.

- For FERS, the minimum retirement age is currently 56 years and 2 months for persons born in 1965, 56 for those born from 1953 to 1964 and will increase to 57 years for workers born in 1970 or later.

What is the most common retirement age?

While the average retirement age is 61, most people cannot collect their full Social Security benefit until age 67 (if you were born after 1960). Plus, you are not eligible for Medicare until you are 65 years old. So “retirement age” can have many different definitions!

What age do most federal employees retire?

The vast majority of FERS employees will be eligible to sign at the age of 62 because they have probably had a lifetime of work where they contributed to social security.

How do I apply for pension?

Pension application – 2 copies 2. Joint photo (with spouse) – 2 copies of passport size Joint photos with wife or husband duly certified by the office manager 3. Identification marks – 2 copies duly certified by a government employee 4. Signature test – 2 sets duly certified by a Gazette Officer 5.

How much is a national pension? The full basic state pension is £ 137.60 per annum. week. You can receive more national pension if: you are entitled to a supplementary national pension.

What documents do I need to claim my pension?

You may need to specify these when making claims:

- Your CPR number (and your partner’s if you have one)

- Proof of your identity (for example, your passport, birth certificate or driver’s license)

- Marriage certificate or partnership certificate.

- Divorce certificate or partnership dissolution certificate.

How soon after my 65th birthday do I get my state pension?

The day on which you receive your payment depends on the last two digits of your national insurance number, but it will not be later than six days after you reach the state pension age.

How do I claim my pension at 66?

You can call Pensionservice’s claims telephone on 0800 731 7898 (text telephone: 0800 731 7339) to receive a claim form. Visit www.gov.uk/state-pension/how-to-claim to download a form. Once you have completed it, send it to your local pension center.

How long does it take to apply for aged pension?

If you file your claim on the day you reach retirement age, you will in most cases wait between two weeks and two months to get paid.

How long does it take to receive your first pension check?

Once the application has been submitted, the Pensions Board must await the final salary from the member’s unit, which can take up to six weeks from the date of resignation. The first payment can be up to two to three months from the date of retirement.

How long does state pension take to come through?

Your first payment will be made within five weeks of reaching retirement age. You will then receive full payment every four weeks. If you delay the recording of your national pension, you will receive your first payment at the end of the first full week you want to start receiving it.

How long does it take to process a pension claim UK?

You can claim your deferred national pension at any time. It can take six to eight weeks before it is assessed and paid.

How long does pension take to process?

From the receipt of your authorization, the process will usually take 4 to 5 weeks. Some pension providers have a faster turnaround time than others. It may be possible for you to have your pension fund within 3 weeks, but it may take longer.

How long does it take to get your State Pension after applying?

Your first payment will be made within five weeks of reaching retirement age. You will then receive full payment every four weeks. If you delay the recording of your national pension, you will receive your first payment at the end of the first full week you want to start receiving it.

What is the average TSP balance at retirement?

| Age | Average contribution rate | Average balance |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| All ages | 9% | $ 95,600 |

What is the average amount of a TSP account? Average TSP account balances for Uniformed Service members reached nearly $ 30,000 at the end of 2019, while balances for new ‘Blended Retirement System’ (BRS) participants reached close to $ 7,000 in just two years since BRS became operational.

How much should I have in my TSP by age 50?

Measures for pension savings At the age of 50, six times your salary; at the age of 60, eight times; and at the age of 67, 10 times. 8ï »¿If you reach age 67 and earn $ 75,000 a year, you should have $ 750,000 saved.

What savings should you have at 50?

As a general rule, Fidelity Investments recommends having at least six times your early retirement savings when you turn 50 years old.

How much money should I have in my TSP when I retire?

I often say that there is not too much money in the savings plan. If you want your TSP balance to be able to generate an inflation-indexed annual income of $ 10,000, most financial planners will suggest that you have a $ 250,000 balance by the time you retire.

Can TSP make you a millionaire?

It’s an “elite club.” With over 75,000 members, the TSP millionaires received their title by contributing to the TSP for 25-30 years, being at least moderately aggressive in investing their funds. New members are welcome, but once you reach the financial “top”, you have to work just as hard to stay there.

How much money should I have in my TSP when I retire?

I often say that there is not too much money in the savings plan. If you want your TSP balance to be able to generate an inflation-indexed annual income of $ 10,000, most financial planners will suggest that you have a $ 250,000 balance by the time you retire.

How long does it take to be a TSP Millionaire?

An article by Lyn Alden in FEDweek notes that the average contribution year for a TSP millionaire is over 29 years. Your investment will grow, but it will take time for your investment to reach $ 1 million.

How long does it take to be a TSP Millionaire?

An article by Lyn Alden in FEDweek notes that the average contribution year for a TSP millionaire is over 29 years. Your investment will grow, but it will take time for your investment to reach $ 1 million.

How much should I have in my TSP at 40?

Retirement Savings Target If you earn $ 50,000 at age 30, you should have $ 50,000 set aside for retirement. At the age of 40, you must have three times your annual salary.

How much does the average person have in TSP?

There are 287,000 Civil Service Retirement System participants with an average account balance at the end of 2020 of $ 175,000.

Can you retire from federal service after 10 years?

Under the MRA 10 option, only 10 years of service is required to qualify for immediate retirement if you are under the age of 62 (but you must be at least with your MRA at the time of your separation from federal service).

Can I retire after 5 years of federal service? To be eligible (eligible to receive your pension benefits from the basic benefit plan if you leave federal service before retiring), you must have at least 5 years of creditworthy civilian service.

Can I retire from the federal government after 10 years?

It is possible to retire from the government with as little as 10 years of service. But it will cost you. … Under the MRA 10 option, only 10 years of service is required to qualify for immediate retirement if you are under the age of 62 (but you must be at least on your MRA at the time of your separation from the federal service).

What happens to federal pension if you quit?

As FERS employees are covered by social security, these years, when applying for a social security benefit, will be counted together with those they have earned through external employment. In this respect, nothing is lost by leaving the government.

What happens if I leave federal service before retirement age?

If you leave your government job before you become entitled to a pension: you can request that your pension contributions be repaid to you in a lump sum, or. If you have at least five years of creditworthy service, you can wait until you are of retirement age to apply for monthly pension payments.

How many years do you have to work for federal retirement?

You must work for at least 5 years with the federal government before you are eligible for a FERS federal pension, and for each year you work, you will be entitled to at least 1% of your High-3 average pay history.

Can I get pension after 5 years?

This typically means that if you leave the job in five years or less, you will lose all pension benefits. But if you travel after five years, you get 100% of your promised benefits. Graded earnings. With this type of earnings, you are entitled to a minimum of 20% of your benefit if you leave after three years.

Can I retire with 5 years of federal service?

To be eligible (eligible to receive your pension benefits from the basic benefit plan if you leave federal service before retiring), you must have at least 5 years of creditworthy civilian service. Survivors’ and disability benefits are available after 18 months of civilian service.

What happens if I leave federal service before retirement age?

If you leave your government job before you become entitled to a pension: you can request that your pension contributions be repaid to you in a lump sum, or. If you have at least five years of creditworthy service, you can wait until you are of retirement age to apply for monthly pension payments.

What happens if you quit before retirement age?

In short, unless you are able to come up with that amount and put it in a qualifying retirement account, it is considered a distribution that may be taxable. And if you are under 55 when you leave the job, you will have to pay a 10% fine for early retirement.

Can a FERS employee retire early?

It is possible to retire from the government with as little as 10 years of service. … Among them is a unique option under the Federal Employees Retirement System that allows a worker to retire at their minimum retirement age with as little as 10 years of service.

How much money do I have in FERS?

How can I find out the balance in my pension account? If you are a current employee, contact your staff office. If you are divorced from federal service or are currently retired, please contact OPM’s Retirement Office at 1-888-767-6738 or retire@opm.gov.

Where can I find my FERS statement? How to access your monthly annuity statement

- Log in to your online account. Go to OPM Retirement Services Online.

- Click Annuity Statements in the menu.

- Select the payment period you want to view from the drop-down menu.

- Click the save or print icon to download or print your bank statement.

Can I cash out my FERS?

Federal employees leaving federal service have the option to deduct their retirement contributions or wait until retirement age to apply for a retirement annuity, typically at age 60 or 62 depending on the year of service. This is called a deferred retirement.

What happens to your FERS if you quit?

As FERS employees are covered by social security, these years, when applying for a social security benefit, will be counted together with those they have earned through external employment. In this respect, nothing is lost by leaving the government.

How do I cash out my FERS retirement?

You can apply for a refund after separation at any time. Repayment of pension deduction â € “Fill in an application for repayment (SF-3106). If you submit the form within 30 days of separation, you must return it to the Benefits Office. After 30 days, forward it to OPM at the address on the form.

What is my FERS benefit?

The FERS Basic Benefit Scheme is a defined benefit scheme for federal employees that allows you and your agency to contribute a portion of your salary today to a scheme that will pay you a monthly pension when you retire, provided that you obviously meet the requirements of the scheme’s rules for participation.

How much is the FERS basic benefit?

Generally, the FERS basic benefit is 1% of your high-3 average salary times your years of credible service. FERS employees can currently contribute up to 11% of the basic salary to the austerity plan.

How much will I get from my FERS retirement?

This three-year term may be at any time during your federal career. Your regular salary, together with any local salary, is included in the calculation for your average of three. FERS pension = 1.1% x high salary-3 x years of employment. This equates to 1% – 1.1% of your highest annual salary for each year in federal service.

Can I cash my pension in at 55?

When you turn 55, you may be able to take your entire retirement pot as a lump sum if you wish. … But if you do, you could end up with a big tax bill, and risk running out of money in retirement. It is important to get advice before committing.

Can I retire at 55 and still work? Can I retire early and continue working? The short answer is yes. These days, there is no set retirement age. You can continue to work for as long as you want, and you can also access most private pensions of all ages from 55 and up – in a variety of ways.

Can I take a lump sum from my pension at 55?

Take it all as cash It’s as simple as it sounds; you can withdraw the entire pension without penalty. However, there may be tax consequences depending on the size of the pension pool. You get the first 25% as a tax-free lump sum, but you have to pay tax on the remaining 75%.

How much of your pension can you take tax free at 55?

If you are 55 years or older, you can withdraw part or all of your pension savings at once. You can take 25% of your pension tax free; the rest is subject to income tax.

Can I take a tax free lump sum from my pension at 55?

It’s as simple as it sounds; you can withdraw the entire pension without penalty. However, there may be tax consequences depending on the size of the pension pool. You get the first 25% as a tax-free lump sum, but you have to pay tax on the remaining 75%.

Can I take cash out of my pension at 55?

Most personal pensions set an age at which you can start taking money from them. It is usually not before 55. … You can take up to 25% of the money built up in your pension as a tax-free lump sum. You then have 6 months to start taking the remaining 75% of which you normally pay tax.

How much of your pension can you take tax-free at 55?

If you are 55 years or older, you can withdraw part or all of your pension savings at once. You can take 25% of your pension tax free; the rest is subject to income tax.

Can I cash in my pension if I no longer work for the company?

Can I redeem my pension if I no longer work for the company? Yes. You can withdraw money on a pension that you have built up with an old employer, as all the money you have earned is yours. … You can also transfer the money from your old employer’s pension scheme to your new pension provider if you wish.

What happens to your pension when you quit a job?

Leave your pension where it is: Leave your pension in your current employer’s pension scheme, if permitted. By doing this, your pension money remains locked (you cannot withdraw it) and they continue to earn earnings depending on how the money is invested and how the relevant markets perform.

What happens to my final salary pension if I leave the company?

When you leave the company that provides Slutlønspension, you become a ‘suspended member’ of the scheme, and the pension is sometimes referred to as ‘frozen’ or dormant. It refers to the point you left the company when you and your employer stopped paying contributions.