If you ask what the amount of retirement savings is normal, you think one 64% of Americans who don’t think their savings are on track or aren’t convinced, according to the Federal Reserve’s “Report on U.S. Household Economic Welfare in 2020. Among all adults, retirement savings median …

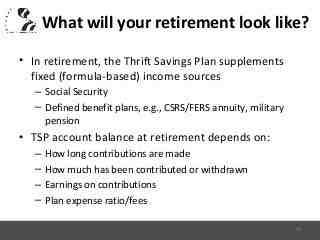

Should I move TSP money to G Fund?

| FUNDS | price | This year |

|---|---|---|

| L 2060 | $ 13,6051 | -8.58% |

| L 2065 | $ 13,6048 | -8.58% |

Are G funds in TSP safe? The funds are invested in short -term U.S. Treasury securities that are specifically issued to the TSP, so principal and interest payments are guaranteed by the federal government. When the stock market is volatile (and not always?), The G Fund seems to be a safe option.

What fund should you put your TSP in?

How Much Should You Invest in a TSP Account? We recommend investing 15% of your income for retirement.

What is the safest fund for TSP?

Fund G is invested in short -term U.S. Treasury securities that are issued specifically to TSP. Principal and interest payments are guaranteed by the U.S. government. Thus, there is no â € œcredit risk.â €

Should I put my TSP in C fund?

Fund C is the Best Performing TSP Fund Over 12 Months Among the core TSP funds, the worst performing fund over the past twelve months is Fund S which is down 5.31%. Fund G rose 1.56% in the past twelve months. Fund S also ended the month with a positive return of 0.90%.

How much money do you need to retire with $100000 a year income?

Most experts say your retirement income should be about 80% of your final pre-retirement annual income. 1 That means if you make $ 100,000 annually in retirement, you need at least $ 80,000 per year to have a comfortable lifestyle after leaving the workforce.

What is a good monthly retirement income? According to AARP, retirement income is a good about 80 percent of your pre-tax income before leaving the workforce. This is because when you don’t work anymore, you won’t pay income taxes or costs associated with employment.

Can you retire comfortably on 100k a year?

True, you can retire with an income of $ 100,000 a year So, living $ 100,000 a year as long as retirement is possible only if you build a realistic plan and you are willing to work hard.

Can you retire before 55 in the UK?

In the UK there is currently no age restriction for retirement and generally, you can access your pension pot from the first 55 years.

Do I have to retire at 67 in UK?

Retirement age. There is no legal retirement age, and employers can no longer force their employees to retire at a certain age. It’s up to you when you decide to stop working.

How much money do you need to retire with $120000 a year income?

Suppose you consider yourself a regular retiree. Between you and your spouse, you now have an annual income of $ 120,000. Based on the 80%principle, you can expect to need approximately $ 96,000 in annual income after you retire, that is $ 8,000 per month.

How do I get ahead financially in my 50s?

With around 10 to 15 years of full-time work ahead, these are some of the most memorable and reliable money movements that you can implement in your 50s.

- Curb Education Expenses. …

- Create a Caregiving Plan. …

- Take advantage of Catch-Up Contributions. …

- Double Down on Investment. …

- Don’t Touch Your Retirement Account. …

- Eliminate Debt. …

- Focus on Your Future.

How much money does the average 50 year old have saved? For ages 44 to 49, retirement savings average $ 81,347. Finally, people ages 50 to 55 have saved an average of $ 124,831.

Where should you be financially at 50?

In fact, according to retirement plan provider Fidelity Investments, you must have 6 times your income saved by age 50 in order to establish employment at age 67.

How much should you have saved by age 50?

Retirement Savings Goals By age 40, you should have three times your annual salary. By age 50, six times your salary; by age 60, eight times; and by age 67, 10 times. 8 If you are 67 years old and receive $ 75,000 per year, you should save $ 750,000.

What is the average amount in TSP?

The average TSP account balance for Uniformed Service Members reached nearly $ 30,000 at the end of 2019, while the balance for new ‘Blended Retirement System’ (BRS) participants reached $ 7,000 in just two years since BRS operated.

How much do I need to retire on $80000 a year?

Using the standard assumptions built into the Moneysmart Retirement Calculator – and assuming you are single, will retire at age 65, want funds to last until age 90, and require an annual income of $ 80,000 (actually up each year for inflation) – then you need around $ 1,550,000 by retire to live on …

How much should I retire on $ 60 000 a year? Most retirees want to maintain a standard of living when they retire. To accomplish this, financial experts say that you need between 70-80% of your pre-retirement income. So, for example, a couple earning $ 60,000 per year would need between $ 42,000 ($ 60,000 x.

How much money do you need to retire with $80000 a year income?

Retirement Rule of Thumb: The 4%Rule An easy formula to use is to divide your desired annual retirement income by 4%, which is known as the 4%rule. To generate the $ 80,000 cited above, for example, you need a nest egg when you retire around $ 2 million ($ 80,000 / 0.04).

How much do I need to retire if I make 100k a year?

How much money do you need for $ 100k per Year? To create a $ 100,000 retirement income, you thought you needed $ 1.9 million in savings.

How much money do you need to retire with $80 000 a year income?

Many experts say your annual retirement income should be 70 percent to 80 percent of your final pre-retirement salary. So, if you earn $ 80,000 when you retire, you need at least $ 56,000 for each year that you are going to retire.

How much do I need to save to have 75000 a year in retirement?

According to the Center for Retirement Research at Boston College, you need at least 80 percent of your current income in retirement. This is sometimes called â € œreplacement income.â € So if you earn $ 75,000 a year now, you will need at least $ 60,000 a year to maintain your lifestyle.

How much do I need to save to retire 100k a year?

How much money do you need for $ 100k per Year? To create a $ 100,000 retirement income, you thought you needed $ 1.9 million in savings.

How much do I need to save to have 80000 a year in retirement?

Some experts recommend that you save at least 70 â € “80% of your pre retirement income. This means if you earned $ 100,000 a year before retire, you should plan to spend $ 70,000 â € “$ 80,000 a year in retirement. The advantage of this strategy is easy to calculate.

Sources :