Social Security offers a monthly benefit check for many types of recipients. As of August 2021, the average check is $ 1,437.55, according to the Social Security Administration – but that amount can be very different depending on the type of recipient.

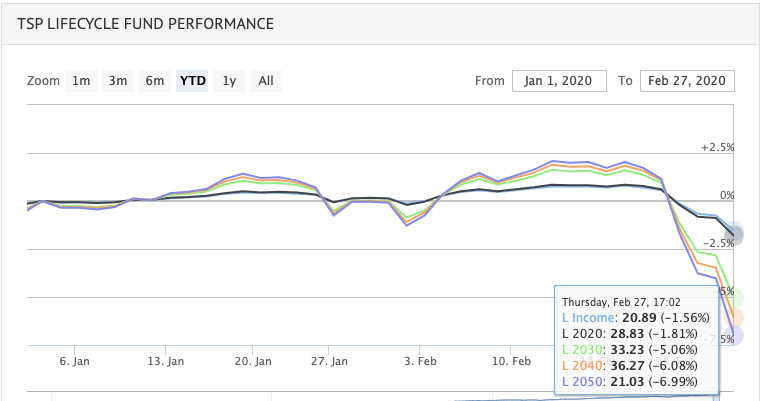

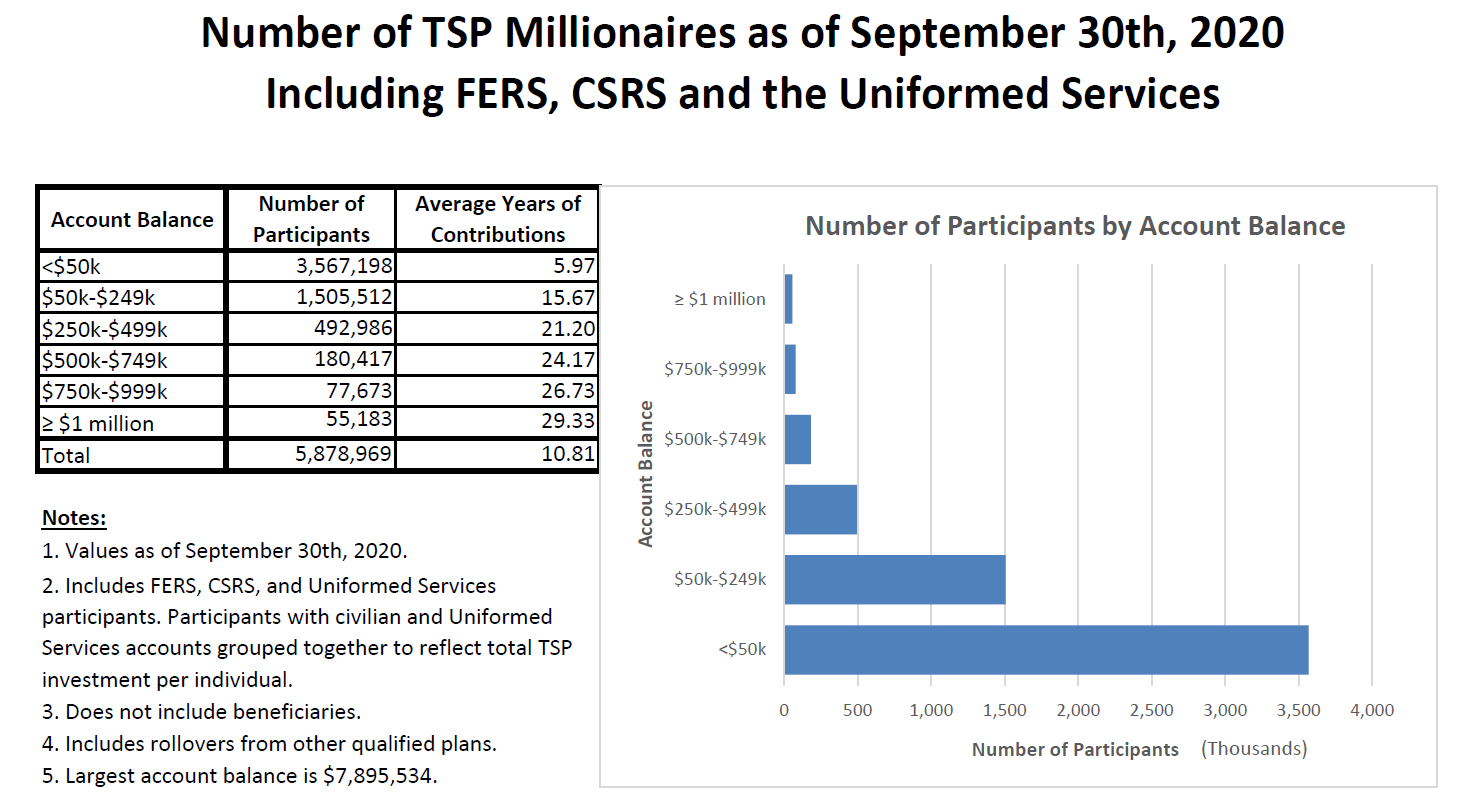

Are there TSP millionaires?

There are almost 99,000 millionaires in the TSP as of September 30, 2021. 99,000 is a big number, but, remember that at the end of August when there were 6,402,933 TSP investors. That is, only 1.5% of TSP investors are millionaires.

What is the largest TSP account? The balance of the largest TSP account at the end of March 2021 was a staggering $ 9,318,238, up from â € œjustâ € $ 6.3 million March 2020. Not a bad year of retirement plan growth, especially given the challenges presented by the COVID pandemic- 19.

Can TSP make you a millionaire?

It is a â € œelite.â € club With over 75,000 members, TSP millionaires acquired their title by contributing to the TSP for 25-30 years, being at least relatively aggressive with investing their funds. New members are welcome, but once you get to the financial ‘finances’, you need to work just as hard to stay there.

How much should you have in your TSP when you retire?

How much should you invest in a TSP Account? We recommend investing 15% of your retirement income. When you’re constantly contributing 15%, you’re setting yourself up for options when you retire.

How much should I have in my TSP by age 50?

Retirement Saving Goals By age 50, six times your salary; by age 60, eight times; and by age 67, 10 times. 8ï »¿If you reach age 67 and earn $ 75,000 a year, you should save $ 750,000.

Should I leave my money in TSP when I retire?

Leave it in the TSP and let it grow Depending on when you start retirement, you can leave the money in the TSP let it continue to grow. If you don’t need to access it yet, it might be wise to let it be. Like other retirement accounts, you will need to start withdrawing money at age 72.

What is the average amount in TSP balance at retirement?

| Age | Average Contribution Rate | Average Balance |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| All Ages | 9% | $ 95,600 |

How much should I have in my TSP by age 50?

Retirement Saving Goals By age 50, six times your salary; by age 60, eight times; and by age 67, 10 times. 8 If you reach age 67 and earn $ 75,000 a year, you should save $ 750,000.

How much should I get in my TSP at 60? By age 60: Save eight times your annual salary. By age 67: Save 10 times your annual salary.

How much should I have in my TSP by age 50?

Retirement Saving Goals By age 50, six times your salary; by age 60, eight times; and by age 67, 10 times. 8ï »¿If you reach age 67 and earn $ 75,000 a year, you should save $ 750,000.

What is the average amount in the TSP?

There are 287,000 participants in the Civil Service Retirement System, with an average account balance at the end of 2020 of $ 175,000.

How much should you have in TSP to retire?

How much should you invest in a TSP Account? We recommend investing 15% of your retirement income. When you’re constantly contributing 15%, you’re setting yourself up for options when you retire.

What is the average amount in the TSP?

There are 287,000 participants in the Civil Service Retirement System, with an average account balance at the end of 2020 of $ 175,000.

How many TSP is a millionaire?

| Account Balance | Number of Participants | Average Contribution Years |

|---|---|---|

| $ 500k- $ 749k | 211,806 | 23.22 |

| $ 750k- $ 999k | 99,287 | 25.35 |

| â ‰ ¥ $ 1 million | 98,523 | 28.44 |

| Total amount | 6,214,062 | 10.64 |

What is a good amount in TSP?

How much should you invest in a TSP Account? We recommend investing 15% of your retirement income. When you’re constantly contributing 15%, you’re setting yourself up for options when you retire.

What is a good income for retirement?

| Age of Household | Median Income | Mean Income |

|---|---|---|

| Households aged 60-64 | $ 64,846 | $ 91,543 |

| Households aged 65-69 | $ 53,951 | $ 79,661 |

| Households aged 70-74 | $ 50,840 | $ 73,028 |

| Households aged 75 and over | $ 34,925 | $ 54,416 |

What is a good monthly retirement income? According to 2016 data from the Bureau of Labor Statistics, the average 65+ home spends $ 48,885 a year, which works out to about $ 4,000 a month.

Can I retire on $5000 a month?

Typically, you can generate at least $ 5,000 a month in retirement income, guaranteed for the rest of your life. This does not include Social Security Benefits.

How much per month is a good retirement?

Based on your projected savings and target age, you may have about $ 1,300 a month in retirement income. If you save this amount by age 67, you’ll be able to spend $ 2,550 a month to support your retirement living costs. Tap the bars to reveal more about your results.

What is a reasonable monthly income when you retire?

On average, older people earn between $ 2000 and $ 6000 a month. Older retirees tend to earn less than retire younger. It is recommended that you save enough to replace 70% of your monthly income before retiring. This works out to about 10-12 times the amount you make in a year.

How much does the average retired person live on per month?

According to Office for Labor Statistics data, ‘larger households’ – defined as those run by someone 65 and older – spend an average of $ 45,756 a year, or about $ 3,800 a month.

How many IRA millionaires are there?

There are More 401 (k) Millionaires and IRA Than Ever.

How Many Retirement Account Millionaires Are There? Loyalty Investments reported that the number of 401 (k) millionaire investors with 401 (k) account balances of $ 1 million or moreâ € ”reached 233,000 at the end of the fourth quarter of 2019, a 16% increase from the third quarter account. of 200,000 and up over 1000% from the 2009 count of 21,000.

Do billionaires have IRA accounts?

Lawmakers find thousands of ‘mega’ IRAs The answer: there are nearly 25,000 during tax year 2019, three times as many as back in 2011. Nearly 500 accounts hold more than $ 25 million. Buffett, which has historically supported higher taxes on the rich, had a Roth IRA worth $ 20.2 million at the end of 2018.

Can IRA make you a millionaire?

Fully fund a Roth IRA every year, build a diversified portfolio, and you can become a millionaire in time for retirement. As long as you start early enough.

Do IRAs make sense for high earners?

You may be eligible for incredible tax savings if you contribute to a Traditional IRA account in 2021. … Being a higher earner now means you’re in a great position to set yourself up for a great retirement and enjoy instant tax savings not available to Roth IRA Contributors.

Can millionaires have a Roth IRA?

High earners who exceed the annual income limits set by the IRS cannot make direct contributions to a Roth IRA. The good news is that there is a gap to go around the limit and reap the tax benefits that Roth IRAs offer.

How many millionaires does IRA have?

IRA 401 (k) and millionaire ranks are exploding. The number of 401 (k) accounts with at least $ 1 million in balances at Fidelity Investments grew 84% year-on-year to 412,000, while seven-figure IRA volumes jumped more than 64% to 341,600, Fidelity said.

What percent of people have IRA?

Men and women are equally likely to own an IRA (table 1). About 23 percent of taxpayers own traditional IRAs, while about 10 percent own Roth IRAs. Many types of IRAs can be owned by taxpayers. Only a small percentage of taxpayers own SEP IRAs or Simple IRAs.

Do millionaires have IRAs?

Wealthy people use many accounts to build wealth, and three are widely available. They use retirement accounts like IRAs and 401 (k) s for tax benefits and free money.