Is TSP better than IRA?

Basically, your agency will contribute money to your TSP account depending on how much you are contributing. There is no equivalent when you invest in an IRA. Another big difference between TSP and IRA is how much you can contribute each year. From 2021 onwards, you can invest much more in TSP compared to IRAs.

Is TSP a good retirement plan? Although they don’t have as many funds to choose from, TSP participants have a big advantage over most 401 (s) investors: lower fees. The total expenditure ratio, which covers investment and administrative fees, is 0.055% for individual TSP funds.

Should I roll my TSP into an IRA?

In short, even if the recommendation is good, any financial professional who recommends moving money from TSP to IRA can benefit from that move.

Should I move my TSP after retirement?

Leave it at TSP and let it grow As you start retiring, you can leave your money at TSP to keep it growing. If you do not have access to it yet, it may be advisable to leave it. As with other retirement accounts, you will need to start with a minimum retirement age of 72 years.

How do I avoid paying taxes on my TSP withdrawal?

If you want to avoid paying taxes on your TSP account for as long as possible, do not withdraw until the IRS requires you to do so. By law, you must take the required Minimum Allowances (RMD) from the age of 72.

Why is TSP so great?

The tax is deferred and cheap. As with the IRA, federal taxes on your TSP earnings are deferred until you retire. In addition, TSP expenses are low compared to civilian plans provided by employers and other internal or external IRA mutual funds. All of this means that more of your money goes to work for you.

Can you get rich from TSP?

In the last quarter of 2021, the number of millionaires investing in the Thrift Savings Plan (TSP) rose sharply by almost 50%.

Is TSP a good idea?

More than 5 million people have a Thrift Savings Plan account, and even better, 89% of participants are happy or satisfied with the Thrift Savings Plan. Now, the key to investing in a Thrift Savings Plan is to invest consistently and choose the right funds to help you create long-term wealth.

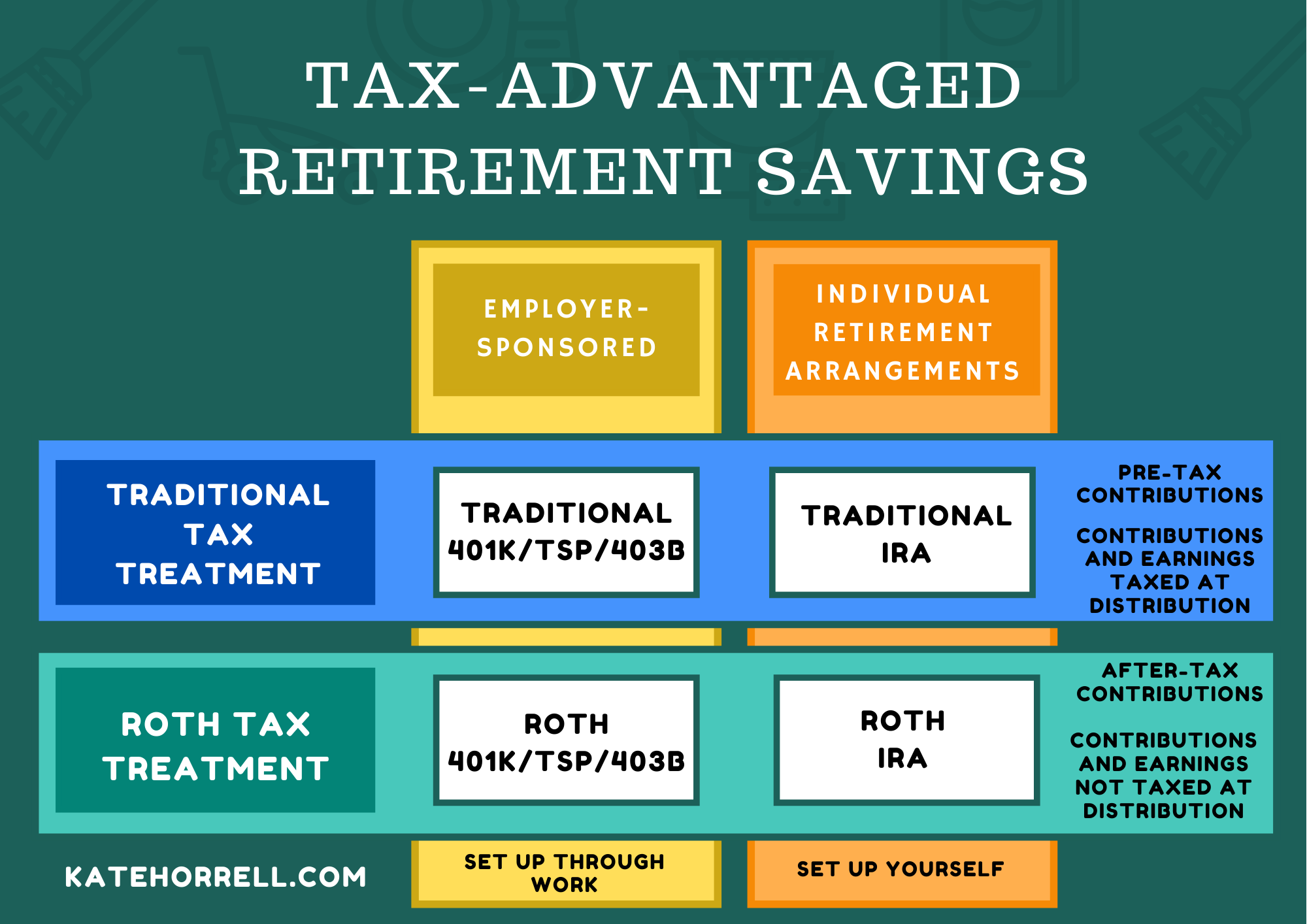

Can I have both TSP and IRA?

Can I help with my TSP account and an IRA? Yes. Your participation in the TSP does not affect your right to contribute to an IRA.

Can I have both TSP and 401k?

The Internal Revenue Service (IRS) has provided tax benefits to retirement plans to promote retirement savings. The most commonly used retirement accounts are 401 (k) and Thrift Savings Plan (TSP). And you can have both.

Can I max out TSP and contribute to a Roth IRA?

The IRC § 402 (g) optional delay limit for 2020 is $ 19,500. This limitation applies to regular (deferred tax) and Roth contributions made by an employee during the calendar year. The combined total of the contributions made during the year (deferred tax) and Roth’s contributions cannot exceed the optional deferral limit.

Should I transfer my TSP to an IRA?

In short, even if the recommendation is good, any financial professional who recommends moving money from TSP to IRA can benefit from that move. 6. Compare investment opportunities and other services.

Should I move my TSP after retirement? Leave it at TSP and let it grow As you start retiring, you can leave your money at TSP to keep it growing. If you do not have access to it yet, it may be advisable to leave it. As with other retirement accounts, you will need to start with a minimum retirement age of 72 years.

Should I move my money out of TSP?

Consider leaving your funds in TSP if you don’t want to deal with additional paperwork or if you want more investment opportunities. Alternatively, consider adding your TSP account assets to your new 401 (s) plan if you have one or other of these options.

Where should my money be in TSP?

How much should I contribute to my TSP? A common suggestion for how much to save for retirement is at least 15% of your income. Others believe that the minimum should be one that maximizes your employer’s contribution; In the case of TSP funds, that would be 5% of your income.

Can you lose money in a TSP?

If the stock market goes up, you can make money. If you go down, you may lose money. The risk is still higher than the F fund, but the rate of return is also higher. S Fund.

Can you transfer TSP to IRA?

If you decide to transfer your active TSP to an IRA, you can choose a traditional IRA or a Roth IRA. No tax will be paid if you transfer from a traditional TSP account to a traditional IRA, or if you transfer your contributions and earnings from a Roth TSP account to a Roth IRA.

How do I transfer my TSP?

A transfer or “direct flip” occurs when eligible plans send all or part of your money to TSP. Use Form TSP-60, a transfer request to TSP, for tax-deferred amounts. To transfer Roth money, use Form TSP-60-R to request a Roth transfer to TSP.

Should I transfer my TSP to an IRA?

Professional Money Management: One of the advantages of transferring TSP funds to an IRA is that a professional investment advisor can directly manage IRA investments. Money management can be confused with investments and may benefit some who do not want to value the advice of an investment manager.

How much will my TSP grow after retirement?

When the Federal Workers ’Retirement System was set up, experts said the TSP would be critical, along with Social Security and a changed civil service income, as the TSP could provide up to 30% to 50% of retirees’ income.

How old should I be in my TSP at 50? At age 40, you should have a triple annual salary. At age 50, six times your salary; At age 60, eight times; and at age 67, 10 times. 8 If you turn 67 and earn $ 75,000 a year, you should save $ 750,000.

Can you get rich from TSP?

In the last quarter of 2021, the number of millionaires investing in the Thrift Savings Plan (TSP) rose sharply by almost 50%.

Is maxing out TSP a good idea?

The Thrift Savings Plan (TSP) is a great tool for federal employees to save for retirement. Saving your contributions to TSP and further reducing them is usually considered a good thing. Yes, maximizing your TSP can be very beneficial, but it may not be the best for your financial future.

What is the average return on TSP?

The TSP C-Fund, which is close to the S&P 500, gained an average annual gain of 12.29 percent between 1988 and 2020; The TSP F-Fund, a broad index representing the U.S. bond market, averaged 6.29 percent annually from 1988 to 2020; and G-Fund, a long-term U.S. Treasury bill, has averaged 4.70 years …

How much money should I have in my TSP when I retire?

Most experts say that your retirement income should be about 80% of your final pre-retirement income. 1 This means that if you earn $ 100,000 a year in retirement, you need at least $ 80,000 a year to make a comfortable living after leaving the workforce.

What is the average amount in TSP balance at retirement?

| Adina | Average contribution rate | Average balance |

|---|---|---|

| 60-69 | % 11 | $ 182,100 |

| 70-79 | % 12 | $ 171,400 |

| All ages | % 9 | $ 95,600 |

Can you retire with 500k in TSP?

For example, if you start with 500k in retirement, you can get $ 20,000 out of the first year. In the second year, if you have 5% inflation, you can get $ 21,000 out of it.

Does TSP still grow after retirement?

Once you start retiring, you can leave the money in TSP to keep it growing. If you do not have access to it yet, it may be advisable to leave it. As with other retirement accounts, you will need to start with a minimum retirement age of 72 years. This is called the Minimum Required Distribution (RMD).

How long can you keep TSP after retirement?

1. Leave Money in TSP. You can withdraw money from the Thrift Savings Plan until the age of 70 ½ until the 1st of April of the year. After that, you need to start taking distributions.

What is the average TSP balance at retirement?

| Adina | Average contribution rate | Average balance |

|---|---|---|

| 60-69 | % 11 | $ 182,100 |

| 70-79 | % 12 | $ 171,400 |

| All ages | % 9 | $ 95,600 |

Should I transfer my TSP to an IRA?

Professional Money Management: One of the advantages of transferring TSP funds to an IRA is that a professional investment advisor can directly manage IRA investments. Money management can be confused with investments and may benefit some who do not want to value the advice of an investment manager.

Do I have to withdraw my money from TSP? Consider leaving your funds in TSP if you don’t want to deal with additional paperwork or if you want more investment opportunities. Alternatively, consider adding your TSP account assets to your new 401 (s) plan if you have one or other of these options.

Can you transfer TSP to IRA?

If you decide to transfer your active TSP to an IRA, you can choose a traditional IRA or a Roth IRA. No tax will be paid if you transfer from a traditional TSP account to a traditional IRA, or if you transfer your contributions and earnings from a Roth TSP account to a Roth IRA.

When can I roll my TSP into an IRA?

You have 60 days to deposit your traditional TSP funds, including 20% attached, back into your Roth IRA. If you do not meet this deadline, the unpaid portion will be taxed.

Can I transfer my TSP into a Roth IRA?

Converting a TSP Roth IRA As stated above, if you transfer funds from a traditional TSP to a Roth IRA, you will have to pay the full amount of income taxes. And, TSP will not withhold any funds for tax purposes, i.e. you will need to plan your entire tax bill.

How do I make the most money in my TSP?

6 Keys to Maximizing Your Thrift Savings Plan Account

- Weigh your options. …

- Help as much as you can. …

- Consider the Roth Opportunity. …

- Don’t retire early. …

- Invest according to your situation. …

- Control your investments.

Sources :