Can I contribute to both TSP and a 401k?

You are eligible to have both 401 (k) and TSP and can contribute to anyone during the year. You can contribute to both plans if you have worked for the government and a private employer. While you can hold on to and contribute to both plans, the IRS limits the amount of money you can invest in them each year.

Can I make a full contribution to TSP? Can I make a full payment to my TSP? Your contributions to the Savings Plan must be made by deducting your wages; you cannot pay the full amount.

Is a thrift savings plan the same as a 401k?

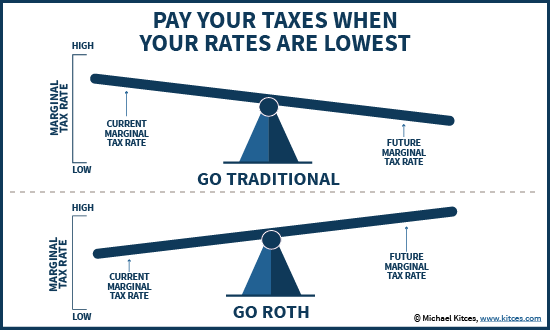

A savings plan is similar to a 401 (k) plan for federal employees and uniformed service personnel. TSP participants can receive an immediate tax rebate for their savings. They may also choose to invest in Roth for tax-free retirement.

Is TSP considered a retirement plan?

The Thrift Savings Plan (TSP) is a retirement savings plan and investment plan for Federal employees and members of the uniformed services, including the Readiness Reserve.

What is a Thrift Savings Plan considered?

The Thrift Savings Plan (TSP) is a tax-deferred retirement savings and investment plan that offers Federal employees the same kind of savings and tax benefits that many private companies offer their employees under 401 (k) plans.

How much does the government match in TSP?

When you become eligible, your agency will equal the first 3% of the base salary you contribute to each payday dollar for a dollar. Each dollar of the next 2% of base salary will be equal 50 cents on the dollar. You immediately belong to the matching contributions.

Does government match count towards TSP limit?

The short and simple answer is no. Compatible contributions made by employers do not count toward your maximum contribution limit. But the IRS makes a limit on the total contribution to 401 (k) from both the employer and the employee.

How much does the military match TSP?

How much is the military on the TSP? The military automatically matches 1% of your base salary into your military Thrift Savings Plan account. If you contribute at least 5% of your military salary to the Roth or Traditional TSP, the military will contribute another 5% to your Traditional TSP.

How much should I have in my TSP at 40?

How much should I have in my TSP up to 40? Retirement Savings Benefits At age 40, you should have triple your annual salary. At the age of 50, six times your salary; at the age of 60, eight times; and at the age of 67, 10 times. 8ï »If you reach the age of 67 and earn $ 75,000 a year, you should have $ 750,000 saved.

How much did a 40-year-old save for retirement? How many 40-year-olds actually have a pension savings? The average 401 (k) balance for Americans between the ages of 40 and 49 is $ 120,800 in the fourth quarter of 2020, according to data from Fidelity’s retirement platform. Americans in this age group contribute an average of 8.9% of their wages.

What is the average TSP balance by age?

| Age | Medium fee | Medium balance |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| All ages | 9% | $ 95,600 |

What is the shift business?

Shift Technologies, Inc. is an American company that maintains an online marketplace for buying and selling used cars. Founded in 2014, Shift is based in San Francisco’s Mission District.

What is the shift project study?

The Change Project, a joint project at Harvard Kennedy School and UCSF, examines the nature and consequences of precarious employment in the service sector with a focus on how policymakers and firms can improve work quality.

How much should I have in my TSP at 45?

By the age of 45, experts recommend that you have the equivalent of four times your annual salary in the bank if you plan to retire at age 67 and maintain a similar lifestyle, according to a recent report by financial services company Fidelity.

How much should I have in my TSP by age 50?

Retirement Savings Benefits At age 40, you should have triple your annual salary. At the age of 50, six times your salary; at the age of 60, eight times; and at the age of 67, 10 times. 8ï »If you reach the age of 67 and earn $ 75,000 a year, you should have $ 750,000 saved.

How much should a 45 year old have in savings?

Basically, at the age of 45, you should have a savings / net worth equivalent to at least 8X your annual expenses. Your spending coverage ratio is the most important ratio to determine how much you have saved because it is a function of your lifestyle.

Why did I get an extra deposit from Social Security this month?

The surcharge compensates those Social Security beneficiaries who were affected by the error for any shortfall they experienced between January 2000 and July 2001, when the payments were made. Who was affected by the mistake? The mistake affected people who were eligible for Social Security before January 2000.

Are taxes high in Luxembourg? Income tax rates in Luxembourg Income tax in Luxembourg is charged on a progressive scale with 23 brackets, ranging from 0% to 42%. Workers also have to pay between 7% and 9% as an additional contribution to the employment fund. The first €11,265 is offered tax-free, with the lowest rate of 8% kicking afterwards.

What is Social Security in Luxembourg?

Luxembourg has a highly developed and effective social security system. Every citizen has the right to social assistance (family benefits, pensions, reimbursement of medical expenses, work capacity, etc.). All Luxembourgers are subject to social security.

What is Social Security in a country?

Social security is the protection that society provides to individuals and households to ensure access to health care and to ensure income security, especially in cases of old age, unemployment, illness, disability, work injury, motherhood or loss of life.

How much is Social Security in Luxembourg?

| Related | Last | One |

|---|---|---|

| Own Income Tax | 45.78 | percentage |

| Corporate Tax | 24.94 | percentage |

| Sales Tax | 17.00 | percentage |

| Social Security | 27.62 | percentage |

What is dependence contribution in Luxembourg?

The dependency contribution amounts to 1.4% (side rate).

What are the benefits in Luxembourg?

Benefits for employees in Luxembourg

- Social Security. The Luxembourg social security system was codified into a single unified system. …

- Healthcare and Insurance. …

- Holidays and Annual Holiday. …

- Maternity and Parental Leave. …

- Sick and Disabled Leave. …

- Pensions: Mandatory and Typically Arranged.

Should I leave my money in TSP when I retire?

Depending on when you start retiring, you can just leave the money in the TSP, let it continue to grow. If you don’t need to access it yet, it might be wise to let it be. Similar to other retirement accounts, you will need to start minimum withdrawals at the age of 72. This is called a Minimum Required Distribution (RMD).

Do I have to keep my TSP account? Consider adding a “hold” to your account to prevent fraudulent loan and withdrawal requests. If you are concerned about identity theft, data breach, or someone else gaining access to your TSP account, you may want to consider withholding to prevent new withdrawals and loan applications.

How long can you keep TSP after retirement?

1. Leave Money in the TSP. You can leave the money in your Thrift Savings Plan account until April 1 of the year after you turn 70 ½. After that, you need to start taking distributions.

Should I take my money out of TSP when I retire?

Leave it in the TSP and let it grow Depending on when you start retiring, you can just let the money in the TSP let it continue to grow. If you don’t need to access it yet, it might be wise to let it be. As with other retirement accounts, you will need to start minimum withdrawals at the age of 72.

What is the average amount in TSP balance at retirement?

| Age | Medium fee | Medium balance |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| All ages | 9% | $ 95,600 |

Should I move my money out of TSP?

As a starting point, the burden of proof should drop during transfer from the TSP. Its beautiful simplicity coupled with rock bottom costs makes it an ideal investment choice. One should not lightly move one’s retirement savings from the TSP.

Where should my money be in TSP?

How much should I contribute to my TSP? One common suggestion on how much to save for retirement is at least 15% of your income. Others think that the minimum should be whatever maximizes your employee contribution; in the case of TSP funds, that would be 5% of your income.

What is the average amount in TSP balance at retirement?

| Age | Medium fee | Medium balance |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| All ages | 9% | $ 95,600 |

Can I roll my 401k into my TSP?

We will accept both direct and indirect transfers of tax-deferred money from traditional IRAs, SIMPLE IRAs and eligible employers such as 401 (k) or 403 (b) to the traditional balance of your account.

Can you move money in TSP? First and foremost, you can roll money into your TSP while you are still an employee or after you have left federal employment. The income component of a Traditional IRA, where you could not deduct your IRA contributions from your federal income tax (called “Traditional non-deductible IRA”).

Can I transfer my IRA to my TSP?

To transfer or transfer a traditional IRA to your TSP account, you and the IRA guardian must complete Form TSP-60, Request for Transfer in the TSP. The form is available on the TSP website or you can call ThriftLine.

How do I transfer an IRA?

If you want to move your individual retirement account (IRA) balance from one provider to another, simply call the current provider and request a “trustee-to-trustee” transfer. This moves money directly from one financial institution to another, and it will not trigger taxes.

Is TSP better than IRA?

IRA has one major advantage over the TSP. Flexibility. As long as you meet certain basic criteria, you can withdraw money from your IRA however you like. With the TSP though, there are a few rules that control how and when you can withdraw money.

Is TSP better than 401k?

Although they may not have as much funding to choose from, TSP participants have one big advantage over most 401 (k) investors: lower fees. The total expenditure ratio, which covers both investment and management fees, is 0.055% for individual TSP funds.

Why is TSP so great?

It is tax deferred and payable. As with IRAs, federal income taxes on your TSP are deferred until they are withdrawn. Moreover, TSP expenditures are low compared to civilian employer-provided plans and other mutual funds within or outside IRAs. All this means that more of your money is working for you.

Is TSP same as 401k?

A savings plan is similar to a 401 (k) plan for federal employees and uniformed service personnel. TSP participants can receive an immediate tax rebate for their savings. They may also choose to invest in Roth for tax-free retirement.

How do I convert my 401k to TSP?

Insert your TSP account into your new employer’s 401 (k) plan. Withdraw your TSP account assets in full. Transfer your TSP account assets to a qualified annuity.

Sources :