Is it better to contribute to 401k or Roth 401k?

If you prefer to pay taxes now and get them out of the way, or you think your tax rate will be higher in retirement than it is now, choose a Roth 401 (k). … In return, each Roth 401 (k) contribution will reduce your paycheck by more than a traditional 401 (k) contribution, as it is made after tax rather than before.

Is it better to contribute to Roth 401k or Roth IRA? A Roth 401 (k) tends to be better for people with high incomes, has higher contribution limits, and allows for employer matching funds. A Roth IRA allows your investments to grow longer, tends to offer more investment options, and allows for easier early withdrawals.

Can you contribute to both a 401k and a Roth 401k?

If your employer offers a 401 (k) plan, there may still be room in your retirement savings for a Roth IRA. Yes, you can contribute to both a 401 (k) and a Roth IRA, but there are certain limitations that you will need to consider. This article will explain how to determine your eligibility for a Roth IRA.

Are 401k and Roth 401k limits combined?

This is an after-tax contribution, which means that you will not be able to deduct the contributions from your tax base. Please note that the maximum contribution is an aggregate limit on all of your 401 (k) plans; You can’t save $ 19,500 on a traditional 401 (k) and another $ 19,500 on a Roth 401 (k).

How much can I contribute to my 401k and Roth 401k in 2020?

The maximum amount you can contribute to a Roth 401 (k) for 2020 is $ 19,500 if you are under age 50. If you are age 50 or older, you can add an additional $ 6,500 per year in “catch-up” contributions. , bringing the total amount to $ 26,000.

How much can you contribute to a 401k and a Roth IRA in the same year?

So, if you have a Roth 401 (k) plan and a Roth IRA, your total annual contribution for all accounts in 2021 and you have a combined limit of $ 25,500 ($ 19,500 Roth 401 (k) contribution $ 6,000 Roth IRA contribution ) or $ 33,000 if you are 50 or older ($ 19,500 Roth 401 (k) contribution $ 6,500 catch-up contribution …

How much do I need in my TSP?

Answer: More! I often say that there is not much money in the Thrift Savings Plan. If you want your TSP balance to be able to generate an annual inflation-indexed income of $ 10,000, most financial planners will suggest that you have a balance of $ 250,000 at retirement.

How much should you have on your TSP at 30? Here’s what Fidelity recommends that Americans have saved at every age: By 30, you should have saved the equivalent of your salary. At 40, you should have saved three times your salary. At 50, you should have saved six times your salary.

What is the average amount in TSP balance at retirement?

To complete the grid, 530,357 participants have account balances ranging from $ 250,000- $ 499,000 (20.36 years contributing on average) and 212,110 participants are in the range of $ 500,000- $ 749,000 (23.12 years on average).

How much should I have in my TSP at 60?

At age 60: save eight times your annual salary. At age 67: Save 10 times your annual salary.

What is the average TSP balance by age?

| Age | Average contribution rate | Average balance |

|---|---|---|

| 20-29 | 7% | $ 10,500 |

| 30-39 | 8% | $ 38,400 |

| 40-49 | 8% | $ 93,400 |

| 50-59 | 10% | $ 160,000 |

How much should I have in my TSP by age 50?

Retirement Savings Goals By age 40, you should be making three times your yearly salary. At age 50, six times your salary; at age 60, eight times; and before age 67, 10 times.8 If you reach age 67 and earn $ 75,000 per year, you should have saved $ 750,000.

How many TSP is a millionaire?

| Account balance | Number of participants | Average years of contributions |

|---|---|---|

| $ 500,000- $ 749,000 | 211,806 | 23.22 |

| $ 750,000- $ 999,000 | 99,287 | 25.35 |

| â ‰ ¥ $ 1 million | 98,523 | 28.44 |

| Total | 6,214,062 | 10.64 |

How many TSP participants are millionaires?

Good news: There are 98,879 federal TSP millionaires! Bad News: Too Many People Know! The number of federal / postal workers who have become Thrift Savings Plan millionaires has exploded in recent years.

How much money should I have in my TSP?

How much should I invest in a TSP account? We recommend investing 15% of your income for retirement. When you contribute 15% consistently, you prepare yourself for options when you retire.

Should I rollover 401k to TSP?

Ability to Transfer Old 401k IRAs to TSP – You can transfer your old IRA or 401 (k) accounts to TSP. This will allow you to consolidate investments in one account for better management. This is highly recommended as old 401 (k) plans tend not to get as much TLC so that consolidation can maximize your return.

Should I transfer my 401k to TSP? Option 2: Transfer your funds to your new employer’s plan If you are leaving the non-federal sector for a job with the government, it is often worth transferring money from your old employer’s plan to the TSP. The benefits of this move include: Simplification by having fewer accounts to keep track of.

Should I roll into TSP?

5 – Transfer of traditional IRA assets after taxes to the traditional TSP or transfer of Roth IRA assets to the TSP Roth. Traditional after-tax IRA assets should never be incorporated into the traditional TSP. Only traditional IRA assets before taxes should be transferred to the traditional TSP.

Should I roll over my TSP?

You do not have to reinvest 100% of the investments you have in the TSP. You may decide to renew some assets for a specific reason, leaving the rest with the TSP. Whatever you decide, get the advice of an expert advisor who has no financial interest in your decision.

What is a good percentage to contribute to TSP?

How much should I invest in a TSP account? We recommend investing 15% of your income for retirement. When you contribute 15% consistently, you prepare yourself for options when you retire.

Should I leave my money in TSP?

Leave it in the TSP and let it grow Depending on when retirement begins, you can simply leave the money in the TSP to keep it growing. If you don’t need to access it yet, it would be wise to leave it at that. As with other retirement accounts, you will need to start making minimum withdrawals at age 72.

Should I keep my money in TSP after retirement?

Leave it in the TSP and let it grow Depending on when retirement begins, you can simply leave the money in the TSP to keep it growing. If you don’t need to access it yet, it would be wise to leave it at that. As with other retirement accounts, you will need to start making minimum withdrawals at age 72.

Should I move my TSP to an IRA?

If you move your TSP account to a Roth IRA, you could lose this benefit. Pay attention to taxes. If you decide to move your TSP account to an IRA, be sure to transfer the funds directly to your new institution rather than through an indirect transfer (where the money comes to you first).

At what age do I have to start withdrawing from my TSP?

1) You must begin withdrawals when you turn 70½ In general, separated participants are expected (required) to begin withdrawing from the TSP once they reach the age of 70½, but you do not have to begin withdrawing into your account exactly when you turn 70 ½.

What is the average TSP balance at retirement?

| Age | Average contribution rate | Average balance |

|---|---|---|

| 60-69 | eleven% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| All ages | 9% | $ 95,600 |

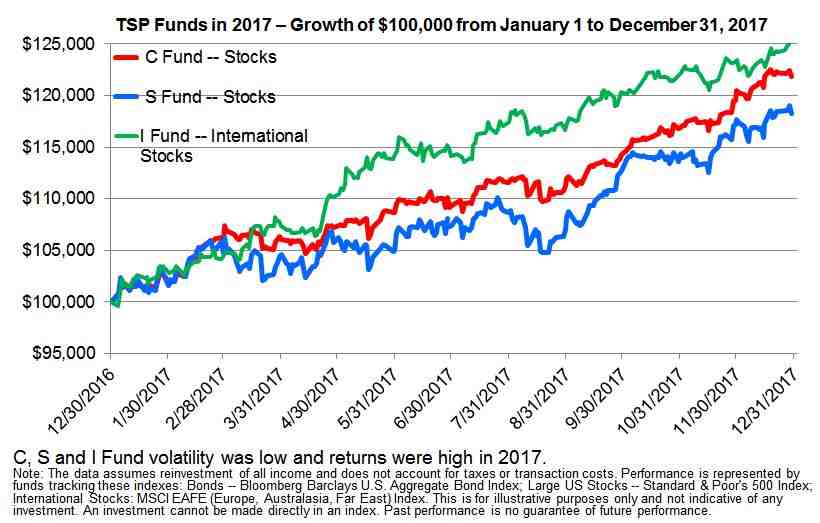

How do I maximize my TSP growth?

6 keys to maximize your savings plan account

- Evaluate your options. …

- Contribute as much as possible. …

- Consider the Roth option. …

- Don’t leave early. …

- Invest according to your situation. …

- Monitor your investments.

What is a good percentage to contribute to TSP? How much should I invest in a TSP account? We recommend investing 15% of your income for retirement. When you contribute 15% consistently, you prepare yourself for options when you retire.

What is the average amount in TSP balance at retirement?

To complete the grid, 530,357 participants have account balances ranging from $ 250,000- $ 499,000 (20.36 years contributing on average) and 212,110 participants are in the range of $ 500,000- $ 749,000 (23.12 years on average).

How much should I have in my TSP at 60?

At age 60: save eight times your annual salary. At age 67: Save 10 times your annual salary.

What is the average TSP balance by age?

| Age | Average contribution rate | Average balance |

|---|---|---|

| 20-29 | 7% | $ 10,500 |

| 30-39 | 8% | $ 38,400 |

| 40-49 | 8% | $ 93,400 |

| 50-59 | 10% | $ 160,000 |

How much should I have in my TSP by age 50?

Retirement Savings Goals By age 40, you should be making three times your yearly salary. At age 50, six times your salary; at age 60, eight times; and before age 67, 10 times.8 If you reach age 67 and earn $ 75,000 per year, you should have saved $ 750,000.

How do you become a millionaire on TSP?

It is an “elite club”. With over 75,000 members, TSP millionaires received their title by contributing to the TSP for 25-30 years, being at least moderately aggressive with the investment of their funds. New members are welcome, but once you reach the financial peak, you have to work just as hard to stay there.

Can TSP make you a millionaire?

Of course, most TSP investors don’t become millionaires, but, combined with an annuity, Social Security, and TSP, a retired federal employee can live very well with less than $ 1 million in their retirement account.

What is the average TSP balance at retirement?

| Age | Average contribution rate | Average balance |

|---|---|---|

| 60-69 | eleven% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| All ages | 9% | $ 95,600 |

How many TSP is a millionaire?

Good news: There are 98,879 federal TSP millionaires! Bad News: Too Many People Know! The number of federal / postal workers who have become Thrift Savings Plan millionaires has exploded in recent years.