Is TSP enough for retirement?

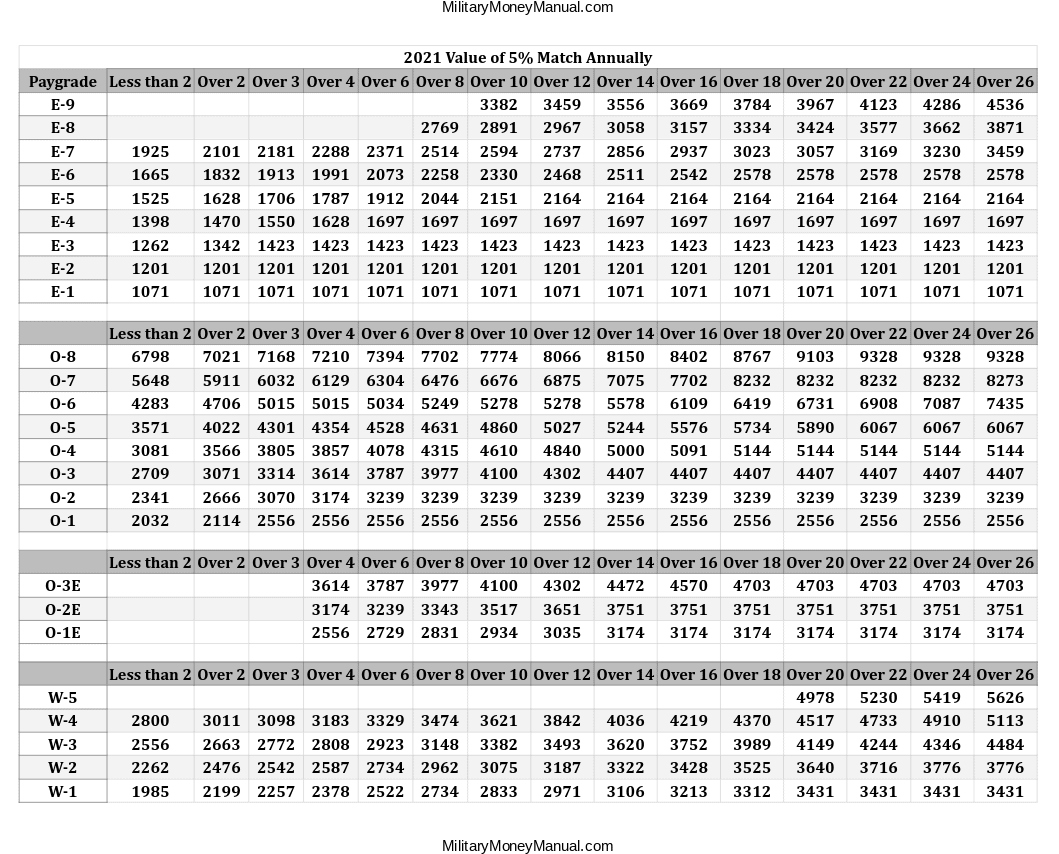

2 – Staying at the TSP default contribution level Fidelity Investments recommends that individuals should aim to save at least 15 percent of their salary each year (split between their contributions and employer matching contributions) for retirement.

Is TSP a good retirement plan? Many people consider it the best 401k plan. Period. Maximize your contributions, invest through good and bad. … For employer – backed 401k plans, most experts say that TSP, with its 5% match and very low administration fees, is the best measure around.

Is TSP better than 401k?

Overall, there is a favorable comparison between the Stream Savings Plan and 401 (k) plans, and if you work for the Federal government and can participate, it is probably wise to do so. It serves as a firm adaptation to the FERS pension, and the combination of the TSP and FERS can provide a solid foundation for retirement.

Is TSP the best investment?

The CTA is considered to be one of the best, most monitored and lowest cost funds in the business. But many people believe that it lacks flexibility and does not offer as many investment options as most external plans.

Is the TSP a good retirement plan?

As far as defined contribution plans go, the CTA is the largest in the world, with assets of over $ 558 billion. Over 5 million people have a Stream Savings Plan account, and “even better” 89% of participants are satisfied or extremely satisfied with the Stream Savings Plan.

Why is TSP the best?

It is tax deferred and affordable. Like IRAs, federal income taxes are charged on earnings in your TSP until they are withdrawn. In addition, TSP costs are low compared to civil plans provided by employers and other mutual funds inside or outside IRAs. All this means that more of your money goes to work for you.

What is the best thing to do with your TSP when you retire?

Many retirees choose to withdraw the full amount and transfer the CTA to an IRA. This is usually the best option for people because it gives you more control.

Should I move my money out of TSP?

A person should not lightly transfer their retirement savings from the CTA. … It’s much cheaper, and you can keep your money in the CTA if you and your advisor choose that. They have no incentive to talk to you from the CTA. The second option is to roll the TSP over an IRA at Vanguard.

At what age do I have to start withdrawing from my TSP?

The Internal Revenue Code (IRC) requires you to start receiving distributions from your account in the calendar year you turn 72 and are separated from federal service. Your entire TSP account – both traditional and Wheeled – is subject to these minimum required distributions (RMDs).

Should I move my TSP to an IRA?

If you transfer your TSP account to an IRA Wheel, you could lose this benefit. Pay attention to taxes. If you decide to transfer your TSP account to an IRA, make sure you transfer the funds directly to your new institution rather than by indirect transfer (where the money comes to you first).

Do I report Roth TSP on taxes?

The Stream Savings Plan Improvement Act 2009 enabled the TSP Wheel option, which allows you to fund your account with after-tax money. In both cases, as with plans 401 (k) and 403 (b), you cannot deduct your contributions on your tax return.

Do I need to report a TSP Wheel on taxes? If you have made too many Wheel contributions, the extra amount is taxable. However, you do not need to report it on your tax return because the extra amount is already stated as taxable earnings in Box 1 of your W-2.

Does TSP count as Roth IRA for taxes?

The Stream Savings Plan (TSP) is not a Single Retirement Arrangement (IRA) – and vice versa. While they are similar in that they are tax-advantageous retirement savings plans, the rules can change dramatically, and those who are unaware of the price differences can pay at tax time.

Does TSP count as IRA for tax purposes?

Yes. Your participation in the CTA does not affect eligibility to contribute to an IRA. However, the International Income Code (IRC) sets limits on the amount of dollars you can add to eligible employer plans such as the TSP and individual retirement accounts such as traditional IRAs and Wheel IRAs.

Is TSP considered a Roth IRA?

“The TSP Wheel is not an IRA Wheel.” Accessed December 17, 2020.

Do I need to put my TSP on my taxes?

The TSP is required to withhold 20% of your federal income tax payment. In order to roll over your entire payment, you must use other funds to make up the 20% withheld. If you do not roll over the full amount of your payment, the non-roll over portion will be taxed.

Can you claim Roth TSP on taxes?

With a TSP Wheel retirement account, contributions are made after deducting income taxes from wages. This means that TSP Wheel contributions are not tax deductible. But withdrawals of TSP Wheel contributions and earnings at retirement will be tax-free provided the account has been open for at least five years.

How do I claim my TSP on my taxes?

If you have 401 (k) or TSP through your employer, your contribution is reported in Box 12 of your W-2 with the letter code D. As your contribution is included in your W-2, do not re-enter it. exit part.

Do I report my TSP on my taxes?

No, you should not include your CTA contributions separately on your tax return. … At the end of the year, when you receive your W-2 form showing your earnings, you will notice that your pay subject to federal income tax (box 1) is lower because of your contributions from a plan TSP (box 12).

How does Roth TSP affect taxes?

RSP TSP. With TSP Wheel, your contributions go into the CTA after tax withholding. This means that you pay taxes on your contributions at your current income tax rate. The advantage of the TSP Wheel is that you do not pay taxes later when you withdraw your contributions and any qualifying earnings.

Can you max out Roth TSP and Roth IRA?

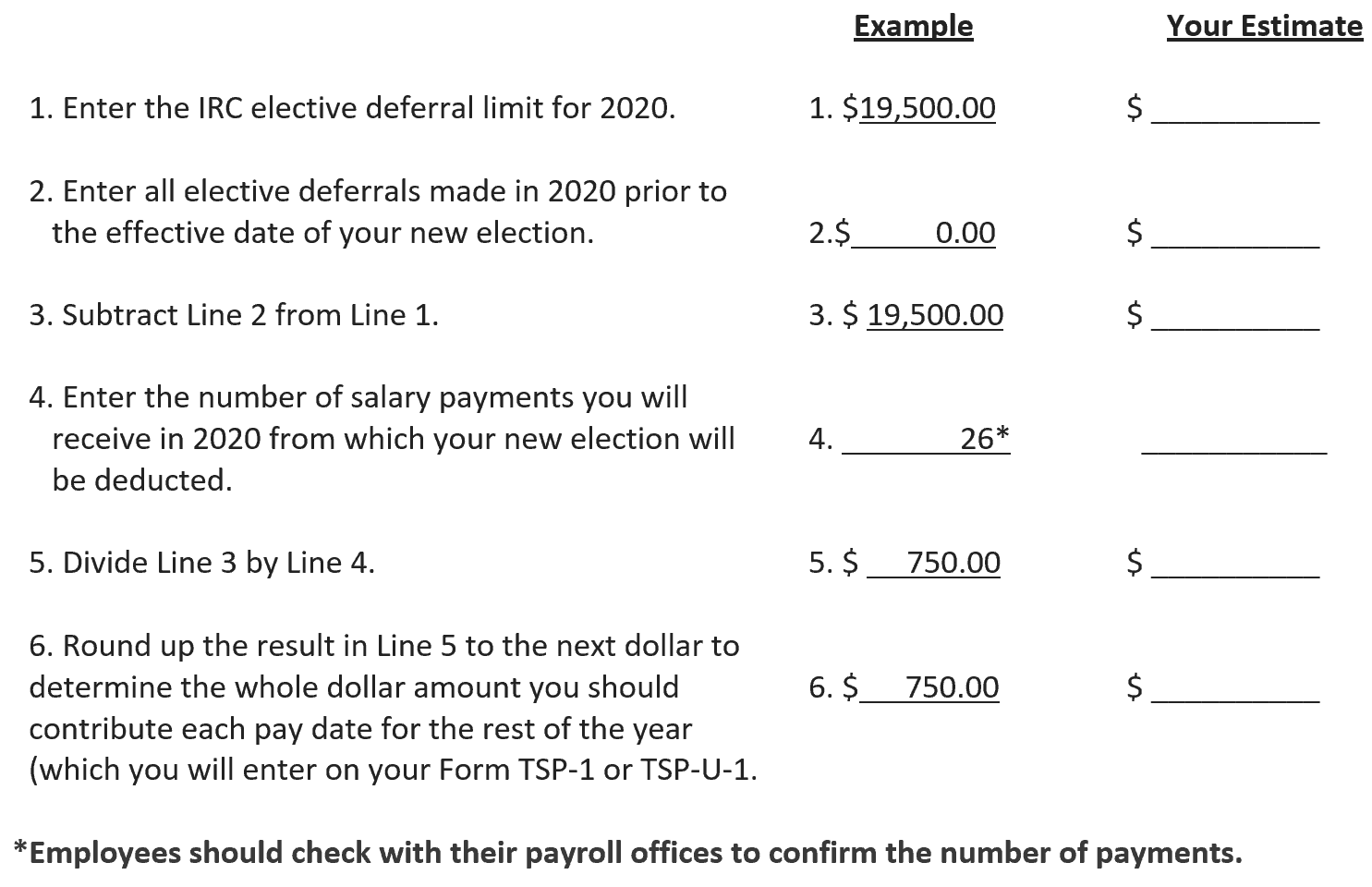

IRC § 402 (g) optional deferral limit for 2020 is $ 19,500. This limit applies to the traditional (tax deferred) and Wheel contributions made by an employee during the calendar year. The aggregate of the traditional (deferred tax) and Wheel contributions made during the year cannot exceed the optional deferral limit.

Can I add an IRA Wheel and a TSP Wheel? Can I add to both my TSP and IRA account? Yes. Your participation in the CTA does not affect eligibility to contribute to an IRA.

Can you max out two ROTH IRAs?

There is no limit to the number of IRAs you can have. You can even have multiple IRA multipliers, which means you can have multiple Wheel IRAs, SEP IRAs and traditional IRAs. … You are free to split that money between IRA types in any given year, if you wish.

Is having two Roth IRA accounts bad?

It is perfectly legal to have multiple IRA Wheel accounts, but the total contribution you have made to both accounts cannot exceed the federally set annual contribution limits.

How much can you max out a Roth IRA 2021?

Wheel IRA contribution and income limits Wheel IRA annual contribution limits in 2021 and 2022 are the same as for traditional IRAs: $ 6,000 for people under 50. $ 7,000 for people 50 and older.

Can you max out two IRAs?

There is no limit to the number of individual retirement accounts (IRAs) you can have. However, no matter how many accounts you have, your total contributions for 2021 cannot exceed the $ 6,000 annual limit, or $ 7,000 for people aged 50 and over.

How much can I contribute to my TSP and Roth IRA?

You can add an annual ceiling, which can be adjusted annually. For tax years 2020 and 2021, the maximum is $ 19,500, plus $ 6,500 if you are 50 years or older. That’s your traditional TSP Wheel or TSP, or even an account combination if you have more than one.

Does the federal government match Roth TSP contributions?

That’s like feds under the Federal Employee Retirement System, which can get a 5 percent match to their Stream Savings Plan account. Even more fortunate are those who have a Wheel option as part of their 401 (k) plan, like the government.

Can I contribute $5000 to both a Roth and traditional IRA?

You may be able to contribute to both a traditional Wheel and IRA, up to the limits set by the IRS, which is $ 6,000 in total between each IRA account in 2021 and 2022. The company has eligibility requirements. for this kind of IRA too. together.

What if I contribute too much to Roth TSP?

If a payroll office submits a contribution in excess of the optional deferral limit, the CTA will reject the full contribution and all related matching contributions, and will send a report to the payroll office showing the additional contributions allowed for the year.

How much can you max out TSP?

| Year | Annual Contribution Limit | Max Catch-Up Contribution Limit |

|---|---|---|

| 2020 | $ 19,500 | $ 6,500 |

| 2019 | $ 19,000 | $ 6,000 |

| 2018 | $ 18,500 | $ 6,000 |

| 2017 | $ 18,000 | $ 6,000 |

How much can I maximize my TSP in 2021? The maximum you can add to a TSP account for this year is $ 19,500. If you are 50 or older, your plan may allow you to add an additional $ 6,500 as a ‘pick-up’ contribution, bringing your 2021 TSP contribution to $ 26,000.

Can I contribute 100% of my salary to TSP?

Theoretically, you can add 100 percent of your basic pay, incentive pay, special pay, or bonuses to the TSP. If you are in a combat zone you may be able to do more. You cannot pay any allowances such as Basic Housing Allowance, Family Separation Allowance, etc.

Can I contribute 100% of my paycheck to TSP?

You can contribute from 1 to 100 per cent of any incentive pay, special pay, or bonus pay (even if you are not currently getting it) – as long as you choose to contribute from your basic pay.

How much can I contribute to TSP per pay period?

If you are not old enough to make matching contributions, you can add $ 19,500 to the TSP in 2021. You do this by adding $ 750 per pay period.

Can you contribute directly to TSP?

Transfer money directly into the CTA A transfer or “direct roll over” occurs when the eligible plan sends all or part of your money to the TSP. Use Form TSP-60, Application to Transfer Into CTA, for tax deferred amounts. To transfer Wheel money, use Form TSP-60-R, Request for Wheel Transfer Into TSP.

What is the maximum pay period to max out TSP?

If you are not old enough to make matching contributions, you can add $ 19,500 to the TSP in 2021. You do this by adding $ 750 per pay period. You will have maxxing out in pay period 26, scoring the government game in every single pay period.

What is the pay period to max out TSP 2021?

IRC’s optional deferral limit is $ 19,500 § 402 (g) for 2021. This limit applies to the traditional (tax deferred) and Wheel contributions made by an employee during the calendar year.

What is the maximum pay period to max out TSP 2020?

IRC § 402 (g) optional deferral limit is $ 19,500 for 2020. This limit applies to the traditional (tax deferred) and Wheel contributions made by a service member during the calendar year.

How do I max out my TSP 2021?

The maximum you can add to a TSP account for this year is $ 19,500. If you are 50 or older, your plan may allow you to add an additional $ 6,500 as a ‘pick-up’ contribution, bringing your 2021 TSP contribution to $ 26,000. (These amounts are the same as the limits in 2020.)