What states do not tax TSP withdrawals?

While most states tax TSP distributions, these 12 do not tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming, Illinois, Mississippi, and Pennsylvania.

Is TSP taxable in New York? DiGianni, are: (1) Are distributions from the Federal Employee Savings Plan (TSP) tax-exempt at the New York State level. … TSP is a retirement savings and investment plan for federal employees. The TSP was established by the 1986 Federal Employees Pension System Act.

Which state is the most tax friendly for retirees?

1. Delaware. Congratulations, Delaware – you are the state most eligible for retirement taxes! With no sales taxes, low property taxes, and no death taxes, it’s easy to see why Delaware is a tax haven for retirees.

Which states do not tax pensions and Social Security?

Alaska, Nevada, Washington, and Wyoming have no state income taxes at all, and Arizona, California, Hawaii, Idaho, and Oregon have special provisions that exempt Social Security benefits from state taxation.

What states have no state tax on pensions?

| state | 2021 Pop. |

|---|---|

| Pennsylvania | 12,804,123 |

| South Dakota | 896,581 |

| Tennessee | 6,944,260 |

| Texas | 29,730,311 |

What states have no state tax on pensions?

| state | 2021 Pop. |

|---|---|

| Pennsylvania | 12,804,123 |

| South Dakota | 896,581 |

| Tennessee | 6,944,260 |

| Texas | 29,730,311 |

Which states don’t tax Social Security or pensions?

Alaska also pays a dividend from the Alaska Permanent Fund (PFD) each year, and in 2019 it was $ 1,606 per capita. Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming have sales taxes, but there is NO government revenue, Social Security, or retirement tax. Delaware, Montana and Oregon do not have sales taxes.

Are pensions taxed in every state?

Most states tax at least part of the revenue from defined private sector defined benefit plans. Your state may have a pension exclusion, but it is likely to be limited based on your age and / or income. However, several states do not tax retirement income at all, no matter how old you are or how much money you have.

What states do not tax pensions and 401k?

States that will not tax your retirement income

- Alaska.

- Florida.

- Nevada.

- South Dakota.

- Tennessee.

- Texas.

- Washington.

- Wyoming.

Can you lose money in the G fund?

With the TSP G fund, you can earn at medium to long-term interest rates without the risk of losing money, no matter how long you keep investing.

Does the G fund in TSP ever lose money? It’s important to know what an investment can do for you – and what it can’t. The G fund is unique. It is the only fund Thrift Savings Plan that the government guarantees will not lose money.

Can the TSP G Fund go negative?

Safe in the sense that unlike equity and bond funds – C, S, I and F TSP funds – G fund never falls. … Financial planner Arthur Stein says the drop in G fund returns is a result of a general drop in interest rates.

Should I keep my money in the G fund?

2. You are 100% invested in a G fund. … When the stock market is volatile (and isn’t it always?), The G fund seems to be a safe choice. Unfortunately, if you invest all your money in the G fund, you are exposing your retirement savings to another challenge: the risk of inflation.

What is the riskiest fund in TSP?

According to this measure, the I fund is the most risky, with a maximum withdrawal of -60.89%, which occurred during the global financial crisis 2008-2009. (An investor who bought the fund at the peak of 2007 to March 2009 would experience a loss of 60.89%).

Does TSP G fund keep up with inflation?

The stated goal of the G fund is to keep pace with inflation. It invests in short-term US Treasury securities. Yet the most conservative of TSP’s life cycle funds – the L Income Fund – still holds 23% of its stock.

Should I keep money in the G fund?

You are 100% invested in a G fund When the stock market is volatile (and isn’t it always?), The G fund seems to be a safe choice. Unfortunately, if you invest all your money in the G fund, you are exposing your retirement savings to another challenge: the risk of inflation.

How secure is the G fund?

The G fund invests in short-term U.S. Treasury securities specifically issued to TSP. Payment of principal and interest is guaranteed by the US government. So no ‘credit risk’

Which is better G fund or F Fund?

The main difference between the two funds is that G invests in short-term government securities and F tracks the aggregate bond index. The F fund provides a higher return than the G fund, but with a little more risk. However, the risk is still lower than other individual funds in the TSP.

Is the TSP G fund going away?

The Treasury suspends investments in TSP’s G Fund, and more – the executive. Receive the latest news on salaries and benefits in your inbox.

Is TSP better than IRA?

TSP is better if your taxes are high today and you expect it to be much lower in retirement. It is better to take advantage of your deduction compared to the higher tax rate. The Roth IRA is better the farther you are from retirement.

Is TSP a good retirement plan? In terms of defined contribution plans, TSP is the largest in the world with assets of over $ 558 billion. More than 5 million people have a savings savings account, and – even better – 89% of participants are satisfied or extremely satisfied with the savings savings plan.

What is the difference between TSP and IRA?

One of the main differences between these two accounts is that as federal employees your agency offers appropriate contributions if you invest in TSP. Basically, your agency will contribute money to your TSP account based on how much you contribute. There is no match when you invest in an IRA.

Can you have a traditional IRA and TSP?

Traditional. Keep in mind that you can have your TSP money in a Roth or traditional TSP account, and you can also have an IRA that is either Roth or traditional. They are completely separate. You can even have a traditional and Roth TSP account, as long as the total contribution amount is below the limit.

Is a TSP the same as an IRA?

No, they are not the same kind of retirement plan. The IRA-Individual Retirement Account (IRA) is a type of savings account that is designed to help you save for retirement and offers many tax benefits.

Should I move my TSP to an IRA?

If you move your TSP account to a Roth IRA, you could lose this benefit. Pay attention to taxes. If you decide to move your TSP account to the IRA, make sure you transfer the funds directly to your new institution instead of by indirect transfer (where your money comes first).

Should I leave my money in TSP after I retire?

Leave it in the TSP and let it grow. Depending on when you start retiring, you can simply leave the money in the TSP and let it continue to grow. If you don’t need to access it yet, it might be wise to let it go. Similar to other retirement accounts, you will need to start with minimum payments at age 72.

At what age do I have to start withdrawing from my TSP?

1) You must start making payments when you turn 70 ½ In general, individual participants are expected (mandatory) to start withdrawing from the TSP after they turn 70 (, but you do not have to start withdrawing to your account exactly when you turn 70 (.

Should I move my money out of TSP?

You should not take your retirement savings out of the TSP lightly. … It is much cheaper, and you can keep your money in TSP if you and your advisor choose it. They have no incentive to answer you from the TSP. Another alternative is to transfer TSP to the IRA in Vanguard.

What is the average TSP balance at retirement?

| Age | Average contribution rate | Average condition |

|---|---|---|

| 60-69. | 11% | $ 182,100 |

| 70-79. | 12% | $ 171,400 |

| All the years | 9% | $ 95,600 |

Is TSP a traditional IRA?

The Savings Plan (TSP) is not an individual pension arrangement (IRA) – and vice versa. Although both are similar in that retirement savings plans have tax benefits, the rules can vary significantly, and those unaware of the difference can pay the price at the time of taxation.

Is the TSP considered a traditional IRA for tax purposes? A. A TSP is not considered an IRA for any purpose. From the Internal Revenue Service website: “The owner of an IRA must calculate the RMD separately for each IRA he owns, but may withdraw the total amount of one or more IRAs.

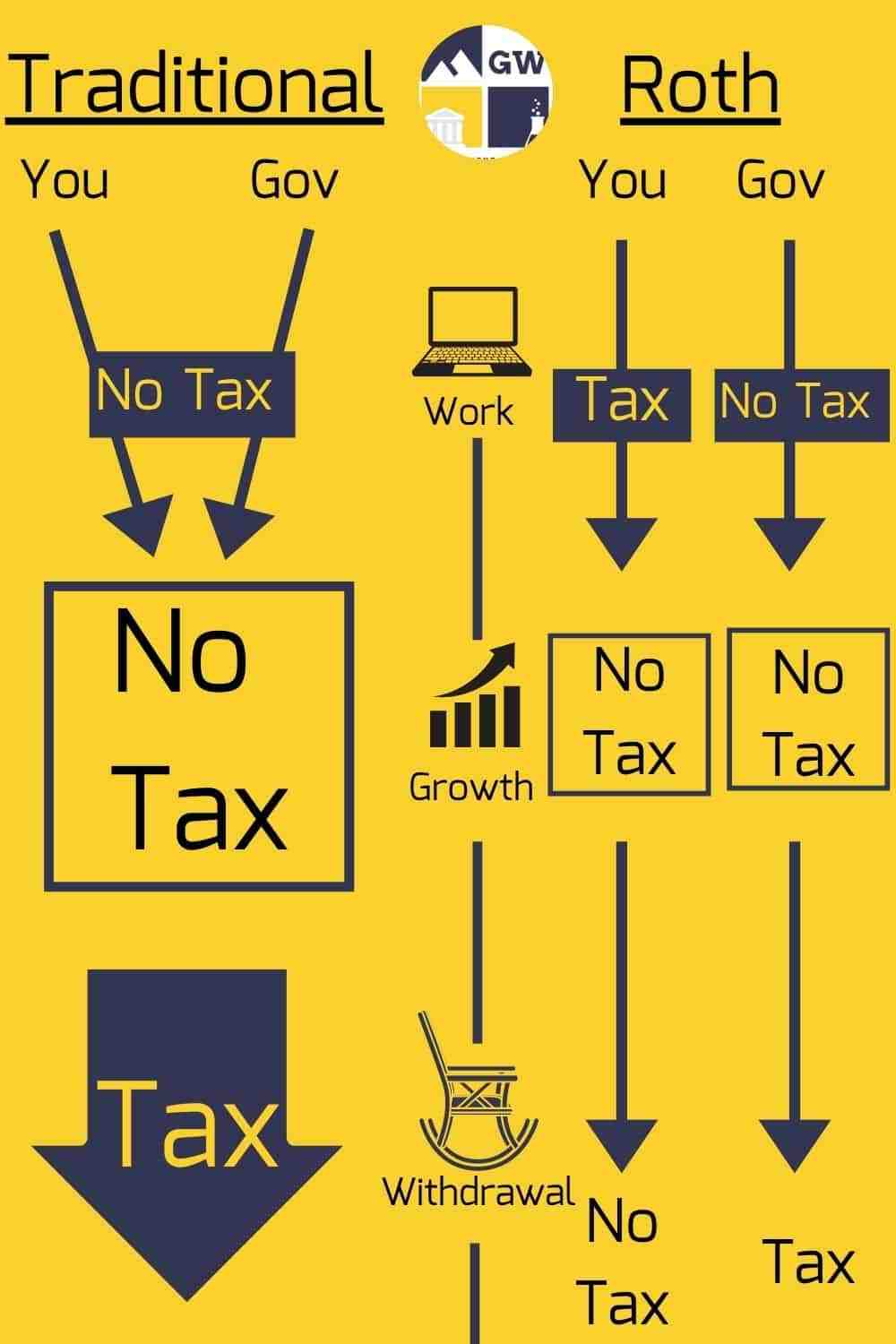

Is TSP a traditional or Roth IRA?

With Roth TSP contributions you contribute to post-tax income by paying taxes in advance. During retirement, you receive qualified Roth distributions without taxes. Traditional TSP allows you to pay contributions before the tax is deducted from your income and then pay the payout tax.

Is TSP an IRA or 401k?

The TSP is a deferred tax plan for “employer” retirement for federal employees that can be compared to a plan of 401,000 in the private sector. The IRA is a “single” deferred tax retirement plan. Great difference! The TSP must follow the administrative rules set out in Section 401k of the Internal Revenue Act.

Is a TSP the same as an IRA?

No, they are not the same kind of retirement plan. The IRA-Individual Retirement Account (IRA) is a type of savings account that is designed to help you save for retirement and offers many tax benefits.

Does TSP count as 401 K?

Although the TSP is not technically 401k, it is a defined contribution plan just like 401k (and 403b for that matter). A defined contribution means that your employer â € “in this case, the federal government â €“ will contribute a defined amount to your pension according to certain rules.

Is thrift savings plan an IRA or 401k?

The Savings Plan (TSP) is not an individual pension arrangement (IRA) – and vice versa. Although both are similar in that retirement savings plans have tax benefits, the rules can vary significantly, and those unaware of the difference can pay the price at the time of taxation.