Can you lose money in a Roth IRA?

Is my money safe in a Roth IRA? FDIC also offers insurance coverage up to $ 250,000 for traditional or Roth IRA accounts. … However, IRA deposit accounts and non-IRA deposit accounts fall into different classifications, which means that they are insured separately – even if they are held in the same bank by the same owner.

Can You Lose All Your Money in an IRA? Understanding IRAs An IRA is a type of tax-distributed investment account that can help individuals plan and save up for retirement. IRAs allow a wide range of investments, but – as with any volatile investment – individuals can lose money in an IRA if their investments are marked by market highs and lows.

Is a Roth IRA high risk?

What is the disadvantage of a Roth IRA? One obvious downside is that you contribute money after tax, and that’s a bigger hit on your current income. Another disadvantage is that you must not withdraw until at least five years have passed since your first contribution.

Is a Roth IRA good or bad?

Why is a Roth IRA a bad idea? Roth IRAs offer several key benefits, including tax-free growth, tax-free retirement and no required minimum distributions. One obvious downside is that you contribute money after tax, and that’s a bigger hit on your current income.

How are Roth IRAs protected?

Is your money protected in a Roth IRA? First, the Federal Deposit Insurance Corporation (FDIC) insurance protects the money in Roth IRAs and other IRAs at FDIC-insured banks. Your money is protected up to $ 250,000 per. deposit per. account type.

Is it smart to open a Roth IRA?

Is it worth opening a Roth IRA? A Roth IRA or 401 (k) makes the most sense if you are sure of a higher income on retirement than you are earning now. If you expect your income (and tax rate) to be lower in retirement than today, a traditional account is probably the best bet.

What if I lose money in my Roth IRA?

Can I Lose All My Money in a Roth IRA? Yes, you can lose money in a Roth IRA. The most common causes of a loss include: negative market fluctuations, penalties for early withdrawal and an insufficient time to put together. The good news is, the more time you allow a Roth IRA to grow, the less likely you are to lose money.

Why a Roth IRA is a bad idea?

What is the disadvantage of a Roth IRA? One obvious downside is that you contribute money after tax, and that’s a bigger hit on your current income. Another disadvantage is that you must not withdraw until at least five years have passed since your first contribution.

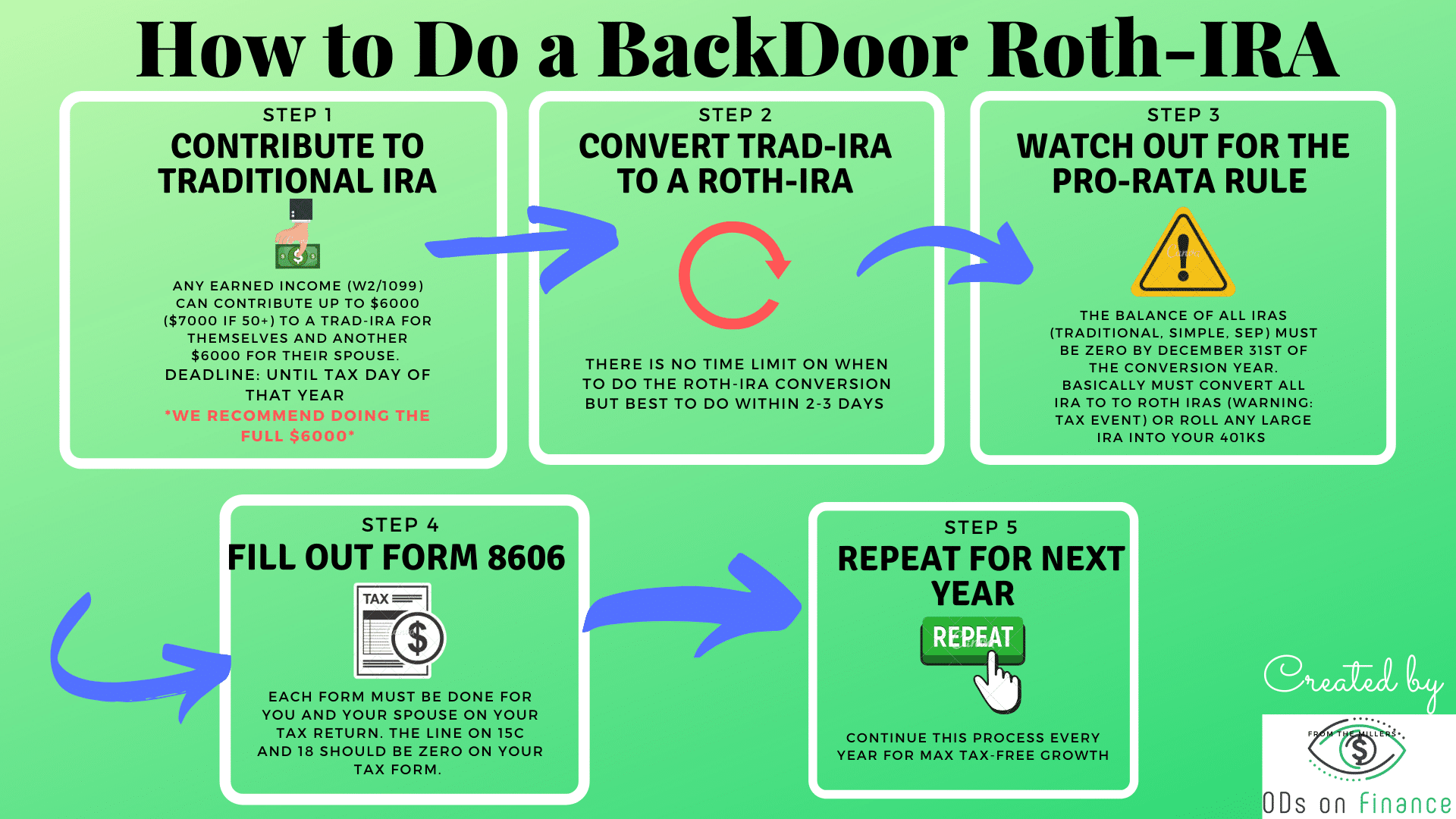

Is a Roth IRA ever a bad idea? A Roth IRA is not necessarily a bad idea if you are eligible for an employer match through your company’s retirement pension scheme, but it’s not a good first choice. … You can contribute up to $ 19,500 to a 401 (k) by 2020 or $ 26,000 if you are 50 or older, compared to only $ 6,000 and $ 7,000 for a Roth IRA, respectively.

Can I retire at 62 with 400k?

Can I retire at age 60 with 400k? It is retirement in its most basic form. But if you hope to enjoy a comfortable retirement, experts estimate that you need between £ 15,000 to £ 40,000 a year (or if you use Target Replacement Rate as a measure, you need between half and two-thirds of your annual income before retirement each year).

Can I retire at 60 with 400k?

Can you retire with 400K? Yes, you can retire as a 62-year-old with four hundred thousand dollars. At age 62, an annuity will provide a guaranteed income of $ 21,000 annually, starting immediately, for the remainder of the life of the insured. … The longer you wait before starting the lifetime income payment, the higher the income amount for you will be.

How much money do I need to retire at age 62?

Is a million dollars enough to retire as a 62-year-old? However, these numbers may change depending on the return on your investment, your withdrawal rate and inflation. So the short answer is that $ 1 million is a good start for the average person retiring today to pay their bills.

What is the average return on $500 000 investment?

What is the average return on investment of 500,000? Given the S & P 500’s average annual return of 10%, a $ 500,000 upfront investment could turn into more than $ 8.7 million when you’m ready to retire. It is also even if you never put a penny more into the account.

What is the 5 year rule for Roth IRA?

Can you withdraw money from a Roth IRA within 5 years? Roth IRA Payout Basics You can always withdraw contributions from a Roth IRA without penalty at any age. At age 59, you can withdraw both contributions and earnings without penalty, provided your Roth IRA has been open for at least five tax years. 5ï »¿

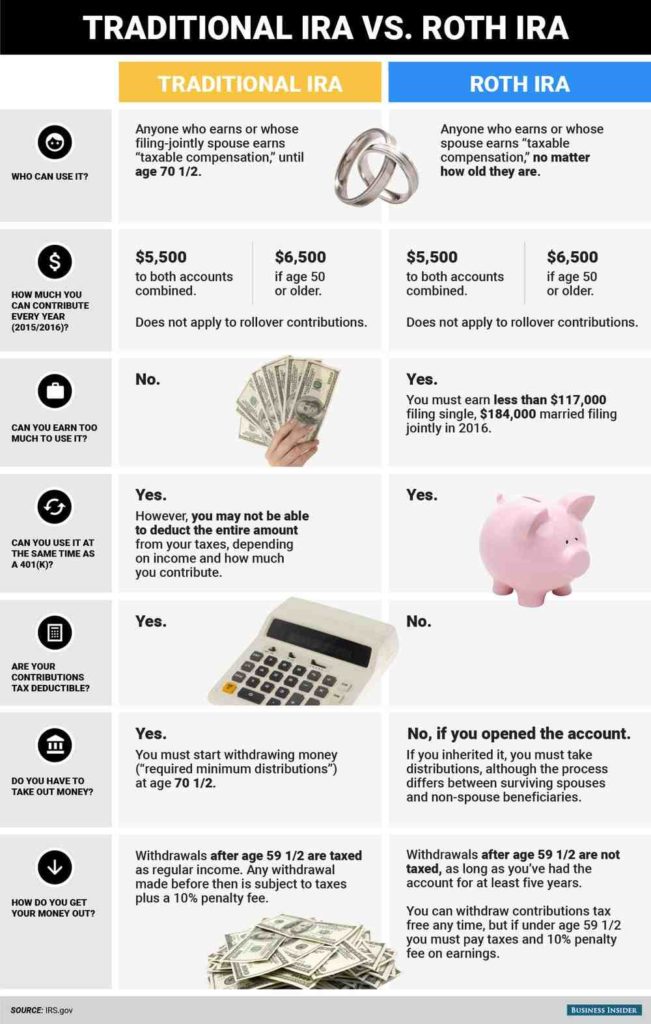

Which is better a Roth IRA or traditional IRA?

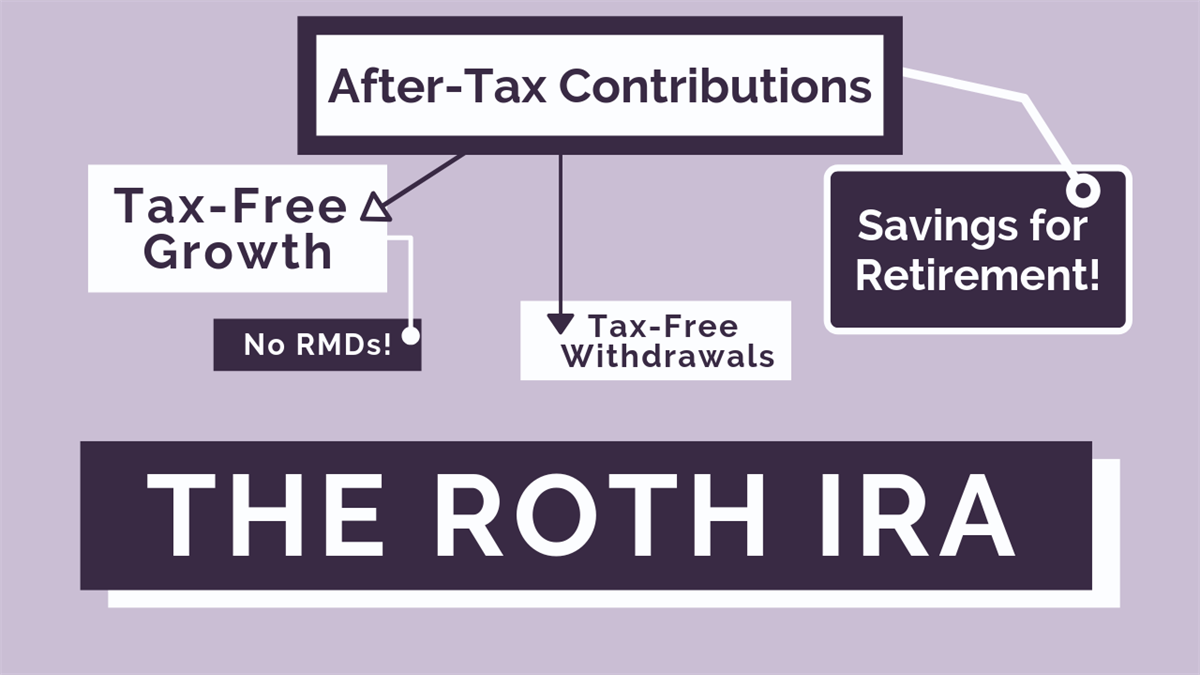

Why would you choose traditional IRA over Roth IRA? With a Roth IRA, you contribute dollars after tax, your money grows tax-free, and you can generally make tax- and penalty-free withdrawals after the age of 59½. With a traditional IRA, you contribute dollars before or after tax, your money grows tax-deferred, and payments are taxed as current income after the age of 59½.

Is it better to invest in Roth IRA or 401k?

Is It Worth Investing In A Roth IRA? A Roth IRA or 401 (k) makes the most sense if you are sure of a higher income on retirement than you are earning now. If you expect your income (and tax rate) to be lower in retirement than today, a traditional account is probably the best bet.

Should I invest in 401k before Roth? The opportunity to contribute is being phased out at higher incomes. First, finance a 401 (k) if your business offers matching dollars. First fund an IRA or Roth IRA if your 401 (k) does not offer a match. If you maximize your IRA, start contributing to your 401 (k).

Does money grow in a Roth IRA?

How much will a Roth IRA grow? Typically, Roth IRAs see average annual returns of 7-10%. For example, if you are under 50 and you have just opened a Roth IRA, $ 6,000 in contributions each year for 10 years with an interest rate of 7% will total $ 83,095. Wait another 30 years and the account will grow to more than $ 500,000.

How much can a Roth IRA grow in 30 years?

How much do ROTH IRAs grow in 30 years? Let’s say you open a Roth IRA and contribute the maximum amount each year. If the contribution limit remains $ 6,000 per year for those under 50, you will collect $ 83,095 (assuming an interest rate of 7%) after 10 years. After 30 years, you would accumulate over $ 500,000.

How much should I put in my Roth IRA monthly?

How much should you put into a Roth IRA? For 2020, $ 6,000 or $ 7,000 if you are 50 years or older by the end of the year; or. your taxable allowance for the year. For 2021, $ 6,000 or $ 7,000 if you are 50 years or older by the end of the year; or. your taxable allowance for the year.

Does an IRA earn interest?

What is the average return on an IRA account? There are several factors that will affect how your money grows in a Roth IRA, including how diversified your portfolio is, your retirement timeline, and your risk tolerance. That said, Roth IRA accounts have historically delivered between 7% and 10% average annual returns.

How much should I have in my 401k at 45?

What is the average 401K balance for a 45 year old?

Is it better to do pre tax or Roth?

Which is better before tax or Roth? You can save by lowering your taxable income now and paying tax on your savings when you retire. You’d rather save up for retirement with a minor hit for your home payment. You pay less in tax now when you contribute before tax, while Roth contributions lower your paycheck even more after tax is paid.

How much money do you need to start a Roth IRA?

Can I open a $ 100 Roth IRA? Generally, no minimum balance is required to start financing a Roth IRA. Whether you are willing to deposit $ 100 or $ 1,000 dollars, you can do so without incurring any fine or fee.

Do you need income to open a Roth IRA? The first Roth IRA eligibility consideration is income. You need to make money to open an IRA. If your only income is from unearned sources, such as investments, you cannot contribute to an IRA. You must have been paid a salary, salary, gratuity, fees or bonuses.

Can I open a Roth IRA with $100?

How much money do you need to start a Roth IRA? The good news is that the IRS does not require a minimum amount to open a Roth IRA. While there is a Roth IRA maximum contribution amount, there is no minimum according to IRS rules.

Can I open an IRA with $500?

What is the minimum amount to open an IRA? The IRS does not require a minimum amount to open an IRA. However, some providers require an account minimum, so if you only have a small amount to invest, find a provider with a minimum or $ 0 minimum. Some mutual funds also have a minimum of $ 1,000 or more, so you need to take this into account when choosing your investments.

What is the minimum to open a Vanguard Roth IRA?

Is there a minimum amount to open a Roth IRA? The good news is that the IRS does not require a minimum amount to open a Roth IRA. While there is a Roth IRA maximum contribution amount, there is no minimum according to IRS rules. … Generally, you do not have to pay a fee to open a Roth IRA, but there are some costs.

Can I start a Roth IRA with $50000?

Can I put 50,000 in a Roth IRA? You can contribute up to $ 19,500 a year (with an additional $ 6,500 as a fundraiser for those 50 or older). Some employers even offer a Roth version of 401 (k) with no income limits. You can also contribute up to $ 6,000 ($ 7,000 if you are 50 years or older) to a traditional non-deductible IRA.

What is the minimum amount to open an IRA?

Can I open an IRA with $ 500? You can open a Roth IRA account for as little as $ 500. Your account is managed professionally for a very low fee of 0.25% of your account balance. The first $ 5,000 in your account is managed for free.