How do I prepare for federal retirement?

Contents

How long does it take to process federal retirement? How long will it take to process my federal retirement application? It takes about 60 days (2 months) to process regular case requests.

What is the average retirement of federal employees? The average federal official who retired in fiscal year 2016 was 61.5 years old and had completed 26.8 years of federal service. The average monthly payment to workers who retired from CSRS in 2018 is $ 4,973. Workers who retired under FERS received an average monthly income of $ 1,834.

How long does it take to process federal retirement?

How long does it take to receive the first federal retirement check? How long before I receive my first retirement check? In my experience, most federal employees will not receive their first retirement check until 3 months after their retirement.

How long does it take OPM to finalize retirement?

How long does it take to process retirement benefits? It usually takes about six weeks to process your Social Security retirement application, but it is recommended that you apply a few months before you need your payments.

How long does it take to get retirement orders?

How long does it take to receive army retirement orders? Your first retirement payment The normal processing time for setting up a retirement payment account is 30 days after you receive ALL the necessary documentation. If DFAS receives a full DD 2656 and all necessary documentation prior to your retirement date, you will be paid 30 days after that date.

What day of the month do federal retirees get paid?

What day do retirement checks come out? Payments for Social Security benefits are deposited on the second, third, or fourth Wednesday of each month, depending on your day of birth. This payment schedule has been in effect since June 1997.

How long does it take to get your first federal retirement check?

How long does it take to receive the first pension check? In most cases, you will receive your first pension payment about two to three weeks after the effective date of your pension. The effective date of your pension is the first day of the month after you stop working for your employer.

What is the average federal employee retirement?

What is the average retirement pay of federal employees? The average federal official who retired in fiscal year 2016 was 61.5 years old and had completed 26.8 years of federal service. The average monthly payment to workers who retired from CSRS in 2018 is $ 4,973.

Do federal employees have a good retirement? Contrary to the popular image of the government as a lifelong employer, most people who enter the federal service do not stay long enough to retire and get an annuity. Or another excellent government benefit, such as high-subsidized, lifetime health insurance.

What is the average TSP balance by age?

How Much Should I Have in My TSP at 50? Retirement Savings Goals At age 50, six times your salary; at age 60, eight times; and at age 67, 10 times. 8ï »If you reach the age of 67 and earn $ 75,000 a year, you should save $ 750,000.

How much should I have in my TSP by age 50?

How much should I have on my TSP at 50? At age 30, you should save half your annual salary. At age 40, you should have double your salary, and at age 50, you should aim for four times your salary in retirement savings.

How much is in the average TSP account at retirement?

What is the average balance of the TSP in retirement?

How much should I have in my TSP at 50?

How much should you have saved at age 50? Fidelity Investments suggests that you save at least six times your annual salary at age 50 to retire comfortably at age 67, the age at which people born after 1960 are entitled to receive full Social Security benefits.

What is the average retirement income?

What is a good retirement income? Most experts say that your retirement income should be around 80% of your final pre-retirement salary. 3ï »Does this mean that if you earn $ 100,000 a year in retirement, you need at least $ 80,000 a year to have a comfortable lifestyle after leaving the workforce.

How much do government employees get after retirement?

How much money does a government employee receive after retirement? The retirement bonus to be paid for a qualified service of 33 years or more is 16 ½ times the basic pay plus DA, subject to a maximum of Rs. 20 lakhs. Half of the emoluments for each completed period of 6 months of qualified service, subject to a maximum of 33 emoluments.

At what age do most federal employees retire?

At what age do most federal employees retire? The vast majority of FERS employees will be eligible to draw at age 62 because they have probably had a lifetime working where they contributed to Social Security.

What is the average pension of a federal employee? The average federal civilian employee who retired in fiscal year 2016 was 61.5 years old and had completed 26.8 years of federal service. The average monthly annuity payment to workers who retired under CSRS in fiscal year 2018 was $ 4,973. Workers who retired under FERS received an average monthly annuity of $ 1,834.

Can I retire with 10 years of federal service?

How many years do you have to work for federal retirement? You must have worked with the federal government for at least 5 years before you are eligible for a FERS federal pension, and for each year you work, you will be able to earn at least 1% of your average high 3 salary history.

Can you retire after 10 years of work?

Can you retire in 10 years? If you want to retire in 10 years, it is possible. But it will require some work. … Although everyone has a different budget and circumstances, it is possible to retire comfortably sooner than you think. However, it can take more than 10 years, depending on your starting point.

Will I get Social Security if I only worked 10 years?

How many years do you have to work to get full Social Security? Anyone born in 1929 or later needs 10 years of work (40 credits) to be entitled to retirement benefits.

What happens if I leave federal service before retirement age?

What happens to my federal retirement if I resign? Since FERS employees are covered by Social Security, when they apply for a Social Security benefit, these years are counted together with those who have earned for external work. In this sense, nothing is lost when leaving the government.

Which is better FERS or CSRS?

Is CSRS better than FERS? An FERS employee has a smaller pension, one that does not purport to fully fund his or her retirement. … FERS workers tend to retire twice as much as CSRS workers accumulate, even though CSRS employees have higher pension benefits.

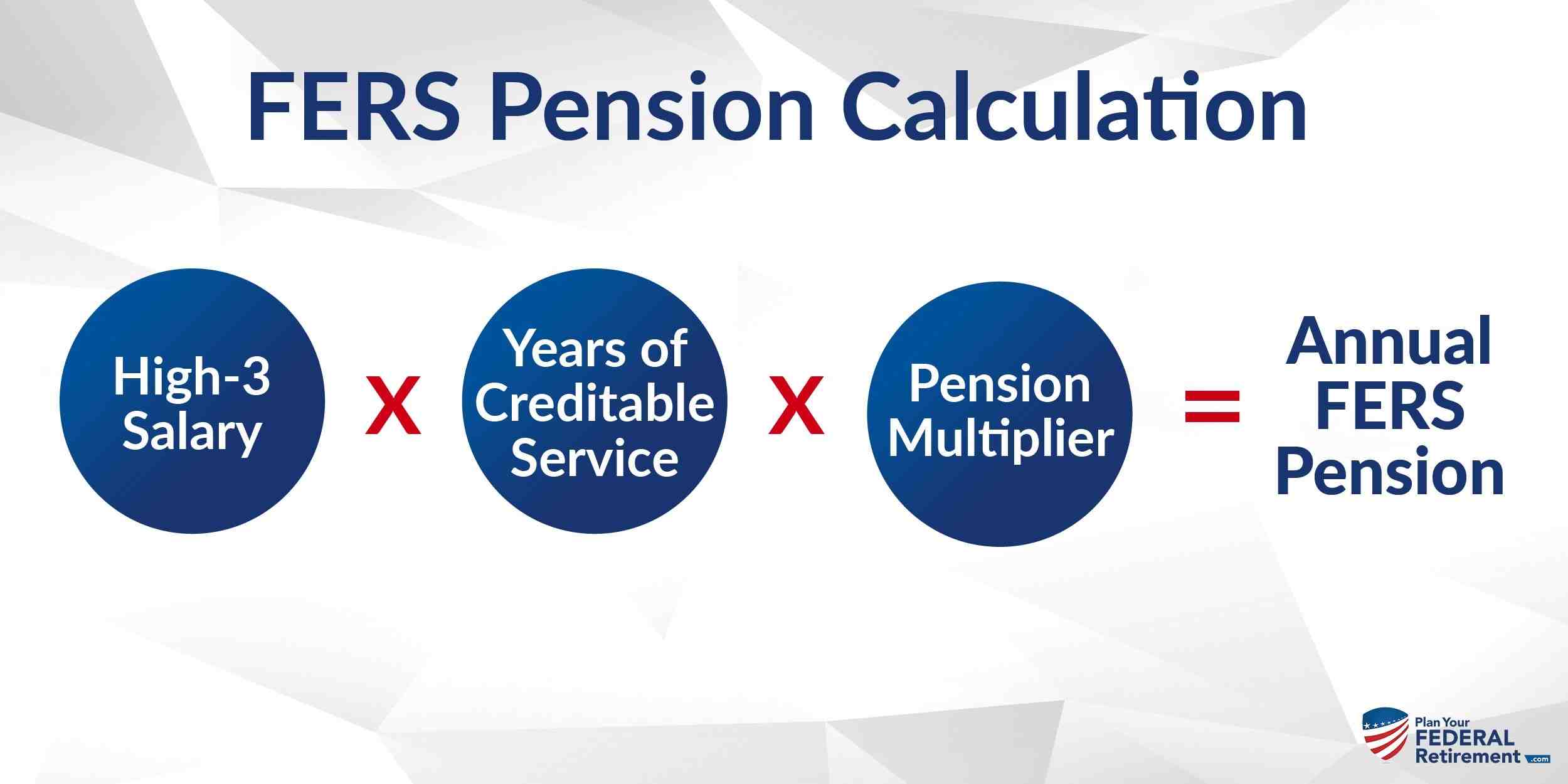

How much is a federal pension?

How is the federal pension calculated? Overall, the benefit is calculated as 1 percent of the high-3 average pay multiplied by years of credible service. For those who retire at age 62 or older with at least 20 years of service, a factor of 1.1 percent is used instead of 1 percent.

Is the FERS retirement plan good?

Is the FERS pension safe? It is likely that most, if not all, of the White House proposals to renew or eliminate the civil service retirement system and federal employee retirement system programs will crash and burn, again, on Capitol Hill. .

Can you lose your FERS retirement? The short answer is no. Unfortunately, the misconception that you can lose your federal retirement if we fire you persists even among federal employees. Many employees incorrectly believe they will lose their federal retirement benefits if the agency fires them.

How long does FERS retirement last?

Is the FERS a life annuity? FERS is a retirement plan that offers benefits from three different sources: a basic benefit plan, Social Security, and the savings plan (TSP). … Then, after you retire, you receive annual payments each month for the rest of your life.

How long does a government pension last?

Do pensions last a lifetime? Pension payments are made for the rest of your life, regardless of how long you live, and can possibly continue after death with your spouse. … It is not uncommon for people who earn a lump sum to survive the payment, while pension payments continue until death.

Can you cash out your FERS retirement?

How is the FERS retirement paid? System Benefit (FERS) In general, your FERS benefit is 1% of your average “high-3” salary multiplied by your years and months of service. If you were at least 62 years old at the time of separation and had at least 20 years of service, your annuity is 1.1% of your average “high-3” salary multiplied by your years and months of service.

Can you lose your federal retirement if fired?

What about federal retirement if you’re fired? To be clear, federal employees who are retired from federal service (“fired”) typically do not lose any entitlement to already earned (accrued) retirement benefits, with limited exceptions (see, 5 USC 8312).

How much does FERS retirement pay?

What is the average FERS pension? Benefits defined by FERS are smaller: an average of about $ 1,600 per month and an average of about $ 1,300, for annual figures of $ 19,200 and $ 15,600, because this program also includes Social Security as a basic element.

How much is my FERS retirement worth?

How do I know how much my FERS is worth? How do I know my retirement account balance? If you are a current employee, you should contact your human resources office. If you have left the federal service or are currently retired, you should contact the OPM Retirement Office at 1-888-767-6738 or retire@opm.gov.