Can I max out TSP and contribute to a Roth IRA?

The IRC § 402(g) elective deferral limit for 2020 is $19,500. This limit applies to traditional (tax-deferred) and Roth contributions made by an employee during the calendar year. The combined total of traditional (tax-deferred) and Roth contributions made during the year cannot exceed the optional deferral limit.

Can I contribute to both Roth and traditional TSP? Can I contribute to Roth TSP and Traditional TSP at the same time? Yes, you can use both in any combination as long as you don’t contribute more than the annual limit between the two accounts. For 2021, the annual limit is $19,500 or $26,000 if you are 50 or older.

Does TSP count towards IRA limit?

Contribution limits do not overlap between TSPs and IRAs. Therefore, every dollar you contribute to a TSP does not reduce the contribution limit for IRAs. However, the limits are cumulative between Roth and traditional TSPs and between Roth and traditional IRAs.

Does TSP count towards limit?

Instead, your contributions will automatically count toward the IRS catch-up limit if you meet the optional carry-forward or annual add-on limit and continue saving. If you are eligible for an agency or service, contributions overflowing towards the catch-up limit will be eligible for the match up to 5% of your salary.

Do TSP contributions count as IRA contributions?

Your participation in the TSP does not affect your eligibility to contribute to an IRA. However, the Internal Revenue Code (IRC) sets limits on the dollar amount you can contribute to qualifying employer plans like the TSP and individual retirement accounts like traditional IRAs and Roth IRAs.

Can you max out TSP and Roth IRA?

Age-eligible participants who make the maximum amount of contributions allowed under the optional deferral limit and make catch-up contributions have the opportunity to contribute up to $26,000 (combined total of traditional contributions (with deferral tax) and Roth) in 2020 to their TSP accounts.

What are the stages of wealth?

The three stages of wealth management

- Accumulation (your working years) As you progress towards future milestones, your investments should be positioned to help you achieve your long-term goals. …

- Preservation (approaching retirement)…

- Distribution (retirement)

What are the journey to wealth?

The Journey to Wealth has been recently revised and contains new information on historical market returns through 2020, comparisons of the best market sectors to invest in, the best strategy between holding or selling in a falling bear market , whether to invest in cryptocurrency, and the risks of bonds and ETF bond funds, and …

Can you contribute to TSP and Roth TSP at the same time?

An employee can contribute to both the traditional TSP and the Roth TSP in 2021. Total contributions cannot exceed $19,500 for employees under age 50 in 2019 and $26,000 for employees over age 49 in 2021.

Can I contribute to a Roth IRA if I have a TSP?

Yes. Your participation in the TSP does not affect your eligibility to contribute to an IRA. However, the Internal Revenue Code (IRC) sets limits on the dollar amount you can contribute to qualifying employer plans like the TSP and individual retirement accounts like traditional IRAs and Roth IRAs.

Is TSP better than IRA?

A TSP has less flexibility than a Roth IRA. With the TSP, you are limited to the available funds. However, it is important to note that TSP funds have some of the lowest fees in the market. In addition, you will not be able to permanently withdraw your contributions before retirement age without penalty.

What is the difference between an IRA and a TSP? The TSP must be funded by payroll deduction, while an IRA can be funded from any source as long as you have enough earned income to cover the contribution. You can contribute from your earned income to an IRA for a non-working spouse; this is not the case with the TSP.

Is TSP a good retirement plan?

Although they don’t have as many funds to choose from, TSP participants have one big advantage over most 401(k) investors: lower fees. The total expense ratio, which covers both investment and administrative expenses, is 0.055% for individual TSP funds.

What is the average TSP balance at retirement?

| Age | Average contribution rate | The equilibrium average |

|---|---|---|

| 60-69 | 11% | $182,100 |

| 70-79 | 12% | $171,400 |

| All ages | 9% | $95,600 |

Should I keep my money in TSP after retirement?

Leave it in the TSP and let it grow Depending on when you start to retire, you can simply leave the money in the TSP to continue to grow. If you don’t need to access it yet, it might be a good idea to let it. As with other retirement accounts, you must begin minimum withdrawals at age 72.

Should I have a TSP and an IRA?

Your participation in the TSP does not affect your eligibility to contribute to an IRA. However, the Internal Revenue Code (IRC) sets limits on the dollar amount you can contribute to qualifying employer plans like the TSP and individual retirement accounts like traditional IRAs and Roth IRAs.

Should I roll my TSP into an IRA?

In short, even if the recommendation is sound, any financial professional who recommends that you transfer money from the TSP to an IRA could benefit financially from that transfer.

Can I have a TSP and IRA at the same time?

Can I contribute to both my TSP account and an IRA? Yes. Your participation in the TSP does not affect your eligibility to contribute to an IRA.

Can I contribute to both TSP and IRA?

Federal employees are allowed to contribute to an IRA in addition to the TSP. Here are the contribution limits for 2021. A question federal employees often ask us is whether or not they can contribute to an IRA in addition to their TSP accounts. The short answer is yes!

Can I contribute to both my TSP account and an IRA?

Can I contribute to both my TSP account and an IRA? Yes. Your participation in the TSP does not affect your eligibility to contribute to an IRA.

Does TSP qualify for IRA deduction?

According to IRS Publication 590, if you or your spouse participate in an employer-sponsored retirement plan, such as a TSP, you cannot deduct your traditional IRA contributions if your modified adjusted gross income exceeds the annual limits.

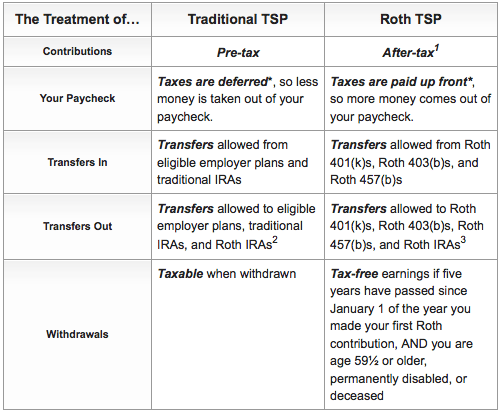

Is TSP like a Roth IRA?

A Roth TSP is similar to a Roth IRA, which means the Roth TSP offers many of the benefits of Roth accounts. 8 The money the employee contributes to the TSP account is in after-tax dollars, which means that income taxes are always deducted from your paycheck before the contribution is deposited into the TSP account.

Is TSP a Roth or a 401k? The Roth TSP provides another compelling reason for service members to start or increase what they are saving for retirement. The TSP is the federal government’s version of a 401(k) plan. It allows participants to invest money for their retirement through payroll deductions.

Is the TSP the same as an IRA?

The Thrift Savings Plan (TSP) is not an Individual Retirement Plan (IRA) – and vice versa. Although they are both similar in that they are tax-advantaged retirement savings plans, the rules can vary widely, and those who are unaware of the differences may pay the price at the time. taxes.

Is the TSP a 401k or IRA?

The TSP is a tax-deferred “employer” retirement plan for federal employees comparable to a 401k plan in the private sector. An IRA is an “individual” tax-deferred retirement plan. Big difference! The TSP must follow the administrative rules of Section 401k of the Internal Revenue Code.

Do TSP contributions count as IRA?

A federal employee’s participation in the TSP does not affect the employee’s eligibility to contribute to an IRA. But the Internal Revenue Code (IRC) sets limits on the dollar amount an employee can contribute each year to the TSP and an IRA (Traditional and Roth IRA).

Should I have an IRA and a TSP?

A federal employee’s participation in the TSP does not affect the employee’s eligibility to contribute to an IRA. But the Internal Revenue Code (IRC) sets limits on the dollar amount an employee can contribute each year to the TSP and an IRA (Traditional and Roth IRA).

Can you contribute to both the TSP and the IRA? Federal employees are allowed to contribute to an IRA in addition to the TSP. Here are the contribution limits for 2021. A question federal employees often ask us is whether or not they can contribute to an IRA in addition to their TSP accounts. The short answer is yes!

Is TSP better than an IRA?

An IRA has one major advantage over the TSP. Flexibility. As long as you meet certain basic criteria, you can withdraw money from your IRA as you wish. However, with the TSP there are a number of rules that control how and when you can withdraw money.

Is TSP a good retirement plan?

Although they don’t have as many funds to choose from, TSP participants have one big advantage over most 401(k) investors: lower fees. The total expense ratio, which covers both investment and administrative expenses, is 0.055% for individual TSP funds.

Why is TSP so great?

It’s tax-deferred and affordable. As with IRAs, federal taxes on your TSP income are deferred until they are withdrawn. Additionally, TSP expenses are low compared to employer-provided civilian plans and other mutual funds inside or outside of IRAs. All of this means more of your money is working for you.

Does the TSP count as an IRA?

The Thrift Savings Plan (TSP) is not an Individual Retirement Plan (IRA) – and vice versa. Although they are both similar in that they are tax-advantaged retirement savings plans, the rules can vary widely, and those who are unaware of the differences may pay the price at the time. taxes.

Is TSP a Roth or IRA?

The giant federal-military 401(k) plan, the Thrift Savings Plan, introduces a Roth option, for its more than 4.5 million investors. The TSP, like other 401(k) plans, is a way to save on taxes. Money invested in the TSP is tax-deferred until you start withdrawing it.

Is TSP considered traditional IRA for tax purposes?

Is the TSP considered a traditional IRA for tax purposes? A. The TSP is not considered an IRA for any purpose. From the Internal Revenue Service website: “An IRA owner must calculate the RMD separately for each IRA they own, but they can withdraw the full amount from one or more IRAs.

Can you have both TSP and Roth IRA?

A: You can contribute to both a Roth IRA and the TSP, but the total amount you can save in both that you have listed is wrong; you can actually contribute more than you ask for.

Can you contribute to TSP and Roth TSP at the same time?

An employee can contribute to both the traditional TSP and the Roth TSP in 2021. Total contributions cannot exceed $19,500 for employees under age 50 in 2019 and $26,000 for employees over age 49 in 2021.

How much can I contribute to my TSP and Roth IRA?

For the 2021 tax year, the maximum is $19,500, plus $6,500 if you’re 50 or older. In 2022, it increases from $1,000 to $20,500. This is for a Roth TSP or a traditional TSP, or even a combination of accounts if you have more than one.

What does Dave Ramsey recommend for TSP?

How much should you invest in a TSP account? We recommend that you invest 15% of your income for retirement. When you contribute 15% consistently, you prepare to have options when you retire.

What is the best allocation for the TSP? Like other voices, he recommends a portfolio made up of 100% stocks, but recommends an allocation of 60% C funds, 20% S funds and 20% I funds.

What is a good TSP balance at retirement?

I often say that there is not too much money in the savings plan. If you want your TSP balance to generate an inflation-indexed annual income of $10,000, most financial planners will suggest that you have a balance of $250,000 when you retire.

What should my TSP distribution be?

How much should I contribute to my TSP? A common suggestion for how much to save for retirement is at least 15% of your income. Others believe that the minimum should be what maximizes your employer’s contribution; in the case of TSP funds, it would be 5% of your income.

What is the average TSP account balance?

It’s no surprise that more than half of total plan participants – 3,663,973 – have account balances below $50,000, yet they’ve only been contributing for 5.77 years on average. And about a quarter of participants (1,529,078) are between $50,000 and $249,000, but have been contributing for 15 years on average.

Should I move TSP money to G Fund?

| FUNDS | THE PRICE | Year to date |

|---|---|---|

| L2060 | $13.6051 | -8.58% |

| L2065 | $13.6048 | -8.58% |

Can the TSP G fund lost money?

With the TSP G Fund, you can earn medium to long-term interest rates without the risk of losing your money, no matter how long you hold the investment.

Should you move your TSP?

In short, even if the recommendation is sound, any financial professional who recommends that you transfer money from the TSP to an IRA could benefit financially from that transfer. 6. Compare investment options and other services.

What should I do with TSP right now?

What should I do with my TSP?

If done correctly, TSPs should be transferable to a similar IRA without any tax consequences… Essentially, when you retire, you have 4 options for your TSP:

- Start with regular payments (probably monthly). …

- Buy an annuity. …

- Leave it in the TSP and let it grow. …

- Make a single withdrawal / transfer the TSP to an IRA.

Should I cash out my TSP?

It is really tempting to cash in your TSP account to pay them. But it’s almost always the worst thing you can do. Most experts agree that it is not a good idea to withdraw money from your TSP retirement account (or any tax-free or tax-deferred retirement account) before you have reached 59 and a half, the normal minimum distribution age.

Sources :