A qualified retirement plan meets the requirements of the IRS and offers certain tax benefits. Examples of qualified pension plans include 401 (k), 403 (b) and profit plans. Stocks, mutual funds, real estate and money market funds are the types of investments sometimes held in qualified pension plans.

What is TSP considered for tax purposes?

The TSP makes all distributions to the Internal Agency Service, and to the person responsible for paying the tax, on IRS Form 1099-R, Pension Distributions, Annuities, Retirement Plans or Profit- Sharing, IRAs, Insurance Contracts, etc. . The TSP does not charge for state or local tax.

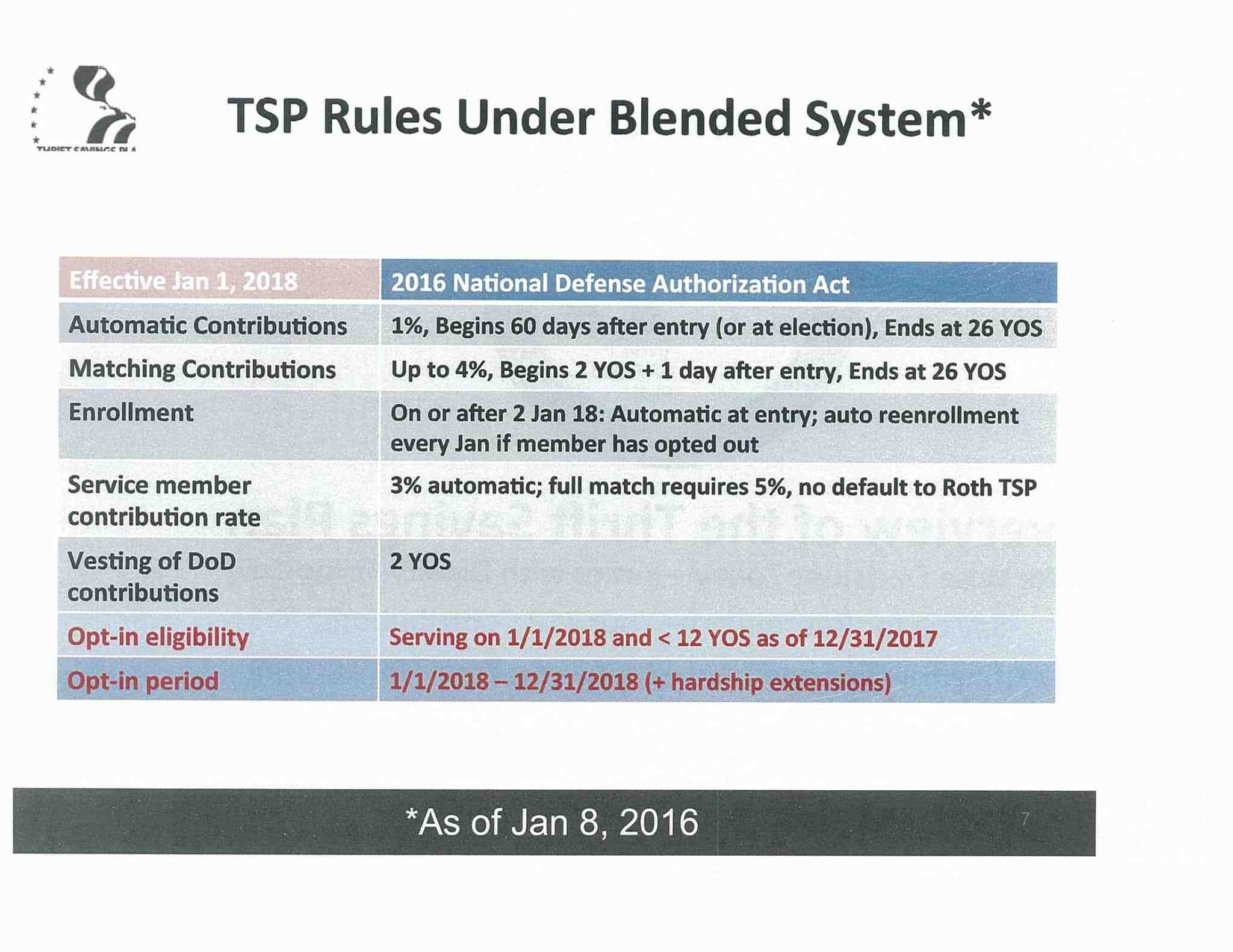

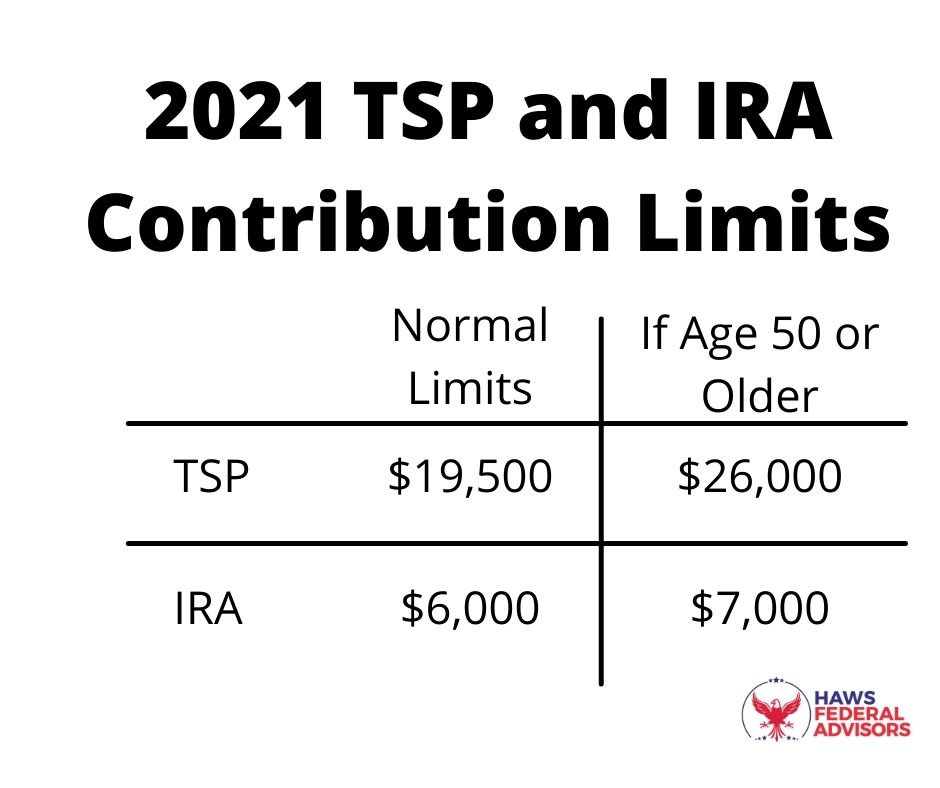

Does the TSP count as an IRA for tax purposes? Yes. Your participation in the TSP does not affect your eligibility to contribute to an IRA. However, the Internal Revenue Code (IRC) sets limits on the amount of dollars you can contribute to the plans of eligible employers such as the TSP and individual retirement accounts such as the. Traditional IRA and Roth IRA.

Does TSP count as 401 K?

Employees in the private sector contribute a portion of their salaries, which can increase in deferred tax. Employers can also contribute to their employees ’accounts, thus increasing their pension savings. The TSP is essentially a 401 (k) for federal employees. … As a result, your withdrawals will be tax-free.

Is TSP a 401k for tax purposes?

As of 2013, you can put up to $ 17,500 in your traditional TSP or Roth. … If you have made excessive Roth contributions, the additional amount is taxable. However, you do not need to report on your tax return, because the extra amount is already declared as taxable earnings in Box 1 of your W-2.

Is the TSP a 401k or IRA?

The TSP is a deferred “employee” pension plan for federal employees comparable to a 401k plan in the private sector. An IRA is a “individual” deferred tax pension plan.

Does TSP count towards limit?

Instead, your contributions will automatically count toward the IRS catch-up limit if you meet the elected deferral limit or annual membership limit and maintain safety. If you are eligible for an agency or service match, contributions spreading toward the catch-up limit will qualify for the match up to 5% of your salary.

Where do I report TSP on tax return?

- Indicate the taxable part of the TSP distribution in line 16b of the Form 1040. …

- Report the entire TSP distribution as a non-taxable pension and an annuity distribution on line 16a of the Form 1040 if any of the distribution is not taxable.

Is there a 1099 for TSP?

The IRS Form 1099-R is used to view TSP distributions during a calendar year. If a TSP participant has taken a TSP distribution or made a TSP withdrawal during 2020, the participant must receive a Form 1099-R from the TSP by February 1, 2021. A copy of the Form 1099-R is also sent. to the IRS.

How do I report TSP on my taxes?

Tax Report We report all TSP distributions to the IRS, appropriate state tax agencies, if applicable, and to you on IRS Form 1099-R, Distributions from pensions, annuities, pension or spread plans , IRAs, insurance contracts, etc.

Where do I find my TSP R 1099?

For participants who have received a withdrawal or other taxable distribution during the calendar year, 1099-Rs are mailed by January 31 of each year, and electronic versions are available online the first week of February in My Account: Statements.

Are TSP withdrawals considered income?

The general rules regarding the taxation of federal income from withdrawals from the Thrift savings plan are: A) All withdrawals from your traditional TSP balance are fully taxable as ordinary income; B) All eligible retirees from your Roth TSP balance are exempt from federal income tax; and C) In each …

Are TSP retirees taxed ordinary income? The money that is in the traditional balance of your TSP account is fully taxable as ordinary income when it is withdrawn. This means that you will not receive favorable tax treatment such as a long-term capital gain or a qualified dividend you would receive.

Is TSP considered income?

The TSP does not charge for state or local tax. However, on IRS Form 1099-R, we make all TSP distributions to the taxpayer’s state of residence at the time of payment (if that state has an income tax return). The taxpayer may need to pay state and local taxes on the payment.

Where do I report TSP on tax return?

- Indicate the taxable part of the TSP distribution in line 16b of the Form 1040. …

- Report the entire TSP distribution as a non-taxable pension and an annuity distribution on line 16a of the Form 1040 if any of the distribution is not taxable.

Is TSP taxed as income or capital gains?

Money withdrawn from the TSP Tax-Deferred account in retirement is taxed as Ordinary Income and not as Capital Gains. When you choose to contribute to the deferred portion of the TSP tax, you are deferring payment of the ordinary income tax until later when you withdraw the money.

Is TSP withdrawal considered earned income?

TSP retirees are not considered earned income.

How do I report TSP withdrawal on my taxes?

- Indicate the taxable part of the TSP distribution in line 16b of the Form 1040. …

- Report the entire TSP distribution as a non-taxable pension and an annuity distribution on line 16a of the Form 1040 if any of the distribution is not taxable.

Do I have to report TSP withdrawal on taxes?

The taxable portion of your retirement is subject to federal income tax at your ordinary rate. In addition, you may have to pay state income tax. An additional IRS early withdrawal penalty of 10% may apply if you are under the age of 59½.

Do you get a 1099 for TSP?

IRS Form 1099-R – The TSP has sent IRS Form 1099-R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., to participants who have received a withdrawal by December 27th. , 2019, and / or a taxable distribution of a loan through December 31, 2019.

Do you get a 1099 for TSP?

IRS Form 1099-R – The TSP has sent IRS Form 1099-R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., to participants who have received a withdrawal by December 27th. 2019, and / or a taxable distribution of a loan through December 31, 2019.

Where does TSP report on the tax return?

Do I need to report TSP on taxes?

No, you should not include your TSP contributions separately in your tax return. … At the end of the year, when you receive your W-2 form showing your earnings, you will see that your wages subject to federal tax (box 1) are lower because of your earnings. TSP plan contributions (box 12).

Do you get a 1099 for TSP?

IRS Form 1099-R – The TSP has sent IRS Form 1099-R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., to participants who have received a withdrawal by December 27th. , 2019, and / or a taxable distribution of a loan through December 31, 2019.

How do I file a TSP on my taxes?

If you have a 401 (k) or TSP through your employer, your contribution is listed in Box 12 of your W-2 with the letter code D. Because your contribution is included in your W-2, don’t put it back in your W-2. to withdrawal section.

Do I need a 1099 for TSP?

The IRS Form 1099-R is used to view TSP distributions during a calendar year. If a TSP participant has taken a TSP distribution or made a TSP withdrawal during 2020, the participant must receive a Form 1099-R from the TSP by February 1, 2021. A copy of the Form 1099-R is also sent. to the IRS.

How do I report TSP on my taxes?

Tax Report We report all TSP distributions to the IRS, appropriate state tax agencies, if applicable, and to you on IRS Form 1099-R, Distributions from pensions, annuities, pension or spread plans , IRAs, insurance contracts, etc.

Does TSP have a tax form?

IRS Form 1099-R – The TSP has sent IRS Form 1099-R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., to participants who have received a withdrawal by December 27th. , 2019, and / or a taxable distribution of a loan through December 31, 2019.

Is TSP A 403 B plan?

While the TSP is not technically a 401k, it is a contribution plan defined as a 401k (and a 403b for that matter). Defined contribution means that your employer – in this case, the Federal Government – contributes a definite amount towards retirement for you subject to certain rules.

Is the TSP a 401k or IRA? The TSP is a deferred “employee” pension plan for federal employees comparable to a 401k plan in the private sector. An IRA is a “individual” deferred tax pension plan.

Does TSP count as 401 K?

Employees in the private sector contribute a portion of their salaries, which can increase in deferred tax. Employers can also contribute to their employees ’accounts, thus increasing their pension savings. The TSP is essentially a 401 (k) for federal employees. … As a result, your withdrawals will be tax-free.

Is TSP a 401k for tax purposes?

As of 2013, you can put up to $ 17,500 in your traditional TSP or Roth. … If you have made excessive Roth contributions, the additional amount is taxable. However, you do not need to report on your tax return, because the extra amount is already declared as taxable earnings in Box 1 of your W-2.

Does TSP count towards limit?

Instead, your contributions will automatically count toward the IRS catch-up limit if you meet the elected deferral limit or annual membership limit and maintain safety. If you are eligible for an agency or service match, contributions spreading toward the catch-up limit will qualify for the match up to 5% of your salary.

Does TSP count as a qualified retirement plan?

CSRS, FERS and TSP annuities are considered qualified pension plans. You can find information on calculating the taxable portion of your annuity by going to IRS Publication 721 (U.S. Civil Service Retirement Benefits Guide) on the Internal Revenue Service website.

Is a TSP a qualified retirement plan?

CSRS, FERS and TSP annuities are considered qualified pension plans.

Is TSP qualified or nonqualified?

The Federal Thrift Savings Plan is considered a qualified pension plan.

Are Thrift Savings Plans Qualified Plans?

It is not only a qualified plan, but it is also a part of the federal retirement system that can deal with federal employees moving into the private sector (or another level of government) prior to retirement. … Because the TSP is a government-sponsored plan, it is not subject to ERISA provisions.

What type of retirement plan is TSP?

The Thrift Savings Plan (TSP) is a tax-deferred retirement and investment savings plan that offers Federal employees the same type of savings and tax benefits that many private corporations offer to their employees under the plans. 401 (k).