What happens if I leave federal service before retirement age?

If you leave your government job before you qualify for retirement: you can request that your pension contributions be returned to you in a lump sum, or. If you have at least five years of creditworthy service, you can wait until you are of retirement age to apply for monthly pension payments.

What happens if you leave federal service? Leave. Annual leave: You receive a one-time payment for unused leave. The same electronic deposit as your paycheck will follow. Sick leave: If you return to the federal government, any accrued sick leave will be credited to your account again.

What happens to my federal retirement if I quit?

Since FERS employees are covered by social security, when they apply for social security benefits, these years will be counted together with those they have earned through work abroad. In this connection, nothing is lost by leaving the government.

What happens if I resign from the federal government?

Annual leave is considered compensation corresponding to cash. As a result, when you leave the federal government, you can pay for your annual vacation. If you have 16 hours of annual leave when you leave, you will have two days’ salary added to the last pay slip. This is treated the same whether you retire or retire.

Do federal employees lose pension if fired?

To be clear, federal employees who are removed from federal service (“dismissed”) normally lose no right to pension benefits already earned (accumulated), with limited exceptions (see 5 USC 8312).

What happens if you quit before retirement age?

Simply put, unless you manage to come up with that amount and deposit it in a qualifying pension account, it is considered a distribution that may be taxable. And if you are under 55 when you leave your job, you pay 10% for early withdrawal.

How much do you lose if you retire early?

In the case of early retirement, a benefit is reduced by 5/9 per cent for each month before the normal retirement age, up to 36 months. If the number of months exceeds 36, the benefit is further reduced by 5/12 per cent per month.

What happens to your retirement when you quit a job?

If you leave a job, you have the right to transfer the money from your 401k account to an IRA without paying income tax on it. … If you decide to transfer your money to an IRA, you can use any financial institution of your choice; you are not required to keep the money with the company that held 401 (k).

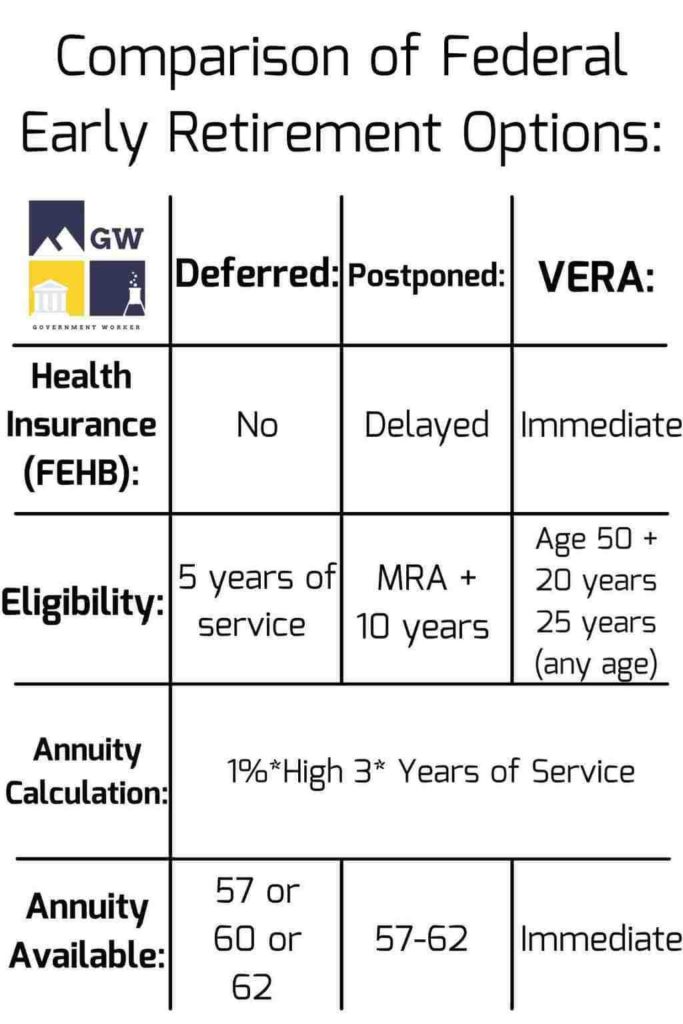

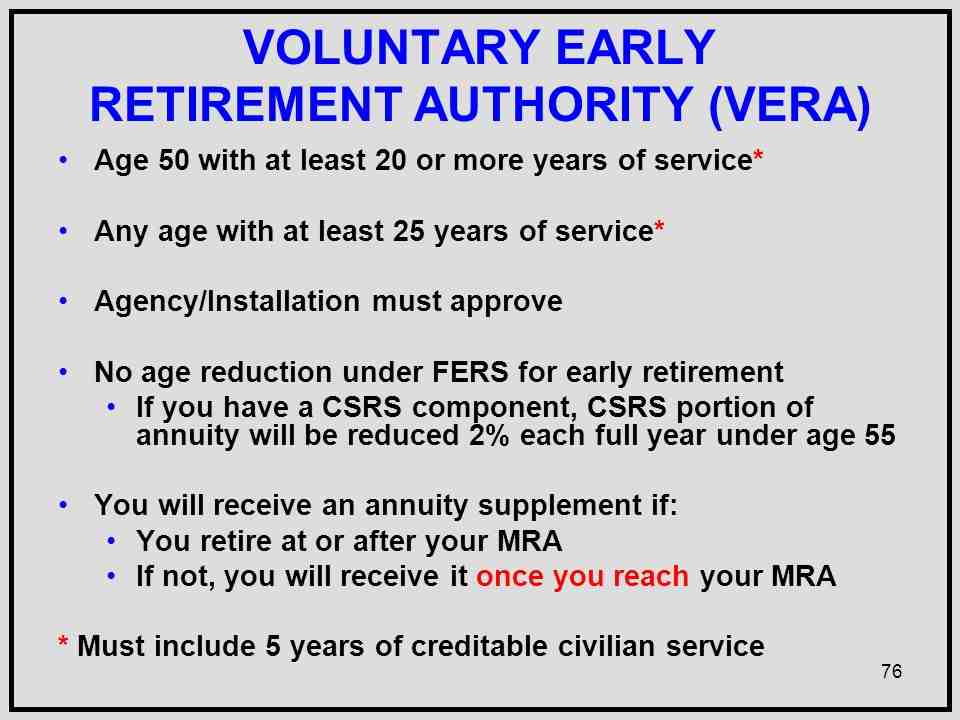

Can a FERS employee retire early?

It is possible to retire early from the state with as little as 10 years of service. … Among them is a unique option under the Federal Employees Retirement System that allows an employee to retire at their minimum retirement age with as little as 10 years of service.

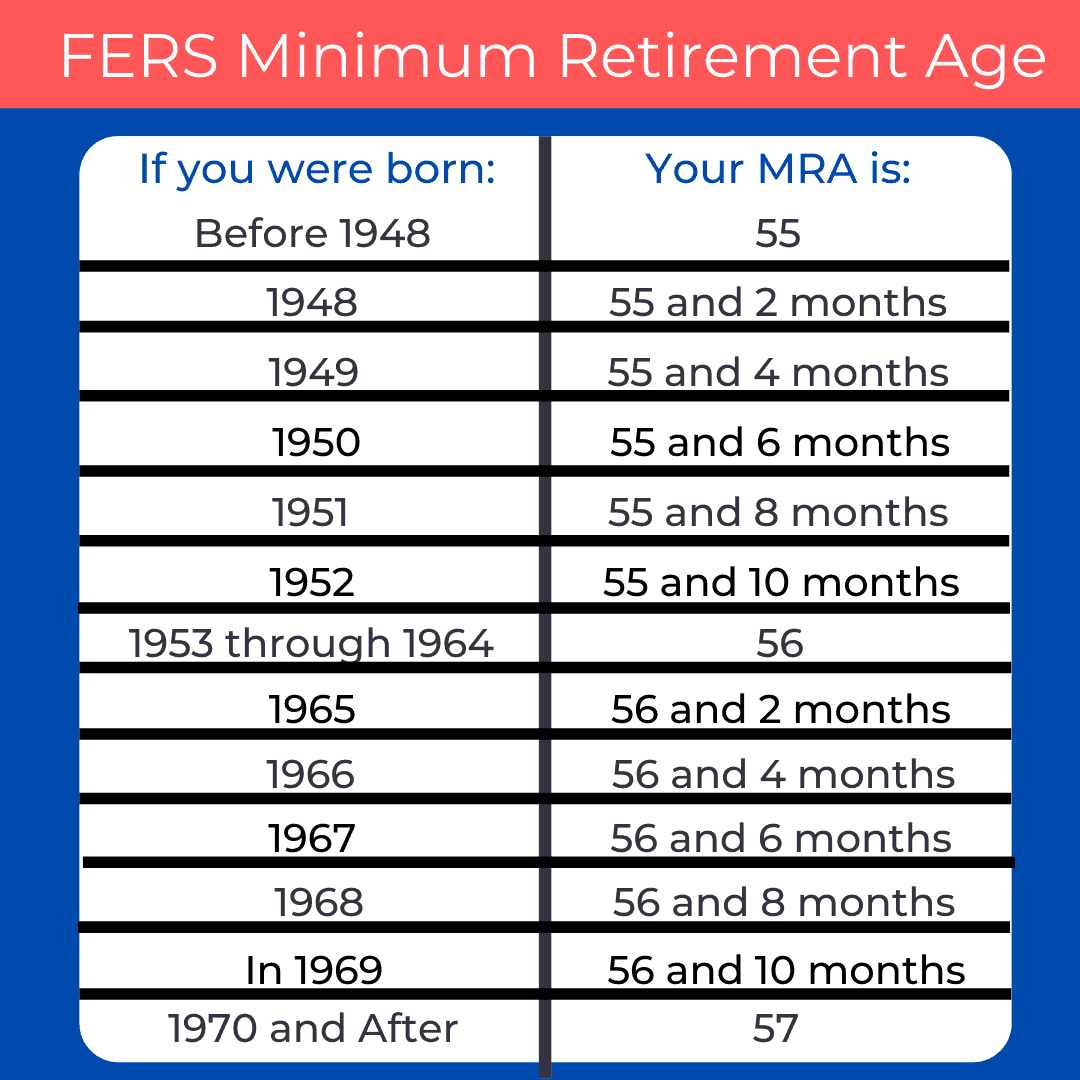

How early can I retire under FERS?

According to FERS, an employee who meets one of the following age and service requirements is entitled to immediate pension benefit: age 62 with five years of service, 60 with 20, minimum retirement age (MRA) with 30 or MRA with 10 (but with reduced benefit).

What happens to federal pension if you quit?

Since FERS employees are covered by social security, when they apply for social security benefits, these years will be counted together with those they have earned through work abroad. In this connection, nothing is lost by leaving the government.

Can you withdraw your FERS pension? Federal employees who leave federal service have the option of withdrawing their pension contributions or waiting until retirement age to apply for a pension, usually at the age of 60 or 62, depending on the year of service.

Do federal employees lose pension if fired?

Will federal employees lose retirement if they are fired? The short answer is no. Unfortunately, the misconception that you could lose your federal retirement if you get fired persists even among federal employees.

Can your pension be taken away?

Employers can terminate a retirement plan through a process called “plan termination.” There are two ways an employer can terminate their pension scheme. … To do so, however, the employer must prove to a probate court or to the PBGC that the employer cannot remain in business unless the plan is terminated.

How can you lose your government pension?

The primary way to lose your pension is to be convicted of a crime against US national security (for a list of these types of crimes, see 5 USC Section 8312).

How early can I retire under FERS?

According to FERS, an employee who meets one of the following age and service requirements is entitled to immediate pension benefit: age 62 with five years of service, 60 with 20, minimum retirement age (MRA) with 30 or MRA with 10 (but with reduced benefit).

Can a FERS employee retire early? It is possible to retire early from the state with as little as 10 years of service. … Among them is a unique option under the Federal Employees Retirement System that allows an employee to retire at their minimum retirement age with as little as 10 years of service.

What is the earliest I can retire under FERS?

MRAs vary between 55 and 57, depending on the year of birth. The same applies if you get rid of a VERA, but only when you reach your MRA. … SRS will continue until the age of 62, when you will first be eligible for a social security benefit.

Can I retire after 5 years of federal service?

To be eligible (eligible to receive your pension benefits from the Basic Benefit Plan if you leave federal service before retiring), you must have at least 5 years of credit-worthy civilian service.

How is FERS early retirement calculated?

FERS (immediate or early) FERS annuities are based on high-3 average salaries. The benefit is usually calculated as 1 per cent of the high-3 average salary multiplied by years of good service. For those who retire at age 62 or later with at least 20 years of service, a factor of 1.1 per cent is used instead of 1 per cent.

How much can I expect from FERS retirement? FERS pension = 1.1% x high salary-3 x years worked. This equates to 1% – 1.1% of your highest annual salary for each year of federal service. You can maximize the benefit with more than 30% of the covered pre-pension income.

Can I cash out my FERS?

Federal employees who leave federal service have the option of withdrawing their pension contributions or waiting until retirement age to apply for a pension, usually at the age of 60 or 62, depending on the year of service. This is called deferred retirement.

Can I withdraw money from FERS? You can deduct your basic benefits if you leave federal work. However, if you do, you will not be eligible to receive benefits based on service covered by the refund. There is no provision in the law on repayment of FERS contributions that has been refunded.

How long does it take to cash out FERS?

It can take up to eight weeks to process a withdrawal after all properly completed withdrawal forms and separation data have been received by the TSP Service Office.

How long does it take to get your first FERS retirement check?

How long before I get my first pension check? In my experience, most federal employees will not receive their first retirement check until 3 months after they retire.

How is FERS retirement paid out?

System benefit (FERS) Usually the FERS benefit is 1% of the average salary “high-3” multiplied by years and months in service. If you were at least 62 years old at the time of separation and had at least 20 years of service, your annuity is 1.1% of the average salary “high-3” multiplied by years of service and months.

How do I cash out my FERS retirement?

You can apply for a refund at any time after separation. Repayment of pension deduction – Fill in the application for reimbursement (SF-3106). If you submit the form within 30 days of separation, return it to the Benefits Office. After 30 days, send it to OPM at the address on the form.

How do I get my FERS balance?

How can I find out the balance in my pension account? If you are a current employee, you should contact your human resources office. If you are divorced from federal service or are currently retired, you should contact OPM’s Retirement Office at 1-888-767-6738 or retire@opm.gov.

How is FERS retirement paid out?

System benefit (FERS) Usually the FERS benefit is 1% of the average salary “high-3” multiplied by years and months in service. If you were at least 62 years old at the time of separation and had at least 20 years of service, your annuity is 1.1% of the average salary “high-3” multiplied by years of service and months.