What can I transfer my TSP to?

You can keep some or all of your savings in your TSP. You can transfer the assets to your new employer’s plan, if allowed (check with the benefits of a new employer or human resources office). You can return your plan assets in an IRA. Or you can withdraw your balance.

Can I transfer my TSP to another account? As a federal government employee, you can save for retirement through the Thrift Savings Plan. As long as you work for the government, you cannot transfer your savings to another account. However, when you have another job, you are free to transfer your TSP to a number of other retirement accounts.

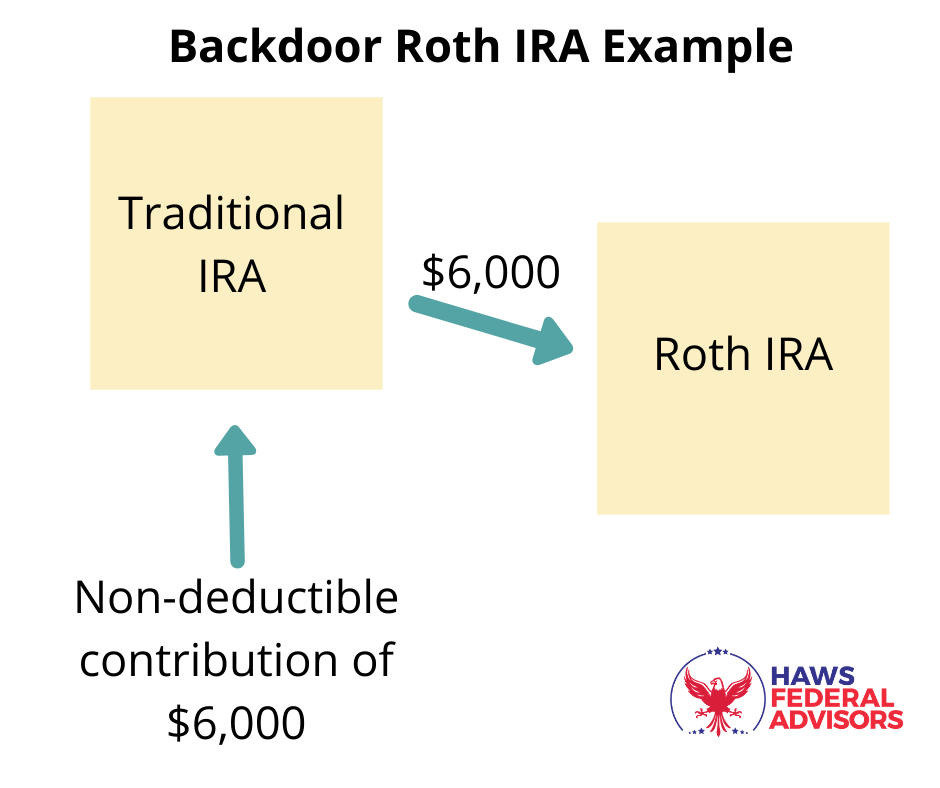

Can I transfer my TSP to a Roth IRA?

If you belong to the TSP, you may choose to transfer or rollover some or all of your TSP balance to a Roth IRA. The rules governing this type of transaction depend on the type of TSP account that is the source of the transfer, and the method by which the money is moved.

How do I transfer my TSP to another employer?

With a direct rollover, you order the TSP to send your TSP assets directly to your new employer’s plan or to an IRA – and you never have to handle the money. With an indirect rollover, you start by requesting a lump sum distribution from TSP and then take responsibility for completing the transfer.

What happens to my TSP if I leave federal service?

When you separate, you can leave your total account balance in the TSP if it is $ 200 or more. Your account will continue to accrue earnings and you can continue to change the way your money is invested in the five TSP investment funds by making interfund transfers. You can make an interfund transfer at any time.

Can TSP be transferred?

To make a withdrawal or transfer from your TSP account, you must apply in writing by completing a Form TSP 70 (for a full withdrawal) or a Form TSP 77 (for a partial withdrawal), and your signature must be notarized.

Should I move my TSP to an IRA?

Professional Money Management: An advantage of transferring TSP funds to an IRA is that a professional investment advisor can directly manage IRA investments. This can be beneficial to those who do not want to mess with investments and value the advice of an investment manager.

At what age can I withdraw from TSP without penalty?

Even if you defer your pension until a later date, since you were separated from service the year you turned 55, you can take part or all of the TSP, without penalty.

At what age can I start drawing from my TSP? Since the TSP is a retirement plan, there is no penalty for withdrawing your money during retirement. If you stop working for the federal government, you can start retiring when you are 55 years old. If you continue to work for the federal government, you need to wait until you turn 59-1 / 2.

How do I avoid paying taxes on my TSP withdrawal?

After all, if you leave the service before the year you turn 55 then you should wait until the age of 59 and ½ to avoid the 10% penalty (unless you qualify for a different exception). Note: Your traditional TSP withdrawals will still be subject to tax even if you avoid the 10% penalty.

At what age are you eligible to draw from TSP savings penalty-free?

If you are 55 or older when you leave the service, you can withdraw from your TSP without penalty. The key concept here is that in order not to incur penalties, you must be age 55 and be separated from service.

What age can you take money out of TSP?

Age-based retirements are available for employees who are 59 ½ years of age or older. Up to four age-based retirements can be taken per year, and the amount that can be taken in one age-based retirement is limited only by the balance of the employee’s account.

Can you withdraw from TSP at age 50?

One big difference between TSPs and IRAs is early retirement penalties. … There is a special provision in the TSP for employees of special categories (mainly law enforcement officers and firefighters); if they separate in the year they turn 50 (or later), they are exempt from the early retirement penalty.

What states do not tax TSP withdrawals?

While most states tax TSP distributions, these 12 do not: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming, Illinois, Mississippi and Pennsylvania.

What state does not impose your 401k? Some of the states that do not impose 401 (k) include Alaska, Illinois, Nevada, New Hampshire, South Dakota, Pennsylvania and Tennessee. You can save a lot of money if you live in these states, since your retirement income will be tax-free.

Which state is the most tax friendly for retirees?

1. Delaware. Congratulations, Delaware – you are the most tax-friendly state for retirees! With no sales tax, low property taxes, and no death taxes, it’s easy to see why Delaware is a tax haven for retirees.

What states have no state tax on pensions?

| State | 2021 Pop. |

|---|---|

| Nevada | 3,185,786 |

| New Hampshire | 1,372,203 |

| Pennsylvania | 12,804,123 |

| South Dakota | 896,581 |

Which states have no property tax for seniors?

# 1: South Dakota. In fiscal terms, South Dakota is one of the best states for retirees. In addition to the state income tax, retired homeowners may also qualify for state tax relief programs.

Which states do not tax pensions and Social Security?

Alaska, Nevada, Washington, and Wyoming do not have state income taxes, and Arizona, California, Hawaii, Idaho, and Oregon have special provisions that exempt Social Security benefits from state taxation.

How much is taxed on a TSP withdrawal?

TSP retirees are always taxed at your ordinary income tax rate. However, every time you take money out of the Roth TSP then the money comes out completely tax free. One of the best known rules when it comes to TSP is the rule of 59 and.

Can I withdraw money from my TSP without penalty?

Since the TSP is a retirement plan, there is no penalty for withdrawing your money during retirement. If you stop working for the federal government, you can start retiring when you are 55 years old.

What percentage of TSP is taxed?

If a traditional TSP account owner chooses to have an eligible rollover distribution paid directly to the account owner, then the TSP must withhold a 20 percent federal income tax return even if the owner of the account rolls. the account plans to defer distribution to another qualifying pension plan or to a traditional plan. IRA.

Does TSP withdrawal count as income?

A. TSP retirees are not considered earned income.

What happens to TSP when you quit?

Once he leaves the federal government, he will no longer be able to make employee contributions. However, you can always change your investment mix, transfer eligible money into your account, and enjoy our low costs – all while your account continues to accrue earnings.