If you want to avoid paying taxes on the money in your TSP account for as long as possible, do not take a withdrawal until the IRS requires you to do so. By law, you are required to take the required minimum distribution (RMD) from the beginning of your age 72.

Can you have TSP and Roth?

A: You can contribute to both Roth IRA and TSP, but the total amount you can save on both you have proposed is wrong; you can actually contribute more than what you ask for. … There is, however, an annual income limit on eligibility for contributions to Roth IRAs.

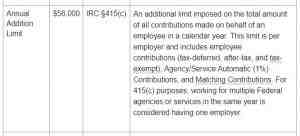

Can I contribute to a TSP and IRA in the same year? Contribution limits do not overlap between TSP and IRA. As a result, every dollar that contributes to a TSP does not reduce the contribution limit for IRAs. However, the boundaries are cumulative between Roth and traditional TSPs and Roth and traditional IRAs.

Should I have a Roth and traditional TSP?

For the most part, Roth TSP is a better option because right now, you’re in a lower tax bracket than you were at first. … In Traditional TSP, the money you donate is pre-tax. This means that you don’t pay taxes when you put the money you will pay taxes when you withdraw funds.

Should I contribute to both traditional and Roth?

It may be appropriate to contribute to both traditional and Roth IRAâ € ”if possible. Doing so will give you the option of taxable and tax -free withdrawal in retirement. Financial planners call this tax diversification, and it’s generally a smart strategy if you’re not sure what your tax picture will look like in retirement.

Should I invest in Roth TSP or traditional TSP?

For the most part, Roth TSP is a better option because right now, you’re in a lower tax bracket than you were at first. With Roth, your income and withdrawals are tax free because you donate money after taxes, meaning you pay taxes in advance. … In Traditional TSP, the money you donate is pre-tax.

Can I have both traditional and Roth TSP?

You cannot change part of your traditional TSP balance to a Roth balance. You can make contributions to both traditional and Roth if you wish. … Roth TSP is similar to Roth 401 (k), not Roth IRA. There is no income limit for Roth TSP contributions.

Can you max out Roth TSP and Roth IRA?

You can contribute up to the maximum annual limit, which can be adjusted annually. For tax years 2020 and 2021, the maximum is $ 19,500, plus $ 6,500 if you are age 50 or older. That’s for Roth TSP or traditional TSP, or even a combination of accounts if you have more than one. 8ï »

Can I contribute to both Roth IRA and Roth TSP?

Can I contribute to a TSP and IRA account? Yes. Your participation in the TSP does not affect your right to contribute to the IRA.

Can you max out both a Roth 401k and Roth IRA?

A financial strategy, for those who want the maximum in tax-advantaged savings: go to both types of Roth accounts. Between the two, you can invest up to $ 25,500 in 2021 ($ 26,500 for 2022) into a Roth 401 (k) and Roth IRAâ € ”or even more, if you have hit the age-50 threshold at the end of the year.

Can you max out two ROTH IRAs?

There is no limit to the number of IRAs you can have. You can even own multiples of the same type of IRA, meaning you can have multiple Roth IRAs, Sep IRAs and traditional IRAs. … You are free to divide that money between IRA types in any year, if you wish.

What are the new rules for TSP withdrawal options?

Participants who are still working in the federal service but have reached age 59-1 / 2 or older will now be able to take up to four partial withdrawals from the TSP during any given calendar year as long as they are at least 30 days apart. Previously, they could take only one.

When can you withdraw money from TSP without penalty? Because TSP is a retirement plan, there is no penalty for withdrawing your money during retirement. If you stop working for the federal government, you can start making retirement withdrawals when you play 55. If you continue to work for the federal government, you have to wait until you turn 59-1/2.

Can you withdraw from TSP during Covid?

The CARES Act includes a favorable tax provision for most types of TSP withdrawals made by participants affected by COVID-19. It also allows us to create new temporary withdrawal options that eliminate withdrawal requirements on regular services and allow all participants who are affected by COVID to eliminate tax deductions.

Can I withdraw money from my TSP without penalty?

Not to worry, you can withdraw from the TSP knowing that the 10% penalty will be eliminated. Even if you put your pension up to a later date, since you were separated from service the year you attained age 55, you are allowed to take part or all of the TSP, penalty-free.

Can you withdrawal money from TSP?

Having the option to take an in-service withdrawal from your TSP account can be a savior when you face financial difficulties. But before you do, evaluate your options carefully and know the consequences. It is a permanent withdrawal from your TSP account. You can’t save money anymore.

When can I withdraw from TSP without penalty?

With TSP, you are exempt from an early withdrawal penalty if you separate from federal service in the year where you reach age 55 or later. For IRAs, the initial withdrawal penalty will be applied to anything you exercise until age 59 ½.

Will the cares Act be extended for TSP?

The CARES Act allows the Federal Thrift Retirement Investment Agency (FRTIB) to create special loan rules for Thrift Savings Plan (TSP) participants who are affected by COVID-19. … Participants can suspend all TSP loan payments until December 31, 2020.

When should I change my TSP for 2021?

Regular TSP You must submit your $ 750 election to myPay by 6 – 12 December 2020, and your election must be effective on December 20, 2020, the first payment period for 2021. Your new election will appear on the Leave and Income Statement (LES) beginning with January 8, 2021.

What should I do with my TSP today?

In essence, when you retire you have 4 options for your TSP:

- Start regular installment payments (probably monthly). …

- Buy an annuity. …

- Leave it on the TSP and let it grow. …

- Make a single withdrawal / transfer of TSP to an IRA.

Do I need to change my TSP contribution for 2021?

Federal employees and military personnel can save the same amount in TSP retirement accounts this year and 2020. The number of federal government employees and military members can contribute to the Thrift Savings Plan for 2021 remains the same as the previous year. .

Does TSP withdrawal affect FERS supplement?

TSP distributions are considered Ordinary Income, and not Generated Income. TSP withdrawal will not affect your FERS supplement.

How long is the FERS supplement? The FERS supplement will end the month you turned age 62. And stop whether you have started drawing Social Security at age 62. Some people may choose to start drawing Social Security at age 62 – but who doesn’t want to delay until later.

How is the FERS supplement calculated?

The supplement is calculated as if you were age 62 and fully insured for Social Security benefits when the supplement started. … For example, if you estimated a full career Social Security benefit to be $ 1,000 and you had worked 30 years at FERS, we would divide 30 by 40 (.75) and multiply ($ 1,000 x. 75 = $ 750).

Does the FERS supplement get a cola?

COLA is usually announced in October for the year ahead. Retirees who qualify and receive a FERS annuity in December will receive some portion of the COLA in January. If you retire six months in 2021 then you will usually receive 50% of the cola for 2022.

How does FERS annuity supplement work?

The FERS supplement is also called the Special Retirement Supplement or SRS. It is designed to bridge the income gap for certain FERS who retire before age 62. It will increase your Social Security income that is lost until age 62. But not all FERS can receive the supplement.

What is the maximum FERS supplement?

For every $ 2 that you earn from the annual income limit (this limit changes each year) your FERS supplement will be reduced by $ 1. In 2020, the limit is $ 18,240 and in 2021 the limit is $ 18,960.

Will the FERS supplement be eliminated?

Any deductions that occur will begin in July of the year after you have “earn income” more than the limit. For example, if you allow more than the limit in 2020, your FERS supplement will not be reduced until July 2021. The reduction is then continued from July 2021 until June 2022.

Will federal employees lose retirement benefits?

To be clear, federal employees who are removed from federal service (â € œfiredâ €) usually do not lose any right to retirement benefits that have been earned (accumulated), with limited exceptions (see, 5 USC 8312).

Will federal government offer early retirement?

Possibility of early retirement from the government with as little as 10 years of service. … Among them is a unique option in the Federal Employee Retirement System that allows a worker to retire at their minimum retirement age with as little as 10 years of service.

Is FERS pension for life?

FERS is a retirement plan that provides benefits from three different sources: Basic Benefit Plan, Social Security and Thrift Savings Plan (TSP). … Then, after you retire, you receive an annuity payment every month for the rest of your life.

Is TSP withdrawal considered earned income?

TSP withdrawal is not considered earned income.

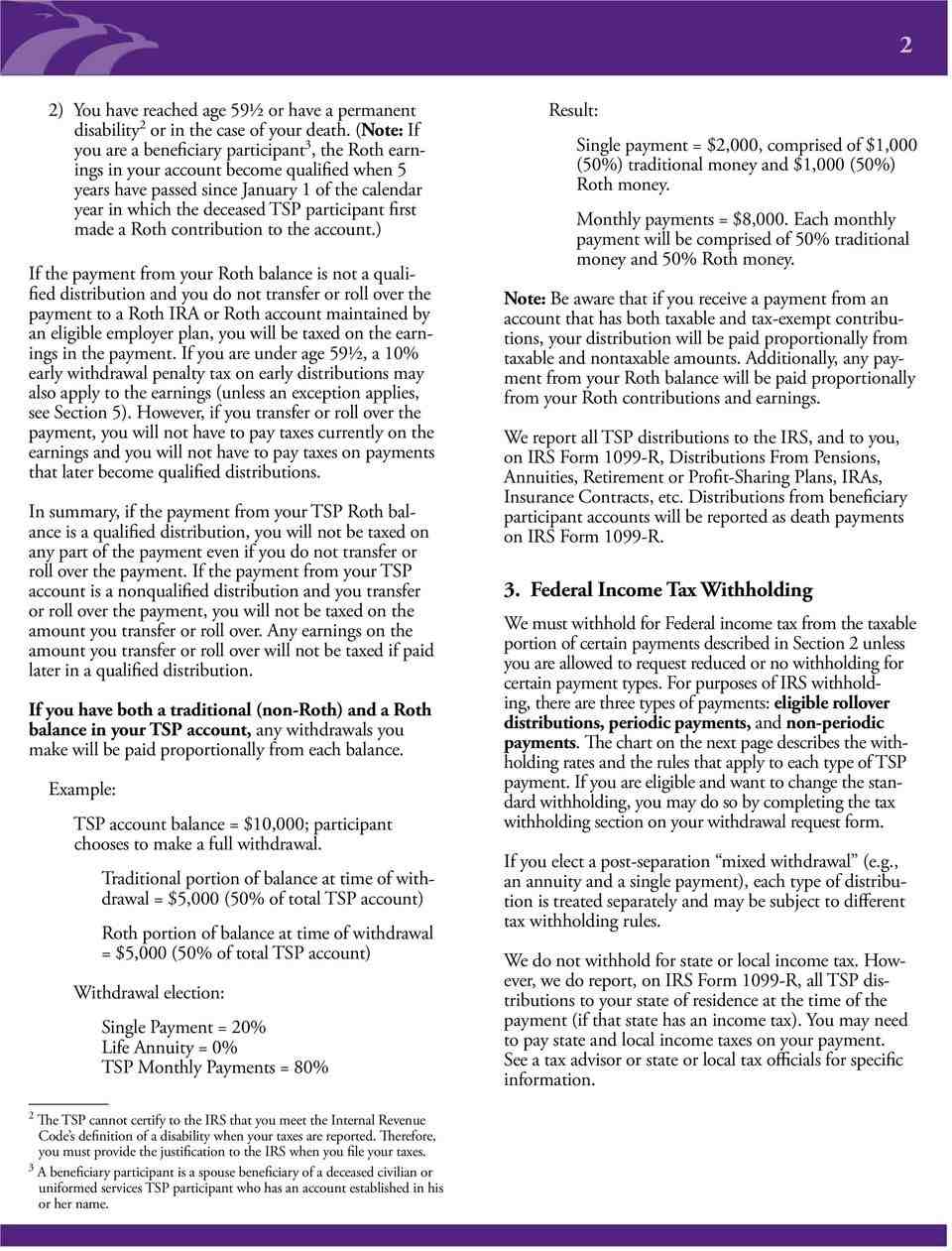

Why is TSP considered income? TSP does not withhold state or local income taxes. However, on IRS Form 1099-R, we report all TSP distributions to the taxpayer’s state of residence when paying (if the state has income taxes). The taxpayer may have to pay state and local income taxes on the payment.

Do I have to report TSP withdrawal on taxes?

The taxable portion of your withdrawal is subject to federal income tax at your regular rate. Also, you thought you should pay state income tax. An additional 10% IRS initial withdrawal penalty can be applied if you are under the age of 59½.

How do I report TSP withdrawal on my taxes?

- Report the affected portion of the TSP distribution on line 16b of Form 1040. …

- Report all TSP distributions as non-tax pension and annuity distributions on line 16a of Form 1040 if one of the distributions is non-tax.

Does TSP withdrawal count as income?

The general rules about federal income taxes of withdrawals from Thrift Savings plans are: A) All withdrawals from your traditional TSP balance are fully taxable as regular income; B) All qualified withdrawals from your Roth TSP balance are exempt from federal income taxes; and C) In any unqualified …

Do I have to claim TSP on my taxes?

No, you do not need to file your TSP contributions alone on your tax return. … At the end of the year, when you receive your W-2 form that shows your income, you will notice that your salary is subject to lower federal income taxes (box 1) because of your TSP plan contributions (box 12).

How do I report TSP withdrawal on my taxes?

- Report the affected portion of the TSP distribution on line 16b of Form 1040. …

- Report all TSP distributions as non-tax pension and annuity distributions on line 16a of Form 1040 if one of the distributions is non-tax.

How do I claim my TSP on my taxes?

If you have a 401 (k) or TSP through your employer, your contribution is reported in Box 12 of your W-2 with the letter code D. Since your contribution is included on your W-2, do not enter it on. retirement section.

Does TSP withdrawal count as income?

The general rules about federal income taxes of withdrawals from Thrift Savings plans are: A) All withdrawals from your traditional TSP balance are fully taxable as regular income; B) All qualified withdrawals from your Roth TSP balance are exempt from federal income taxes; and C) In any unqualified …