How much are you taxed when you withdraw your TSP?

We will retain 10% on the taxable portion of your federal income tax withdrawal. You have the option to increase or decrease this retention. The taxable portion of your withdrawal is subject to federal income tax at your usual rate.

How much are you taxed on TSP withdrawal? TSP payments are always taxed at your usual income tax rate. However, whenever you take money from the Roth TSP, that money comes out completely tax-free. One of the most well-known rules when it comes to TSP is rule 59 and ½.

When can I withdraw TSP without penalty?

Since TSP is a retirement plan, there is no penalty for withdrawing your money during retirement. If you stop working for the federal government, you can start retiring when you turn 55. If you continue to work for the federal government, you need to wait until you turn 59-1 / 2.

Can I withdraw my TSP at age 50?

Federal public safety employees can carry out TSP withdrawals without penalty starting at age 50. … But the law provides an exception for withdrawals from qualified company-sponsored retirement plans (401 (k), 403 (b) plans and TSPs) for employees who retire or retire from age 55 or older.

Can I withdraw from my TSP at age 55?

Don’t worry, you can withdraw from the TSP knowing that these 10% penalties will be removed. Even if you postpone your pension to a later date, since you resigned from the service in the year you turned 55, you are allowed to take part or all of the TSP, without penalty.

How much will I lose if I withdraw my TSP?

The Internal Revenue Service charges a 10 percent early withholding tax on such removals from the TSP, as it does with early withdrawals from other Qualified Retirement Retirement Accounts. If you withdraw money for financial reasons, you cannot pay additional contributions for TSP for six months.

Can I withdraw from my TSP early without penalty?

A 10% tax can be imposed for early withdrawal (before the age of 55 for the distribution of a qualified pension plan and 59 years for the distribution of the IRA). A tax class of 37% is assumed and no exemption from withdrawal penalties applies. State income taxes can be applied to your distribution. Your tax bracket may be lower.

How much is TSP taxed when withdrawn?

“Since the TSP pays directly to the TSP participant and not to another eligible pension plan or IRA, the TSP is required to retain 20 percent of the federal income tax.”

What happens when I cash out my TSP?

When you take an early withdrawal, not only do you have to include distribution as taxable income, but you also have to pay a 10 percent additional tax penalty unless an exception applies. A 10 percent tax applies to the taxable portion of cash.

When should I change my TSP to 2022?

While the current goal seems to revolve around most of the changes that will take effect by the end of summer 2022, the first steps in implementing new TSP systems should begin in January and February.

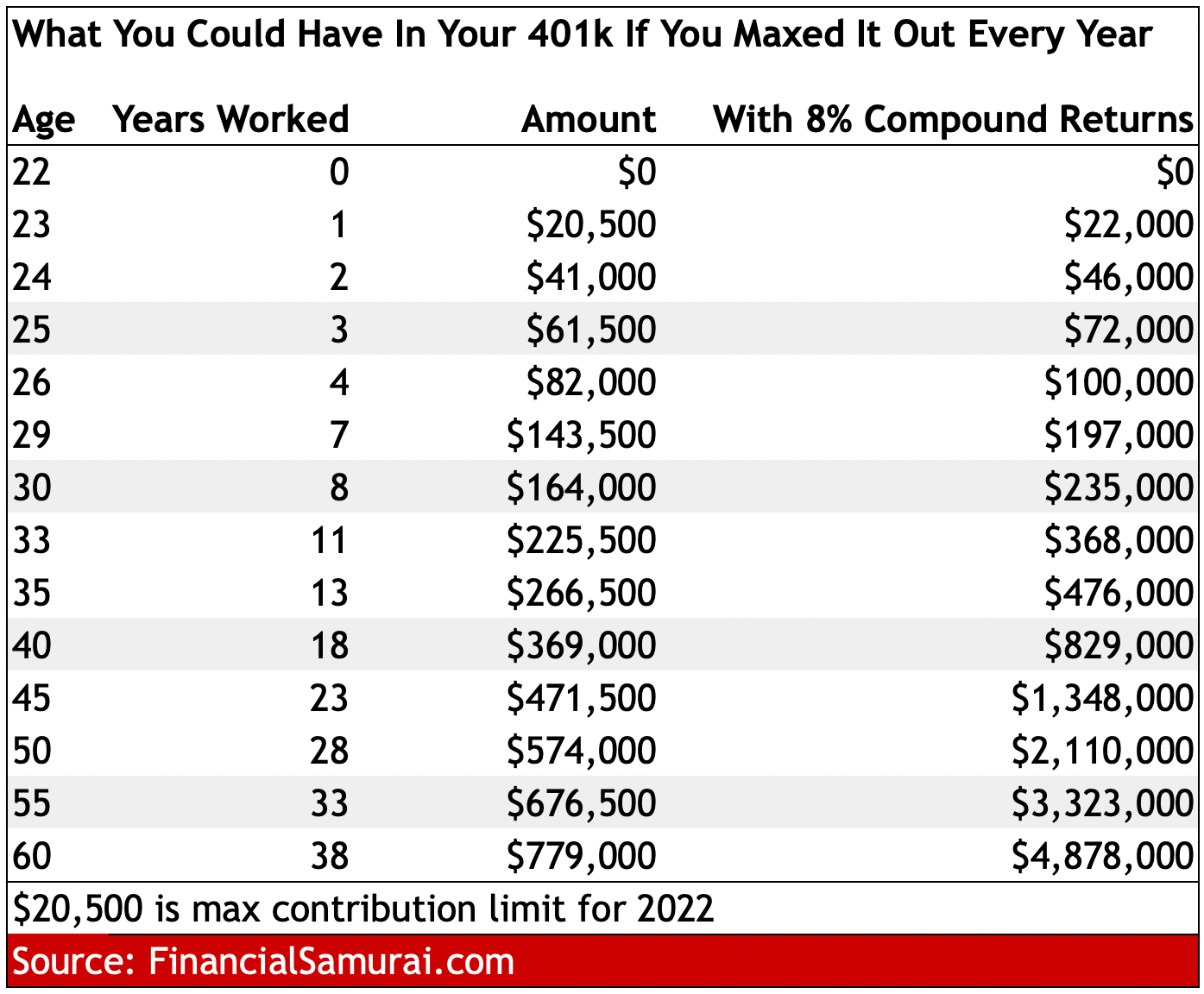

Will the 401k limit increase in 2022? The Tax Administration recently announced that the contribution limit for 401 (k) plans for 2022 will be increased to $ 20,500. The agency also announced cost-of-living adjustments that could affect the retirement plan and other savings related to retirement next year.

Can you contribute 2022 to Roth?

Like a traditional tax-deductible IRA, the maximum Roth IRA contribution for 2022 is $ 6,000, and the compensation contribution for people over 50 is $ 1,000, for a total maximum contribution of $ 7,000 for people over 50 years.

Can I contribute to Roth IRA for next year?

For 2022, 2021, 2020, and 2019, the total contributions you make each year to all of your traditional IRAs and Roth IRAs cannot exceed: $ 6,000 ($ 7,000 if you are 50 or older), or. If less, your taxable fee for the year.

When can you contribute to a Roth IRA for 2022?

Individual pension accounts. (Remember that IRA contributions for 2021 can be given until April 15, 2022, and IRA contributions for 2022 can be given until April 15, 2023.)

When can you contribute to a Roth until?

You can contribute to your Roth IRA after you turn 70. You can leave amounts in your Roth IRA as long as you are alive. The account or annuity must be marked as a Roth IRA when placed.

Do I need to change my TSP contribution for 2021?

The maximum contributions to the Savings Plan (TSP) in 2021 remain unchanged! The Internal Revenue Administration’s (IRS) annual 2021 election delay limit, which applies to the combined total of traditional and Roth contributions, remains at $ 19,500.

Does TSP automatically stop at limit?

Following the implementation of this system change, member contributions will be automatically suspended at the elective $ 19,500 delay limit, and any further contributions paid by members will be prevented, avoiding the need for a refund.

When can I change my TSP contribution?

You can start, change or stop your contributions at any time after your first full payroll period. Your statement of absence and earnings should reflect your TSP deductions within the two payment periods. If you do not work for DoD, you can make changes using your agency’s self-service or electronic system, where applicable.

How much is TSP catch up for 2021?

The maximum amount you can deposit into your TSP account for this year is $ 19,500. If you are 50 or older, your plan may allow you to contribute an additional $ 6,500 as a ‘reimbursement’ contribution, bringing your contribution to the 2021 TSP to a total of $ 26,000. (These amounts are the same as the 2020 limits)

Should you max out your TSP?

The Thrift Savings Plan (TSP) is a great tool for federal employees to save for retirement. Keeping and even maximizing the contribution to the TSP is usually considered a good thing. Yes, maximizing your TSP can be very helpful, but it may not be the best thing for your financial future.

Should I increase my contribution to TSP? You may want to change your savings plan (TSP) contributions, especially if you are in a combined pension scheme (BRS) and still do not contribute at least 5% of your basic salary to your TSP. A contribution of 5% or more of your base salary maximizes the appropriate state contribution for BRS participants.

Should I max out TSP or Roth IRA?

Members of the military: Since there is generally no match with the TSP, I would recommend that you make the most of your Roth IRA first. This gives you a tax-free income from retirement. If you have maximized your IRA and still have the investment funds for your retirement, then I would recommend investing in TSP.

Can I max out TSP and contribute to a Roth IRA?

Contribution limits for 2019, according to the IRS, state that you can give a maximum of $ 6,000 to Roth IRAs and a maximum of $ 19,000 to TSP for a total of $ 25,000.

Should I convert TSP to Roth?

The best time to perform a traditional IRA conversion or to transfer part of your traditional TSP to a Roth IRA is the time when the tax rate on conversion or as a result of the transfer is most likely lower than the tax rate at which future withdrawals would be taxed.

Should I max out my TSP or open a Roth IRA?

Bottom Line. Roth TSP and Roth IRA are great ways to save for retirement. And there are no rules that prevent you from contributing to both. Ideally, you can make the most of both accounts to increase your retirement savings.

What happens when you max out TSP?

This is a limit that employees can deduct from their salaries. It applies to traditional and Roth TSP accounts (which share the same limit, so you can’t give $ 20,500 each). This includes your base salary, special salary and bonuses. To make the most of your TSP, you should contribute $ 1,625 a month from your salaries.

What happens if you go over TSP limit?

Earnings distributed with excess deferral are considered taxable income in the year in which they are distributed. Any earnings from excess Roth TSP contributions are also taxable income. Employees will receive a special IRS Form 1099-R stating the amount of earnings.

What does maxing TSP mean?

How to maximize TSP contributions? To meet the maximum contribution of $ 19,500 per year, you should contribute $ 750 per payout period. Most agencies allow you to set your contribution to the TSP as a dollar amount or a percentage.

Does TSP automatically stop at limit?

Following the implementation of this system change, member contributions will be automatically suspended at the elective $ 19,500 delay limit, and any further contributions paid by members will be prevented, avoiding the need for a refund.

How much should I have in my TSP by 40?

Retirement Savings Goals By the age of 40, you should have triple the annual salary. Up to 50, six times your salary; up to 60 years eight times; and up to age 67, 10 times.8 If you turn 67 and earn $ 75,000 a year, you should have $ 750,000 saved.

How much should I have in my TSP at 45? By age 45, experts recommend that you have four times the annual salary at the bank if you plan to retire at age 67 and pursue a similar lifestyle, according to a recent report by financial services firm Fidelity.

How much should I put into my TSP?

How much should you invest in a TSP account? We recommend that you invest 15% of your retirement income. When you constantly contribute 15%, you set yourself up to have options when you retire.

What is the average TSP balance by age?

| Age | Average contribution rate | Average Balance |

|---|---|---|

| 20-29 | 7% | $ 10,500 |

| 30-39 | 8% | $ 38,400 |

| 40-49 | 8% | $ 93,400 |

| 50-59 | 10% | $ 160,000 |

How much should I have in my TSP at 30?

If you earn $ 50,000 by age 30, you should have $ 50,000 in your retirement bank account. By age 40, you should have triple the annual salary. Up to 50, six times your salary; up to 60 years eight times; and up to age 67, 10 times.8 If you turn 67 and earn $ 75,000 a year, you should have $ 750,000 saved.

How much should I have in my TSP by age 50?

At 30, you should save half your annual salary. By the age of 40, you should have twice the salary, and by the age of 50, you should aim for about four times the salary in retirement savings.

What is the average TSP balance by age?

| Age | Average contribution rate | Average Balance |

|---|---|---|

| 20-29 | 7% | $ 10,500 |

| 30-39 | 8% | $ 38,400 |

| 40-49 | 8% | $ 93,400 |

| 50-59 | 10% | $ 160,000 |

What is the average amount in TSP balance at retirement?

To complete the table, 530,357 participants have account balances ranging from $ 250,000 to $ 499,000 (20.36 years contributors on average) and 212,110 participants range from $ 500,000 to $ 749,000 (23.12 years on average).

How much should I have in my TSP at 60?

Under 60: Save eight times your annual salary. Under age 67: Save 10 times your annual salary.