Social Security offers a monthly benefit check to a wide variety of recipients. As of March 2022, the average check-in is $ 1,536.94, according to the Public Safety Commission – but the amount can vary greatly depending on the recipient type.

How do I make the most money in my TSP?

6 Keys to Creating a Financial Security Account

- Measure Your Options. …

- Contribute to the best of your ability. …

- Consider the Roth Option. …

- Do not pull too fast. …

- Invest in Your Condition. …

- Investment Management.

What happens to my TSP when I retire?

Savings Thrift Programs. Can I leave my money in my TSP account when I leave federal service? Yes, you can leave all balance of your account in TSP when you leave federal service if the balance is $ 200 or more. You can continue to enjoy the benefits of tax deduction and administrative expenses.

What is the average amount in TSP balance during retirement?

How long can you keep TSP after retirement?

1. Leave Money in TSP. You can leave the money in your Thrift Savings Plan account until April 1 of the year after you have completed 70 70. After that, you must first take part.

Should I take my money out of TSP when I retire?

Leave it in TSP and let it grow Depending on when you first retire, you can only leave money in TSP let it continue to grow. If you still do not need access to it, it may be wise to let it do so. As with other retirement accounts, you need to start with a minimum withdrawal of 72 years.

What happens to TSP at retirement?

If the balance of your savings account is $ 200 or more when you leave the federal service, your TSP account stays exactly where it is until you need it. You can save more on what you save thanks to our low price. Additionally, you can change your shareholding and transfer the appropriate funds into your account.

What happens to my TSP after I retire?

If the balance of your savings account is $ 200 or more when you leave the federal service, your TSP account stays exactly where it is until you need it. You can save more on what you save thanks to our low price. Additionally, you can change your shareholding and transfer the appropriate funds into your account.

How long does it take to get TSP money after retirement?

How long does it take to withdraw funds from the TSP? It may take up to eight weeks to process the withdrawal after all the full withdrawal forms have been properly received and the disbursement data received by the TSP Service Office.

Can I keep my TSP after leaving federal service?

Yes, you can leave all balance of your account in TSP when you leave federal service if the balance is $ 200 or more. You can continue to enjoy the benefits of tax deduction and administrative expenses. Once you are separated, you will not be able to contribute to the staff.

How do I avoid paying taxes on my TSP withdrawal?

If you want to avoid paying taxes on your long-term TSP account, do not take any withdrawal until the IRS requires you to do so. By law, you are required to carry a minimum distribution (RMDs) from the age of 72.

How much tax do you pay on TSP withdrawal?

Since TSP pays directly to the TSP candidate and does not go to any eligible program or to an IRA, TSP is required to withhold 20 percent of the federal income tax.

Is TSP withdrawal considered earned income?

A. The resulting TSP withdrawal is not taken into account.

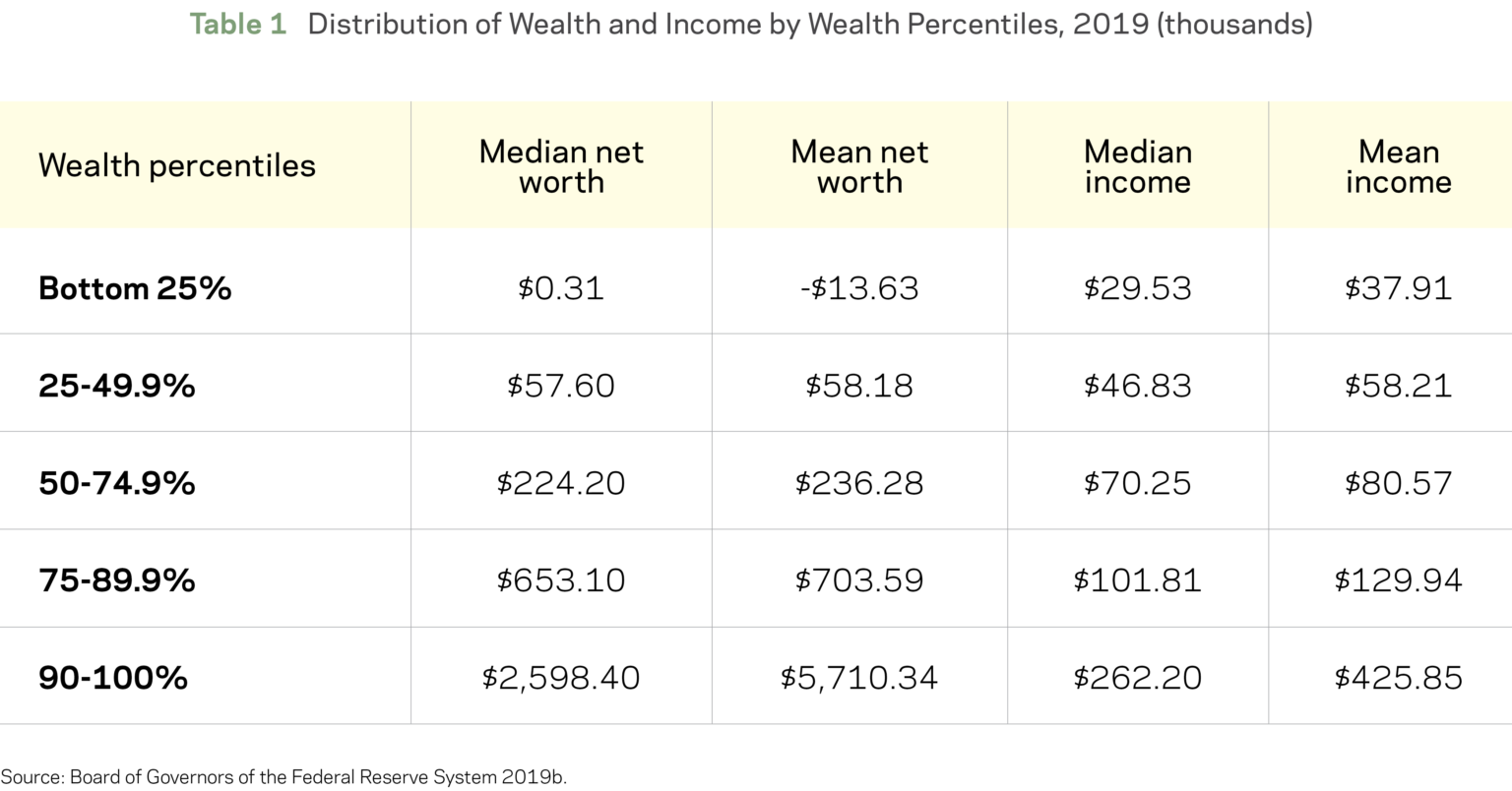

Can you retire off 2 million?

Yes, for some people, $ 2 million should be enough to retire. For some, $ 2 million may not even be able to block the ground. The answer depends on your circumstances and there are many challenges you will face.

Can 2 people retire at $ 1.5 million? Here is a simple example: Couples with $ 1.5 million in retirement savings can deduct $ 60,000 per year. This amount is added to the Security Benefit, pension and other income, providing a lot of money for a comfortable life.

Can you live off interest of 2 million dollars?

And, can you survive from a $ 2 million account return? The answer is yes, if you are serious about it.

How much interest does 2 million dollars earn per year?

For example, profit on $ 2 million is $ 501,845.11 over 7 years with fixed income, providing a 3.25% annual guarantee. Find all current revenue estimates here.

What age can you retire with $2 million?

As a result, the annual income requirement from your $ 2 million portfolio may be higher from 60 to 70 years. At least until you start taking social security. So, while two million dollars may seem like a lot, there are a lot of problems to jump into retirement to make sure your money lasts the rest of your life.

How long can you live off of 2 million dollars?

Yes, you can retire at 45 with $ 2 million. When you are 45 years old, your immediate income will guarantee an income level of $ 73,259.04 per year for just one payment, $ 73,075.80 per year for living with a specific 10 year period, and $ 72,345.48 per year to live with a specific 20 year period.

How long can a person live off of a million dollars?

Being a millionaire seems like a definite way to live a happy life. However, if you do not work anymore, when will the million dollars end in retirement? The answer is about 20 years, according to Brent Lipschultz, a partner in accounting and consulting firm EisnerAmper in New York City.

Can I cash out my TSP when I quit my job?

Can I leave my money in my TSP account when I leave federal service? Yes, you can leave all balance of your account in TSP when you leave federal service if the balance is $ 200 or more. You can continue to enjoy the benefits of tax deduction and administrative expenses.

Can I withdraw my TSP account? 1 There are two types of deductions in service: cash deduction and deduction age-591/2. Note: You may not withdraw a service from a beneficiary candidate account. (Participant account is a beneficiary TSP account inherited from deceased TSP participants.)

What happens to your TSP if you quit?

Once you leave the service equipped, you will not be able to contribute. However, you can still transfer your shares, transfer the money you deserve to your account, and enjoy a lower price while your account continues to make a profit.

How much will I lose if I withdraw my TSP?

Consequences of financial hardship Withdrawal If you are less than 59½, you may have to pay an early deduction tax of 10%. Any contributions made by taxes or Roth contributions included in your deduction are not subject to federal income tax; There is also no Roth salary specialist.

Can I withdraw my TSP if I resign?

Yes, you can leave all balance of your account in TSP when you leave federal service if the balance is $ 200 or more. You can continue to enjoy the benefits of tax deduction and administrative expenses. Once you are separated, you will not be able to contribute to the staff.

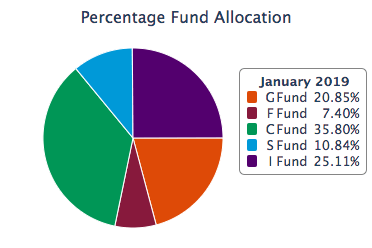

What is the best TSP fund to be in right now?

C Fund is Roaring-Top TSP Core Fund in 2021 As this index fund is dependent on Fund C, Fund C is also good. Account C increased 3.03% in August – the highest return on any major TSP account for the month.

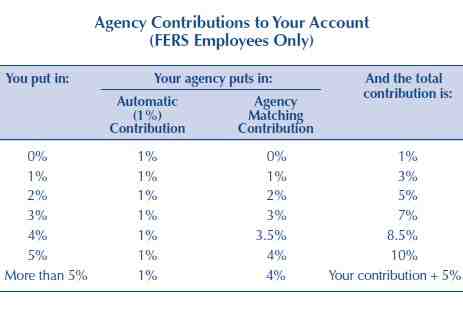

Which account should my TSP be in? How much should I contribute to my TSP? One common recommendation for how much to save for retirement is at least 15% of income. Some believe that at least it should be something that enhances the contribution of the worker; in the case of TSP income, this would be 5% of income.

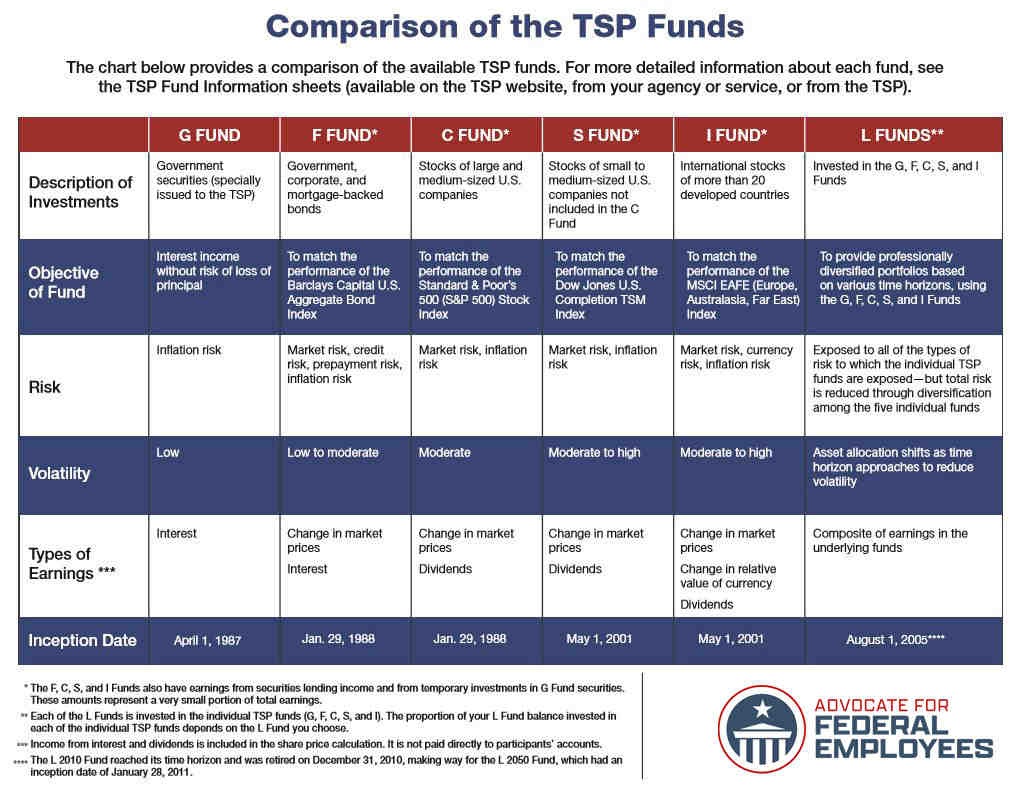

What is the most conservative TSP fund?

However, the L Income Fund is the most important of the L Income Fund. It focuses on saving money while providing minimal exposure to risky funds (C, S, and I Funds) to reduce the impact of inflation on your purchasing power.

What is the best TSP fund to be in right now?

C Fund is Roaringâ & # x20AC; & # x2122; Top TSP Core Fund in 2021 Fund C increased by 3.03% in Augustâ & # x20AC; & # x2122; the highest return on any major TSP account for the month.

What is the safest investment in TSP?

Most investors take into account the G safest bet. Many people switched to G funds during the Great Recession (2008-9) when stocks were full. Some are still not back even though the market has been back since then very well, until last month.

Is the G fund in TSP safe?

Investments are made in short-term US treasury accounts that are specifically given to TSP, so the federal government guarantees large payments and profits. When the stock market is weak (and not always?), The G Fund appears to be a safer option.

Is TSP G fund guaranteed?

More information. The G Fund shares are included in the short-term U.S. Treasury records provided to TSP. The U.S. government has guaranteed large payments and profits. Therefore, there is no such thing as a “debt risk”

How is the G fund in TSP doing?

G Fund has experienced an annual decline of 4.3% since August 1990. Its year-over-year turnover is 0.84%, and its 1-year return is 1.73%.

What is the average return of the C fund in the TSP?

TSP C-Fund, which reached nearly S&P 500, earned an average annual gain of 12.29 percent between 1988 and 2020; TSP F-Fund, the largest index representing the US stock market, had an average annual turnover of 6.29 percent from 1988 to 2020; and G-fund, a long-term U.S. Treasury note, has an average annual turnover of 4.70 …

What is the TSP C fund invested in?

National Stock Exchange (C) Fund C invests in stock equity accounts that follow Standard & Poor’s 500 (S&P 500). This is a large market capitalization consisting of shares of 500 major US companies to medium.

What is a good rate of return on TSP?

TSP performance in 2021 is good, and federal employees should be pleased when they see the results of December and 2021. TSP performance was overall impressive last year.

Sources :